Markethive: The Multi-Dimensional Ecosystem for Collaboration and Unparalleled Reach, Leveraging Advanced Analytics Technology

Markethive is all things to all people. Markethive stands as a truly revolutionary digital platform, meticulously engineered to serve a multifaceted array of users and their diverse needs. It is not merely a social network or a blogging platform; instead, Markethive is a holistic, multi-dimensional system characterized by its deep-level linking dynamics and sophisticated social organizational integrations. This innovative architecture enables a seamless and expansive digital experience, fostering growth and connectivity across various online domains.

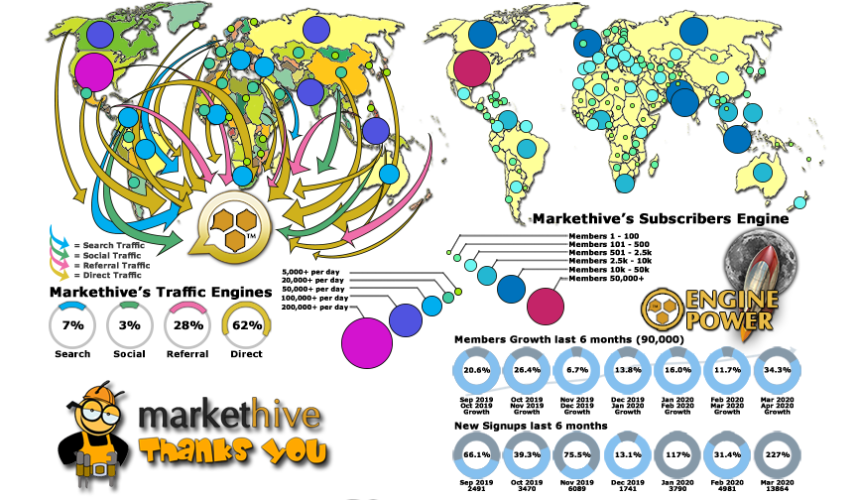

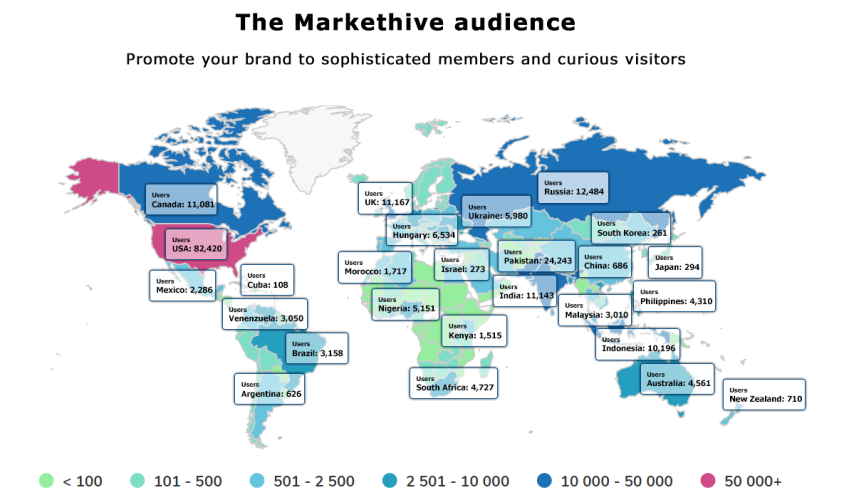

At its core, Markethive masterfully integrates a vast social network reach, allowing users to tap into an extensive global audience. Complementing this outward reach are robust internal social network connections, facilitating vibrant communities and direct interactions among members. This dual approach ensures both broad visibility and intimate engagement within the platform.

A cornerstone of Markethive's expansive capabilities is its provision for unlimited interconnected WordPress blogs. This feature empowers users to create and manage multiple professional-grade blogs, all seamlessly linked within the Markethive ecosystem. These blogs not only serve as powerful content hubs but also benefit from the platform's inherent social and linking advantages.

Markethive also distinguishes itself through its extensive and deeply integrated network of content distribution channels. This network includes unparalleled integration with a multitude of API news sites, encompassing both major traditional media outlets and specialized crypto news platforms. This broad reach ensures that content generated within Markethive, particularly through its interconnected WordPress blogs, gains significant exposure across diverse and authoritative news ecosystems.

