Question Everything

by Jeff Thomas, editor, International Man Communique

.jpeg)

The average person in the First World receives more information than he would if he lived in a Second or Third World country. In many countries of the world, the very idea of twenty-four hour television news coverage would be unthinkable, yet many Westerners feel that, without this constant input, they would be woefully uninformed.

Not surprising, then, that the average First Worlder feels that he understands current events better than those elsewhere in the world. But, as in other things, quality and quantity are not the same.

The average news programme features a commentator who provides "the news," or at least that portion of events that the network deems worthy to be presented. In addition, it is presented from the political slant of the controllers of the network. But we are reassured that the reporting is "balanced," in a portion of the programme that features a panel of "experts."

Customarily, the panel consists of the moderator plus two pundits who share his political slant and a pundit who has an opposing slant. All are paid by the network for their contributions. The moderator will ask a question on a current issue, and an argument will ensue for a few minutes. Generally, no real conclusion is reached—neither side accedes to the other. The moderator then moves on to another question.

So, the network has aired the issues of the day, and we have received a balanced view that may inform our own opinions. Or have we?

Shortcomings

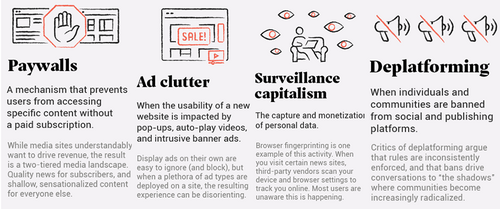

In actual fact, there are significant shortcomings in this type of presentation:

1. The scope of coverage is extremely narrow. Only select facets of each issue are discussed.

2. Generally, the discussion reveals precious little actual insight and, in fact, only the standard opposing liberal and conservative positions are discussed, implying that the viewer must choose one or the other to adopt as his own opinion.

3. On a programme that is liberally-oriented, the one conservative pundit on the panel is made to look foolish by the three liberal pundits, ensuring that the liberal viewer’s beliefs are reaffirmed. (The reverse is true on a conservative news programme.)2Each issue facet that is addressed is repeated many times in the course of the day, then extended for as many days, weeks, or months as the issue remains current. The "message," therefore, is repeated virtually as often as an advert for a brand of laundry powder.

So, what is the net effect of such news reportage? Has the viewer become well-informed? In actual fact, not at all.

What he has become is well-indoctrinated

A liberal will be inclined to regularly watch a liberal news channel, which will result in the continual reaffirmation of his liberal views. A conservative will, in turn, regularly watch a conservative news channel, which will result in the continual reaffirmation of his conservative views.

Many viewers will agree that this is so, yet not recognise that, essentially, they are being programmed to simply absorb information. Along the way, their inclination to actually question and think for themselves is being eroded.

Alternate Possibilities

The proof of this is that those who have been programmed, tend to react with anger when they encounter a Nigel Farage or a Ron Paul, who might well challenge them to consider a third option—an interpretation beyond the narrow conservative and liberal views of events. In truth, on any issue, there exists a wide field of alternate possibilities.

By contrast, it is not uncommon for people outside the First World to have better instincts when encountering a news item. If they do not receive the BBC, Fox News, or CNN, they are likely, when learning of a political event, to think through, on their own, what the event means to them.

As they are not pre-programmed to follow one narrow line of reasoning or another, they are open to a broad range of possibilities. Each individual, based upon his personal experience, is likely to draw a different conclusion and, thorough discourse with others, is likely to continue to update his opinion each time he receives a new viewpoint.

As a result, it is not uncommon for those who are not "plugged-in" to be not only more open-minded, but more imaginative in their considerations, even when they are less educated and less "informed" than those in the First World.

Whilst those who do not receive the regular barrage that is the norm in the First World are no more intelligent than their European or American counterparts, their views are more often the result of personal objective reasoning and common sense and are often more insightful.

Those in First World countries often point with pride at the advanced technology that allows them a greater volume of news than the rest of the world customarily receives.

Further, they are likely to take pride in their belief that the two opposing views that are presented indicate that they live in a "free" country, where dissent is encouraged.

Unfortunately, what is encouraged is one of two views—either the liberal view or the conservative view. Other views are discouraged.

