Crypto Regulations: The WEF “Want In” Recommending A Global Approach For The Crypto Industry

The World Economic Forum (WEF) is notorious for having a far-reaching and perplexing influence over companies and institutions in many countries worldwide. This influence extends to the crypto industry and crypto regulations. The WEF published a crypto regulation white paper in May 2023, which is significant, so we’ll take a look at what they have to say and how it could influence the crypto legislation being proposed worldwide. We’ll also examine how it could affect the crypto market if implemented.

Image source: Weforum.com

The WEF white paper summarized in this article is titled “Pathways to the Regulation of Crypto-Assets: A Global Approach.” The white paper begins with a brief preface by a member of WEF’s Center for the Fourth Industrial Revolution. For context, WEF founder and chairman Klaus Schwab conjured up the Fourth Industrial Revolution. This concept involves replacing all of us so-called serfs with AI and Automation. Another component of the Fourth Industrial Revolution is controlling the population with technology.

In the preface, the question is asked of how governments can control a borderless, open-source, and decentralized technology. Naturally, the only solution is a globally coordinated approach to regulation. The author of the preface reveals that the WEF has been engaging in “multi-stakeholder consultations” to understand how to roll out global crypto regulations.

For reference, a stakeholder is a term the WEF uses to describe powerful individuals and institutions, not ordinary people like us. In this case, the author of the preface specifies that the white paper was put together with “significant contributions from members of the Digital Currency Governance Consortium.” (DCGC)

For those unfamiliar, the DCGC was formed in January 2020, including multiple crypto companies. The complete list of DCGC members is private. Still, research on the WEF reveals that Ripple, also the Ethereum company, Consensus, and USDC issuer Circle are all part of the DCGC, as are dozens of prolific personalities in the crypto industry.

The DCGC has published five reports so far, and the WEF website notes that it is currently in phase two of its master plan, which involves assessing the economic effects of crypto, stablecoins, and central bank digital currencies. (CBDCs)

The Key Takeaways

The next section of the white paper provides a summary of the key takeaways. Here, the authors argue that global crypto regulations are not only desirable but “necessary.” They seem to suggest this is because of the increasing connections between crypto and traditional finance. The authors explain that many things are standing in the way of global crypto regulations, including:

- A lack of universally accepted definitions for different types of cryptos,

- A lack of coordination between Regulatory Agencies

- Regulatory Arbitrage, meaning some countries are too pro-crypto.

The authors highlight that many unaccountable and unelected international organizations have been working on global crypto regulations. This includes the Financial Stability Board (FSB) and the Financial Action Task Force. (FATF) The authors admit that the WEF has been in contact with these organizations but insist that academia, civil society, and crypto users will also have a say in global crypto regulations. Of course, the authors don't put a timeline on when we will have a say in this matter; but we have yet to have a say in anything.

Why Are Global Crypto Regulations Required?

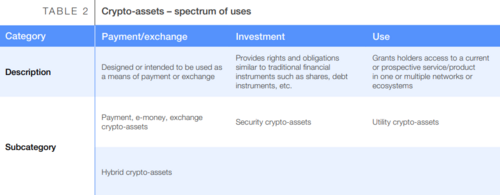

The first part of the report is about why global crypto regulations are required. The authors start by explaining what crypto assets are and include stablecoins under the definition of a crypto asset. Note that these reports seldom refer to cryptos as currencies; they believe cryptos are not currencies. That said, the authors do acknowledge that cryptos have some financial use cases. They say that this is why regulatory scrutiny around crypto has increased.

As you might have guessed, they refer to the crash of Terra last May and the crash of FTX last November as examples of why regulatory scrutiny is justified. The authors then explain that different jurisdictions have since introduced different crypto regulations. They claim that this increases the risk to the global financial system and benefits bad actors in the crypto industry.

They also highlight the inconsistency in crypto definitions. The authors then suggest that smart contracts could be one way of ensuring regulatory compliance. This is not surprising considering that the WEF is a massive fan of programmability in payments. Again, the WEF and its affiliates ultimately want to control what people do, and programmable payments are one way to do just that.

When it comes to regulating cryptocurrencies, the authors say the first step is identifying where the crypto activity is taking place, if possible. The second step is to determine who is engaging in the crypto activity, and the authors say that privacy coins, personal wallets, and DeFi protocols make this problematic. This is a worry because it implies that personal wallets will be a target of global crypto regulations.

