Market experts and retail traders align once again with a majority predicting gold price recovery

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

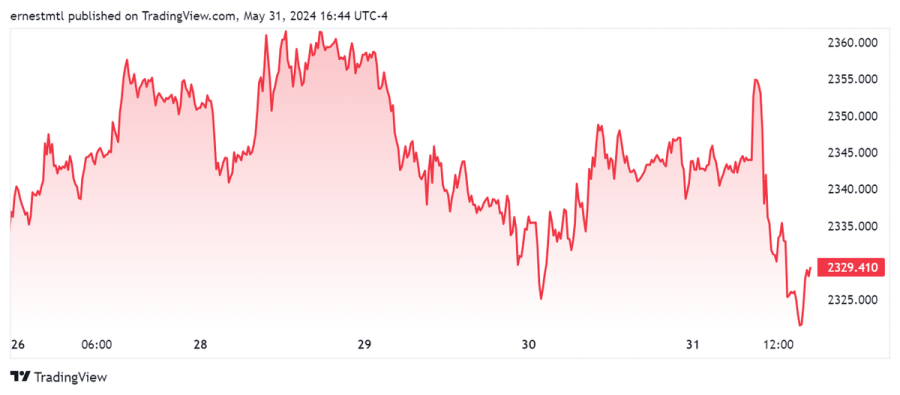

While gold prices did manage to move higher during the first half of the shortened Memorial Day week, the days were mostly characterized by a march toward Friday’s PCE report, with precious metals investors looking to the Fed’s preferred inflation metric to gauge the likely path of interest rates, and the prospects for further gains for gold.

After opening the week trading at $2,334 per ounce, spot gold managed to hit a high just a couple of dollars short of $2,360 during Monday's Memorial Day holiday, but it failed to hold above $2,350 during the evening session. The return of American markets the following morning brought renewed enthusiasm for the precious metal, driving it to the weekly high of $2,361.45 by noon Tuesday. But once again, the bulls ran out of momentum and overnight trading saw the price fall precipitously, which began gold's steady decline to a new weekly low of $2,325.06 early Thursday morning.

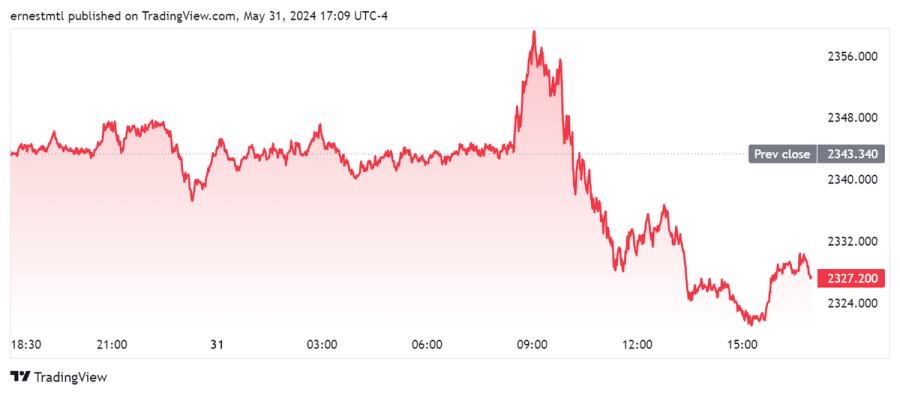

The precious metal bounced hard off this level, however, and by the start of Thursday's North American session, gold was once again within a dollar of $2,350 per ounce. Thereafter began the wait for Friday morning’s PCE report, which brought renewed drama to precious metals markets, driving gold from $2,344 per ounce a half hour before the 8:30 am release to its daily high of $2,359.72 15 minutes afterward.

But as had been the case on Monday and Tuesday, the bulls once again ran themselves to exhaustion, and gold prices fell all the way to a fresh weekly low of $2,320.59 per ounce shortly after 3:00 pm EDT.

