The Rise Of A Parallel Economy: Entrepreneurialism In Full Swing Challenging The “Woke” Trend

In the current political climate and apparent age of awareness around privilege and oppression, many of us are questioning and re-examining previously unchallenged ideas. The degree of polarity is exponential worldwide, and derision is rampant among societies. Many are experiencing their freedom, identity, and self-expression being stripped away by the disingenuous elite who want to crush entrepreneurialism and critical thinking.

The wheels have been set in motion for the Great Reset and Stakeholder Capitalism plans involving ESG, global Digital ID, and a new monetary system by the BIS. NGOs, asset management firms, and the banking cartel working with governments are enforcing mandates of ridiculous restrictions on companies in the name of climate change, hurting businesses and citizens worldwide.

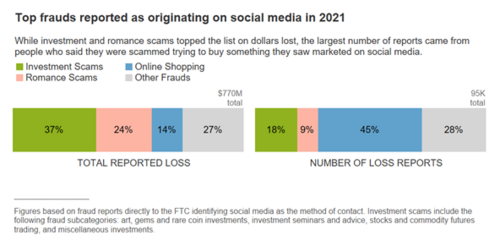

As is with big tech, specifically social media with its cancel culture oppressing free speech and self-expression. Both sides of the spectrum are in lockstep, trying to kill the entrepreneurial spirit and stifle innovation, which is precisely what they want, all in the name of stakeholder capitalism, with an aim to have complete control, but they won’t win.

As we are in the very throes of a new satanic age, it’s time to be more creative and more entrepreneurial because the reality is the perplexing big tech and big finance left-wing ideology has created an entire woke industrial complex.

That complex doesn't like any form of dissonance: you either abide by their rules on everything from climate change to transgenderism and vaccines to abortion, or you're out. That reality has been slowly growing for 20 years but now moving at a very rapid pace.

A growing number of entrepreneurs are seeing this oppressive dictatorship take hold, and the once thought of as “healthy capitalism” has turned into a “woke crony capitalism.” These brave critical thinkers are standing up for their rights and the people's rights, and they are on the verge of breaking the system.

Thanks to the internet, cryptocurrency, blockchain technology, and the introduction of independent cloud servers as an alternative to the centralized AWS and the like, entrepreneurs are actually developing a Parallel Economy where we don't have to rely on the system and its corrupt ideology.

The individuals and companies that are rising up have proved it can be done. When the system rejects your views and confiscates your liberties and livelihood, you can continue and thrive outside the system, which is terrifying to the media. In the last decade, big tech, especially the social media giants, has become the gatekeepers of speech. This is a real threat to anyone who disagrees with the government and its power and string puppets.

Many who have dared to share their views have been canceled on social media, email accounts blocked, bank accounts confiscated, and payment provider boycotts. This is the new system the left-wing is creating. If this insane left-wing crusade continues at the current pace, half of the population will be locked out of the economy entirely. That's what Russia faced when it was sanctioned by various governments and the western banking system. In fact, they created a parallel economy by creating their own banking system.

People just want to participate in regular normal economic activity without being flagged for not believing in and using pronouns or wishing to use energy that actually works. One of the gracious things about the apolitical environment is that it unites us, irrespective of race, gender, or politics.

The role of capitalism and an apolitical marketplace in an otherwise divided polity is to provide social forces that result in cohesion across divisions. So as this parallel economy grows, everybody is welcome to participate, with the only requirement being that you have the common sense to see the actual value of freedom.

Some innovators are fed up with woke left-wing intolerance and are the first to step out and take risks by building alternatives to counter an ever-increasing oppressed system. These alternatives cover the many aspects of our lives that the woke culture has infiltrated.

We’ll review some of these inspiring entrepreneurs and their companies from various sectors pioneering the parallel economy, including financial, dating and relationships, entertainment, social media, and marketing, plus find out how we can participate in building a parallel economy.

Image source: Strive, Media Reel

Strive Asset Management

The mission of Strive Asset Management is to “restore the voices of everyday citizens in the American economy by leading companies to focus on excellence over politics.” They are in direct competition with the asset management giants like Blackrock. They have seen the need to restore capitalism for the people who want to move in the traditional direction of focusing on products and services for profit rather than social agendas or ideologies.

What Strive finds is that many major companies are not in competition with each other. So they do not take advantage of an opportunity to fill the gap that may arise due to a company's decisions to push agendas that many customers are adverse to and put off from participating.

Why is that? It’s because the top shareholders are the same for all these companies; they are the woke investors like Blackrock, State Street, and Vanguard. There's a concentration of capital of around $20 trillion that is handled by these three companies alone. They are essentially the puppet masters behind the scenes pulling the strings and effectively mandating through soft power, ensuring these companies adopt their one-sided political agendas.

