Thoughts on the Crypto Market

The crypto market has been a hot topic in recent years, with many investors and traders eager to get in on the action. As the market continues to evolve, opinions on the future of cryptocurrencies vary widely. In this article, the author shares their thoughts on the current state of the crypto market and where it might be headed.

The author begins by acknowledging the recent volatility of the crypto market and the risks associated with investing in such a fast-paced and unpredictable space. However, they also note that there are many potential benefits to investing in cryptocurrencies, such as the potential for high returns and the ability to diversify one's portfolio.

Throughout the article, the author draws on their own experience and research to provide insights into the crypto market. They discuss topics such as the role of regulators in the space, the impact of market trends on crypto prices, and the potential for new technologies to disrupt the market. Overall, the article provides a thoughtful and nuanced perspective on the complex and ever-changing world of cryptocurrencies.

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use encryption techniques to regulate the generation of units of currency and verify the transfer of funds. They operate independently of a central bank and can be transferred directly between individuals without the need for intermediaries like banks or payment processors.

Decentralized Nature of Crypto

One of the key features of cryptocurrencies is their decentralized nature. Unlike traditional currencies, which are controlled by central authorities like governments or banks, cryptocurrencies are based on a decentralized ledger system called blockchain. This means that no single entity has control over the currency or its transactions, making it more resistant to censorship, hacking, and fraud.

Keys and Security

Another important aspect of cryptocurrencies is the use of cryptographic keys to secure transactions and control access to funds. Each user has a public key and a private key, which are used to encrypt and decrypt transactions. The public key is like a bank account number, while the private key is like a password. It is important to keep the private key secure, as anyone with access to it can control the associated funds.

In addition to the use of keys, many cryptocurrencies also use other security features like multi-signature transactions and two-factor authentication to further protect users' funds. However, it is important to note that cryptocurrencies are not immune to security risks, and users must take care to protect their keys and follow best practices for securing their accounts.

Overall, cryptocurrencies are a complex and rapidly evolving technology with the potential to revolutionize the way we think about money and financial transactions. While there are still many challenges and uncertainties surrounding the crypto market, understanding the basics of how cryptocurrencies work can help individuals make informed decisions about their investments and participation in this exciting new field.

Major Cryptocurrencies

When it comes to the crypto market, there are a few major cryptocurrencies that are worth paying attention to. These include Bitcoin, Ethereum, Ripple, and various altcoins. Each of these cryptocurrencies has its own unique features and benefits, which make them attractive to different types of investors.

Bitcoin

Bitcoin is the largest and most well-known cryptocurrency. It was created in 2009 and has since become a household name. Bitcoin is decentralized, meaning that it is not controlled by any government or financial institution. It operates on a peer-to-peer network, which allows users to send and receive payments without the need for intermediaries.

Ethereum

Ethereum is the second-largest cryptocurrency by market cap. It was created in 2015 and is a decentralized platform that enables smart contracts and decentralized applications (dapps) to be built and run without any downtime, fraud, or interference from a third party. Ethereum is also the platform that many other cryptocurrencies are built on.

Ripple

Ripple is a cryptocurrency that was designed for the banking industry. It operates on a decentralized network, but it is not as decentralized as Bitcoin or Ethereum. Ripple's goal is to provide fast and secure cross-border payments. It has partnerships with many major banks and financial institutions.

Altcoins

Altcoins refer to any cryptocurrency that is not Bitcoin. There are thousands of altcoins available, each with its own unique features and benefits. Some popular altcoins include Litecoin, Bitcoin Cash, and Dogecoin.

Investors should do their own research and due diligence before investing in any cryptocurrency. While the crypto market can be volatile, it has the potential for high returns. However, it is important to remember that cryptocurrencies are still a relatively new and untested asset class.

Crypto Market Dynamics

The crypto market is known for its dynamic nature, with prices fluctuating rapidly and unpredictably. In this section, we will explore some of the key dynamics of the crypto market, including volatility, valuation, and trading.

Volatility

One of the most notable features of the crypto market is its high level of volatility. Cryptocurrencies can experience significant price swings in a matter of minutes or hours, which can make them attractive to traders seeking to profit from short-term price movements.

However, this volatility can also make cryptocurrencies risky investments, as prices can quickly drop just as fast as they rise. It is important for investors to be aware of the risks associated with volatility and to take steps to manage their risk exposure appropriately.

