The Birth Certificate – A Spider’s Web of Deceit and Enslavement?

.jpg)

Was Slavery Ever Abolished?

In 2020 I found myself asking the question, ‘was slavery ever really abolished?’. This question came off the back of observing how seemingly overnight, the UK went from a country where we could question things to one where we could not. The feeling was stark, tangible, and sudden as if being coerced into a mental prison.

It led to a deeper research process in search of the truth as to what was going on. For me, the so-called pandemic represented the middle pieces of a jigsaw puzzle without the edge pieces as a frame of reference. I concluded that even though slavery was supposed to have been abolished during the presidency of Abraham Lincoln (1861 – 1865 ), the opposite was true. While people were not going around in shackles and chains as depicted in the film Roots based on Alex Haley’s book, the marks were like electricity, unseen but tangible through its effects.

This article cannot do justice to an in-depth matter but focuses on the background that led to the creation of the birth certificate and why this is a core aspect of enslavement. It also suggests that the current global event needs to be scrutinized in a different context to that of a health pandemic alone. I provide you with key references for you to further your understanding and verify what is true.

Hiding In Plain Sight

The first discovery left me feeling embarrassed to be candid. I was looking at a £10 note one day while deep in reflection and decided to do an eye test with the small print.

.jpg)

Image source: Public Domain Pictures

Under the Bank of England title, you can see the words ‘I promise to pay the bearer on demand the sum of ten pounds’ [or five pounds, or twenty pounds]. I then asked myself, ‘I wonder what would happen if I took this to the bank and demanded the sum of ten pounds?’.

That's when it hit me afresh for the first time that I was holding fake money, an IOU note, a promissory, or a debt note. I knew about the gold confiscation back in 1933 and that our money had no real backing, yet some part of me still saw it as money because it was being used by everyone to pay for everyday stuff.

I was effectively operating in a debt system with fake money, and the proof was etched on the note hiding in plain sight. I had not truly seen it for what it was until this moment. But it went deeper than this.

I will return to the connection of the birth certificate, but if you take a close look at your birth certificate, it will have words to the effect that what you have in your hand is a ‘certified copy’ of an original entry from the Register Book of Births and with reference to the Registration Act [ 1836 – 1947 here in the UK ].

The First Big Reveal

I was aware that the private banks would print money out of thin air and into circulation. However, the empirical study and conclusion by economics professor Richard Werner took it much further. He demonstrated that banks don’t lend money and don’t take deposits, contrary to what we are told.

So if they don’t do that, what do they do? His answer – they are in the business of trading securities, and you and I are effectively that security through the productive energy of our lifelong work. You can read his abstract here.

He concludes that by sleight of hand and double bookkeeping entry, they turn you, the true creditor, into the debtor. We, the people, effectively become their collateral. I had to watch the video explanation several times to start to grasp what he was revealing. It felt like a corner piece of a jigsaw. It smelt like fraud! You can download Modern Money Mechanics, which expands on the nature of deposits, entries, and securities.

The Second Big Reveal

The second big reveal, which is related, comes in two parts and concerns all world governments, those officials that we supposedly elect to serve us in public service. They are not service entities, as we are led to believe. All governments and countries are registered corporations, which means their primary aim is to make profits.

Furthermore, they are also bankrupt corporations and have been so for a very long time. Most if not all countries are operating in bankruptcy. For example, the USA was declared bankrupt in 1933 during Roosevelt’s presidency, and it is on record by executive orders 6073, 6102, and 6111, also confirmed in the United States Congressional Record, March 17, 1933.

You can do a search through Dun and Bradstreet and through an EDGAR search of the SEC website. The banking cartel are the creditors through the United Nations, World Bank, and IMF. The bankruptcy is rolled over every 70 years approximately.

The removal of the gold standard as backing for money is another layer of evidence of that bankruptcy and that the USA exists in theory only. I wonder what they did with all that gold? The United Kingdom was confirmed as bankrupt in 1799 through a freedom of information request to the debt management office.

Law enforcement agencies such as the courts and the police are also corporations. Add the Federal Reserve and the IRS to the list of corporations too. The IRS is based in Puerto Rico and admits that taxes are not compulsory in law, as we have been led to believe. These are recorded facts, not pure conjecture or conspiracy theories. Please look it up.