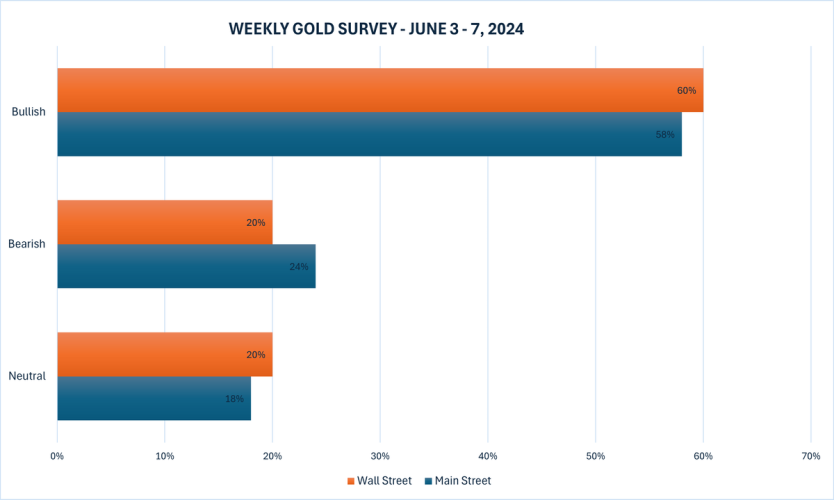

The latest Kitco News Weekly Gold Survey has industry experts and retail traders aligned on gold’s near-term prospects, with a majority seeing gains while equal minorities hold a neutral or negative position.

“I’m sticking with up for this week as sellers had an open door to force a breakdown and they haven’t been able to,” said James Stanley, senior market strategist at Forex.com. “The weekly bar in spot Gold is showing as a doji and there remains a lot of support structure underneath current price, and that’s what sellers were unable to drive through this week. And gold futures finished with a bearish engulf in the prior week and that similarly failed to show follow-through.”

“We could be nearing a turn,” Stanley added, “but until that support structure is violated, I’m going to bias with what’s been the dominant trend.”

“Up,” said Adrian Day, President of Adrian Day Asset Management. “Gold still has further to go in its recovery from the mid-month drop, and somewhat cooler inflation numbers in the U.S. will help support the case for the Federal Reserve to cut rates.”

Ole Hansen, head of commodity strategy at Saxo Bank, said he’s adopting a neutral stance for next week. “Rangebound for now, with risk slightly skewed to the upside,” he said.

“Down,” said Darin Newsom, Senior Market Analyst at Barchart.com. “While the more active August futures contract has technically completed its 3-wave short-term downtrend, it is not showing a bullish reversal pattern through early Friday morning. This leaves the door open to continued pressure early next week. However, technical analysis has to come with an asterisk given the increased chance of chaos tied to China and Russia this coming weekend. As a safe-haven market, this could spark new buying in gold markets ahead of Friday’s close.”

Sean Lusk, co-director of commercial hedging at Walsh Trading, was unpacking the different factors that led to the gold price decline on Friday.

“’m bullish still… I’m a little surprised,” he said about the pullback. “We're at month-end here, so how much of this is just some unwinding? You had a lot of longs in the June contract, so I understand that, prior to option expiration and first notice, you've had a retreat in price. That wasn't a surprise, it was expected.”

“I think interest rates for near term here may have topped, and I think if you have that, you're going to pressure the dollar, and maybe [gold prices] start to work back higher,” Lusk said. “However, Chinese manufacturing came out weak, which hit copper. Some of the industrial metals have given back here, but silver's still holding $30 on the break.”

“I just feel that these breaks are eventually going to be buying opportunities across the board,” he added, looking at the commodities complex as a whole. “You just can't get any traction in crude oil. And there's some real worry about the equities. They've come off here quite a bit, particularly the Dow Jones hitting over 40,000, we just broke 2000 points. NASDAQ has just gotten whacked here. So I don't know… if this starts to leg lower in the equities, does it pull everything else with it? That's the issue.”

“All this talk of raising rates, let's just throw that out,” Lusk said. “I think we go back to more of the buy-the-dips mentality here in commodities overall. Bond yields are going to start to come off here a little bit, I think the tops are in. I just think that with housing, pending home sales, nothing's moving, and I don't see that getting any better until rates come down a little bit. They're going to bring the talk back to rate cuts rather than rate hikes, which is really what turned the stock market around recently.”

“We're going to get another whole slew of data here,” Lusk added. “I think we're going to have a shift change in sentiment coming soon, given the fact that maybe yields have topped, and futures are going to get a lift, and that's going to put pressure on the dollar where rallies are sold in the dollar.”