So is that the free market where companies are free to do what they want to be sustainable and grow in the interests of product and service excellence? In effect, they're being told by a small group of actors directly doing favors for the government behind the scenes who are in bed with unelected leaders of the WEF to direct corporate America's and corporations' behaviors worldwide.

Entrepreneur, Author, and Co-founder of Strive Asset Management, Vivek Ramaswamy, says,

“The free market is not free to fix what it's not free to fix. Companies need to have the restraints lifted so that they are able to and be allowed to pursue their own self-interest.”

Fascism Hurts The Free World

So how do agendas like climate change, ESG, and pushing for a great reset of the world hurt the entrepreneurial and creative spirit?

As explained by Vivek, one example is Chevron Oil and Gas Company when in 2020, they were forced to adopt a Scope 3 Emissions Cap. The company and its board were against this change, but Blackrock, State Street, and Vanguard voted in favor of it, so the majority supported the proposal, and of course, it was set in motion.

The Emissions Cap requires not just Chevron to reduce its own emissions but to reduce the emissions of anyone who uses their oil, all the way downstream, including their employees who commute to work and the Amazon truck delivering food to its customers. So that means Chevron as a company is required to take responsibility for everything and everybody that uses its oil.

It's a problem because Chevron, as a company, cannot exist as it has done if it has to take responsibility for reducing customers using its own product. Why would it ever be in the interest of a business, whether it be a small entrepreneurial business or a legacy company like Chevron, to say, “it's in my interest to force my consumers to use less of the core product that I make?”

Nefarious Double Standards

That is a fundamentally anti-growth measure. It's essentially a measure opposed to human flourishing delivered through American capitalism. Furthermore, it's not even good for the environment or the alleged effects of climate change because when Chevron drops these projects, some firms in China get to pick them up that have even worse and dirtier oil production.

It's interesting to note Blackrock doesn't apply the ESG standards to Chinese companies but gets its license to be an asset management builder in China and make a lot of money. And they're doing it while applying these ESG standards to the United States that cripple American energy companies and affect the lives of everyday citizens.

It’s important to note that these asset management firms use peoples’ retirement funds to invest in their agenda-driven interests that do not serve the people's interests. It’s becoming clear that most people do not want their asset managers advocating for the political agendas they are pushing.

It's a geopolitical tool and a trojan horse. They’ve used capitalism as a trojan horse to undermine America from within, and China will be the biggest beneficiary at the end of the day. It's the merger of state and corporate power that neither of them could do independently. It's a hybrid of the two together, making it more powerful than either alone. The merger of state and corporate power is the classical definition of fascism.

Image source: Twitter

The Right Stuff

The Right Stuff is a new dating app co-founded by Daniel Huff. Huff is a Republican who worked at the White House as an adviser for the Trump administration before becoming an entrepreneur. He saw an opportunity and a real need to counter the antagonism and discrimination from many of the dating apps out there today that either promote or enforce left-wing extremist ideology.

He brings to light how the conservative individual who subscribes to a “live and let live” philosophy has difficulty finding traditional mediums to connect with people. Many dating apps have agendas and ideologies that don’t necessarily fit society's moral values or ethical standards.

It’s not just antagonism from the users of an app but the platforms' discrimination. One example of platform bias is when joining the community on one of the largest dating apps; it is an absolute requirement that you affirm your support for Black Lives Matter before having access.

Another is pressing people to add pronouns to their profiles, which has become a contentious issue for many. Also, adding stickers to profiles relaying your interests, even political interests, except all stickers relate to left-wing only.

According to Huff, the Left has repeatedly stated that if you don’t like how we do things, build your own, so he did! He says the Republicans have been playing catch up for too long with Liberal technology, adding,

“We just don't want to catch up. We want to make a superior product. And we can do that by adding features that no one else has that distinctively set us apart and help to create a parallel economy.”

Image source: Twitter, EricJuly.com

Rippaverse Comics

Rippaverse Comics is about bringing the industry back to its essence. The unfortunate state of the comic industry with the likes of Marvel and Disney, now owned by mega-corporations, where timeless characters have been bastardized beyond recognition. They are distorted with a leftist message of political and social views incongruent with the age-old narrative or characters.

A bunch of activists masquerading as writers has infiltrated the industry. They use well-known characters as a medium or vehicle to push their leftist agendas and fundamentally ruin the industry for those who aren't interested in that.

