オンラインカジノランキング 2022年

こういった種類もそれぞれルールが違って、バカラが人気である理由を押し上げているのではないでしょうか。 しかし、ゲームルールのシンプルさや演出、その他の攻略法などを醍醐味としてカジノゲームの中では最も人気のあるゲームの一つとなっています。 お金を賭けるプレイヤーは、テーブル上のプレイヤー枠とバンカー枠、そして引き分けのタイ枠のどれかに賭けて当たるかどうかを予想したゲームになっています。 www.casinoonlines.jp それぞれのオンラインカジノに違った特徴がありますが、中でもよりバカラの本質から楽しめるカジノを厳選。 基本的なルールは通常バカラと同じですが、ノーコミッションゲームモードを設定することにより、手数料5%がかからずバンカーベットが可能です。 バカラ特有の醍醐味である絞りを楽しめるライブカジノとして、絶対に遊んでおきたいバカラになっています。

ハウスエッジはオンラインカジノ側の取り分を指すのですが、プレイヤーにとってはハウスエッジの低いゲームを選択したほうが勝率が上がります。 それに注目してルーレットの種類を選びましょう、まず、ヨーロピアンルーレットのハウスエッジ(控除率)は2.6〜2.7%なのに対し、アメリカンルーレットのハウスエッジ5〜6%です。 ヨーロピアンルールの方が、断然低いハウスエッジになっており、それを選択するだけで既に勝ちやすい勝負になっているのです。

賭け条件は5倍なので$100分賭ける必要がありますが、無理な金額では無いでしょう。 BeeBetの入金不要ボーナスはスポーツベットのみ使え、ボーナスコード「SPORTS10」を登録時に入力する必要があります。 最大賭け額に上限は無くオッズにも上限が無いので思い切って勝負してみましょう。 無料登録するだけで誰でも$20の入金不要ボーナスが貰えるコニベット!

- 1日にオンラインカジノをプレイする時間などを設定しておくと、それ以上はプレイできなくなります。

- またアカウント凍結などの厳しい措置をとられる場合もありますので注意が必要です。

- 不動産投資家として成功を収めた柏木氏は、莫大な富を蓄積し、ラスベガスとアトランティックシティで最高のカジノのいくつかでプレーしました。

- 6リールからなるスロットで、それぞれ最大で7つのシンボルが登場する可能性があります。

日本語対応が優れているオンラインカジノは、カジノフライデーがおすすめです。 年中無休で毎日午後3時から深夜0時までの日本語ネイティブサポートがあるほか、サイト全体の日本語ローカライズも隅々まで行き届いています。 マルタ共和国のライセンスを取得していてイカサマがないのはもちろんのこと、ギャンブル自己抑制機能やギャンブル依存症診断ツールなど、安全最優先でゲームを楽しむことができます。 「オンラインカジノは還元率が高く、95%〜98%ほどになることもある」。 みなさんも、耳にタコができるほど聞いたことがあると思います。 たしかに、日本の宝くじや公営ギャンブルと比べた場合は高いと言える還元率ですが、決して100%を超えない=遊び続ければいつか資産は0円になる、ということを覚えておいてください。

親しみやすく、遊びやすい外見をしていても、実は「悪質カジノ」ということだってあるのです。 そういったカジノを選ばないためにも、当サイトの紹介情報やプレイヤー様の評判・生の声を参考に、じっくりと検討した上でオンラインカジノをプレイしましょう。 まだまだ一流と呼べるほどの産業ではありませんが、サービスクオリティは少しずつ改善され、オンラインカジノ業界自体の認知度は着実に上がってきています。 摘発事例で一時危惧されたオンラインカジノの違法性についても、一人のプレイヤーが不起訴処分(無罪)となったことから、現在ではほぼ安心できる状況になりつつあります。 もちろん、100%の安全と断言できるものではありませんので、当サイトの「オンラインカジノは違法?合法?」を参考にじっくりと判断してください。

