The Fourth Bitcoin Halving is done. How Has It Stacked Up Historically? What can you expect in the coming months?

The Bitcoin halving, a highly anticipated and pivotal event in the cryptocurrency industry, has finally taken place. As history has demonstrated, when the supply of new BTC is reduced while demand remains steady or increases, Bitcoin tends to reach record levels, significantly impacting the entire cryptocurrency market.

The Bitcoin halving event has sparked concerns about its potential impact on Bitcoin miners, which could, in turn, affect the value of the cryptocurrency and the broader market. This article explores the Bitcoin halving, examining its historical effects on the crypto market and its implications from the most recent halving in April 2024.

What Is The Bitcoin Halving?

It's important to differentiate between Bitcoin, the network, and BTC, the digital currency, to understand Bitcoin's halving. The Bitcoin network is a series of data blocks, each with a record of BTC transactions and a link to the previous block, forming a chain-like structure called a blockchain.

Bitcoin (BTC), on the other hand, functions as a virtual medium of exchange that incentivizes specialized computers, known as miners, to gather and validate outstanding Bitcoin transactions. These transactions are then bundled into a block and linked to the decentralized ledger, referred to as the blockchain. As a result of this process, the miner is rewarded with a predetermined quantity of Bitcoin.

Source: Techopedia

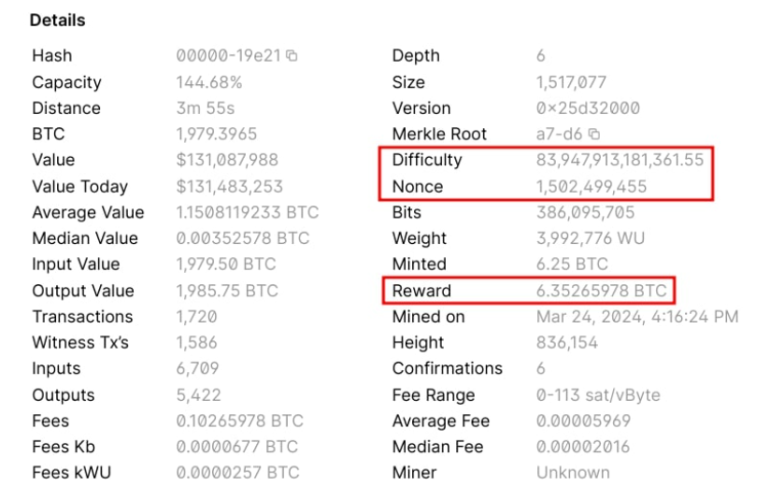

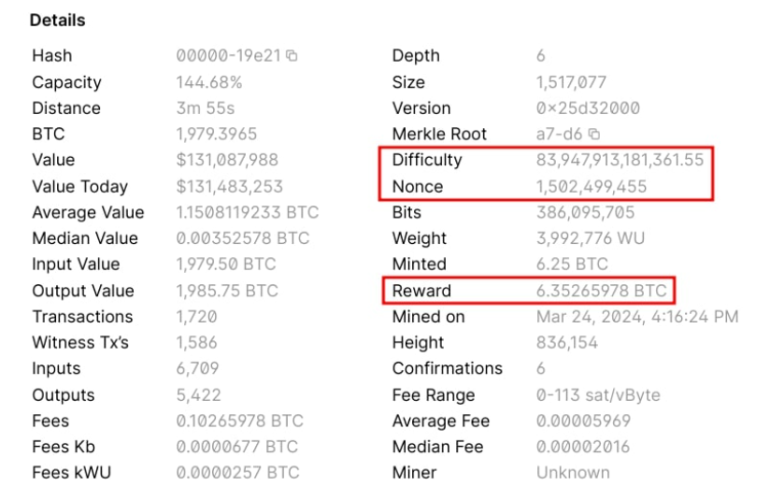

The BTC reward is sourced from two different places. The initial source is the coinbase transaction, also known as the block reward, which is the origin of the name for the Coinbase Exchange. The second source of rewards is miner tips, which are transaction fees paid by users who attach BTC tips to their transactions to expedite their inclusion in blocks.

