Tim Moseley

10 Money-Mindset Hacks for Entrepreneurs

10 Money-Mindset Hacks for Entrepreneurs

Introduction

In this article, we'll cover ten money-mindset hacks that can help you stop sabotaging your own business dreams.

Make a decision about your relationship with money.

-

Make a decision about your relationship with money.

-

Decide what is most important to you and how you want to spend the time, people, and resources that are available to you.

Make lists of your physical and emotional triggers regarding money.

If the phrase “money mindset hack” sounds like a buzzword to you, it might be time for an educational course in self-awareness. One of the best ways to start this process is by taking a look at your physical and emotional triggers around money.

>What are your physical and emotional triggers? Take note of any patterns that emerge as you think about them. How do they make you feel? Do they bring up anger, shame, guilt or another emotion? What causes these feelings?

One common trigger is the sense that someone else has more than you do—and often when someone else has more than us, it's because we're not doing enough with our own money (even if it's just a perception). Another common trigger is fear: fear of missing out on a lucrative opportunity or fear around investing in yourself (and therefore increasing your earning potential) at all costs.

Get clear about what you want to use your money for.

The first thing you need to do is figure out what your goals are. Before you start saving and investing money, it's important to define exactly what you want to use the money for. Do you want it for a new car? A house? To start a family? Or something else entirely? Writing down these goals will help keep your mind focused on how much time and energy they require when making decisions about spending or saving money.

Setting specific goals is an essential part of developing good financial habits, but don't worry if those goals seem incredibly ambitious! Your goal shouldn't be "I want $100 million." Instead, think about what tangible fitness goals could achieve in 3-6 months: maybe running two miles without stopping, or getting up early every day by 6am; or doing 500 pushups by next month. These smaller achievements will help keep your motivation high during times when it might otherwise dwindle away because of setbacks or challenges along the way (like losing weight).

Collect the stories you tell yourself about money (and finances).

This is a very simple exercise that you can do in one afternoon.

-

Write down your inner dialogue about money and finances as it currently stands. The more honest, the better. If this feels like a challenging task, start with something easy: What do I tell myself when I'm buying groceries? Or when my credit card bill arrives?

-

Once you've written down everything, look for patterns and themes in your stories about money (and finances). Are there any common threads between them? Why are these stories important to me? How does each story help me get what I want from life or how does it hold me back from what I want to accomplish?

-

Finally, ask yourself why these particular stories are so important to you; after all, they're just thoughts—they don't have control over our actions or reactions (unless they're really strong ones!).

Set beliefs that are aligned with what you truly want in your life and business.

It's important to understand the power of your beliefs. They're the foundation of your mindset, and they determine how you perceive reality. When you believe something is true, it affects everything in your life—from the way you see yourself and treat others to how successful (or not) your business will be.

For example, let's say that one of your core values is compassion for others. If someone mistreats you or doesn't value what you do for them, it might not bother or upset you personally; instead, it may just make sense that they don't understand how valuable their actions are as an opportunity for growth. On the other hand, if someone gets frustrated with themselves because they aren't doing well enough at something in their lives or business—even though everyone makes mistakes—that person might get angry because there's no easy solution available to fix the situation immediately!

If this sounds like a familiar scenario for some reason…it probably is! In both examples above (the first being compassionate vs non-complacent), both parties have different beliefs about what's happening around them in terms of other people's behavior versus their own performance as individuals/entrepreneurs respectively within those circumstances."

Give yourself permission to receive even more abundance.

Giving yourself permission to receive more abundance is a powerful way to get your mind aligned with what truly matters most: your dreams. When you start thinking about all the good things in life, you build up an inner momentum that makes it easier for everything else—money included—to flow into your life.

This practice can be applied in many ways, including through gratitude and visualization exercises.

First, write down 10 things you're grateful for right now. Do this immediately if possible; otherwise, do it today before bedtime. This exercise helps remind us of the abundance we already have in our lives and helps us focus on what really matters instead of fretting over money problems or daydreaming about leaving town and starting a new life somewhere else (which would only distract from paying off debt).

Choose options that align with your new money beliefs.

If you have money beliefs that are outdated, it's time to let go of them. It's not easy, but it can be done.

The first step is to create a list of all the money beliefs that are holding you back from having the career/relationship/money situation that you want. Then, take this list and look for ways to align your current behaviors with these new beliefs. For example, if one of your top values includes "making more money," then select an option that will help get there:

For instance:

If one of my goals is making more money this month than last month (which it is), then I could start another side hustle or ask for a raise at work!

Work on your relationship with time.

-

Time is a commodity. It's finite, and you can only do so much in a day. So, if you want to become more financially successful, it's important to work on managing your time well.

-

Being more conscious of how you spend your time will help both with personal goals and business endeavors. If you want to be able to go on vacation or take long lunches every once in a while, then make sure that this happens by setting aside blocks of “me time” in your calendar or blocking off specific periods when you won't be available for work emails or calls (or texts).

If your goal is making money as an entrepreneur or freelancer, then remember that there are only 24 hours in a day—and some days those hours are shorter than others depending on what other commitments come up during the week. If something unexpected comes up during business hours like an urgent email from clients requesting changes to their website design before it goes live tomorrow morning at 10 AM PST; don't panic! Instead, focus on prioritizing tasks based on their importance rather than worrying about whether there's enough available time left over after dealing with everything else later; just make sure everything gets done without sacrificing quality just because deadlines have been moved up unexpectedly due!