Although, in fairness, the authors of this white paper don't seem to be that opposed to personal wallets. That's because they know that if you buy your crypto through an exchange with KYC, it's easy to identify which wallet belongs to who with the help of blockchain analytics companies like Chainalysis. According to the authors, the third step to regulating crypto is determining who is responsible for any crypto activity. They admit this is sometimes difficult, mainly when dealing with decentralized protocols. They note that this will become easier if DAOs become regulated entities.

Crypto And Traditional Finance Connections

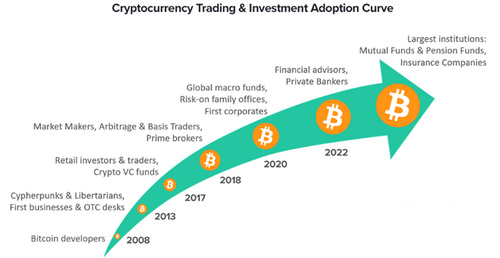

In the next section, the authors dig deeper into the connections between crypto and traditional finance. They start by saying that the crypto market’s correlation to BTC's price is a sign of maturity. Now this is arguably incorrect; a decoupling between different crypto categories would be a sign of maturity. What the authors do get right, however, is that institutional interest in crypto has been on the rise.

Image source: Finoa

They cited a series of statistics from pro-crypto sources, which should be taken with a grain of salt. Genuine institutional interest and investment will come once crypto regulations are introduced everywhere. The authors also note that retail interest in crypto is on the rise and imply that this could cause problems for financial stability. This could explain why some countries, such as Canada, closely aligned with the WEF, have started introducing restrictions on retail investors in crypto.

Besides contagion risks, the authors correctly underscore concentration risks as another concern. The crypto market relies on a handful of stablecoins, a handful of exchanges, and even a handful of cryptos. Oddly enough, the authors claim that Layer 2s on Ethereum lower this concentration risk. This is odd because many Layer 2s still rely on Ethereum for their security, which logically increases concentration risk, never mind that many of these Layer 2s are highly centralized and backed by the same investors.

Challenges To Global Regulation

The second part of the white paper is about the challenges to global crypto regulation. The authors start by reiterating that the absence of universally accepted crypto definitions is the biggest problem. They propose a potential taxonomy but admit that there are exceptions to every crypto definition. They then explain that this is a problem because it makes consensus about specific crypto regulations impossible. It increases the cost of crypto compliance worldwide, making it difficult to protect consumers.

Image source: Weforum.com

According to the authors, regulatory arbitrage is the second challenge to global crypto regulation. They take issue with the fact that crypto developers can relocate wherever they want. It’s becoming all too clear that the WEF would like nothing more than to control the movement of people.

On a related note, did you know that the WEF is also trying to turn almost every major city into a Smart City? More about that in an upcoming article. Meanwhile, Smart technology is already causing issues for consumers.

The authors admit it might still be too soon to push for global crypto regulations. Most governments are still trying to wrap their heads around the technology. Some jurisdictions are further along than others, such as the EU, which recently passed its MiCA crypto regulations.

The authors then reveal that these early crypto regulations, including MiCA, will come into force starting early next year. This is significant because this could make institutional investors comfortable allocating to crypto again. It means the crypto market could rally starting early next year. And this, coincidentally, corresponds with the next Bitcoin halving.

The authors also take issue with so-called crypto hubs. They seem to imply that the crypto hub is code for ‘less crypto regulation’ and appear to blame them for causing regulatory arbitrage. If the WEF starts pulling the strings, this could be awkward for places like the UAE, Dubai, Hong Kong, and Singapore.

Geopolitics

This ties into another vital angle the authors raised regarding crypto regulations – Geopolitics. International relations are deteriorating, making it difficult for certain countries to comply with global crypto regulation recommendations. It's safe to say that this trend will continue.

The above relates to the third challenge to global crypto regulation: "Fragmented monitoring supervision and enforcement.” The authors reiterate that a lack of international cooperation is one of the core causes of this fragmentation, coupled with the rapid evolution of crypto-related technologies.

The authors then provide the FATF's infamous travel rule as a case study. The travel rule requires all transactions above a certain threshold to be tracked and KYC’d. The authors complain about the fact that compliance with the FATF's travel rule has been slow when it comes to crypto.