.png)

Source: bitcoin.com

A fascinating point to note is that Bitcoin initially did not involve any transaction fees due to the presence of primarily empty blocks with no transactions. However, as the use of Bitcoin expanded, the number of transactions rose, leading individuals to add fees to guarantee the inclusion of their transactions in subsequent blocks.

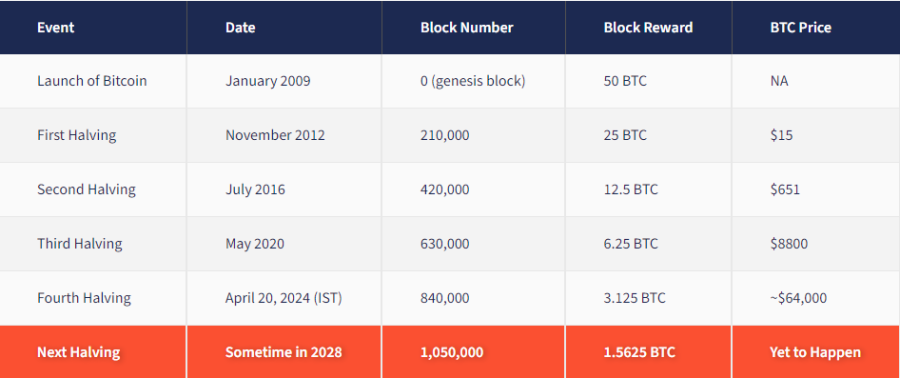

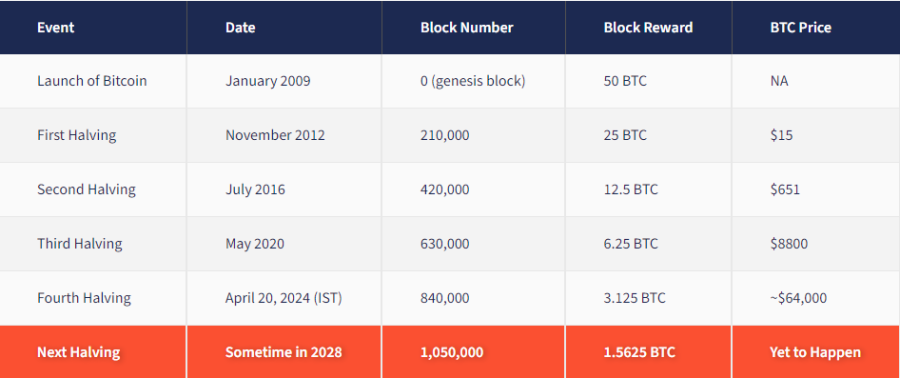

Unlike transaction fees, which fluctuate, block rewards are predetermined and hardcoded into the system. The generation of new Bitcoins is automated. Initially, when Bitcoin's first block was extracted in January 2009, the reward was 50 Bitcoins; however, it has since decreased to 3.125.

This reduction results from the Bitcoin halving mechanism, which systematically slashes the block reward in half every four years. The initial block reward reduction occurred in November 2012, followed by subsequent reductions in July 2016 and May 2020, with the most recent one occurring on April 19th of this year.

Source: Coindcx

According to fundamental economic principles, prices tend to rise when demand remains steady or grows while supply decreases. In the context of Bitcoin's halving, a 50% supply cut should theoretically lead to a doubling of its price. However, past trends have shown that the price surge following each halving has been even more dramatic, primarily due to the concurrent rise in demand for the cryptocurrency.

Let's take a step back to appreciate the remarkable growth of Bitcoin. When it first launched, only a small group of around a few dozen individuals owned BTC. Fast forward to today, and that number has skyrocketed to over 200 million people worldwide. This surge in adoption has had a profound impact on the value of BTC, causing its price to rise exponentially. What's truly astonishing is that since its humble beginnings in July 2010, when it was worth nine cents, BTC has returned a staggering 720,000 times its initial value. This historical growth is a testament to the potential of Bitcoin and its ability to generate significant returns for investors.

