BRICS Alliance Expanding Sets A Challenge For The World Reserve Currency. Crypto In Good Stead

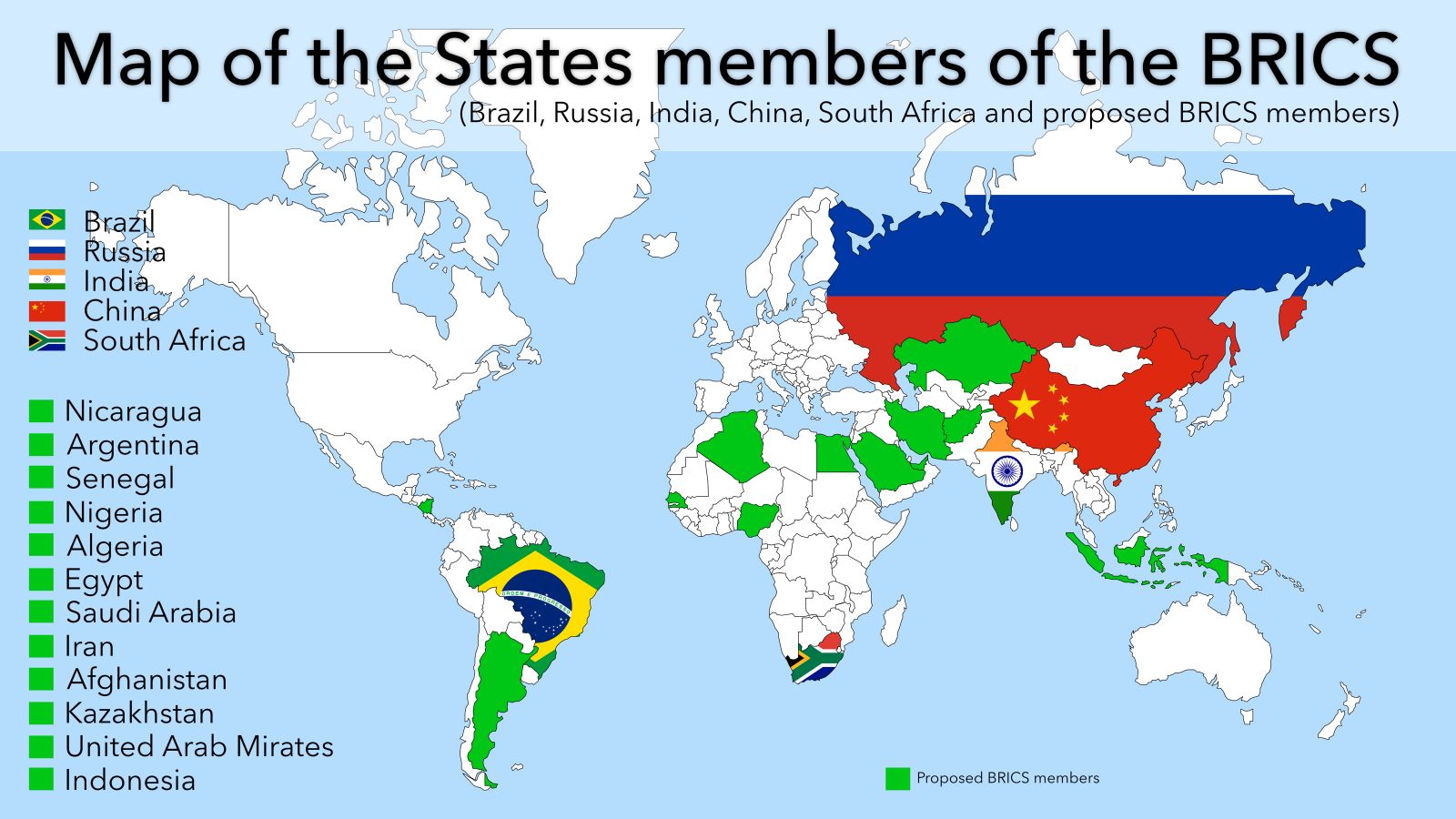

In August 2023, the BRICS countries had their annual summit in South Africa, where some expected a new reserve currency to be unveiled backed by commodities, primarily gold. However, this was not on the agenda for this meeting. The BRICS revealed something arguably more significant when they invited six essential countries to join the coalition. This is in addition to the dozen other countries that have applied to join the BRICS.