Valuation

Another important dynamic of the crypto market is valuation. Unlike traditional financial assets, cryptocurrencies do not have a physical backing or underlying cash flow, which can make it difficult to determine their true value.

Instead, the value of cryptocurrencies is largely determined by market supply and demand dynamics. As more people buy and sell cryptocurrencies, their prices can rise or fall accordingly.

Trading

Trading is a key aspect of the crypto market, with many investors buying and selling cryptocurrencies on exchanges. However, trading cryptocurrencies can be complex, with different exchanges offering different features and trading pairs.

Investors should take the time to research different exchanges and trading strategies to find the approach that works best for them. It is also important to keep in mind the risks associated with trading, including the potential for losses due to price volatility or exchange hacks.

Overall, the crypto market is a complex and dynamic space, with many different factors influencing prices and trading activity. By understanding the key dynamics of the market, investors can make more informed decisions about their investments and manage their risk exposure appropriately.

Investing in Crypto

Cryptocurrency has become a popular investment option for many investors, including retail investors. However, investing in crypto assets is not without risks. In this section, we will explore the potential for profit and associated risks of investing in cryptocurrency.

Potential for Profit

One of the main reasons investors are attracted to cryptocurrency is the potential for high profits. The crypto market is highly volatile, which means that the value of cryptocurrencies can fluctuate rapidly. This volatility can provide opportunities for investors to make significant profits in a short amount of time.

Additionally, some cryptocurrencies have seen significant growth over the years, such as Bitcoin, which has increased in value from just a few cents to thousands of dollars per coin. This growth has led many investors to believe that cryptocurrency has the potential to be a profitable long-term investment.

Associated Risks

While there is potential for profit, investing in cryptocurrency also comes with significant risks. The crypto market is highly volatile, which means that the value of cryptocurrencies can fluctuate rapidly. This volatility can lead to significant losses for investors who do not understand the risks involved.

Additionally, the lack of regulation in the crypto market can make it difficult for investors to make informed investment decisions. There have been instances of fraud and scams in the crypto market, which can lead to significant financial losses for investors.

Furthermore, the security of cryptocurrency wallets and exchanges is also a concern. Hackers can steal cryptocurrencies from poorly secured wallets and exchanges, which can lead to significant losses for investors.

In conclusion, investing in cryptocurrency can be a potentially profitable investment option for investors. However, it is important to understand the associated risks and to invest only what one can afford to lose.

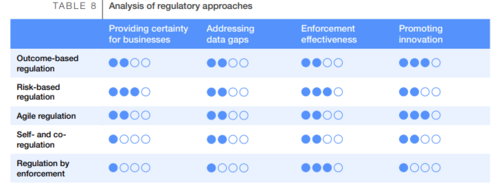

Regulation of Crypto

Role of SEC

The Securities and Exchange Commission (SEC) plays a crucial role in regulating the crypto market. The SEC is responsible for enforcing federal securities laws, which includes regulating securities offerings, trading, and investment activities. In recent years, the SEC has increased its scrutiny of the crypto market due to concerns about fraud, manipulation, and investor protection.

The SEC has taken several actions to regulate the crypto market. For example, the SEC has issued guidance on whether certain crypto assets are securities and subject to federal securities laws. The SEC has also brought enforcement actions against companies that have violated securities laws in connection with their crypto offerings or activities.

Role of Congress

Congress also plays a role in regulating the crypto market. Congress has held hearings on the crypto market and has introduced several bills aimed at regulating the market. For example, some bills would require crypto companies to register with the SEC or to comply with certain anti-money laundering and know-your-customer requirements.

However, there is currently no comprehensive federal regulation of the crypto market. Some lawmakers have called for more regulation, while others have expressed concerns about overregulation stifling innovation in the market.

Role of Crypto

The crypto market itself also plays a role in regulating the market. Some crypto companies have formed self-regulatory organizations (SROs) to establish industry standards and best practices. For example, the Virtual Commodity Association (VCA) was formed by several crypto exchanges to establish standards for the industry.

However, the effectiveness of SROs in regulating the market is limited. SROs are not government agencies and do not have the same enforcement powers as regulatory agencies like the SEC. Additionally, not all crypto companies are members of SROs, and some may not follow industry standards.

In conclusion, the regulation of the crypto market is a complex issue that involves multiple entities, including the SEC, Congress, and the market itself. While there have been some efforts to regulate the market, there is currently no comprehensive federal regulation. As the market continues to evolve, it will be important for regulators and lawmakers to balance the need for investor protection with the need for innovation in the market.