Let the implications of this sink in for a moment. We are being ruled by unelected officials who are not serving us but are bankrupt corporations, actors masquerading as a government, and passing laws by decree. We are unwittingly funding bankrupt corporations and their unlawful activities! They have no jurisdiction over us whatsoever, and yet we are operating within their system.

As an entrepreneur, you know that you cannot demand money from someone who is not in a business contract with you. That would be extortion. If you are bankrupt, you cannot carry out commercial activity under that business name?

So how is it that a corporation can make laws and demand money from you when they are bankrupt? How can they decree wars? How can they do this when they have no money and no jurisdiction over you whatsoever when you are not in a commercial contract with them? Unfortunately, you and I are unknowingly in a contract with them, and they borrow ‘the money’ into existence through our labor.

The Spider's Web

Like a spider’s web, the threads of enslavement by false contract were sown a long time ago. Here I want to point to two milestones in history in which the birth certificate plays a significant part.

The First Milestone

Colonel Edward Mandell House, the advisor to President Woodrow Wilson, spoke in a private meeting about the plan to enslave all Americans (1913-1921). Here is an excerpt:

‘..soon every American will be required to register their biological property in a national system designed to keep track of the people, and that will operate under the ancient system of pledging. By such methodology, we can compel people to submit to our agenda, which will affect our security as a chargeback for our fiat paper currency…

…they will be stripped of their rights and given a commercial value designed to make us a profit, and they will be none the wiser for not one man in a million could ever figure our plans; and if by accident one or two would figure it out, we have in our arsenal plausible deniability…

..This will inevitably reap to us huge profits beyond our wildest expectations and leave every American a contributor to this fraud, which we will call “social insurance”….and we will employ the high office of the President of our dummy corporation [“the UNITED STATES” to foment this plot against America.”

The birth certificate is the biological property referred to above. The registrations came into force in the UK in 1836. The date may vary where you live. What happens essentially is that when your birth is registered, your name is used to set up a dummy corporation using your national insurance number or equivalent. That entity becomes a security traded on the stock markets. I was able to check mine out and verify this in the UK with reference to the instruction on this video by Observation Deck using sort codes and IBAN checker.

It is the corporatization of your birth certificate which removes the rights of you as a private living soul, with unalienable rights and creditor to your ‘estate.’ It changes your status to one of being in the public domain as a debtor with possession use only and no legal rights.

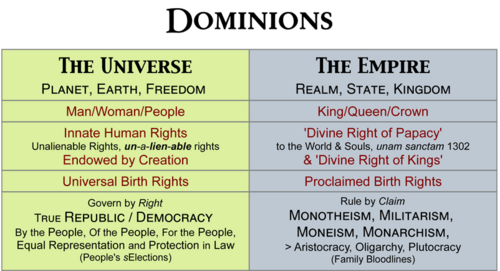

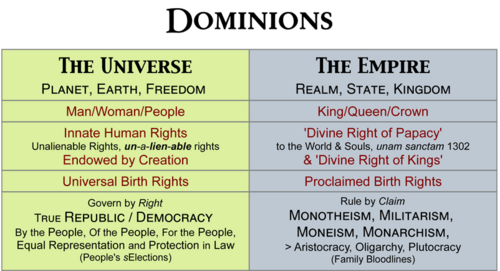

.PNG)

Image Source: Freedom River

In essence, anything you register, such as a passport or driving license, is effectively giving power of attorney to the state. All bills are addressed to the corporate version of you. Three key corporations seem to be implicated in the social engineering that is playing out – namely the City of London, Washington, and The Vatican.

The Second Milestone

As you can see, this plan has been over one hundred years in the making, and I suspect it goes back much further. The groundwork for the birth certificate registrations was laid further back in time. Let’s look at the Vatican.

The Papal Bulls

.jpg)

Image Source: Papal Bulls Free Image

Unam Sanctum Trust AD 1302

An express trust deed which declares that every living soul is to be registered as property to the Vatican.

Romanus Pontifex Trust AD 1455

The first crown, via the C’est Que Vie Trust – All land is claimed as Crown Land.

Aeterni Regus AD 1481

The second crown, via the C’est Que Vie Trust, when a child is born, the birth certificate is sold as a bond to the central bank; hence you are now in servitude.

Convocation AD 1537

The third crown, via the C’est Que Vie Trust, comes into force with reference to a child’s baptism. This means no legal title over your soul; you are deemed as cargo lost at sea, a lost soul which they claim, under the Maritime Law. The Cest Que Vie Trust was revised in 1666.