This article explains the BRICS alliance, including how it got started, why it’s more potent than people think, how it could challenge the US dollar as the reserve currency, and how crypto fits into this picture in the next ten years.

.png)

Russian President Vladimir Putin delivers his remarks virtually at the 2023 BRICS

Summit in Johannesburg on August 24. Source: CNN

The BRICS Background

BRICS is an acronym for Brazil, Russia, India, China, and South Africa. The term was coined in 2001 by Jim O'Neill, the former chairman of Goldman Sachs’ asset management division. Back then, the acronym was BRIC; South Africa wasn't part of the original lineup. Naturally, Jim was interested in the BRIC countries because he believed that they would be the fastest-growing economies of the coming decades and the most significant economies by 2050.

Jim believed this would be due to their low labor costs, rapidly growing populations, and abundant natural resources. Today, this prediction seems crazy to many, but back then, it made perfect sense to most. For context, many of these countries had started joining US-affiliated organizations at the time, notably China, joining the World Trade Organization. Note that the Commodity markets were also booming, which is significant.

In a 2012 interview, Jim revealed that the performance of the BRICS countries had exceeded his expectations. By then, it was the BRICS because South Africa had joined in 2010. Jim had predicted that the BRICS would account for 14% of global GDP by 2010. They ended up accounting for over 18%. By then, Goldman Sachs had introduced a BRICS investment fund that had accumulated almost $1 billion in assets under management, which was a lot back then.

Wall Street was exceptionally bullish on the BRICS, but this sentiment had turned bearish by 2014. This shift in sentiment has been due to two factors. The first was that Xi Jinping became the president of China in 2013. Xi immediately began embarking on various initiatives that were more in the interests of China and less in the interests of the United States, such as the Belt and Road Initiative.

The Belt and Road initiative marked the end of the so-called age of debt, wherein the West benefited from Eastern countries' purchasing debt. Instead of buying Western debt, China started building global infrastructure. It's possible, if not likely, that Wall Street giants, like Goldman Sachs, were pressured by the US government to stop investing as heavily in the BRICS because of China going rogue.

The other factor that caused Wall Street sentiment on the BRICS to flip was that commodity prices collapsed in 2014, primarily oil. This was caused by an oversupply of oil coming from the United States. US oil producers had discovered new reserves in Texas a few years earlier. You may recall the subsequent decline in oil prices decimated Nigeria’s economy. The same was true for other commodity-reliant economies in the global South. By 2015, the BRICS narrative was as good as gone, and all the BRICS-related funds on Wall Street had closed or consolidated.

In a recent interview regarding the most recent BRICS conference, Jim O'Neill revealed that China was the only BRICS country that had continued to grow according to his expectations. Jim said that the growth in the other BRICS countries was disappointing and said the same about BRICS’s evolution as an organization. In retrospect, he said it made no sense that South Africa was added and that it made no sense that all the countries under consideration by the BRICS also had weak economies. But that is just the US side of the story.

The BRICS Side Of The Story

The BRICS view on things sounds very different, and what It suggests about the BRICS economies and their evolution is much more nuanced. For starters, the BRICS technically isn't an official organization. It has yet to have an official website or social media. The current website for The BRICS appears to be run by Russians.

Russia was the one that turned the acronym into an actual thing driven by President Vladimir Putin. At a United Nations meeting in 2006, the Foreign Ministers of the BRICS countries gathered for their first informal meeting. However, it wasn't until 2009 that the BRICS countries held their first formal meeting in Russia. Interestingly, it's possible that the 2008 financial crisis was the catalyst that brought the BRICS together.

For reference, it's believed that 2008 shook global confidence in the US-led system. In 2012, things started to get truly interesting for the BRICS. The countries collectively pledged to give $75 billion to the International Monetary Fund (IMF) in exchange for reforms. Note that the IMF is an international organization closely affiliated with the US that gives USD loans to developing countries, and these loans come with unfavorable conditions; hence, the BRICS wanted reforms.