While we’re on that topic, you should know that the FATF has reportedly been pressuring countries to restrict or even permanently ban crypto to get off its grey list. Any country on this so-called naughty list is refused bailouts from the IMF, so a clean report from the FATF may be a political priority. If there is any truth to this, crypto hubs could face financial sanctions if they don't comply with the FATF’s crypto recommendations; perish the thought.

Approaches To Regulating Crypto Globally

The third part of the white paper is about the possible approaches to regulating crypto on a global scale. The authors provide a de facto list of regulations the WEF wants to see.

- Crypto-specific

- Stablecoin-specific

- Know Your Customer (KYC) /Anti Money Laundering (AML)

- Consumer protection, including restricting retail access to crypto

- Strict regulations around crypto marketing

- Regulation of DeFi and DAOs

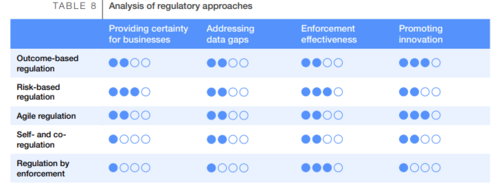

The authors then detail the five primary approaches to crypto regulation.

1: The first is Principles-based regulation. This involves regulating around a series of broad principles rather than specific rules. The benefits of this approach are innovation and flexibility. The drawback is regulatory uncertainty.

2: The second approach is Risk-based crypto regulation and involves applying the same risk/same regulation principle, meaning that crypto should abide by existing financial regulations. The benefit of this approach is regulatory certainty, and the drawback is difficulty in assessing risks.

Notably, the WEF is a massive fan of this same risk/same regulation approach. It's why you see it in many existing regulatory recommendations for crypto. If that wasn't concerning enough, in this section, the WEF advocates for eliminating cash and going digital to ensure that KYC/AML is followed.

3: The authors call Agile regulation the third approach to crypto regulation. This effectively allows regulations to evolve in response to new innovations. The benefit of this approach is that it is flexible. The drawback is that it requires much coordination and collaboration with the crypto industry.

4: The fourth approach to crypto regulation is Self- and co-regulation. It involves allowing the crypto industry to set standards. The benefit of this approach is that it builds trust. The downside is that it can lead to capture; For instance, one company determines all the standards.

5: The fifth approach to crypto regulation is one we’re all familiar with: Regulation by enforcement. It involves taking crypto companies and projects to court and using the precedent as de facto regulations. The benefit is accountability, and the drawback is zero innovation.

Interestingly, the authors asked their so-called stakeholders which regulatory approaches are best. The results can be seen in the image below. As one would expect, Risk-based regulation is the most popular, especially considering that the WEF is a fan of this particular approach.

Image source: Weforum.com

The authors confirm that the other unaccountable and unelected organizations, such as the FSB and FATF, have been adhering to the WEF’s Risk-based approach to crypto regulation. It's preposterous to consider just how much influence the WEF has, and this is just the public stuff.

WEF’s Recommendations for Global crypto regulations.

The fourth part of the report contains the WEF’s recommendations for Global crypto regulations. The authors explain that these recommendations are meant for international organizations, governments, and “industry stakeholders” who are presumably part of the WEF.

In other words, these recommendations are what most crypto regulations will look like, regardless of what we, the people, say or do. The authors again claim that the average person will get the chance to give their input someday, but we’ll just have to wait and see if that happens.

The first set of recommendations is specifically for international organizations. These are to;

- Create definitions for different types of cryptos and crypto activities

- Set standards for how these cryptos and activities should be regulated

- Share data about registered entities with all organizations.

It brings into question whether ‘registered entities’ include the average crypto user. As it’s the WEF, the answer is probably, yes. After all, the endgame of these international elites is to create a global government with a global digital ID and a global centrally controlled digital currency.

The second set of recommendations is specifically for governments. These are to;

- Coordinate regulations between jurisdictions.

- Create regulatory certainty for the crypto industry.

- *Use technology for regulation by design.

*The latter means regulation at the blockchain level via Smart contracts. Remember, the WEF loves programmability.

The third set of recommendations is specifically for the crypto industry. They are;

- To set standards

- To share best practices

- Ensure “Responsible Innovation.”

This seems to be code for adhering to ESG criteria, given that the term refers to environmental, social, and economic risks.

If you've been following articles about ESG, you'll know it's an investment ideology to ensure the UN's sustainable development goals or SDGs are met. Every country is supposed to meet the UN's SDGs by 2030. My research suggests that all the dystopian stuff being pushed has its roots in the United Nation's SDGs, be it CBDCs, digital IDs, smart cities, or online censorship.