Stop comparing yourself to others and their success.

-

Stop comparing yourself to others and their success.

-

This is one of the biggest obstacles for entrepreneurs but is also one of the easiest to overcome. There’s no doubt that it can be natural and even helpful to compare yourself with others, especially when you feel like you’re struggling or not getting what you want from your business. But constantly looking at other people’s success stories can be a huge distraction from your own goals, and will leave you feeling bad about yourself instead of empowered by your vision for what’s possible. It also doesn't help if someone else has done something similar in their business before or better than yours—you have no control over what they do (or don't do), so why waste time worrying about it?

Declutter and organize your home and office space.

Declutter and organize your home and office space. Clean, clean, clean. If you have a messy desk or piles of papers on the floor, it is time to get rid of them. The same goes for your home office: clear out all the unnecessary things in your workspace, keep it organized and clean up after yourself. This will help prevent distractions while you're working so that you can focus on the task at hand instead of worrying about other things around you (or feeling guilt because there are too many things on your desk).

It is possible to have a supportive mindset about money

Your money mindset is a choice. You can have a supportive mindset about your business and life, and you can change it if you want to.

Money is a tool. It is not the enemy, but it's also not the solution. One of my favorite quotes about money comes from author Robert Kiyosaki: “Money amplifies your goodness or your badness."

If you're doing something that makes other people happy—like helping them with their problems—and you charge for that service, then there's nothing wrong with charging someone for what they've paid for! To me this feels like an honest transaction where both parties are getting what they need from each other (and maybe even some extra benefit).

Conclusion

Money is a tool that we can use to create the most amazing life for ourselves. The more we are able to move past our limiting beliefs about money and abundance, the more we will be able to focus on what is truly important in life. This will help us live up to our full potential as entrepreneurs.

Tim Moseley

Gold trades sideways as investors wait for next week’s FOMC and CPI report

Gold trades sideways as investors wait for next week’s FOMC and CPI report

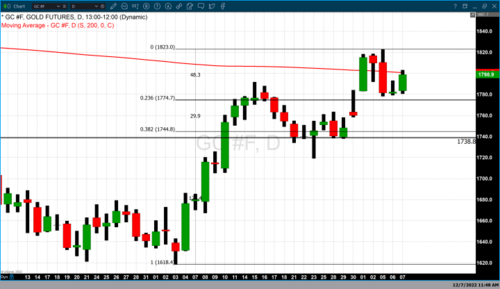

Unlike yesterday’s double-digit gain in gold prices, today we see gold once again consolidating as it did on Tuesday. Tuesday’s price consolidation in gold indicated that the dramatic decline that occurred on Monday was more akin to a one-and-done scenario than the beginning of a correction. It was the equal or slightly higher low on Tuesday that was just as important as the fractional gains. It indicated solid short-term support for gold futures at around $1780.

.png)

Yesterday gold had a respectable price advance recovering roughly half of the decline traders witnessed on Monday. But I believe the key takeaway from the fractional gains on Tuesday and today is that market participants are waiting for the latest information on inflation when the CPI (Consumer Price Index) is released next Tuesday and the Federal Reserve’s last FOMC meeting of the year concludes on the following day.

The most important factor in recent and upcoming price changes in gold is that it has been and will continue to be driven by headlines.

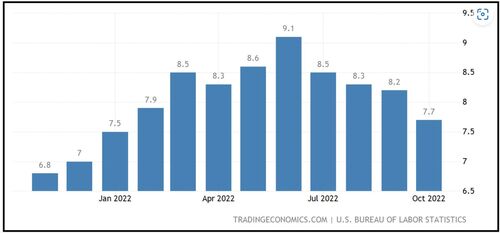

Market participants are by large anticipating that the Federal Reserve will announce a 50-basis point rate hike rather than 75-basis points. According to the CME’s FedWatch tool, there is a 79.4% probability of a 50-BP rate hike, with only a 20.6% probability of a 75-BP rate hike by the Fed next week. This would break the 75-BP rate hike cycle set by the Federal Reserve beginning in June. This means that a rate hike of ½ a percent next week has been largely factored or baked into the pricing.

Gold futures basis the most active February 2023 contract opened in New York at $1799.50 and traded to a high of $1806. As of 4:35 PM EST, the February contract of gold futures is currently fixed at $1801.20 after factoring in today’s net gain of $3.30. This is just above the 200-day MA which is at $1800.20.

Today’s gains in gold pricing were based upon dollar weakness combined with fractional selling pressure in gold. The dollar is currently trading lower by 0.28% and gold futures are currently up 0.18% higher which confirms that today’s price change in gold is a net result of that combination.

By Gary Wagner

Contributing to kitco.com

Tim Moseley

Gold breaks above its 200-day moving average then moves back below it

Gold breaks above its 200-day moving average then moves back below it

Gold futures basis the most active February 2023 contract opened in New York at $1783.30 and traded to a high of $1803.20 just above its 200-day moving average which is currently fixed at $1800.70. The price point of this long-term moving average at least for the short term became a technical level of resistance moving gold back below it. As of 4:19 PM EST, the February contract of gold futures is currently fixed at $1798.90 after factoring in today’s net gain of $16.50 or 0.93%.