Additionally, Markethive's proprietary HivePress system significantly enhances this reach. Hivepress makes it easy to connect with thousands of customized domains and independent news sites, creating a decentralized yet unified content syndication network. This extensive integration allows Markethive users to share any content they create, including articles, blog posts, press releases, and updates, across these trusted news platforms.

Markethive's core architecture is carefully designed to simplify the content distribution process, ensuring both effective sharing and broad visibility for all user-generated content. Unlike traditional platforms that usually focus on a single aspect of digital interaction, Markethive stands out by offering a complete set of features. These include powerful tools for social networking, advanced marketing automation, and sophisticated digital broadcasting capabilities.

This holistic design enables a seamless flow of information, allowing user content to reach a broad and diverse array of digital news and information sources. By transcending the limitations of single-focus platforms, Markethive empowers users to leverage all facets of online engagement from a unified ecosystem, maximizing their reach and impact across the digital landscape.

The power of your own Markethive network is a key driver in this expansion, as active engagement and content creation continually enhance the platform's reach and influence. Moreover, the collaborative efforts of separate Markethive groups, all working in union with each other, significantly amplify this effect, creating a self-reinforcing cycle of expanded visibility and influence within the digital landscape.

The ability to register and connect your various social networks within the Markethive matrix extends your reach to billions. Imagine a dynamic, ever-expanding content cloud that constantly works on your behalf. With Markethive's advanced features, you can not only visualize the massive content cloud working for you but also physically interact with and manipulate it to see your cloud in 3D as it grows and changes right before your eyes, as explained by CEO and founder Thomas Prendergast in the video below.

Markethive: A Paradigm Shift for Digital Entrepreneurs

Markethive marks a breakthrough for individuals aiming to succeed in online entrepreneurship, where the digital world can be overwhelming. It's a game-changer that empowers everyday internet users to overcome their limitations and compete with experienced professionals. For aspiring entrepreneurs, even those just starting out, Markethive offers a unique opportunity to join the ranks of successful individuals by providing access to premium tools and insights that can help them achieve their goals.

Markethive leverages advanced data aggregation and clustering techniques to expand the reach and impact of your content. By intelligently grouping data and clusters, your message gains significant velocity, enabling it to penetrate and resonate within audiences and markets you might not have envisioned. This organic, data-driven growth is further highlighted through Markethive's intuitive data technology, which enables users to conduct visual research that reveals the true extent of their content's reach. This unmatched insight helps every piece of content work harder, reaching its ideal audience with maximum efficiency.

The Power of Community and Actionable Metrics

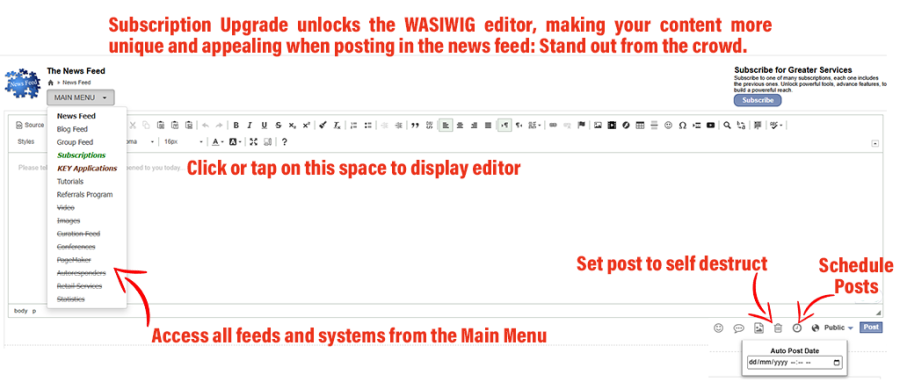

Markethive's collaborative ecosystem generates an "exponential effect" on content development. By engaging with other members, users ignite innovation, share knowledge, and foster mutual growth, creating a vibrant environment where ideas flourish and campaigns gain momentum. What's essential is that metrics provide solid evidence of your network's success, offering the tangible proof you need. Markethive has seamlessly integrated comprehensive traffic metrics into every part of your broadcasting platforms, providing a complete view of your digital footprint. This includes detailed analytics for:

- Capture Pages: Understanding how effective your lead generation efforts are.

- Blogging: Gauging engagement and readership for your written content.

- Groups: Tracking the vitality and influence of your community interactions.

- Profile Pages: Assessing the reach and appeal of your personal brand.