.png)

NEW DEVELOPMENT BANK – The headquarters of the BRICS-founded New

Development Bank is in Shanghai. Source: DN Africa

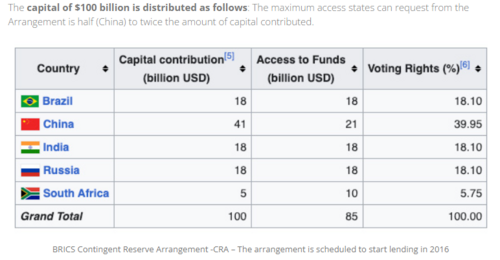

Not surprisingly, the BRICS didn't get these reforms. The result was India proposing that the BRICS set up its versions of the IMF and the World Bank, another international organization closely affiliated with the US that issues USD loans to developing countries for infrastructure development. So, in 2014, BRICS countries created the BRICS Contingent Reserve Arrangement (CRA) and the New Development Bank, colloquially called the BRICS Development Bank.

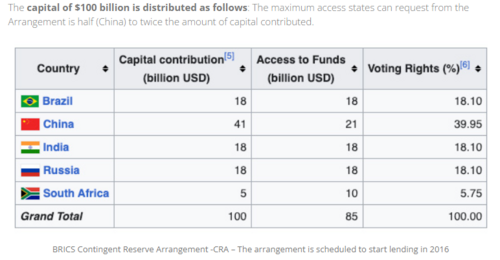

Whereas the CRA is just a framework, the BRICS Development Bank is an official organization headquartered in China. BRICS countries have an almost equal stake in both. The framework includes a capital contribution of $100 billion, primarily meant for a payment emergency in a member country.

It’s understood that the bank can issue up to $100 billion of loans for infrastructure development. This is significant because the IMF and the World Bank were the international organizations that set the stage for the US-led world order. Both were created at the famous Bretton Woods conference in 1944, where the US dollar was established as the world's reserve currency.

Image source: DN Africa

In the following decades, other international organizations closely affiliated with the US were established, such as the United Nations (UN), and many countries were corralled into these organizations by the IMF and the World Bank. This was done using those conditions mentioned earlier on loans, which favor US policy.

The BRICS are in a different position than the US was in the 1940s. The majority don’t believe that the Chinese Yuan, the Russian Ruble, the Indian Rupee, or a combination of these currencies will become the world's reserve currency. However, the BRICS wants to compete with other US-affiliated international organizations like the UN. The CRA and the BRICS Development Bank are precursors to this, but if the BRICS genuinely want to compete first, they must become an official organization.

The BRICS Shows The World Its Serious

This ties into the BRICS' most recent Summit in South Africa, where Xi Jinping was physically in attendance. It’s significant because Xi has only left the Chinese mainland once since January 2020. Not only that, but Xi was there when the Chinese economy was reportedly on the brink of collapse, suggesting that the BRICS is even more important than China to Xi.