Today’s double-digit gains came out of a combination of dollar weakness and traders bidding the precious yellow metal higher. Currently, the dollar is down 0.41% with the dollar index fixed at 105.105. Gold’s gain of 0.92% indicates that market participants were not only active buyers but provided just over 50% of the gains realized in gold futures.

That same ratio can be seen in today’s pricing of physical gold. According to the Kitco Gold Index (KGX), spot gold as of 4:23 PM EST was fixed at $1786.70 after factoring in a net gain today of $15.50. Dollar weakness accounted for $6.55 of the $15.50 gain with the rest attributable to buyers bidding gold prices higher by $8.95.

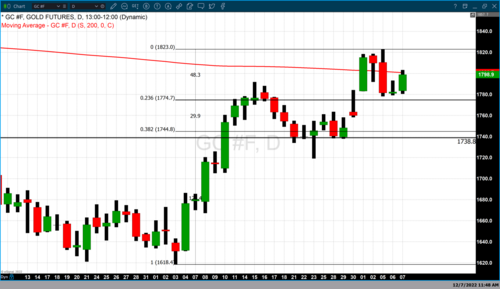

Market participants move gold prices higher today as continued concerns focus on the Federal Reserve’s last FOMC meeting of the year next week and the next inflation report, the CPI. This report will be released during the first day of the two-day FOMC meeting. This will allow the Federal Reserve to see if the fractional decline in inflation reported for October 2022 in November is a continuation of declines in the CPI index after hitting the highest level this year in June when the CPI came in at a scorching 9.1%. From July to October, the CPI has had consecutive declines coming in at 8.5% in July, 8.3% in August, 8.2% in September, and 7.7% in October.

Traders and investors have largely priced in the high likelihood that the Fed will raise rates by 50 basis points, or a ½ %. This will take the current target rate of 375 – 400 basis points to 425 – 450 basis points by the end of the year. According to the CME’s FedWatch tool, there is a 74.7% probability of a 50-basis point rate hike and a 25.3% probability of a 75-basis point rate hike. It is the possibility, although remote, of a fifth consecutive rate hike of 75 basis points that continues to give market participants angst about the upcoming meeting.

Technical levels to watch with gold futures

Our technical studies indicate that the first level of resistance still occurs at $1802 based on gold’s current 200-day moving average. The next level of resistance above that is $1825 based upon the double top that occurred in both August and December.

Minor support first occurs at $1775 which corresponds to the 23.6% Fibonacci retracement. Major support occurs between $1720 the 50% retracement and $1745 the 38.2% Fibonacci retracement level.

By Gary Wagner

Contributing to kitco.com

Tim Moseley

Crypto Adoption Increasing Regardless: Self-Custody Is Key: Markethive’s Next Move

Crypto Adoption Increasing Regardless: Self-Custody Is Key: Markethive’s Next Move: Checkmate.

It’s been a disturbing year for the crypto community and institutional investors alike as we’ve witnessed the collapse of Celsius, BlockFi, and now FTX. Billions of dollars of client funds have been lost and, in the case of FTX, one of the world’s largest crypto exchanges, are quite possibly unrecoverable. It’s become increasingly clear that relying on centralized entities to hold your crypto is foolish and purported to be a rookie mistake. But it wasn’t only newbies or retail investors affected by FTX’s demise. Very few predicted the depravity and criminality of FTX cohorts led by Sam Bankman-Fried.

Hedge funds, venture capitalists, investment managers, and high-net-worth individuals were all caught off guard. Who would’ve thought a company praised by politicians, regulators, VCs, and the mainstream media would collapse so quickly and spectacularly? Until you realize that fraud and ill-intent are rife in many so-called respected sectors. Some say FTX was worse than Mount Gox and Quadriga, and others say it’s worse than Enron.

Image source: Cointelegraph

Crypto Adoption Increases

Contrary to the FUD about crypto acceptance diminishing due to recent events, crypto adoption is still increasing. As a store of value, Bitcoin is alive and well, and the decentralized public blockchain of Bitcoin remains as secure as ever. The confidence in the protocol is helping assert its role as a store of value and can reinforce its position as the gold standard of crypto.

Bitcoin has proven to be an effective form of decentralized non-government money. TechCrunch reveals that consumers are utilizing BTC for international remittances for many reasons. Its ability to transcend the traditional financial system is valuable and, in some cases, critical to many potential users. The collapse of FTX or any token doesn't change that.

Many are starting to see that FTX and the like are just stories based on misbehavior and lack of compliance, if not lining one’s pockets under the guise of effective altruism, turned moral vanity. There have been many failures in 2022, and the real losers are the ecosystem of centralized actors and cryptocurrency altcoins that have failed to deliver on their hype.

Questionable Alt-coins

Although FTX and its FTT token are the latest to fail, others have fallen this year alone. The Celsius Network exposed the risk of "stablecoins" as the TerraUSD coin and LUNA token crashed. There was also the collapse of crypto lender Voyager Digital, which FTX subsequently purchased for a mere $51 million, down from a peak valuation of $1.5 billion. Hacks and marketing scams have also plagued the broader sector.