- Supergroups: Providing e-commerce insights.

- WP Plugins: Even delivering real traffic reports to your WordPress blogs, extending Markethive's analytical prowess beyond its native environment.

Furthermore, Markethive's innovative "capture page widgets" provide a unique advantage. These versatile widgets can be seamlessly embedded into many third-party blogs, profile pages, and press release platforms. Besides simple integration, they deliver accurate data on traffic, origin, bounce rates, and duration, offering critical insights that guide strategic adjustments. All of this valuable information is then intuitively displayed within Markethive's advanced "visualization matrix displays," transforming raw data into clear, actionable insights.

Markethive: Leading the Way in Digital Engagement and Income Generation

Markethive is at the forefront of developing groundbreaking technologies that are set to redefine how businesses and individuals interact in the digital landscape. Through innovative solutions, Markethive is creating a dynamic and rewarding ecosystem for its global community.

One of Markethive's key advancements is its development of dynamic, interactive displays. These cutting-edge systems are engineered to deliver a truly 3-dimensional production, offering a powerful and captivating perceptual display. This technology aims to revolutionize how information is presented, making digital content more engaging and impactful than ever before.

At the core of Markethive's analytical capabilities is its sophisticated Vector Research. This proprietary system has been meticulously developed within the Markethive platform to provide deep, insightful research and highly accurate reports. Vector Research delves into the intricate depth and dynamics of the multilevel relationships that are cultivated within the Markethive ecosystem.

By understanding these complex interconnections, Markethive empowers its users with valuable data, enabling them to optimize their strategies and maximize their reach. This analytical prowess provides an unparalleled understanding of network interactions, fostering growth and efficiency.

A fundamental component of the Markethive foundation is the robust Social Networks Control Panel. This intuitive hub is designed to enhance your online presence and increase your income potential. By seamlessly integrating all your social media accounts into this panel, you unlock incredible power, reach, and additional income with Markethive’s Bounty Program.

The Bounty Program is a testament to Markethive's commitment to rewarding active participation. By simply following Markethive's official social accounts, users are directly rewarded with Hivecoin (HVC), Markethive's own secure and robust cryptocurrency. This innovative approach is just one facet of Markethive’s incredibly generous Faucet system that continually pays you for your activity on the platform.

The Faucet system ensures that every interaction and contribution within the Markethive community is recognized and compensated, creating a truly reciprocal and rewarding environment for all its members. This holistic approach to social engagement and cryptocurrency rewards truly sets Markethive apart, empowering users to not only expand their network but also generate tangible income through their digital activities.

Data Analysis: Empowerment, Not Exploitation

A fundamental principle guiding Markethive's design is its unwavering commitment to serving its users, rather than exploiting them. Unlike many platforms that monetize user data through data analysis (big data) for their own benefit, Markethive's data analysis is built to serve you, not exploit you. The Markethive system meticulously analyzes this data and delivers it in interactive graphics, charts, and displays, empowering users to make informed decisions.

This clarity enables entrepreneurs to easily identify what is driving traffic and what is not, allowing them to refine their strategies, optimize their campaigns, and ultimately achieve greater success without concern for their data being misused. Markethive redefines the relationship between users and platforms, placing power and control squarely in the hands of entrepreneurs.

.png)