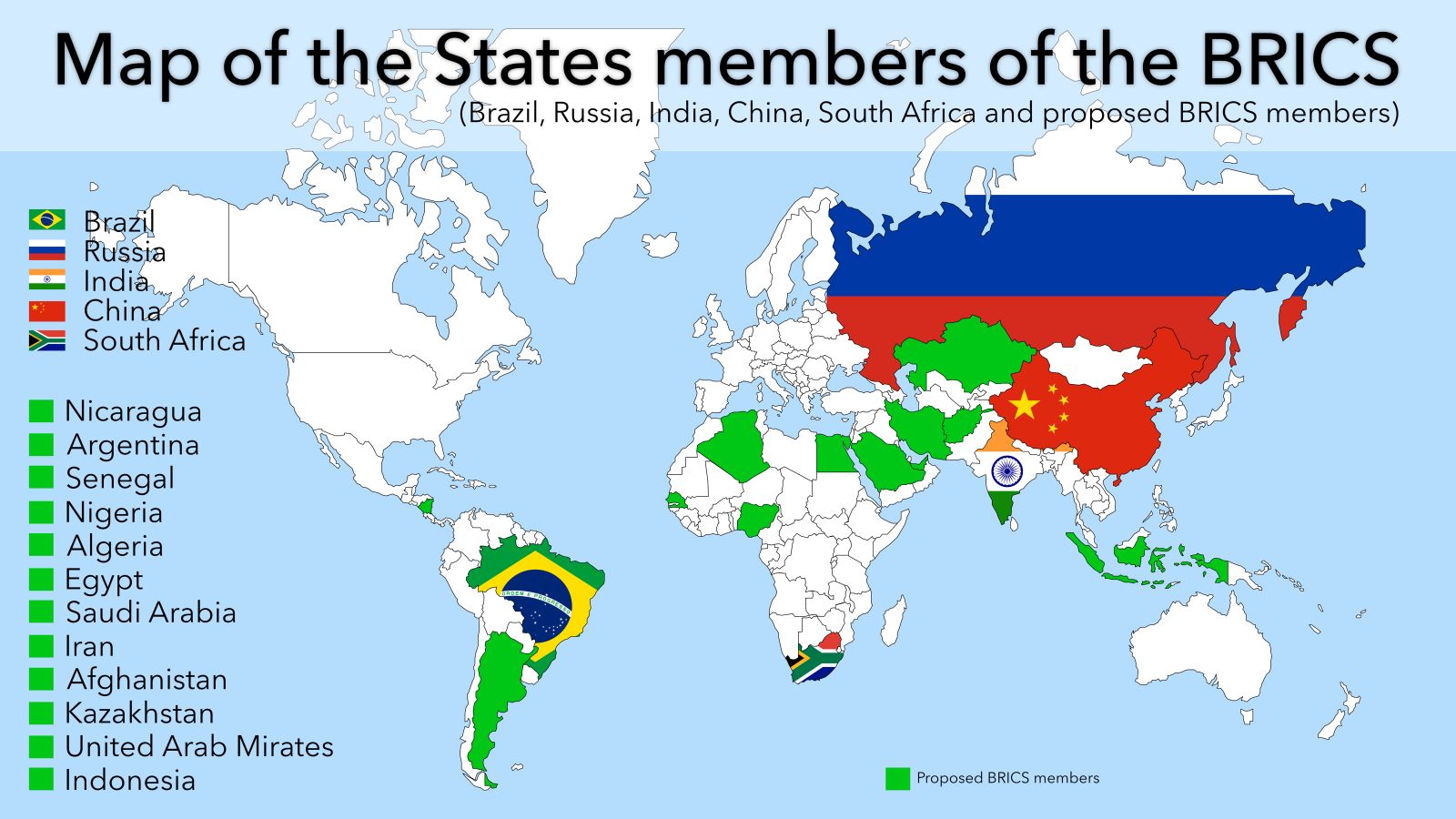

Regardless, Xi’s presence was significant, and it begs the question of why he made the effort. The answer seems to be that Xi wanted to show the world that the BRICS is serious, notably to the countries that the BRICS invited to join their coalition. These countries are Saudi Arabia, the United Arab Emirates, Iran, Egypt, Ethiopia and Argentina. All six countries will join the BRICS starting January 2024 if they accept the invitation.

These new countries are significant for many reasons. The main one is that they are all major oil or agriculture producers. Saudi, UAE, Iran, And Egypt are the major oil producers, while Ethiopia and Argentina are the primary agricultural nations.

As a fun fact, Argentina is the most self-sufficient country in the world. It's estimated that it could feed its entire population with just a fraction of its resources. It's a shame that inflation is ruining everything. They also aren't being helped by the IMF, which recently forced the Argentine government to curb crypto adoption.

.png)

The Chinese President Xi Jinping addressed the BRICS summit in Johannesburg.

Source: The Guardian

There are other reasons why these countries are significant. In Saudi Arabia's case, it's because it has supported the so-called Petrodollar system since 1974. For those unfamiliar, the Petrodollar system ensures that all oil is bought and sold using US dollars. More recently, Saudi Arabia is reportedly looking into de-dollarization from the Petrodollar. This is evident in its experimentation with accepting payment for oil in other currencies, namely the Chinese Yuan. Oddly enough, every country trying to move away from the US dollar has been in conflict.

On that note, Iran is significant because it's been heavily sanctioned by the United States due to its alleged involvement in terrorist activity. Therefore, Iran's admission to the BRICS could cause geopolitical issues for its other member countries and potentially discourage other prospective applicants. The main likely reason the BRICS has yet to become an official organization is because its members are concerned about pushback from the US.