What Has Been the Outcome of Previous Halving Events?

The results of past halving events have shown significant price increases for Bitcoin. For instance, after the first halving in November 2012, Bitcoin's price surged from about $11 to $1,100 in November 2013. Similarly, following the second halving in July 2016, the price jumped from around $650 to almost $20,000 by December 2017. In the third halving, Bitcoin reached over $69,000 the following year.

Historical examples indicate that the decreased availability of newly generated Bitcoins following a halving event may result in greater scarcity and, thus, elevated prices. It is crucial to recognize that although a relationship between these factors exists, it does not necessarily indicate a direct cause-and-effect relationship. Multiple elements, such as market sentiment, adoption patterns, and macroeconomic circumstances, also play a role in influencing price fluctuations.

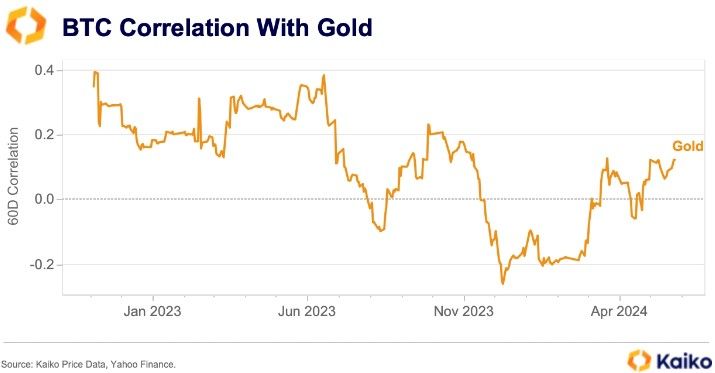

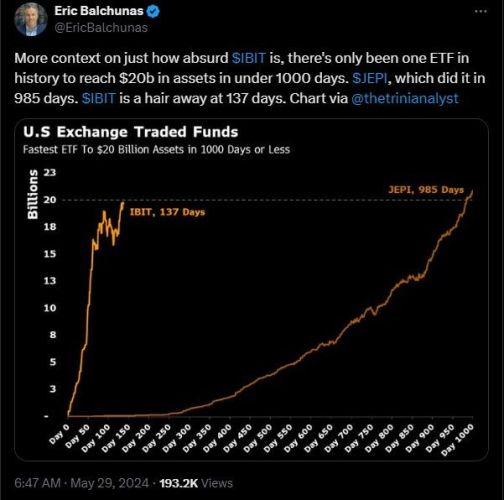

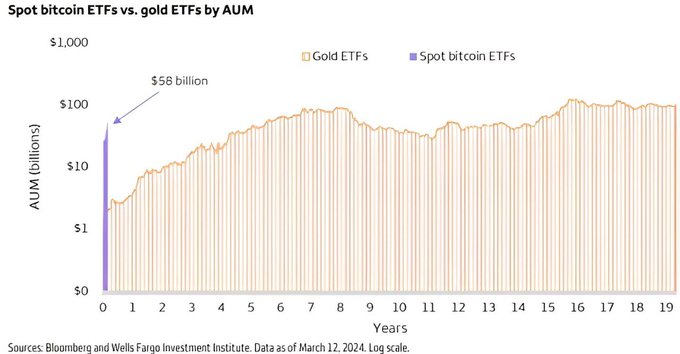

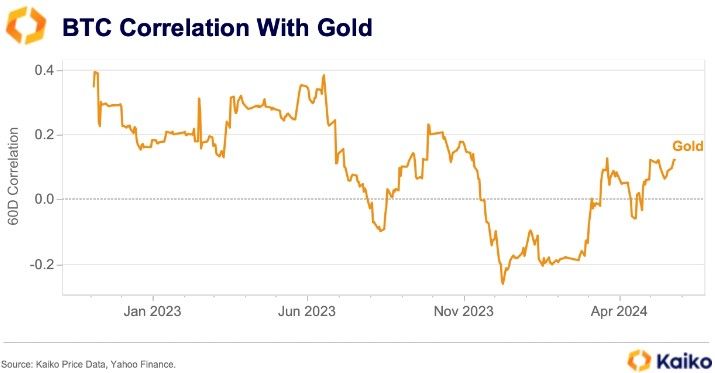

This brings us to the current halving, with Bitcoin's widespread recognition reaching an all-time high. Some pundits believe that this increased awareness has already been factored into the current market price, leading to a relatively stable future for BTC. On the other hand, others contend that the introduction of spot Bitcoin ETFs has generated a consistent flow of investment, which, when paired with the impending reduction in new coin supply, will likely trigger a rapid and dramatic surge in price following the halving.

What About The Bitcoin Miners?

Halving Bitcoin has an immediate and significant effect on miners, who experience a 50% reduction in their earnings from block rewards. This drastic cut can alter the profitability of mining operations, potentially leading to a shift in the cryptocurrency mining landscape. Following the latest halving event, the payout for successfully mining a Bitcoin block dropped from 6.25 BTC to 3.125 BTC.

About a week before the halving event on April 13, the value of a single Bitcoin plummeted from over $67,000 to $62,000. At that time, with the block reward standing at 6.25 Bitcoins, an individual miner would receive a payout of roughly $387,500 for each block of Bitcoin successfully mined.