Markethive – A Giant Blockchain Crypto Project

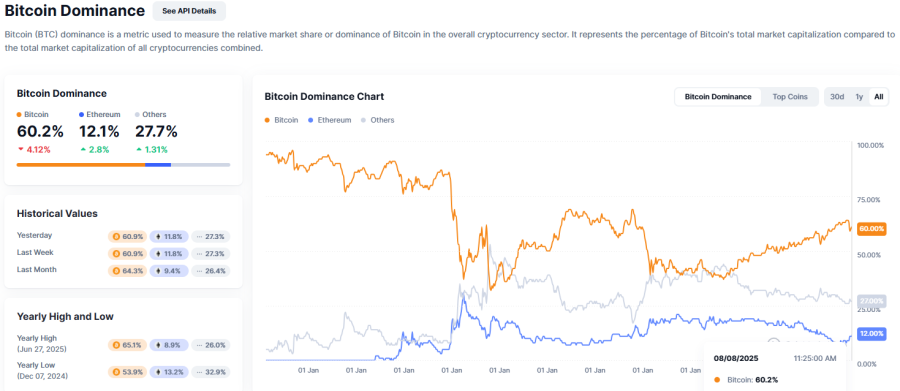

Blockchain – Empowering a New Era of Entrepreneurship

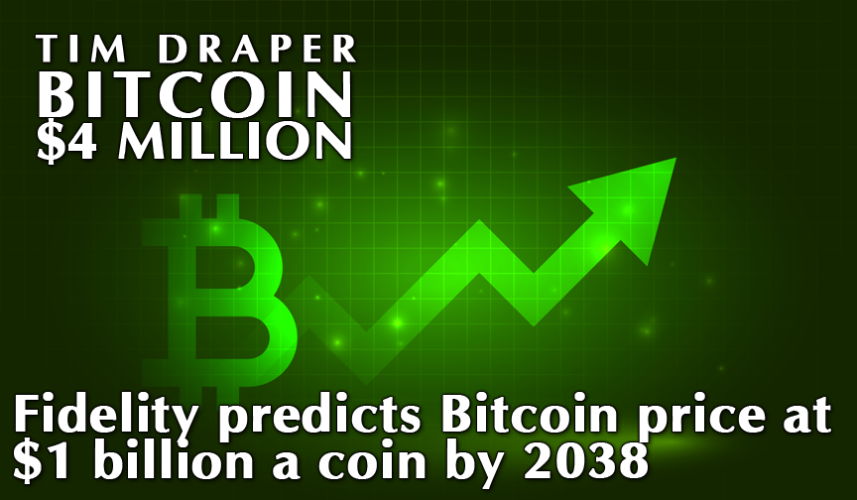

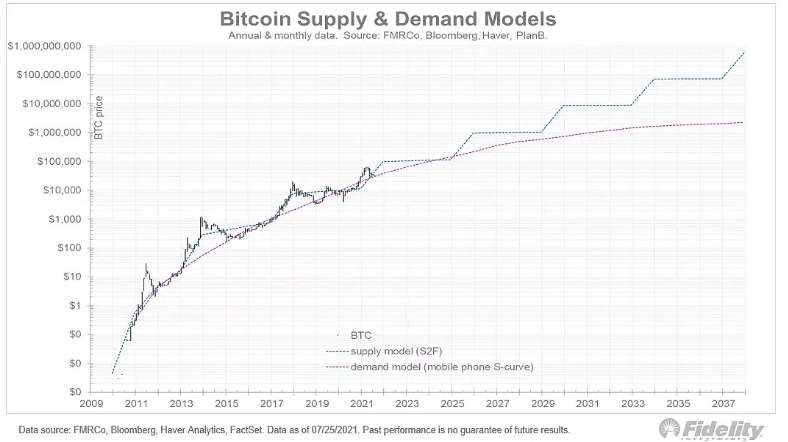

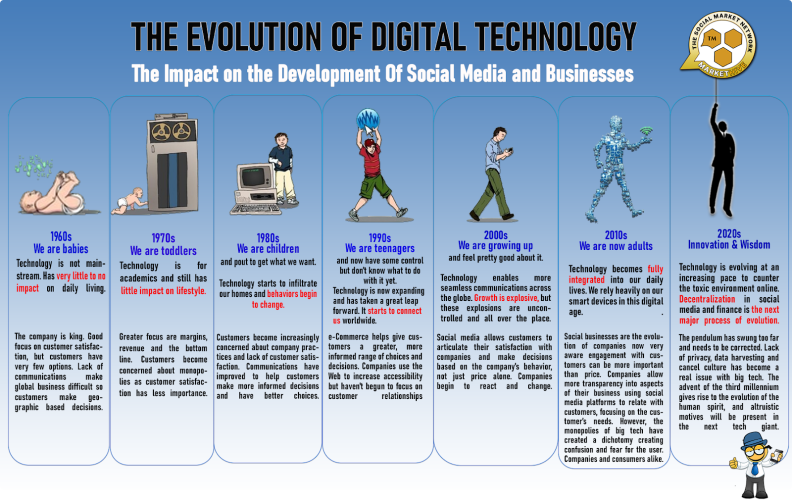

Blockchain technology and the growing cryptocurrency industry have revolutionized the business world, enabling companies to meet their users' needs and genuinely safeguard their rights. This shift empowers individuals to control their data and monetize their time and efforts in new ways.