India is the outlier as it's been the most hesitant to side with the other BRICS countries on issues like a new currency, yet a dozen other nations have formally applied to join the BRICS over the last year or so. This list includes Algeria, Bangladesh, Belarus, Bolivia, Cuba, Honduras, Kazakhstan, Kuwait, Palestine, Senegal, Thailand, Venezuela, and Vietnam.

Over a dozen other countries have expressed interest in joining, too. The BRICS is already bigger than many people think. “The five existing BRICS countries account for almost 31.5% of global GDP compared to 30.7% for the G7.” Furthermore, with 3.14 billion people, BRICS nations account for 41% of the world's population.

It's believed that BRICS will establish a formal organization once it becomes large enough, and the recent and future additions could do the trick in that respect. If the six invited countries join the BRICS, the bloc will account for almost 40% of world GDP. Also, if the applications from other countries are approved, they will account for more than 50% of the world's population.

Source: Adobe Stock

Commodity Market Prices Crucial For The Rise Of BRICS

It could also account for most of the world's commodity exports by that point. The only thing missing in the BRICS’ rise is commodity prices. You'll recall that one of the main reasons Jim was bullish on the BRICS was their abundant resources and high commodity prices. You'll also remember that the BRICS narrative fell apart when commodities crashed. But the other reasons Jim was bullish on the BRICS haven't changed. The labor cost in these countries is still very cheap, and most of their populations continue to grow. When you realize this, adding South Africa and the other countries makes sense; all that's missing is commodity prices.

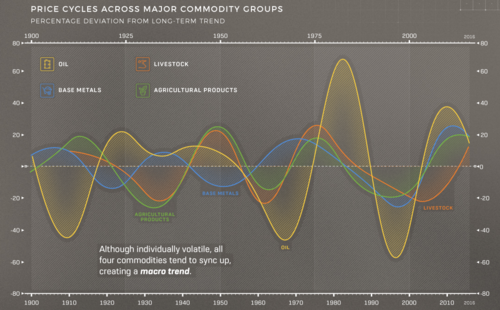

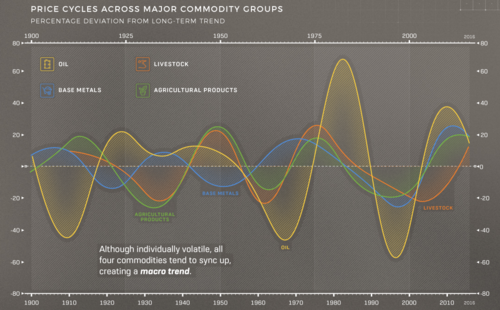

Prices follow a cycle that repeats every 20 to 30 years. As the image below indicates, oil prices, agriculture, livestock, and base metals are highly correlated, although they peak and trough at slightly different times. Even so, they follow a trend of 10 to 15 years up and 10 to 15 years down. The last commodity cycle peaked in the early 2010s. This means the next peak could happen as soon as the mid-2030s; however, commodity prices could continue to fall until the mid-2020s. The caveat is that commodity prices will likely vary by type and region, with some rising first and others rising later.

Image source: Visual Capitalist

The BRICS narrative will likely flip back to bullish during the next commodity cycle, not just because they have many natural resources. The profits from extracting resources and turning them into commodities are much higher in current and future BRICS countries. It’s due to many factors, such as developed countries having exhausted the most accessible resources. They also have higher labor costs and fewer people. Developed countries also have more regulations.

The BRICS countries are at the opposite end of the spectrum for all these factors. If the BRICS Coalition manages to add all the major commodity exporters, it could establish monopolies on the most valuable commodities and force countries to side with the BRICS in exchange for these commodities, the same way that the US has forced countries to side with it in exchange for US Dollars.

Of course, the US and some of its allies also have lots of natural resources. Again, the difference is that the US and select allies have less accessible resources, higher costs of labor, and more regulations.

Image source: The Washington Post

The Commodity Monopoly

Investors will see this dynamic and take their money to the BRICS for more significant profit margins. At the same time, US allies, unable to secure most of their resources, such as Europe, will face extreme pressure to buy less expensive commodities from the BRICS. The inevitable result is that the BRICS will have a de facto monopoly on commodities outside of everywhere except North America. This pertains to an essential question that nations worldwide must ask themselves when the next commodity cycle inevitably occurs. Which do they value more, the US dollars used to buy commodities or the commodities themselves?

