Is Bitcoin Changing The Way The Left Thinks?

by Isabel Foxen Duke –

As inflation leaves young Democrats with few options for acquiring wealth, some voters are challenging party leaders’ perspective on Bitcoin.

I’ve always considered myself a left-leaning progressive type… or, in my mind, someone who prides themselves on putting the needs of everyday folk over corporate interests or the wealthy few.

I grew up in a coastal city with liberal parents, went to progressive schools, and can spit a Marxist critique of just about anything you throw at me. Fairly distributing wealth across classes — and narrowing the wealth gap — has been at the fore of my political consciousness for as long as I can remember.

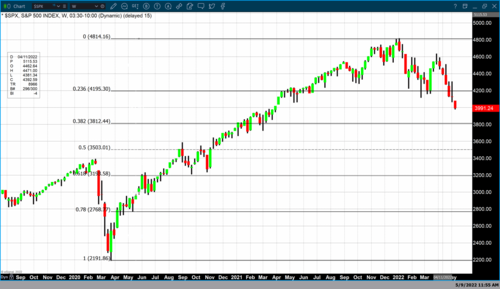

Fast forward to my learning about Bitcoin and I quickly began to understand the economic injustice of current fiat monetary policies, and how government control of the U.S. dollar has been used to “make the rich richer” at the expense of pretty much everyone else.

When countries are in economic hot water for any reason — ranging from irresponsible use of debt to unforeseeable challenges like the pandemic — they will print new currency (aka expand the money supply) to pay whomever they see fit, which is usually creditors or capital asset holders, aka existing rich people.

In the process, the purchasing power of the average person’s paycheck goes down. When there’s more money in the economy, everything gets more expensive, especially things that are hard to make more of — like real estate and commodities.

Until I started learning about Bitcoin, I didn’t really understand what was causing the fast-rising prices of assets like real estate. I only knew it was happening, and it was happening faster than I could keep up.

Younger generations are, of course, disproportionately affected by these policies — as even high-income millennial earners will struggle to afford homeownership in the cities where they’re likely employed.

Most millennials will remain renters permanently as the price of real estate has far outpaced wages, all but killing the American Dream.

Thankfully though, and pretty uniquely, this particular economic problem may have a relatively simple solution: one that isn’t dependent on the results of an election, a disorganized legislature or any other governing body outside of our individual control.

Enter Bitcoin — a digital money that’s been engineered to be un-inflatable (that is, no one can “print” more of it) and uncontrollable by a central governing body. The network functions on thousands of independent computers without any one primary authority.

Unlike other inflation-resistant assets, like gold or real estate, bitcoin is also incredibly accessible. There’s no minimum investment to purchase bitcoin and you can store as much or as little of it as you want on a thumbdrive in your studio apartment. You don’t even need a bank account to buy bitcoin. Head on over to your local “Bitcoin ATM” with some cash on hand and boom — you own scarce financial assets that can’t be inflated away. Of course, if you do have a bank account, there’s no need to get out of bed. Buying bitcoin takes under a minute on any number of exchange mobile apps.

Yay for the “common man,” right?

A great equalizer for the average working person, bitcoin felt immediately aligned with the values I grew up with… until I was struck with cognitive dissonance to learn that many of “my people,” — most visibly folks like Elizabeth Warren and other left-leaning Democrats — seemed to hold a stronger negative bias against Bitcoin than those from the right.

“Why do Democrats hate Bitcoin?” I thought to myself.

After doing a little research and talking to some smart economist friends, what I learned wasn’t all that surprising.

First off, from a straight-up political theory perspective, left-leaning folks are ideologically more apt to trust a central government to distribute wealth “fairly” rather than trusting free-market economics. The left is generally pro-government (especially when it comes to finances) and Bitcoin was intentionally designed to resist government control.

Bitcoin was essentially born out of a libertarian ethic — a word many on the left hear with skepticism.

It was unfettered “free capitalism,” after all, that led to the subjugation and subsequent riots of the working class in the era of Standard Oil and U.S. Steel. Without government intervention and the advent of antitrust laws, it’s quite possible today’s capitalism might look more like feudalism than the relative financial freedom we have today.

Skepticism aside, there’s also a practical argument for government control over currency — an argument that most Bitcoiners don’t like to talk about — and that is, government-controlled currency allows us to avoid or mitigate economic contractions.

It would be difficult to avoid a full-blown pandemic depression, or a complete banking meltdown like in 2008, if the government wasn’t able to “bail out” whomever they saw fit with freshly minted money.

In theory, this kind of printing saves jobs (the most important quality-of-life determinant for the majority of the country) and in some instances, new money is directly distributed to working and low-income folks as was the case with Covid-era stimulus checks.

When looking deeper into this reality, however, the lion’s share of the money that was printed during the pandemic did not go to saving jobs or padding the wallets of average citizens, but instead went to saving the stock market and other asset-holder interests.

According to the Washington Post, only one-fifth of U.S. stimulus distributed during the pandemic went to individual citizens, while the majority went to businesses who were not required to show if they were impacted by the pandemic nor were they required to use the funds to keep people employed.

Another clear example of stimulus being used to save the rich instead of the working class was in 2008 when stimulus was used to bail out the banks (creditors) that issued predatory loans instead of using stimulus to bail out the debtors — the ordinary working people who were victims of such predatory loans in the first place.

This all to say, if anyone’s going to make the claim that the government should be able to control the money supply, then they also have to be held accountable for how those dollars are distributed. Unfortunately, neither side of the aisle has a proven track record in this regard.

When you look back at the history of money — all the way back to Ancient Rome — for centuries, government control of currency has almost always been used to widen the wealth gap, not narrow it.

Roman emperors frequently debased silver coins by adding more bronze or tin in order to increase the money supply — and the windfall was mostly spent on wars of conquest and lavish architectural projects. Similarly, Henry the VIII was famous for debasing gold bullion with copper to enhance his personal lifestyle and fund sieges throughout Europe.

The history of currency debasement has a very clear tie with irresponsible spending by governments at the expense of civilians, with very few, if any, examples to the contrary.

This makes me sad. I actually want to live in a world where wealth can be distributed fairly by a trustworthy government. But I’m understanding more and more why so many think that hope is naive. It’s because of an observable history of thousands of years of governments using currency debasement in the best interests of the few rather than the many.

If there’s anything I’ve learned from hanging out with Bitcoiners, it’s that millennials, many of whom are generally progressive voters, are joining in on this chorus after learning about how current monetary policy is rapidly destroying our chances of accumulating wealth.

I recently heard a friend say at a Bitcoin meetup, “I’m a vegan environmentalist — and I’m all of the sudden finding myself agreeing with Ted Cruz over Elizabeth Warren.”

Until we see a fiat monetary policy that actually benefits us (which I’m not holding out hope for), I want to store my money in an inflation-safe asset that I can easily afford, maintain and self-custody.

In other words, I’m buying bitcoin.

Tim Moseley

Nothing can fix inflation now, 'economic stupidity' is underway by the Fed, Biden – Steve Hanke

Nothing can fix inflation now, 'economic stupidity' is underway by the Fed, Biden – Steve Hanke.gif)

.gif)

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

CBS News @CBSNews

CBS News @CBSNews

Ylan Q. Mui @ylanmui

Ylan Q. Mui @ylanmui LifeNews.com @LifeNewsHQ

LifeNews.com @LifeNewsHQ

.jpg)

.jpg)