Considering there are over 13,000 cryptocurrencies, only a handful of altcoins have legitimacy and a place in the crypto ecosystem with well-defined utility or unique applications. Altcoins like Ethereum, Litecoin, Cardano, Elrond, and Solana have a reason for being, but there are many with questionable structures with no utility created for speculation purposes only. Some are just coin gimmicks with almost unlimited supply caps, which contradicts the supply and demand theory.

The critical distinction is that these questionable alts are not related to Bitcoin or legitimate altcoins with purpose, especially benevolent ones, that are working towards an alternative future monetary system, just like Satoshi envisioned. There will always be nefarious actors in our midst, and with all that’s been happening, the crypto community is much more discerning.

With Markethive about to appear on the global scene as the first blockchain-driven decentralized social media integrated with broadcasting and inbound marketing platforms and its sovereign monetary system using its native crypto, Hivecoin, security, and privacy are paramount. There are various ecosystems in the crypto space, and a parallel economy is on the rise. Markethive is creating an ecosystem for everyone with an entrepreneurial spirit looking for a sanctuary away from the escalating evil in the world.

Security in centralized exchanges will always be a concern, as is the rollout of CBDCs and digital IDs that are making headlines. In a recent interview, Aman Jabbi, a computer scientist, says that if the population accepts these factors of control, it’ll be game over for humanity. He states the easiest way to push against the system is to “starve the beast” by refusing to use technologies that collect and share your data. Notably, in this case, the beast is AI and is used for evil against humanity, not for good.

As with many other factions rejecting the global elite’s plans, Markethive is building an impenetrable fortress to protect its growing community. Cryptocurrency is the key to freedom and financial sovereignty, so how do we protect ourselves and keep control of our crypto?

With the impending release of the Markethive internal wallet and its official listing of Hivecoin, you will need an external wallet connected to the blockchain for transactions. Unlike keeping your crypto on an exchange, there is only one way you can know for sure that your crypto is under your control: to self-custody your funds.

What Is Self-Custody?

Self-custody is when you hold the private keys to your cryptocurrency wallet, so you can only sign transactions from that wallet. Hence, you are the only person who effectively controls your crypto. There is a well-known phrase in the crypto world; not your keys, not your crypto.

Conversely, when you place your funds on an exchange or any centralized platform, you use a wallet to which the platform has the private key, not you. It's a communal wallet; you have to hope and trust that the exchange won't lend or send those funds to anyone else. So what you essentially have from the exchange is an IOU, which is worth nothing if that exchange goes bust. It’s the same with a traditional bank account in that cash only exists as a database entry.

It’s important to note that there is a distinct difference between self-custody and custody services. Companies like Coinbase, Gemini, Bitgo, and the like, operate custody services. Their primary modus operandi is to hold those coins and tokens for you in a supposedly safe manner. They're much safer than an exchange but are still not the gold standard when controlling your crypto. What you need is a self-hosted wallet.

There are various self-hosted wallets, so the wallet you choose will depend on what you want to use it for and the coins and tokens you want to store.

Image source: Exodus

Non-custodial Wallets

Desktop or software wallets are software programs that you install on your PC and to which you can send your crypto. The private keys themselves are stored on your device in an encrypted fashion, and whenever you want to send a transaction out, they are used to decrypt and sign that transaction.

A reputable wallet, and the one I use is the Exodus Wallet. Exodus has wide-ranging coin support and an intuitive, easy-to-use AI. It’s important to note that no exchange integration in any of the self-custody crypto wallets would ever allow an exchange to hold your private keys.

Exodus also has a mobile wallet for smartphone users and a Web3 wallet that connects you to dApps, DeFi, and all of Web3. The Exodus Web3 Wallet is also a self-custody crypto wallet. It allows you to send, receive, and swap crypto and interact with NFTs on all supported networks.

Other multi-coin wallets to consider are the Atomic wallet or Jaxx wallet. Because of the Markethive and Solana Integration, as long as any of these wallets recognize Solana, they will accept Hivecoin going forward.

Forewarned is Forearmed

It’s also notable that Exodus has never been hacked. If you’ve heard of any reports about Exodus users getting hacked, it stems from where they downloaded the software. When downloading these desktop wallets, check that you download them from the official site. There are thousands of phishing sites that try to impersonate official wallet websites.

Sometimes they'll have a dodgy domain that’s easily overlooked. There have been instances of phishing sites paying for Google ads to have their sites placed above those of the official sites. Once you go on these phishing sites, you may accidentally download a wallet jammed with malware that could be used to steal your private keys.

As with desktop wallets, ensure you download the correct mobile wallet app from the Apple or Google Play store. There have been examples where hackers have uploaded malicious apps and wallets with predictably unpleasant results. It’s also critical to keep your crypto wallet a secret, especially if you have any on your phone. The more people know about your holdings, the more of a target you are for the $5 wrench attack.

It’s also essential to distinguish between crypto company mobile apps and mobile wallets. Smartphone apps like Coinbase, Binance, Nexo, and Crypto.com are just mobile versions of exchanges allowing you to access your crypto accounts. You don't hold the keys; the exchange does.