By April 20, the bitcoin price had stabilized at around $64,000, meaning the new 3.125 BTC reward was roughly $200,000. However, reducing mining rewards could pose difficulties for smaller-scale mining operations in the post-halving period: the increased processing power and energy required to produce new coins pressure miners' profit margins. Numerous predictions have been made that several major Bitcoin miners will struggle to stay afloat following the halving event.

The established, more prominent mining operations should have the financial means to upgrade their equipment and explore more efficient power options. Others believe that given their ample time to adapt to the impending Bitcoin halving, it's reasonable to expect them to be prepared. On the other hand, the halving event poses an existential threat to smaller, less-resourced mining entities, making their survival increasingly uncertain with each successive occurrence.

The Bitcoin halving in April 2024 stands out from its predecessors. Unlike in the past, the crypto landscape has shifted due to the influx of new mining operations, leading to decreased profitability as the growing number of miners share the same rewards pool.

Another notable shift this time is that the block reward is no longer miners' primary source of income. According to reports, mining companies are expanding their business scope beyond traditional Bitcoin mining to explore alternative revenue streams, venturing into complementary areas such as energy harvesting, data warehousing, and AI development to boost their earnings.

So, How High Could Bitcoin Go?

Some experts believe that introducing ETFs has opened the floodgates to a new wave of investment that could propel Bitcoin's price to unprecedented heights. Moreover, these ETF inflows may also serve as a buffer, mitigating the severity of any future downturns in the cryptocurrency's value. Historically, Bitcoin has experienced drastic declines of over 70% following market peaks. However, the subsequent correction may be less severe, with more seasoned investors entering the fray and accumulating more significant stakes in BTC.

If ETFs are not the driving force, central banks could step in to make an impact instead. In a new development, central banks can allocate 2% of their balance sheets to cryptocurrency starting January 1, 2025. In 2022, the Central Bank of Switzerland expressed interest in purchasing BTC. A significant BTC purchase by a major central bank might trigger a peak in BTC's price. On the other hand, it could also signify the start of the blow-off top phase of the crypto bull market cycle, similar to when MicroStrategy acquired BTC in mid-2020.