This week, 10 Wall Street analysts participated in the Kitco News Gold Survey, and a solid majority have returned to the bullish camp with six experts, representing 60%, expecting to see gold prices climb higher next week. Two analysts, or 20%, predicted a price decline, and the same number see gold trending sideways as it waits for direction during the coming week.

Meanwhile, 222 votes were cast in Kitco’s online poll, with Main Street investors mirroring expert sentiment this week. 128 retail traders, or 58%, look for gold prices to rise next week. Another 53, or 24%, expect they will be lower, while 41 respondents, representing the remaining 18%, expect prices to remain rangebound during the week ahead.

Next week promises a return to a more normal rhythm of economic news releases. On Monday, markets will receive the S&P global manufacturing PMI and the ISM manufacturing PMI for May. Then on Wednesday, the Bank of Canada will announce its interest rate decision, with economists predicting a quarter-point cut, and shortly afterward, markets will receive the ISM services PMI for May.

Thursday morning brings the ECB interest rate decision, with markets priced in for a 25 basis point cut to the benchmark interest rate, along with weekly jobless claims. And Friday morning, markets will await the release of May's nonfarm payrolls report.

“The week ahead features possible rate cuts by the ECB and the Bank of Canada, and US jobs data,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “Spot gold consolidated between roughly $2322 and $2364 last week. Still, it has advanced in five of the last six sessions. The momentum indicators look poised to turn higher.”

“I like it higher,” Chandler said. “A move above $2372 could signal a retest on $2400.”

Everett Millman, Chief Market Analyst at Gainesville Coins, was looking past this week’s near-term volatility to the medium-term drivers that are likely to dominate gold’s price action between now and the fall.

“I definitely agree that the end-of-month volatility we're seeing is typical,” he said. “That's more of a trading dynamic than anything else, so I don't think it speaks very strongly to what's driving the gold market overall.”

“It is true that the summer season is usually quite bad for gold,” Millman said. “Those are the dog days of summer where typically we expect to see gold prices, at minimum trade sideways, if not drift lower. But that's under normal circumstances. I think that much of what gold has done this year bucks the normal trend on every front. The Fed has been consistently hawkish and rate cut expectations seem to be fluctuating. They definitely have been volatile in their own right. So I think it's difficult to point toward a direct line between Fed expectations and what gold is doing.”

Millman said his general take is that gold is responding to the uncertainty surrounding the rate path itself, rather than any sense of what that path might be.

“If we go from 70 percent expectation of a September rate cut to 30 percent, back and forth, it speaks to the fact that the market still doesn't have a strong hold on what it expects the Fed to do,” he said. “I think that will be the big story over the summer. How do the Fed rate cut expectations change between now and when we get closer to September? I don't think anybody really knows. You could make a pretty compelling argument that even the FOMC members don't seem to know exactly where things are going to go.”

Millman said that in the absence of anything else changing, the gold market will continue to try to read the collective mind of the Fed. “Obviously, all of the macro geopolitical factors are still there, but I think gold has mostly baked in all of that stuff, he said. “That's why we're still sitting above $2,300 now.”

“Fed policy, and how the economy holds up, I think, is going to be the big driver over the summer for gold.”

“Bull,” said Mark Leibovit, publisher of the VR Metals/Resource Letter. “Hanging in there.”

“We are likely in higher timeframe bearish correction against the move up from 19001,” said Michael Moor, Founder of Moor Analytics. “The trade below 24343 (+1.3 tics per/hour) has brought in $113.5 of pressure. These roll into the (Q) and are ON HOLD. In (Q) we are currently holding exhaustion warned about at 23447 with a 23433 low and have rallied $30.4. The trade above 23594 (-6 per/hour) now warns of decent strength. Decent trade back below where this comes in at 23452 (-6 tics per/hour starting at 9:20 am EST) will warn of decent pressure and take bear calls OFF HOLD.”

And Kitco Senior Analyst Jim Wyckoff sees gold prices staging a recovery next week. “Steady-higher as charts still bullish,” he said.

Spot gold last traded at $2,327.20 per ounce at the time of writing, down 0.69% on the day and down 0.29% on the week.

Kitco Media

Ernest Hoffman

Tim Moseley