Once you've downloaded and installed any of these wallets, you'll be asked to generate a collection of seed words. These words are the keys to your crypto kingdom, so be sure to keep them in a safe and secure place and make backups. Remember, anyone with the seed words can regenerate your wallet and exfiltrate your crypto.

All the self-custody wallet solutions mentioned above are free to download and use. The next level option is hardware wallets, like Trezor or Ledger. They store your private keys in a cold environment, which means they are never exposed to the internet as they're always kept on the device itself.

Image source: Exodus

In terms of functionality, hardware wallets will be connected to your computer and operated with software that the device manufacturer has produced. Therefore from a simplicity perspective, they should be relatively easy to use as the software wallet. Furthermore, Exodus has a Trezor integration on its desktop wallet, which adds an advanced layer of security.

Not only is your crypto much more secure with self-custody, but you also have complete control of what you do with that crypto. No permission is needed to withdraw, no limits, and no KYC. It's your wallet, keys, crypto, and your financial freedom.

Moving Forward

2022 will arguably go down as one of the worst years in the crypto ecosystem; however, it is a turning point for the industry as we adapt to weed out bad actors. It'll also be the year where nearly everyone, from big money to average retail users, truly appreciates the importance of decentralization and having total control of their crypto assets.

As we enter 2023 and witness the storm of catastrophic events worldwide and the unveiling of unscrupulous entities, the crypto industry is evolving, realizing and addressing issues borne from a nascent technology.

Markethive is in the eye of the storm, where it’s calm and peaceful, diligently working to bring a blockchain-driven multi-media network to the crypto space. People worldwide who have suffered the tyranny of big tech and social media elite or been displaced or scammed by bad actors are being enlightened.

We can consider all these adverse occurrences as blessings in disguise. The time is right for Markethive to distinguish itself and bring to light its purpose of delivering a broadcasting platform, marketing systems, and communication interface foundational to God’s law, the universal spiritual law where truth, freedom, and liberty are upheld for all of humanity.

Come to our Sunday meetings at 10 am MST as we approach massive significant upgrades and the wallet launch. See and hear explanations, ask questions, and witness the ever-evolving technology and concepts of Markethive. The link to the meeting room is located in the Markethive Calendar.

.png)

Tim Moseley

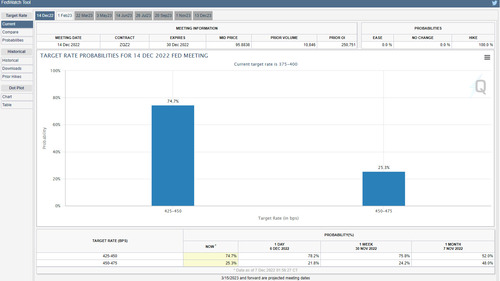

Gold consolidates after trading to a double top near 1825 yesterday

Gold consolidates after trading to a double top near $1825 yesterday

Market participants are acutely aware of next week’s FOMC meeting which begins on Tuesday, December 13, and concludes the following day. Following the conclusion of the last FOMC meeting of the year, the Federal Reserve will release a statement which will be followed by Chairman Powell’s press conference. It is highly anticipated that the Federal Reserve will raise its benchmark Fed funds rate as it has at every consecutive FOMC meeting since March.

Traders and investors have largely priced in the high likelihood that the Fed will raise rates by 50 basis points, or a ½ %. This will take the current target rate of 375 – 400 basis points to 425 – 450 basis points by the end of the year. According to the CME’s FedWatch tool, there is a 77% probability of a 50-basis point rate hike and a 23% probability of a 75-basis point rate hike. It is the possibility, although remote, of a fifth consecutive rate hike of 75 basis points that has given market participants angst about the upcoming meeting.

.png)

Gold had fractional gains with the most active February 2023 Comex contract gaining $2.30 or 0.13%. As of 4:55 PM, EST gold futures are fixed at $1783.80. Gold futures opened today at $1780.80 and traded to a high of $1793.20, and a low of $1779.10. The dollar gained 0.26% in trading today with the dollar index currently fixed at 105.515. This means that traders were able to bid gold prices higher while overcoming mild dollar strength.

This can also be seen in the pricing of physical gold today. According to the Kitco Gold Index spot gold is currently fixed at $1771.40. Traders bid physical gold higher by $6.40 and dollar strength took away $4.10 of that gain which resulted in today’s net gain of $2.30.

Today’s fractional gain in gold indicates that market participants have paused the selling pressure seen in yesterday’s technical selling that moved gold prices sharply lower.

Important technical levels in gold futures

Our technical studies indicate that the first level of resistance occurs at $1802 based on gold’s current 200-day moving average. The next level of resistance above that is $1825 based upon the top that occurred in August. Major resistance can be seen at $1883; this is based upon the top that occurred in mid-June.

Minor support first occurs at $1775 which corresponds to the 23.6% Fibonacci retracement. Major support occurs between $1720 the 50% retracement and $1745 the 38.2% Fibonacci retracement level.