The liberal view espouses that a powerful liberal government is necessary to control the greed of capitalists, taxing and regulating them as much as possible to limit their ability to victimise the poorer classes.

The conservative view espouses that a powerful conservative government is needed to control the liberals, who threaten to create chaos and moral collapse through such efforts as gay rights, legalised abortion, etc.

What these two dogmatic concepts have in common is that a powerful government is needed.

Each group, therefore, seeks the increase in the power of its group of legislators to overpower the opposing group. This ensures that, regardless of whether the present government is dominated by liberals of conservatives, the one certainty will be that the government will be powerful.

When seen in this light, if the television viewer were to click the remote back and forth regularly from the liberal channel to the conservative channel, he would begin to see a strong similarity between the two.

It’s easy for any viewer to question the opposition group, to consider them disingenuous—the bearers of false information. It is far more difficult to question the pundits who are on our own "team," to ask ourselves if they, also, are disingenuous.

This is especially difficult when it’s three to one—when three commentators share our political view and all say the same thing to the odd-man-out on the panel. In such a situation, the hardest task is to question our own team, who are clearly succeeding at beating down the odd-man-out.

Evolution of Indoctrination

In bygone eras, the kings of old would tell their minions what to believe and the minions would then either accept or reject the information received. They would rely on their own experience and reasoning powers to inform them.

Later, a better method evolved: the use of media to indoctrinate the populace with government-generated propaganda (think: Josef Goebbels or Uncle Joe Stalin).

Today, a far more effective method exists—one that retains the repetition of the latter method but helps to eliminate the open-ended field of alternate points of view. It does so by providing a choice between "View A" and "View B."

In a democracy, there is always an "A" and a "B." This illusion of choice is infinitely more effective in helping the populace to believe that they have been able to choose their leaders and their points of view.

In the modern method, when voting, regardless of what choice the individual makes, he is voting for an all-powerful government. (Whether it calls itself a conservative one or a liberal one is incidental.)

Likewise, through the modern media, when the viewer absorbs what is presented as discourse, regardless of whether he chooses View A or View B, he is endorsing an all-powerful government.

Two Solutions

One solution to avoid being brainwashed by the dogmatic messaging of the media is to simply avoid watching the news. But this is difficult to do, as our associates and neighbours are watching it every day and will want to discuss with us what they have been taught.

The other choice is to question everything.

To consider that the event that is being discussed may not only be being falsely reported, but that the message being provided by the pundits may be consciously planned for our consumption.

This is difficult to do at first but can eventually become habit. If so, the likelihood of being led down the garden path by the powers-that-be may be greatly diminished. In truth, on any issue, there exists a wide field of alternate possibilities.

Developing your own view may, in the coming years, be vital to your well-being.

New Opportunities Are Emerging For Citizens of The World.

Freedom and democracy may appear to be struggling to stay alive in America, but there may be a knock-out punch ready to be released. The evolution of the blockchain-enabled metaverse is going to enable the 'Citizens of the World' to gain their own Freedom by democratizing power and creating a new world with new rules, new players, and new opportunities. For 99.99% of us, the metaverse will improve our real-world lives through the democratization of power and opportunity.

Along with the major long-term trend of society towards decentralization and smaller-scale organizations, there are new opportunities developing to help 'Preparers' in the cryptocurrency sector. Businesses are beginning to issue their own Crypto Coins that can be traded on Cryptocoin Exchanges.

Markethive.com for example will be releasing its HiveCoin (HIV) in the coming weeks. It has tremendous upside potential that is outlined in a Video by Founder Tom Prendergast, "Entrepreneur Advantage…".

Not only that, if you go to their website and register as a FREE Member, you will be given 500 HiveCoins for "FREE" along with access to several Earning Opportunities and online tools to increase your HiveCoin balance.

Be sure to check it out today – Markethive.com

Tim Moseley

Gold hammered, analysts warn of capitulation event if price drops below pre-pandemic levels

Gold hammered, analysts warn of capitulation event if price drops below pre-pandemic levels.gif)

.gif)

.png)

This is why gold is below $1,800 even as U.S. inflation hits a 40-year high at 9.1%

This is why gold is below $1,800 even as U.S. inflation hits a 40-year high at 9.1%

.jpeg)