入金不要ボーナスを貰うには電話番号認証と個人情報認証が必要ですがボーナスがお得なのでしっかり貰っておきましょう。 オンラインカジノブログとは、オンラインカジノごとの解説、各ゲームのルールや攻略法などが載っているブログを指します。 必勝カジノオンラインZの場合、それらに加えて、カジノ協賛の賞金付きイベント、日記メンバーによるプレイ記事といった、読者さんが楽しめるコンテンツをお届けしています。

入金・出金手段

業界のプロフェッショナルはもちろん、法律のプロフェッショナルもボーディングメンバーに在籍しています。 取得が厳しいライセンスだけに、このライセンスを取得しているカジノはそれなりの信頼性が確保されています。 オンラインカジノは日本で人気が出つつありますが、まだまだ外国が主導しているマーケットです。 日本人好みのゲームを揃えているところもあれば、しっくりこないゲームばかりのことも。 エンターテインメント性に富んだ楽しいゲームが次々に見つかるようなオンラインカジノを選びたいですよね。 日本でオンラインカジノをして年間50万円以上儲かったら(サラリーマンの場合は70万円)確定申告しないと、違法行為になります。

現在の状態では、違法行為になるため、仮想通貨を現実のお金に換えることはできない。 オークションサイトでの取引も法律に抵触するため、eBayなどの大手サイトでも、「仮想通貨や仮想アイテムの出品や取引は認めない」と注意事項が表示される。 いったんゲームを休むと「無料で毎日遊べます」とDJ風の音声が素早く入る。 仮想通貨を使い果たすと、購入するか、翌日にアクセスすると無料で少し追加される仕組みだ。

オンラインカジノとランドカジノの違い

大吉カジノでは、日本カジノレビューを非常に真剣に受け止め、細部にわたって比類のない非常に信頼できる情報を読者に提供しています。 最高品質のサイトのみを推奨するように、カジノが満たさなければならない包括的な一連の基準を開発しました。 これにより、大吉カジノのチームが探しているものと、各オンラインカジノ 日本をどのようにテストするかを確認できます。 入金不要ボーナスで禁止ゲームを遊ぶと最悪アカウントの停止もあり得ます。 禁止ゲームはオンラインカジノ毎に異なりますので、必ず確認しておきましょう。

また日本語サイトであっても、違法となるカジノがある可能性もあります。 当サイトでは細心の注意を払い、逮捕の可能性がないカジノを紹介していますが、自分の目でもチェックするようにしましょう。 キュラソー島のライセンスは、ベラジョンカジノだけではなく、ビットカジノやライブカジノハウスなど、人気のオンラインカジノも取得しているため、安全性が高いと言えます。 その点、オンラインカジノサイトはカジノが合法とされている国からのライセンスを得て運営されているので、日本の賭博罪は適用されず違法ではありません。 かといって合法でもないので、難しいところではあるんですが‥。

また最大出金額が「$100~$300」程になっていますので、高配当を得た時に損した気分になる可能性もあります。 フリースピンに50倍の賭け条件が付くので魅力は下がりますが、合計3750回のフリースピンが貰える点は魅力的だと言えます。 365日1日10回のフリースピンですので、毎日が楽しくなる事間違いなしです。 フリースピン専用ではないのですが、3日間で60回のフリースピンを獲得する事ができます。 ムーンプリンセス・ハワイアンドリーム・マジックメイドカフェと大人気のスロットが対象なので楽しめる事間違い無しです。 その数百円がジャックポット当選で数十億円になる可能性はゼロでは無いのです。

日本語サポートの質やサイト上の日本語のレベル(不自然な表現があるなど)は、カジノによって異なります。 カジノを選ぶ際には、日本語の質も各サイトのレビューを参考にしてみるとよいでしょう。 とはいえ、日本国内で海外で合法的に運営されているオンラインカジノを利用する行為については、適用される法律がまだ存在しないため、グレーゾーンと評されることがあります。