Crypto and Traditional Financial Systems

Cryptocurrencies have disrupted traditional financial systems in many ways. In this section, we will discuss the differences between crypto and traditional financial systems, and how they interact with each other.

Crypto vs Stocks

One of the main differences between cryptocurrencies and stocks is that stocks represent ownership in a company, while cryptocurrencies are digital assets that can be used for transactions. Additionally, stocks are regulated by the Securities and Exchange Commission (SEC), while cryptocurrencies are not.

Crypto and Central Banks

Central banks play a crucial role in traditional financial systems, as they are responsible for regulating the money supply and setting interest rates. Cryptocurrencies, on the other hand, are decentralized and not controlled by any central authority. This has led to concerns among central banks about the potential impact of cryptocurrencies on monetary policy.

Crypto and the U.S. Banking System

The U.S. banking system is heavily regulated, and banks are required to follow strict rules and regulations. Cryptocurrencies, on the other hand, are not subject to the same regulations, which has led to concerns about their use in illegal activities such as money laundering.

Despite these differences, cryptocurrencies and traditional financial systems are becoming increasingly intertwined. Many banks and financial institutions are now offering crypto-related services, and some are even investing in cryptocurrencies themselves. This suggests that cryptocurrencies are here to stay, and that they will continue to play an important role in the financial markets.

Overall, the relationship between crypto and traditional financial systems is complex and constantly evolving. While there are certainly differences between the two, they are not necessarily mutually exclusive. As the crypto market continues to mature, it will be interesting to see how it interacts with traditional financial systems, and what impact it has on the broader economy.

Crypto Exchanges and Products

When it comes to trading cryptocurrencies, there are many exchanges and products available in the market. Here are some of the most popular ones:

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It offers a wide range of trading pairs and has a reputation for low fees. Binance also has its own cryptocurrency, Binance Coin (BNB), which can be used to pay for trading fees on the platform. Binance has a user-friendly interface and offers a wide range of trading tools for both beginners and advanced traders.

Coinbase

Coinbase is a popular cryptocurrency exchange that is known for its user-friendly interface and high level of security. It is a regulated exchange and is available in many countries around the world. Coinbase offers a wide range of trading pairs and also has its own cryptocurrency, Coinbase Coin (COIN). Coinbase also offers a mobile app that allows users to trade cryptocurrencies on the go.

Stablecoins

Stablecoins are cryptocurrencies that are designed to maintain a stable value. They are often pegged to a fiat currency, such as the US dollar, and are used to hedge against the volatility of other cryptocurrencies. Some popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Overall, there are many cryptocurrency exchanges and products available in the market. It is important to do your research and choose an exchange or product that meets your needs and fits your trading style.

Challenges in the Crypto Market

The crypto market has been growing rapidly in recent years, but it is not without its challenges. In this section, we will explore some of the key challenges that the crypto market faces.

Security Issues

One of the biggest challenges facing the crypto market is security. With billions of dollars worth of cryptocurrencies being traded every day, hackers are constantly looking for ways to steal them. In fact, according to a report by CipherTrace, losses due to crypto theft, hacks, and frauds amounted to $1.9 billion in the first quarter of 2022 alone.

To combat this, many crypto exchanges and wallets have implemented various security measures, such as two-factor authentication, cold storage, and multi-signature wallets. However, these measures are not foolproof, and there have been several high-profile hacks in recent years, such as the $600 million hack of Poly Network in 2021.

Price Manipulation

Another challenge facing the crypto market is price manipulation. Due to the lack of regulation and oversight, it is relatively easy for large players to manipulate the price of cryptocurrencies. This can be done through various means, such as spreading false rumors, creating fake news, or using trading bots to artificially inflate or deflate the price.

This can have a significant impact on the market, as it can cause investors to panic and sell their holdings, leading to a sharp drop in prices. In extreme cases, it can even lead to market crashes, as we saw in the winter of 2022 when the crypto market lost more than half of its value.

Money Laundering

A third challenge facing the crypto market is money laundering. Due to the anonymity and decentralization of cryptocurrencies, they have become a popular tool for criminals to launder money. This can be done by converting dirty money into cryptocurrencies, which can then be transferred to other accounts or exchanged for other cryptocurrencies, making it difficult to trace the source of the funds.

To combat this, many governments and regulatory bodies have introduced various measures, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. However, these measures are often criticized for being too strict and hindering the growth of the crypto market.