By Gary Wagner

Contributing to kitco.com

Tim Moseley

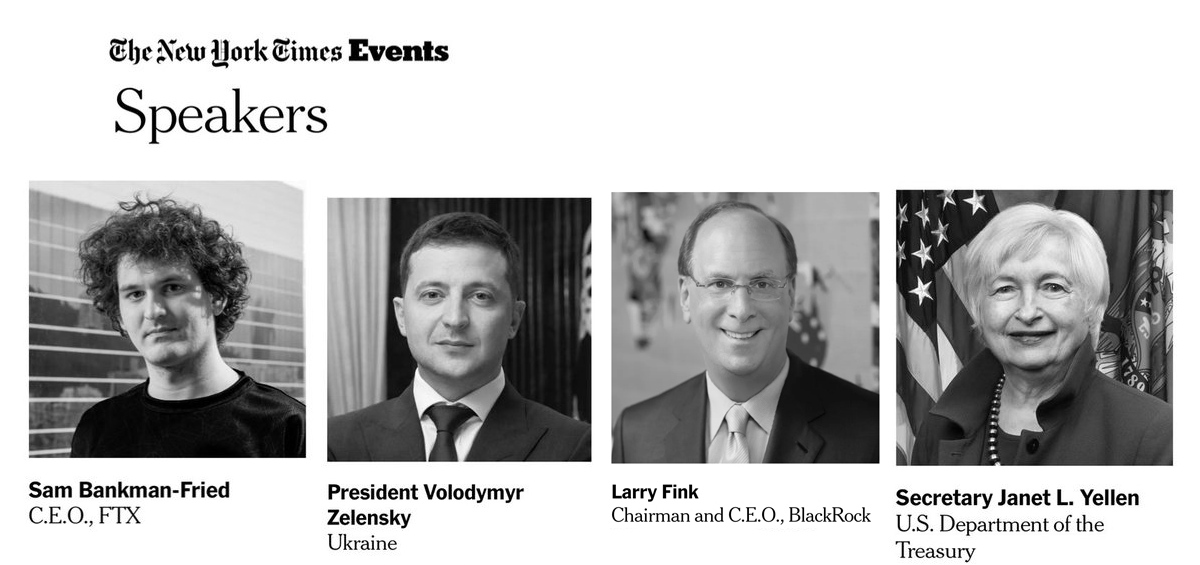

Everything That’s Wrong With the Mainstream Media and Finance in One Picture

.jpg)

Everything That's Wrong With the Mainstream Media and Finance in One Picture

by Nick Giambruno, contributor, International Man Communique

.jpg)

It’s hard to recall a more despicable and widespread public-relations effort to transform the image of an obvious villain.

Of course, I'm referring to the mainstream media's treatment of Sam Bankman-Fried (SBF).

It’s reminiscent of the movie Batman Returns, where a corrupt media tries to polish the image of the repugnant criminal Oswald Cobblepot—better known as the Penguin.

SBF founded FTX in 2019. The company seemed to come out of nowhere to become one of the world’s largest cryptocurrency exchanges in mere months.

How did this strange newcomer—who didn't know much about Bitcoin—suddenly become the so-called "JP Morgan of Crypto?"

Powerful people in finance, the media, and the government all had a hand in FTX's meteoric rise. So the company was clearly at the nexus of something important—though the whole picture is not exactly clear at this point.

Simply put, FTX was a cesspool.

The company allegedly mishandled customer deposits, was involved in shady activities in Ukraine, sold Bitcoin it didn’t have and had suspicious connections with prominent politicians and regulators.

For example, SBF was the second-largest donor to the Democratic Party, behind only George Soros.

FTX also lobbied the government for special treatment and to suffocate its competitors with regulations.

Tom Brady, Larry David, and other celebrities lent their image to FTX. The company even aired a commercial during the Super Bowl. In addition, FTX acquired the naming rights to the stadium where the Miami Heat basketball team plays.

As a result of all this mainstream publicity, countless ordinary people were suckered into FTX and lost many billions of dollars in minutes as this crooked institution went bankrupt recently.

Instead of treating SBF like a criminal, the media launched a bizarre PR blitz to paint him as some selfless altruist out to save the planet.

It's not uncommon to see the mainstream media bend over backward to gloss over any of SBF's alleged wrongdoing and instead highlight what might make you think he's not such a bad guy.

SBF also appeared on Good Morning America. He denied he knew about the improper use of customer funds—it wasn't convincing. Host George Stephanopoulos was either unwilling or not sufficiently informed to challenge the assertions.

Perhaps the most ridiculous display in this coordinated PR campaign was SBF’s remote appearance from the Bahamas—he hasn’t returned to the US since FTX’s collapse—at the New York Times Dealbook Summit.

Andrew Ross Sorkin, an establishment darling and event host, asked fake hard questions. Clearly, his goal was to do damage control, not discover the truth. In the end, a sympathetic audience gave SBF enthusiastic applause.

When you take a step back and look at the big picture, powerful people and institutions are clearly protecting SBF.

The mainstream media, which already has a well-deserved dismal reputation, is destroying what little credibility it has left with these endless SBF puff pieces. It’s a desperate and foolish move, and I don’t think it will work.

Whatever was really going on with FTX could be exposed soon. And since the media has been working so hard to cover it up, it could be explosive.

The fallout could devastate other cryptocurrency exchanges and companies.

That’s why it’s crucial to hold Bitcoin properly.