リアルマネー残高が0の場合は、次にボーナスマネーが使われるようになります。 この節は特に記述がない限り、日本国内の法令について解説しています。 連勝すれば利益をコツコツ積み上げることもできるので、高額勝利より損失額を最小限に抑えたい方向けの攻略法です。 は、負けたらベット額を倍にしていき勝ったら最初の金額に戻すという方法で、一度勝てば損失分を取り戻すことができます。 二重登録やマネーロンダリング(資金の不正使用)防止のため、登録者本人であることを証明する必要があり、身分証明書の提出が求められます。

お気に入りのオンラインカジノを決めるならスロットのプロバイダーはMicrogamingやNetEnt、ライブゲームはEvolution。 日本で局所的な人気があるJTGなどが幅広く遊べるカジノを選びたいところです。 プレイオジョカジノは、2022年4月に日本に上陸した最新カジノです。

野党議員からオンラインカジノを「放置するのか」と迫られた岸田文雄首相は「違法なもので、厳正に取り締まる」と述べた。 オンラインカジノが注目を集めたきっかけは、山口県阿武町で起きた4630万円の誤給付問題だ。 電子計算機使用詐欺容疑で逮捕された男は誤給付された金を「オンラインカジノに使った」と供述。 事実関係は今も判然としないが、大金が一瞬で消えるとされるオンラインカジノの怖さを多くの国民が認識した。

公式で「モバイルカジノの王様」と謳っている通り、操作性が非常に高いサイト設計でストレスのないプレイ環境を実現しています。 ボーナスも手厚く準備されており、特に条件のつかないフリースピンは非常に人気が高いです。 当サイトの限定ボーナスでもご用意がありますので、是非お役立てください。 オンラインカジノに日本語カスタマーサポートがある事は、私たちプレイヤーの強い味方です。

さらにカジノシークレット専用のライブカジノスタンドを設けているのも人気の理由の一つ! VIPのような快適なライブカジノの時間をお楽しみいただけることでしょう。 遊雅堂 とは 遊雅堂 (ゆうがどう)は、あの人気NO.1オンラインカジノであるベラジョンカジノやインターカジノと同じ運営会社から誕生した姉妹ブランドです。

彼のお気に入りのゲームの1つはバカラでしたが、ゲームのプレイに関しては、通常の賭けについては話していません。 柏木昭男は、1ハンドあたり約$ 100,000〜 $ 200,000の賭け金を何時間も配置します。 残念ながら、1992年に柏木さんが殺害され、事件は解決されませんでした。

ゲームの種類TVショープロバイダEvolution GamingDeal or No Dealは、海外の有名なテレビ番組をモチーフにしたおすすめのライブゲームです。 他のカジノゲームと比べると、運よりも判断力によって得られる配当の大小が決定するのが大きな人気の理由となっています。 表示を別々にしているカジノもありますが、内部的には入金したお金もボーナス扱いとなるので賭け条件を達成するまで出金することはできません。 確認書類の撮影は、書類の四隅を画像内におさめ、文字がハッキリ移るように撮影しましょう。

登録する項目は氏名、メールアドレス、電話番号、住所などで、一般的な会員サイトと大差はありません。 「会員登録」ボタンを押し、表示されたフォームに入力していくというごく一般的な登録方法で、どなたでも簡単に行えます。 興味はあるけど、お金を賭けて遊ぶのにはまだ抵抗があるような方は、まずデモゲームでのプレーをおすすめします。 ギャンブリングコミッションはイギリスのギャンブル監視機関です。

実際にプレイする前に、日本 オンライン カジノか信頼して使用出来るものかどうかを確認するようにしましょう! 安心して遊べるオンライン カジノ 日本であるかどうかは以下の項目をチェックする事でセルフチェックする事が可能です。 オンラインだからこそ、本当に安心できるオンライン カジノ 日本であることをしっかり確認したうえで楽しくプレイしたいですね。