In conclusion, the crypto market faces several challenges, including security issues, price manipulation, and money laundering. While various measures have been implemented to address these challenges, they are not foolproof, and the market will need to continue to evolve to meet these challenges head-on.

The Future of Crypto

As the crypto market continues to evolve, it's important to consider what the future holds for this new asset class. There are several factors that will likely shape the future of crypto, including adoption trends, the influence of tech giants, and the impact of economic factors.

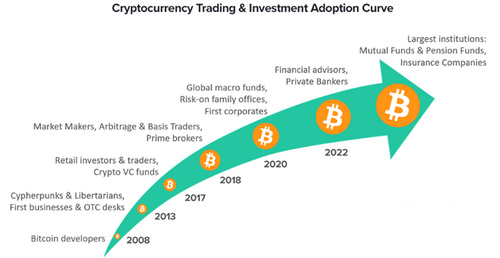

Adoption Trends

One of the most significant drivers of the future of crypto is adoption. As more people become familiar with crypto and its potential uses, adoption is likely to continue to grow. This could be driven by a number of factors, including increased awareness of crypto's potential uses, more accessible and user-friendly platforms, and the continued development of blockchain technology.

Influence of Tech Giants

Another factor that could shape the future of crypto is the influence of tech giants like Microsoft and Apple. These companies have significant resources and expertise that could be leveraged to drive adoption and innovation in the crypto space. For example, Microsoft has already announced plans to integrate blockchain technology into its Azure cloud platform, which could make it easier for developers to build and deploy decentralized applications.

Impact of Economic Factors

Finally, the future of crypto will also be influenced by broader economic factors, such as interest rates, inflation, and the strength of the U.S. dollar. These factors could impact the value of crypto assets and the overall demand for crypto as an investment. For example, if inflation continues to rise, investors may turn to crypto as a hedge against inflation.

Overall, the future of crypto is likely to be shaped by a complex interplay of factors, including adoption trends, the influence of tech giants, and broader economic factors. While it's impossible to predict exactly how these factors will play out, it's clear that crypto is here to stay and will continue to play an increasingly important role in the global financial system.

Frequently Asked Questions

What are the latest trends in the crypto market?

The crypto market is constantly evolving, and new trends emerge regularly. One of the latest trends is the growing adoption of non-fungible tokens (NFTs), which are unique digital assets that are authenticated on a blockchain. Another trend is the increasing interest in decentralized finance (DeFi), which refers to financial applications built on a blockchain that operate without intermediaries.

How has the Morgan Stanley cryptocurrency report impacted the market?

Morgan Stanley released a report in March 2021 that was bullish on Bitcoin and predicted that it could become a mainstream asset class. The report helped to legitimize Bitcoin in the eyes of institutional investors and contributed to the current bull run. However, it's worth noting that the report was just one factor among many that have influenced the market.

What factors are driving the current rise in crypto prices?

There are several factors driving the current rise in crypto prices, including increased institutional adoption, growing mainstream acceptance, and a low-interest-rate environment. Additionally, the limited supply of some cryptocurrencies, such as Bitcoin, has contributed to their appreciation in value.

What are some potential risks and challenges facing the crypto market?

The crypto market faces several potential risks and challenges, including regulatory uncertainty, security risks, and the potential for market manipulation. Additionally, the volatility of the market can make it difficult for investors to manage risk.

How can investors best navigate the volatility of the crypto market?

Investors can best navigate the volatility of the crypto market by diversifying their portfolios, investing only what they can afford to lose, and staying up-to-date on market trends and news. Additionally, setting clear investment goals and having a long-term strategy can help investors weather short-term fluctuations in the market.

What are some long-term predictions for the future of cryptocurrency?

The long-term future of cryptocurrency is difficult to predict, but many experts believe that it will continue to grow and evolve. Some predict that cryptocurrencies will become more mainstream and widely accepted, while others believe that they will remain a niche asset class. Additionally, the development of new technologies, such as blockchain, could lead to new use cases and applications for cryptocurrencies.

Tim Moseley

Gold price is stuck in neutral, but that is its strength now

Gold price is stuck in neutral, but that is its strength now

The green hydrogen economy is real, but it might not define platinum's role in the global green energy transition

The green hydrogen economy is real, but it might not define platinum's role in the global green energy transition

.png)

.jpg) analysis.

analysis.

.jpg)