If you hold your Bitcoin on Coinbase or some other platform, you don’t really own your Bitcoin and are taking on significant counterparty risk. Instead, you own a Bitcoin IOU, which is something very different—as FTX clients are finding out.

These custodians can freeze and seize your funds for any pretext they find convenient. You need to ask for their permission to use your funds.

Custodians can also go bankrupt, and you can lose all your funds, which has happened countless times. They also know your entire transaction history, so you have no privacy.

The whole point of Bitcoin is for you to totally control your money. Relying on a third party defeats the entire purpose.

It’s much more secure to hold your Bitcoin off the exchange’s website in your own self-custody wallet, where you control the private keys to eliminate this dangerous counterparty risk.

As Bitcoiners like to say, "not your keys, not your Bitcoin."

New Opportunities Are Emerging For Citizens of The World.

Freedom and democracy may appear to be struggling to stay alive in America, but there may be a knock-out punch ready to be released. The evolution of the blockchain-enabled metaverse is going to enable the 'Citizens of the World' to gain their own Freedom by democratizing power and creating a new world with new rules, new players, and new opportunities. For 99.99% of us, the metaverse will improve our real-world lives by democratizing power and opportunity.

Along with the major long-term trend of society towards decentralization and smaller-scale organizations, there are new opportunities developing to help 'Preparers' in the cryptocurrency sector. Businesses are beginning to issue their own Crypto Coins that can be traded on Cryptocoin Exchanges.

Markethive.com will release its HiveCoin (HIV) in the coming weeks. It has tremendous upside potential that is outlined in a Video by Founder Tom Prendergast, "Entrepreneur Advantage…".

Not only that, if you go to their website and register as a FREE Member, you will be given 500 HiveCoins for "FREE" along with access to several Earning Opportunities and online tools to increase your HiveCoin balance.

Be sure to check it out today – Markethive.com

Tim Moseley

Gold silver hit hard by profit taking bearish outside markets

Gold, silver hit hard by profit taking, bearish outside markets

Gold and silver prices are sharply lower in midday U.S. trading Monday after hitting multi-month highs overnight. The metals are being hit by heavy profit taking from the shorter-term futures traders and by bearish outside markets. The U.S. dollar index is solidly higher and crude oil prices are lower and lost good early gains. Rising U.S. Treasury yields are also a bearish element for the precious metals markets today. February gold was last down $24.10 at $1,785.20 and March silver was down $0.88 at $22.375.

Today's report on the U.S. ISM services index unexpectedly improved in November, and with only a slight decrease in prices paid. The data may suggest wage pressures will remain stronger. The headline index for November came in at 56.6, which was higher than the expected reading of 53.3. The employment component also moved back to expansion territory. The report falls into the hawkish camp on Federal Reserve monetary policy and helped pressure the stock market, and in turn supported the U.S. dollar index while lifting U.S. bond yields.

Global stock markets were mixed to firmer overnight. U.S. stock indexes are sharply lower near midday, but are still no too far below last week's multi-month highs.

.gif) JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold

JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold

The key outside markets today see the U.S. dollar index solidly higher after hitting a 3.5-month low last Friday. Nymex crude oil prices are lower and trading around $79.00 a barrel. As of Monday, the European Union and the U.K. have barred inbound shipments of crude oil from Russia and put a cap of $60 a barrel on EU companies doing business facilitating Russian oil shipments elsewhere in the world. At a meeting over the weekend the OPEC oil cartel lefts its collective crude oil production unchanged. Meantime, the yield on the benchmark U.S. 10-year Treasury note is presently 3.57%.

.gif)

Technically,February gold futures prices hit a 3.5-month high early on today and then reversed course to score a bearish "outside day" down on the daily bar chart. The gold futures bulls still have the overall near-term technical advantage but faded today. Prices are in a four-week-old uptrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at today's high of $1,822.90. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,733.50. First resistance is seen at $1,800.00 and then at the November high of $1,806.00. First support is seen at $1,770.00 and then at $1,750.00. Wyckoff's Market Rating: 6.0Live 24 hours silver chart [

March silver futures prices hit a seven-month high early on today but then reversed course to score a bearish "outside day" down on the daily bar chart. The silver bulls still have the overall near-term technical advantage but faded today. Prices are in a choppy three-month-old uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $24.00. The next downside price objective for the bears is closing prices below solid support at $20.79. First resistance is seen at $23.00 and then at today's high of $23.69. Next support is seen at $22.00 and then at $21.435. Wyckoff's Market Rating: 6.0.

March N.Y. copper closed down 440 points at 380.60 cents today. Prices closed near the session low today after hitting a three-week high early on. The copper bulls have the overall near-term technical advantage. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at the November high of 394.70 cents. The next downside price objective for the bears is closing prices below solid technical support at 354.70 cents. First resistance is seen at today's high of 389.45 cents and then at 394.70 cents. First support is seen at 373.50 cents and then at 365.00 cents. Wyckoff's Market Rating: 6.0.

By Jim Wyckoff

For Kitco News

Tim Moseley

What are Backlinks and How do They Help Your Website

What are Backlinks and How do They Help Your Website

Introduction

In the world of SEO, backlinks are the most important factor to consider. They tell Google that your website is relevant to a particular topic, which helps you rank higher in search results. Backlinks can be either internal (within the text of your website) or external (outside on another site).