このページのカジノリストを見ての通り、オンラインカジノの種類・特徴は千差万別です。 現在、各オンラインカジノがボーナスで他のオンラインカジノより抜き出ようと努力しています。 また、ランドカジノとは違いオンラインカジノは落ち着いた雰囲気の中で集中してゲームをプレイする事ができます。 ランドカジノって周りの人の目もあるし結構ガヤガヤしてますよね。

ベラジョンオンラインカジノでは、各種電子マネーや国内の銀行口座への出金に加え最近では仮想通貨への出金も導入され、たくさんのプレイヤーの方々に利用していただいています。 今なら当サイト経由の登録で無料30ドルボーナスや30日間のフリースピン、その他もたくさんの登録ボーナスがつくのでこの機会に無料登録して遊んでみましょう。 覚えておきたいのは、ライセンスを取得したからと言って、「全ての国を対象にオンラインカジノを提供できるわけではない」という点です。

1人で複数のアカウントを作成し、同一のボーナスを複数回受け取ることは禁止されています。 複数アカウントを作成するだけでも違反行為とみなされ、アカウントの凍結などの措置を受ける可能性があるので絶対にやめましょう。 その条件を満たさないとボーナスを出金することができません。 マネーロンダリング対策以外でも出金出来ないケースがあります。 それは入金したキャッシュに対して課せられる賭け条件がある場合です。

自分のプレイ頻度やスタイルに合わせて、よりメリットのあるカジノを選ぶことが重要です。 を行っていることもあり、お得なオファーを受けられる機会が増えることもアプリの魅力の一つです。 すべてのカジノにアプリがあるわけではありませんが、大手カジノはアプリに対応していることが多く、特にレオベガスのアプリはその使いやすさから高く評価されています。 オンラインカジノはパソコンでしか遊べないというのは、もう一昔前の話。

また、セキュリティ面では万全の体制を整えてプレイヤーの皆様の情報を大切に保護しております。 具体的には、金融機関でも採用されている256ビットのSSL暗号化通信方式により、皆様の資金や取引情報を守っています。 このように、LIVE CASINO HOUSEはデータ保護および個人情報保護規制を含む法令を遵守した安心・安全に遊ぶことができるオンラインカジノです。 ライブカジノハウスでは、信頼性の高いキュラソー島発行のネットカジノライセンスを保持しています。 ガイドラインに沿った運営をしており、第三者の監視もあるため、不正は起きません。 トラブルが起きても、カスタマーサービスが日本語ですぐ対応してくれるため安心です。

オンラインカジノには、楽しみながら人生を変えるような高額の勝利金を稼ぐチャンスがあることは間違いありません。 しかしながら、インターネットカジノはあくまでギャンブルです。 娯楽として支払える金額の範囲内で、楽しく責任をもってカジノオンラインの醍醐味を満喫しましょう。 オンラインカジノでキャッシュを使って遊んでいると、必ず1度は必要となるのが証明書類の提出です。 主な書類としては、パスポートや運転免許証などの写真付きの身分証明書、氏名と住所が確認できる住所確認書類、さらに、決済方法が本人名義であることが確認できるものが要請されます。 よって、一般的には18歳以上、カジノによっては20歳以上の年齢制限があります。

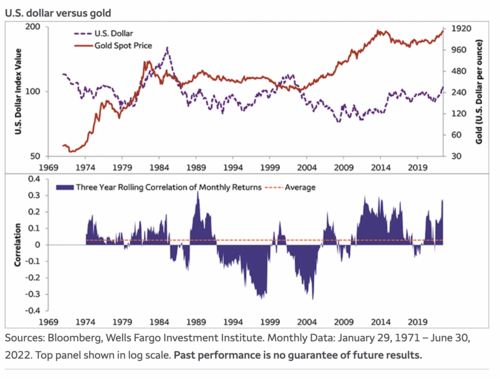

This is why gold is below $1,800 even as U.S. inflation hits a 40-year high at 9.1%

This is why gold is below $1,800 even as U.S. inflation hits a 40-year high at 9.1%

.jpeg)

.jpg)