Analysts expect gold to kick off Q4 with gains, while retail investors are evenly split

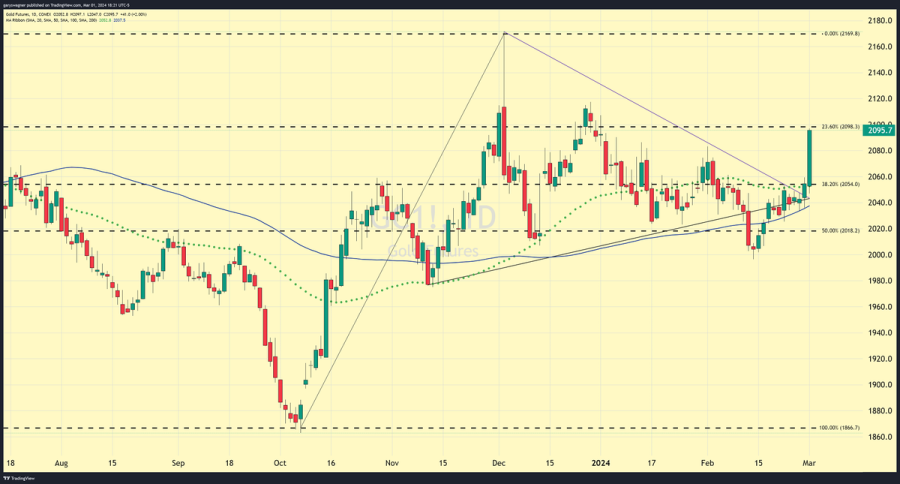

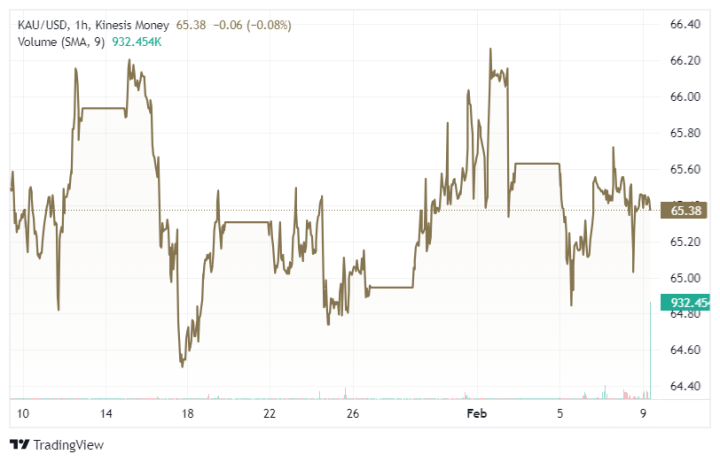

Gold prices underwent a dramatic selloff this week, continuing and accelerating the downtrend that began after the Federal Reserve left interest rates unchanged on the 20th and reiterated that rates would remain higher for longer than previously anticipated.

The latest Kitco News Weekly Gold Survey sees most market analysts optimistic that gold will see a bounce in the near term, while retail investors are more evenly divided after experiencing seven straight sessions of losses.

Everett Millman, Chief Market Analyst at Gainesville Coins, attributed gold's recent slide largely to seasonal factors and options contracts expiring, and sees the precious metal rebounding to start the fourth quarter.

"My initial reaction to the downturn this week was that it had a lot to do with the options expiry on Comex, which does usually lead to a lot of downside volatility as people are closing out or rolling over contracts," he said. "But given that this price action continued throughout the rest of the week, I'm also going to attribute that a bit to seasonality. The gold market usually goes into a slumber in the late summer, early autumn months. We saw that exact same pattern last year. Unless markets are interpreting the FOMC to be extremely hawkish, which I don't think is what's going on, I think you have to chalk it up to seasonality and just the regular trading dynamics that come at this time of year."

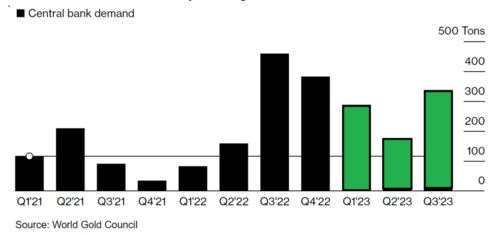

"Usually October, the beginning of the fourth quarter, is when you see the tide turn the opposite direction," Millman said. "It's when we get a lot of gold buying events out East, in both India and China. India has the Diwali festival coming up in early November, a lot of buyers over there start accumulating gold in the weeks preceding that."

"I would expect to see gold, if not at the beginning of October, certainly by the beginning of November, to see prices on the rise again."

James Stanley, senior market strategist at Forex.com, believes gold could fall further in the first week of October. "The rates theme has markets on edge and gold's behavior since FOMC has been aggressively bearish with both spot and futures taking out a number of supports along the way," Stanley said. "There's no evidence that's finished yet."