Image credit: Markethive.com

What Affect Will It Have On The Crypto Market?

So the big question is, how could the WEF’s global crypto regulation recommendations affect the crypto market if implemented? The short answer is that it would result in the crypto industry being absorbed into the existing financial system, which is precisely what the WEF wants.

The practical effect of Risk-based regulation is that crypto is forced to comply with existing financial regulations. As the authors tacitly admit, these risks posed by crypto aren't always clear. Many argue that the risks are significantly different and justify different regulations. The WEF’s recommendations would make crypto worse than the existing financial system. That's because they would require information about all registered entities to be;

- Shared with international organizations

- Require regulations to be enforced via Smart contracts

- Require all cryptos to be ESG compliant

These three unsuitable recommendations have one thing in common: Governance, more succinctly, control. This article about ESG and Bitcoin explains that the environmental aspect isn't the problem; it's the governance. Bitcoin can't be controlled because it has no traditional governance structure. In case you missed it, this is the core issue the WEF and its allies are trying to address. How do we control something that is designed not to be controlled?

It's possible, if not likely, that the endgame of the environmental-focused attacks on Bitcoin is to track all Bitcoin miners and nodes. It’s something that the WEF’s global crypto regulations would prescribe because Bitcoin miners and nodes would presumably need to be registered.

Their information would therefore have to be shared with all international organizations. At that point, it would become possible to control Bitcoin in theory. In practice, the WEF’s global crypto regulations will never come to pass, which the authors have also tacitly admitted.

In addition to the geopolitical tensions, it's practically impossible to introduce the same crypto regulations in every single country simultaneously. This means that there's going to be some regulatory arbitrage, whether it's intentional or not. This regulatory arbitrage will exist for years, and in some countries, it will persist for decades.

So long as there's a country out there that the WEF can't influence, it won't be able to entirely corrupt crypto. Also, because crypto innovation is essentially exponential, there's a high likelihood that it will evolve to the point that the WEF and its allies can’t control it. This is the most important takeaway – Crypto is too fast for the WEF.

Klaus & Co will never be able to keep up, and crypto will eventually win the race. Right now, though, there are many hurdles facing the crypto industry, and the WEF’s white paper suggests that it played a role in putting those hurdles in place. The WEF's fingerprints are there, whether it's the FSB or the FATF. It’s also common knowledge that there are WEF allies in the crypto industry.

Even so, many in the crypto industry who are on the right side of history, and we at Markethive, genuinely believe that the incentives of crypto are more robust than the WEF’s cronyism. Imagine helping to create a powerful crypto or protocol that allows the average person to preserve their purchasing power, grow their wealth, and maintain their financial freedom. In that case, you are rewarded in every possible way.

As purchasing power, wealth, and financial freedom continue to erode, the incentive to create robust protocols with crypto will only increase. Eventually, the incentives will become so strong that the WEF’s hurdles will become irrelevant. The people will want freedom, and they will achieve it through crypto.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

References: World Economic Forum, Coinbureau

Also published @ BeforeIt’sNews.com; Steemit.com; Substack.com

Tim Moseley

.png)

Bill Gates and other billionaire 'Controligarchs' are pushing for global digital IDs, centralized control and a 'paywall around your life' – Seamus Bruner

Bill Gates and other billionaire 'Controligarchs' are pushing for global digital IDs, centralized control and a 'paywall around your life' – Seamus Bruner

.gif) Gold needs to break above $2,010 for prices to have a chance at ATHs

Gold needs to break above $2,010 for prices to have a chance at ATHs.gif)

The gold market has managed to reclaim the $2,000 level as it looks to end its second consecutive week in positive territory. However, analysts have said that gold's momentum remains limited, and prices are unlikely to break current resistance levels as the Federal Reserve maintains its tight monetary policy bias.

The gold market has managed to reclaim the $2,000 level as it looks to end its second consecutive week in positive territory. However, analysts have said that gold's momentum remains limited, and prices are unlikely to break current resistance levels as the Federal Reserve maintains its tight monetary policy bias.(1).gif) Gold and silver prices stuck, waiting for a catalyst – Quant Insight's Huw Roberts

Gold and silver prices stuck, waiting for a catalyst – Quant Insight's Huw Roberts

Gold needs to break above $2,010 for prices to have a chance at ATHs

Gold needs to break above $2,010 for prices to have a chance at ATHs

.png)

%20copy(1).png)

.png)