Gold bulls can look forward to a bright future despite headwinds – Heraeus

Get all the essential market news and expert opinions in one place with our daily newsletter. Receive a comprehensive recap of the day's top stories directly to your inbox. Sign up here!

Even as markets watch gold prices fall into the low 1830s as the fourth quarter gets underway, interest rate history favors gold bugs in the medium and long term, according to the latest precious metals report from Heraeus.

“The gold price tends to rise following the first cut of US interest rate cycles,” the analysts write. “On average since 1984, one calendar year after the Federal Reserve first cuts its rate after a hiking cycle, gold is 10% higher than the day of the decision to reduce interest rates, and after two years is 18% higher. The dollar tends to weaken, yields on U.S. Treasuries fall, and the economy tends to have deteriorated. All of these elements can act as a tailwind for the gold price.”

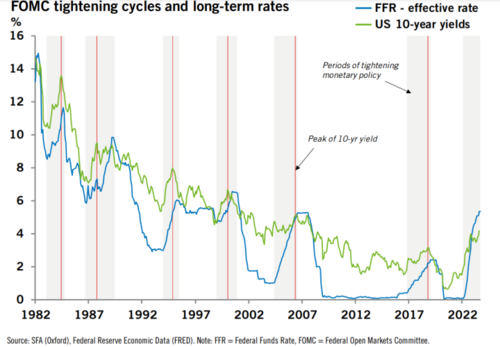

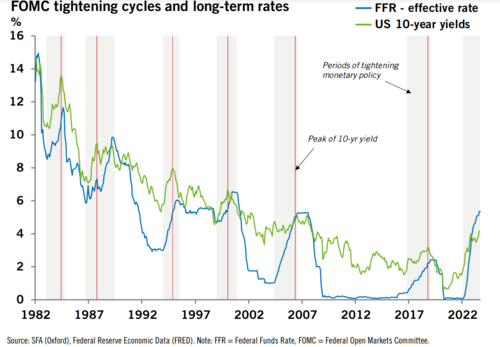

The analysts say that after the yield on the 10-year treasury note peaks, it’s only a matter of time before Fed Chair Jerome Powell begins to cut. “The last rate hike of the cycle also tends to coincide with the peak in the yield on 10-year U.S. Treasuries,” they write. “Since 1984, interest rate cuts have never lagged the peak in 10-year U.S. Treasury notes by more than one year and seven months – this being the outlier in 1989. Excluding 1989, cuts have followed the peak by an average of ~10 months.”

They note, however, that this does not constitute a guarantee. “Two years after the first interest rate reduction in 1995, gold was 16% lower at $325.50/oz,” they say. “On the other hand, gold’s relative performance to the upside following interest rate cuts has grown since the 2001 cycle.”

U.S. government bond yields are now at the highest rate in 16 years, hitting a fresh high of 4.7% just after noon EDT on Monday. “The yield on longdated US Government debt has not hit 4.5% since September 2007, the month that interest rates were lowered 50 bp from 5.25% to 4.75% and the US was on the brink of recession,” note the Heraeus analysts. “This suggests the higher-for-longer message from the Fed may now be sinking in for investors, and raises the expectation that for this cycle there could be a more prolonged period before interest rates begin to fall.”

They acknowledge that gold’s short-term outlook is challenged by the surge in yields. “The average rate tightening cycle has lasted for 21 months with a total Federal Funds increase of 3.02%, but this point is clearly past,” the analysts write. “Historically, long-term yields peak shortly before the Fed stops increasing short-term rates. Inflation may continue to climb well after the Fed curtails rate hikes. The uptick in consumer prices in August highlights that despite a Fed pause in September, inflation may not be tamed just yet, and that gold is likely to face headwinds until at least the new year or until yields flag.”

Another key headwind for the yellow metal is the strength of the U.S. dollar, which continues to outperform, with DXY flirting with 107 on Monday afternoon, a level it has not breached since Nov. 22. “The strength in the U.S. dollar in the last week may be a sign that traders are beginning to accept that interest rates may be higher for longer,” they write, noting that the dollar index “is up ~7% since mid-July, against other major currencies.”

The Heraeus analysts believe the next significant technical support for gold is all the way down at $1,800 per ounce, a price the precious metal has not seen since the days before Christmas last year.

By

Ernest Hoffman

For Kitco News

Tim Moseley