Again, the answer will ultimately depend on geography. Countries that produce most of their commodities will likely be the first to ditch the US dollar. Most of the BRICS countries produce their own commodities and have been actively trying to ditch the US dollar in recent years. This is not a coincidence from a commodity perspective.

Conversely, countries that import most of their commodities will likely continue to value US dollars more if it's commercially viable. The inflation of the US dollar, high commodity prices from US allies, and geopolitical tensions with the BRICS will likely force them to side with the BRICS in the end. Many speculate the EU will be the first to fold. Large European countries, like France, have already hesitated to side with the US regarding China. So, an EU country could break ranks and join the BRICS in the coming years.

Crypto To The Rescue

So, where could crypto fit into this picture? As the US dollar continues to decline, an alternative currency will rise. The BRICS want a common currency they can use for commodity payments instead of the USD. As mentioned earlier, it's doubtful that any of the BRICS currencies could play this role and even less likely that a combination of BRICS currencies could either. That's because there will be constant disagreement about the composition and governance of these currencies.

Case in point, BRICS countries apparently couldn't agree on the details of the CRA and the BRICS Development Bank when first proposed, never mind that many of the BRICS countries also have significant geopolitical tensions, such as China and India, over disputed territory. The BRICS countries require a credibly neutral currency, preferably digital, so it's easy to store and transfer across borders.

Now, as impressive as having a gold-backed currency of some kind would be, it would not be very user-friendly. Believe it or not, the ideal BRICS currency would be Bitcoin’s BTC. That's because BTC is created by proof-of-work mining, which requires lots of commodities for computers. The Bitcoin blockchain is secured by the energy commodities that computers use. Notably, BRICS countries have most of both.

This makes BTC a credibly mutual currency that the BRICS can collectively control, albeit to a much lesser extent than a fiat currency. In furtherance, BRICS countries must account for most of Bitcoin’s mining power and collectively agree on changes with Bitcoin developers and the community.

By contrast, if the BRICS adopted a proof-of-stake cryptocurrency, the US could easily print the dollars required to buy up the stake to maintain blockchain control. So long as the US dollar retains its supremacy, it could undermine any proof-of-stake crypto adopted by the BRICS.

.png)

Amid Sanctions, Bitcoin Mining Machines Are ‘Flowing’ Into Russia, as Industry Thrives

Image source: CoinDesk

Interestingly, the BRICS have been discussing using crypto for payments since at least 2017. In 2019, BRICS countries discussed creating a unified crypto payment system, with Russia proposing a unified stablecoin less than a year later. Interestingly, this push for the BRICS to adopt crypto comes primarily from Russia. This could be because of Russia's immense development of crypto-related technology. Whatever the reason, Russia seems more open to adopting crypto than ever. Multiple reports have mentioned Russia considering using crypto for international trade and mining its own BTC for these purposes.

One Russian bank is using crypto for international trade already. Of course, Russia's recent willingness to adopt crypto is reinforced by the unprecedented sanctions imposed on it by the US and its allies after the Ukraine/ Russia war last year. This is a position that Iran was familiar with and probably why Iran is also reportedly using crypto for international trade as of August 2022.

Incidentally, Iran joining the BRICS in 2024 could be one of the catalysts that opens the door to BTC adoption within the bloc. The fact that central banks worldwide will be allowed to hold up to 2% of their balance sheets in crypto starting in 2025 sets the stage for non-BRICS countries to follow suit, and then Bitcoin will be just a few steps away from becoming the world's next reserve currency.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.gif) Gold shopping spree continues for Poland, Czechia and India, Uzbekistan also buys in August

Gold shopping spree continues for Poland, Czechia and India, Uzbekistan also buys in August

.png)

.png)

.gif) Gold shopping spree continues for Poland, Czechia and India, Uzbekistan also buys in August

Gold shopping spree continues for Poland, Czechia and India, Uzbekistan also buys in August

.gif) Gold shopping spree continues for Poland, Czechia and India, Uzbekistan also buys in August

Gold shopping spree continues for Poland, Czechia and India, Uzbekistan also buys in August.gif)

.png)

.png)

.gif)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)