This week, 13 Wall Street analysts participated in the Kitco News Gold Survey. Seven experts, or 54%, expected to see higher gold prices next week, while four analysts, or 31%, predicted a drop in price. Only two analysts, or 15%, were neutral on gold for the coming week.

Meanwhile, 540 votes were cast in online polls. Of these, 245 retail investors, or 45%, looked for gold to rise next week. Another 219, or 41%, expected it would be lower, while 76 respondents, or 14%, were neutral about the near-term prospects for the precious metal.

Kitco Gold Survey

Wall Street

Bullish54%

Bearish31%

Neutral15%

VS

Main Street

Bullish45%

Bearish41%

Neutral14%

The latest survey shows that retail investors expect gold to trade around $1,872 per ounce next week, which is $64 below last week's prediction, but which would still represent a gain of $23 from the current spot price.

The coming week will see the release of the ISM Manufacturing and Services PMIs for September along with over a dozen speeches by U.S. and European central bankers, including Fed chair Jerome Powell and ECB president Christine Lagarde. The highlight of the week will be the Nonfarm Payrolls report for September, which is slated for release on Friday morning, but which could be canceled if the U.S. government shuts down.

Mark Leibovit, publisher of the VR Metals/Resource Letter, sees gold prices rising next week as the greenback pulls back. "Bullish, as it appears the U.S. dollar may be forming a trading top," he said.

Darin Newsom, Senior Market Analyst at Barchart.com, shared a technical case in favor of gold gaining ground next week.

"While the long-term trend and intermediate-term trends remain down, Dec gold's short-term daily chart is showing the contract to be sharply oversold," Newsom said. "Daily stochastics established a bullish crossover below 20% at Thursday's close, a signal the short-term trend is set to turn up. It's possible, maybe not probable, Dec23 completes a bullish 2-day reversal Friday. To do so, it would need to rally and close near the daily high. If that doesn't happen, a bullish reversal pattern will be delayed for a bit."

Marc Chandler, Managing Director at Bannockburn Global Forex, also sees upside potential for gold as the fourth quarter gets underway. "I look for gold to bottom shortly," Chandler said. "Soft US core inflation helping US rates stabilize and the dollar's pullback should help the yellow metal. Month-end and quarter-end flows may be distorting the immediate picture, but the headwinds on the US economy look set to intensify: tightening of credit, the cumulative effect of rising rates, deposits still leaving banks, the resumption of student debt servicing, the likely partial closure of the US federal government, and the high energy price may sap the strength of the US economy."

Looking at the technical picture, Chandler said, "I would be inclined to buy gold on further weakness and look for a move to $1885 to stabilize the technical tone and a move $1892 to boost confidence a low is in place."

"Funds are still holding a net-long futures position, not changing it much over the course of September," Newsom noted, "so with the end of the quarter in sight, it could lead to some long-liquidation."

Adam Button, Chief Currency Analyst at Forexlive.com, still believes bonds and the U.S. dollar will dictate the precious metal's trajectory in the near term, but he sees a silver lining to gold's recent weakness.

"There's a wonderful seasonal gold trade that kicks off in November, and this is setting up very nicely for a test of $1800, and then strength November through January," Button said. "Obviously the bonds are the catalyst here. Right now, you can buy a three-month T-bill, five and a half percent, 10-years, four and a half percent, and gold still yielding zero. The yield difference between gold and other traditional safe havens is painful at the moment, especially in an environment with a rising dollar."

He said gold bulls believed the Fed would be signaling an end to rate hikes by this point. "Instead, there was talk this week about extending the hiking cycle into 2024, Kashkari was a pretty big catalyst saying that, a 40 percent chance that they have to keep hiking, perhaps significantly, in 2024."

Button believes gold will need to see weakness in U.S. economic data before any kind of sustained rally. "I suspect it's coming, but we may not be getting any economic data starting next week if the shutdown happens, at least not the top tier data," he said. "That stokes some economic weakness later. But now, say the shutdown last two weeks in October, then can you really trust the October data? Because it's all going to be skewed. I don't know… I think the market will probably figure out whether it's real or fake weakness, but it might look like weakness at least, which should be bullish for gold."

Button also agreed that quarter-end factors were in play this week, and he thinks there's a decent chance gold sees a bounce early next week. The price action today isn't particularly promising, but the day's not over," he said. "I don't have a huge amount of confidence we'll get a big bounce, but I'd say I'm neutral for next week."

And Kitco Senior Analyst Jim Wyckoff sees downside risks for the precious metal. "Steady-lower. Technicals bearish," Wyckoff said. "That means the path of least resistance for prices remains sideways to lower."

Gold prices are currently down 0.84% on the day and 4% on the week, with spot gold last trading near session lows at $1,849.09 an ounce at the time of writing.

By

Ernest Hoffman

For Kitco News

Time to Buy Gold and Silver

Tim Moseley