Image Source: Freedom River

The Vatican appears to be highly complicit in the ownership of you and all your possessions. Who would have thought they would feature heavily in this crime and fraud? I suspect this goes back even further in time. The old testament is littered with the ongoing theme of ‘set my people free.’ So these two further milestones strongly point to enslavement as an ongoing theme.

Why has this gone unopposed in the main for so long? Some aspect of this lies in the fact that most of us reading this were born into a society where debt is the norm and have become conditioned by this. Normal does not make it right, though. The other important factor lies in how the web of lies is spun. History has been hidden from us for so long where the truth is concerned. Like a spider’s web, the initial moves are imperceptible and sugar-coated with benefits and some truth to hook people in.

The subtle use and change of language to deceive by broadening the scope of what it means, is a key strategy used, particularly in law. When you think of LAW, there appear to be three layers – Common Law (land), Equity Law (air), and Maritime Law (sea, commerce). We are operating under maritime law, not common law, as was the original underpinning of the constitution. Bear in mind that though the focus is on America here, it applies worldwide.

So we have been unwittingly ensnared and are complicit in the fraud by ignorance. The establishment relies on status, power, and your ignorance to get your buy-in. Once they have that locked in, they use fear and coercion to keep you there.

The Good News

The good news is that all contracts obtained by deception are null and void. The challenging aspect of this is the redress, and it is not something that can be avoided if the corruption is to be corrected. There are two choices as I perceive it. Do nothing and become knowingly complicit in the fraud or apply redress.

Remedy

The practical remedies seem to range from removal of consent, to contract to application of equity courts using private law, rather than a simple verbal declaration of non-consent. There are educational videos on youtube, paid educational courses, and advocacy services around the globe. Here are a few.

In Australia, there is Solutions Empowerment; in the USA, there is You Are Law; in the UK, The Peoples’ Lawyer. Look up your resources according to your country. A warrior calls was the start of my journey. There are many resources for help and many individuals who have applied redress successfully. One of my colleagues is successfully redressing his credit and his mortgage claim in the UK via an advocacy service. Others have struggled.

What you choose to do will depend on a number of factors. However, since all change starts with perception, and ours was framed by the deception of language, redress needs to start with perception of what is true.

So it is important to do the following:

1) Use the key reference points here and beyond to conduct due diligence and verify the matter for yourself.

2) Connect with like-minded people and learn to overcome fear because fear is like oxygen to the establishment.

3) Educate yourself on the various remedies and their format, whether it be DIY or advocacy based.

4) Apply with assistance or on your own, depending on your needs.

5) Put new structures in place that make the old obsolete.

What has been relayed here has huge ramifications if you decide it is true. I, for one, do not consider it an option to do nothing and am applying the above steps. The inner work is essential first. If you need to get a better grasp of the issues highlighted here, I recommend three resources.

Freedom River gives a diagrammatic overview of the key themes, and expands on them through various resources. The next one is more of a booklet than a book, Meet Your Strawman and Whatever You Need to Know, gives a simple overview and insight into the key issues in layman's terms.

Fruits from A Poisonous Tree by Melvin Stamper in 2008 is a book by a former marine who gives a more in-depth and comprehensive exposition with his remedy, case law, and constitutional law references. His intensive research and investigation led to the discovery of mass fraud by government edict, and his conscience would not allow him to remain quiet and do nothing.

What you do with this information is in your hands. You are not an enemy of the state as deemed by a certain global cult. Now more than ever, we need to let the light of our divine creation shine through and dispel the darkness and corrupt structures that govern our world. You are a living soul. Make true freedom your objective in all you be and do. Our planet depends on this.

About:

Anita Narayan. (United Kingdom) My life's work is about helping individuals to greater freedom through joy and purpose without self-sabotage, so that inspirational legacy can serve generations to come. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.jpg)

.gif) A Worse Financial Crisis than 2008? Peter Schiff forecasts sustained and higher inflation, followed by an implosion of the U.S. dollar

A Worse Financial Crisis than 2008? Peter Schiff forecasts sustained and higher inflation, followed by an implosion of the U.S. dollar.gif)

.gif)

For July, seen up 0.2% from June and compares to the June report’s rise of 1.1% from May.

For July, seen up 0.2% from June and compares to the June report’s rise of 1.1% from May..gif)

.gif)

.jpg)

.jpg)

.PNG)

.jpg)