Source: Coinmarketcap

Historical Decline Of Bitcoin Dominance. What That Means For Altcoins

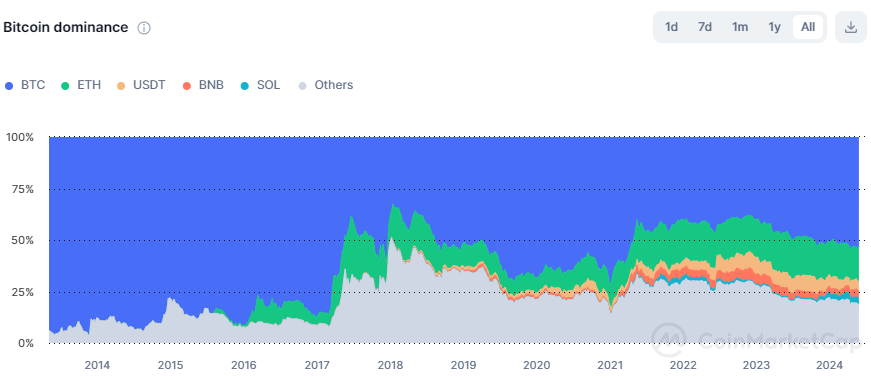

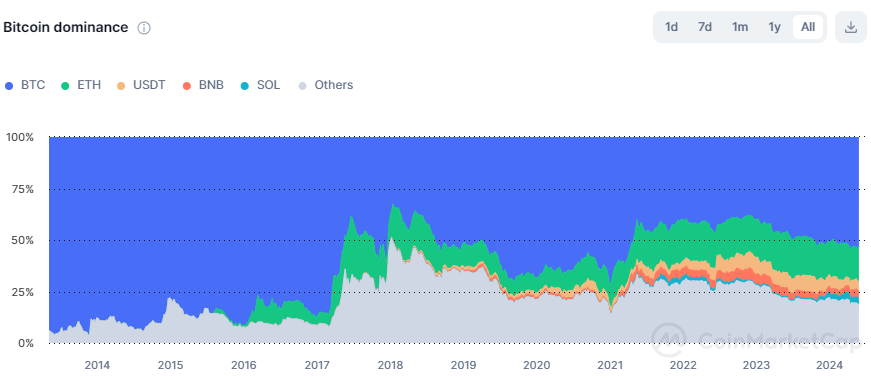

The impact of Bitcoin's halving on the broader cryptocurrency landscape is closely related to the shift in market dynamics that follows this event. Analyzing the changes in Bitcoin's market share after the halving is essential to understanding this phenomenon better. This market share, known as Bitcoin dominance, represents the proportion of the total market capitalization of all cryptocurrencies attributed to Bitcoin alone. However, it's worth noting that historical data on Bitcoin dominance is limited and does not extend back to the first-ever Bitcoin halving in November 2012.

It's probable that altcoins still needed to hold a substantial portion of the market during that time, which limited their influence. Additionally, the entire cryptocurrency infrastructure was still in its early stages, making this point somewhat moot. What's intriguing is that following the second Bitcoin halving event in July 2016, Bitcoin's market dominance decreased by around 4%. This implies that investors shifted their focus away from Bitcoin and towards altcoins. Notably, even when Bitcoin's value plummeted by 40%, its relative strength compared to altcoins failed to rebound.

In other words, BTC is considered the go-to choice for cryptocurrencies' safety. Therefore, a significant 40% drop in BTC's price should have increased BTC's dominance since other cryptocurrencies would have likely decreased in value as well, causing investors to move their funds into BTC. The fact that this shift did not occur could be due to the overall immaturity of the cryptocurrency market.

Despite this, Bitcoin dominance plummeted by 60% during the 2017 cryptocurrency boom, dropping to approximately 40% of the overall market capitalization. Notably, this decline occurred towards the peak of the 2017 cycle, specifically in December 2017, indicating a high level of speculation in alternative cryptocurrencies at that time.

Following the third Bitcoin halving event in May 2020, BTC dominance dropped by 14%, a threefold more significant decrease than the aftermath of the second halving. This considerable decline implies that investors shifted their funds away from Bitcoin and into altcoins even faster after the third halving. Similarly, during the 2021 crypto bull market, Bitcoin's market share plummeted by approximately 35%, falling to around 40% of the total market capitalization, mirroring the trend seen in 2017.