Markethive, a pioneering platform, was created with a clear and ambitious goal: to support entrepreneurs and challenge the oppressive systems that have long troubled society. Its visionary founder anticipated this transformative era, recognizing the urgent need to empower social media users and marketers alike. Markethive was carefully designed to promote equality, generate sustainable income streams, and ultimately benefit society as a whole, from the individual to global communities.

The decentralized nature of blockchain inherently offers transparency, security, and immutability, which are crucial for building trust in digital interactions. This technology underpins Markethive's commitment to giving users ownership of their digital identity and content. Unlike traditional social media platforms, where user data is often exploited for corporate gain, Markethive leverages blockchain to ensure that users are the primary beneficiaries of their contributions.

This empowerment goes beyond data ownership. With integrated cryptocurrency features, Markethive allows direct monetization of creative content, engagement, and marketing efforts. This not only creates new economic opportunities for those who might otherwise be marginalized by traditional systems but also promotes a fairer distribution of wealth. By building a community where every participant has a stake in the platform's success, Markethive aims to dismantle the power imbalances often found in centralized platforms.

The platform's emphasis on entrepreneurs is significant in a world that is becoming more digital and interconnected. It offers tools and resources for both aspiring and established entrepreneurs to develop their businesses, reach their target audiences, and make secure transactions, all within a transparent and supportive setting. This holistic approach to empowering individuals and promoting economic independence is central to Markethive's mission to effect positive societal change at all levels.

.png)

Markethive – A Quarter-Century of Innovation and Empowerment

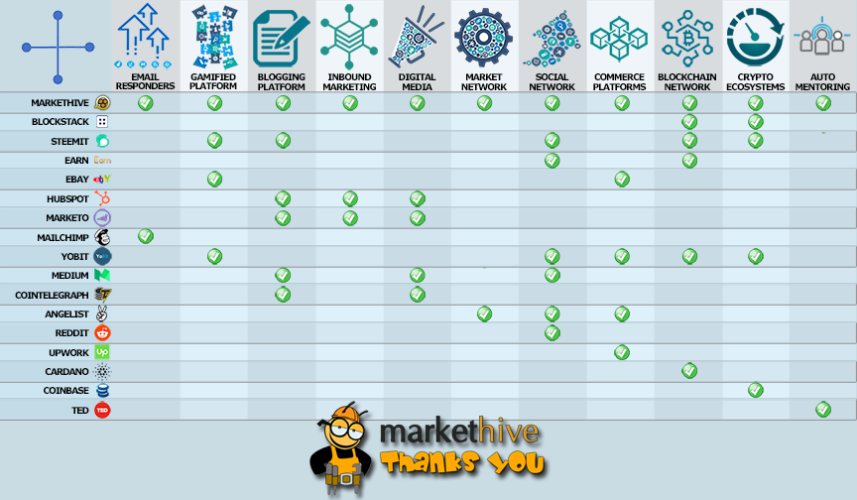

Markethive's 25-year journey highlights its visionary leadership and strong commitment to adopting innovative technology. This long-term development has resulted in a comprehensive ecosystem designed to help anyone succeed online. More than just a platform, Markethive introduces a new paradigm — the world's first Market Network, merged with social media, all built on the secure and transparent foundation of blockchain technology. This innovative approach positions Markethive as the future of digital interaction, surpassing the capabilities of traditional platforms.

What truly distinguishes Markethive is its commitment to delivering what other platforms lack. More than just offering tools and a community, Markethive has developed a unique income-generation model that provides an exceptional opportunity for a wide range of creators and entrepreneurs. Commercial writers, influential bloggers, engaging vloggers, and ambitious entrepreneurs will find ample opportunity for financial growth. The platform's holistic approach welcomes all artists, regardless of their background or medium, providing them with the tools to monetize their talents and connect with a global audience.

Crucially, Markethive prioritizes fundamental human rights in the digital age: privacy and transparency. In an era where data breaches and secretive practices are widespread, Markethive serves as a symbol of ethical operation, ensuring that users' personal information is secure and that all transactions and interactions are conducted transparently. This dedication is reflected in its core philosophy: "It’s for the people by the people."

Essentially, Markethive is more than just a platform; it is a movement focused on empowering individuals who create, connect, and contribute to the digital world. It allows users to control their data, income, and online experience, promoting a truly meritocratic and fair digital environment.

.png)

Tim Moseley

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

%20copy(1).png)

.png)

.png)

.png)

.png)