The corporate entities in control have no loyalty to the reader, the customer, or the legendary comic character that people know well and love. They don't protect or care about the sanctity or legacy of these characters.

Commentator, content creator, and musician Eric July saw the opportunity and the hole in the market for a comic book company with ethics and standards that put customers first. The company vows to deliver content that doesn’t include current politics or narratives that many comic lovers are fed up with being force-fed. Also, the customers' ethnic backgrounds or genetic makeup are totally irrelevant to them.

Founder and owner of Rippaverse Comics, Eric July, started this venture in the parallel economy with no external investors, and he has expressed it will remain that way, saying,

“We want to expand in many different avenues, including video games, animation, and maybe even live-action movies. But not if it means selling off our assets; we only answer to the customer.”

In setting up the company, the project was completely organic. Eric bypassed all major organizations and regular channels when dealing with publishing and distribution and has been very successful in helping creatives and the people behind the scenes at Rippaverse Comics.

This push to subvert the corrupted mega players has successfully gained tens of thousands of followers and subscribers. The company has surpassed its revenue expectations, so it’s clear there is a growing awareness in society of the evil game woke capitalism is playing.

Image source: Markethive.com

Markethive Media – The Ecosystem For Entrepreneurs

Markethive is a prominent contributor to the Parallel Economy in the social media, broadcasting, and inbound marketing spectrum. Thomas Prendergast, entrepreneur, author, artist, and engineer, pioneered the automated marketing concept and was ahead of the curve, initiating a social network in the ‘90s before Web 2.0 social media emerged.

Thomas Prendergast, Founder, Architect, and CEO of Markethive, anticipated the tyrannous and evil direction of where the world was heading, hence the emergence of the first Blockchain-driven, decentralized social market network that circumvents the injustices forced upon us.

Markethive is a Divine vision giving back the autonomy and freedom of expression desperately needed to communicate and conduct any business online. With a holistic approach, Markethive enables every individual to realize their potential regardless of what is happening out there.

Thomas expressly states,

“Amid this upheaval, Markethive’s primary objective is providing financial inclusion for all. We have blockchain technology and an integrated entrepreneurial ecosystem where people have privacy, autonomy, and sovereignty.

They earn income with our native crypto coin (Hivecoin) in many different ways daily, including becoming a shareholder via the ILP, the added staking advantage of our crypto wallet with Markethive Credits, and profiting from the many cottage industries within the Markethive ecosystem. Essentially, it’s the community that owns Markethive and not the hierarchy".

Big venture capitalists or corporations do not fund Markethive. It is for the people, by the people, and of the people who stand for truth, liberty, and freedom. Furthermore, Markethive has removed itself from the centralized giant tech cloud services that have shown themselves as wicked despots and established sovereign cloud server systems, free from dictatorship and an internet shutdown due to censorship.

These aspiring entrepreneurs and critical thinkers will not acquiesce to the insidious actions of big tech and are part of what is causing real frustration and risk for the woke culture and crony capitalists. Due to the fascism of governments and mega-corporations the world is experiencing, Markethive has its own merchant account and exchange to ensure complete privacy and anonymity. It also eliminates the threat of having your account closed or confiscated by authorities who feel the need to censor you and withdraw your liberties for whatever reason.

The End Goal

The end goal of the projects is not to create a more polarized economy; through healthy competition and true diversity, the private sector that is depoliticized can bring divided communities together to cooperate in a transparent fashion.

There’s a resurgence of entrepreneurs and a rise of businesses being created to serve the hundreds of millions of customers and users who are tacitly ill-affected from their private sector or feel left behind by this woke trend. And they will do it in an elegant way rather than combative. The winners will be the new businesses that operate according to apolitical principles.

Much to the chagrin of the authoritarian entities, we are entering a more decentralized age, where everybody wins. The free market is at its finest when we are doing what we love serving other people for the sake of all humanity.

Entrepreneurs are the lifeblood of innovation, striving for a free and peaceful world. They are critical thinkers, creative and inspirational. They also ‘walk softly and carry a big stick’ and are not easily fooled by the trickery and lies of self-serving dictatorial agencies.

With God’s help, we will withstand the technocracy that is trying to enslave humanity. There is something greater than the elite, tech giants, and mega-corporations that even they cannot control. Every thinking individual recognizes that something more prominent is taking place. You can be part of the Parallel Economy by joining and disseminating the good news and supporting the entrepreneurs and companies that will bring us into a new Golden Age.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.png)

Inflation triggered worst market sell-off since 2020, analyst predicts even more pain – John Feneck

Inflation triggered worst market sell-off since 2020, analyst predicts even more pain – John Feneck

.gif)