In contrast to the 2017 scenario, this phenomenon occurred earlier in the cycle, emerging around April 2021 and persisting until April 2022. This prolonged rotation into alternative cryptocurrencies implies a more enduring trend than the 2017 cycle, which is reasonable considering that most alternative cryptocurrencies lacked significant utility until 2021.

The brief historical data indicates some unique trends in altcoin dominance for this cycle. BTC's dominance could decrease significantly, up to 40% after the halving, but only around 10% as we near the next cycle's peak. Additionally, altcoins may demonstrate greater resilience during the next crypto bear market.

The significant 40% decrease in BTC's dominance may seem surprising. Still, it becomes more understandable when considering the rising influence of stablecoins and the recent approval of spot Ethereum ETFs. As we move closer to the next bullish crypto market phase, the market capitalization of stablecoins is expected to see substantial growth, while ETH's market cap is likely to increase following the introduction of spot Ethereum ETFs.

How High Will Altcoins Go?

The critical factor is the extent and duration of the rally that altcoins may experience. It is important to note that the prices of altcoins are closely linked to the price of BTC. Altcoins perform well when BTC's price is stable (trading sideways) or increasing slowly. This scenario tends to prompt traders to seek opportunities in more speculative cryptocurrencies due to boredom.

Source: Investopedia

The experts at Coinbureau recommend analyzing altcoin performance compared to Bitcoin by applying conventional stock market measures. They suggest looking at the "Beta to Bitcoin" concept to gauge the volatility of altcoins with BTC. As a general guideline, altcoins with a market capitalization over $1 billion tend to have a beta of 2, meaning they are twice as volatile as Bitcoin. Those with a market capitalization under $1 billion have a beta of up to 4, while those with a market capitalization under $100 million have a beta of around 8, indicating significantly higher volatility compared to Bitcoin.

So if BTC’s price goes up by 2.5x between now and the cycle top, some large capital coins should eventually go up by around 5x, some mid caps should eventually go up by around 10x, and some small caps should eventually go up by around 20x. It is important to note that this is a general guideline and not a definitive prediction for every coin. It is crucial to emphasize the term "eventually" because these projected outcomes are not immediate and may not unfold simultaneously for all alternative coins.

It's a given that the growth won't be a steady upward trajectory; instead, there will be significant downturns and reversals, which will become more pronounced as the market reaches its peak. If Coinbureau's forecasts about dominance hold true, altcoins may experience prolonged periods at or near their record highs, unlike in past cycles. Conversely, this implies that they will face similar declines during the next downturn in the cryptocurrency bear market.

However, a catch could be that this phenomenon may be limited to well-established alternative cryptocurrencies like Ethereum, which have already inspired their own exchange-traded funds (ETFs) and could consequently exhibit the previously mentioned dynamics: unexpected high points, reduced volatility in downturns and potentially propped up by central banks.

How Can You Take Advantage of Potential Gains?

It is essential to be aware of upcoming opportunities to maximize potential profits. There are three critical steps to take advantage of these gains. The initial step involves recognizing the key narratives expected to dominate the upcoming cryptocurrency bull market. This article explores the narratives likely to experience significant growth in the next bullish cycle.

Your next step is establishing a presence on the most suitable cryptocurrency trading platforms. The third is to remember that not all altcoins will surge in value simultaneously. If you notice specific cryptocurrencies surging in a particular narrative, avoid rushing to invest in them. Look for other cryptocurrencies within that narrative that have yet to experience a rally.

Likewise, if your portfolio's cryptocurrencies are underperforming compared to the broader market, they may be experiencing a temporary delay. While it's true that some may never recover if you've conducted thorough research, likely, this won't be the case, and they'll eventually catch up.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.png)

.png)

.png)

.png)

.png)

.png)