What are backlinks?

Backlinks are links to your website from other websites. For example, if you have a blog and someone publishes an article on their own blog that mentions your article and links to it, then that's essentially a backlink.

Google uses backlinks as ranking factors in its search results – the more backlinks you have pointing at your site, the higher up in the SERPs (search engine result pages) Google will rank it for specific keywords and phrases. This is why it's so important for anyone who owns a website or blogs regularly to build up their backlink profile.

Major types of backlinks

There are three major types of backlinks:

-

Internal links, which are links that point to other pages on the same site.

-

Outbound links, which direct visitors from one page on your website to another outside website.

-

Image links and text links. These can be either internal or external to your website as well.

How backlinks help your website

But what does it mean for your website?

To understand the importance of backlinks, let’s get into the basics. Backlinks are links from other websites pointing to your own. They’re usually text links in content or images and they send referral traffic to your site if clicked on by a visitor. The more backlinks that point to your site, the better off you are when it comes to search engine rankings (SERPs). Search engines use these signals as indicators of how relevant a page is—the more relevant it is, the higher up in the SERP its listing will appear. So how do you boost your backlink profile? By producing high quality content that people want to link too! That makes sense right? Otherwise they wouldn’t want others reading what you write anyway…

Where to find high-quality backlinks

A good place to start is with the resources you already have. Do you have a blog? If so, you're already in luck because that's one of the best places to gain high-quality backlinks. No matter what your niche is, there are probably other blogs in your industry covering similar topics. You can reach out to these bloggers and ask them if they'd be willing to include a link in one of their articles. The key here is being patient and persistent—this kind of outreach takes time and effort but it's well worth it when you see results!

Another great way to find high quality backlinks is by using tools like Ahrefs or Moz Open Site Explorer (Moz). These tools will show which websites are linking out to other sites on the web in order of popularity; this means that any site appearing at the top of these rankings has received more links than other sites around it—which makes sense since those links represent votes from their peers saying "Hey, this site rocks!".

Backlinks vs. Internal Links

When you're learning about backlinks and how they can help your website, it's important to understand the difference between internal links and backlinks.

Internal Links: These are links that point to the same page on your site. They allow users to navigate quickly within a single webpage.

Backlinks: These are external links that point to other pages on other sites (i.e., those not owned by you). They help search engines recognize your content as being relevant or "important" in some way, which helps improve its ranking in search engine results pages (SERPs).

Backlinks are the most crucial component of off-page SEO.

Backlinks. You've probably heard of them, but you may not entirely understand what they are and how they benefit your website. Let's break down backlinks and their role in SEO:

-

Backlinks are the most crucial component of off-page SEO

-

Backlinks are the primary way to get noticed by search engines

-

Backlinks are the only way to get traffic from other sites

Conclusion

Backlinks are the most crucial component of off-page SEO. They are what makes or breaks your website in search engines, so you need to make sure that you have enough backlinks pointing towards your content.

Tim Moseley

Will 1800 bring the gold bulls back? Analysts look for follow-through buying next week

Will $1,800 bring the gold bulls back? Analysts look for follow-through buying next week

rowing expectations that the Federal Reserve will slow the pace of rate hikes are creating new momentum in the gold market as prices ended the week above $1,800 an ounce. However, some analysts aren't entirely convinced that new capital is coming into the market.

Analysts said they are anxious to see if the precious metal can attract some follow-through buying next week and solidly break out above its 200-day moving average, something it hasn't done since February.

Not only is gold starting December off on the front foot, but its 7% rally during November was its best performance since May 2021.

Gold's solid finish to the week comes after the U.S. government reported substantial employment gains and higher wages for November.

Friday, the Bureau of Labor Statistics said 263,000 jobs were created in November; economists expected job gains of 200,000. At the same time, wages increased 5.1% for the year, well above expectations.

Ole Hansen, head of commodity strategy at Saxo Bank, said that sentiment is improving with traders now looking to buy the dips instead of selling the rallies; however, he added that there is still little bullish conviction in the market and that needs to change if prices are going to consolidate at current levels.

"From a momentum perspective, we still need to do a little bit more work," he said. "Momentum traders are still not in a hurry to get into gold."

Kevin Grady, president of Phoenix Futures and Options, said that gold's future remains tied to the Federal Reserve and its aggressive monetary policy stance.

Gold's month-end rally started in earnest Wednesday after Federal Reserve Chair Jerome Powell said it could be appropriate for the U.S. central bank to slow its pace of tightening in December.

However, Grady noted that despite the dovish tilt, the Federal Reserve will continue to raise interest rates and that will keep many gold investors on the sidelines.

.gif) Bitcoin price dips below $17K as recession fears rise to the surface

Bitcoin price dips below $17K as recession fears rise to the surface

He added that he sees the current rally as further short-covering, which is not sustainable.

"You don't want to be short gold if the Fed is going to raise interest rates by 50 basis points," he said. "But people are not saying let's get long gold at $1,800; they are saying let's not be short."

Edward Moya, senior North American market analyst at OANDA, said that given gold's move this past week, he would expect to see some consolidation in the near term.

He added that next week is a relatively quiet one for economic data and traders will probably keep a low profile as they wait for the Federal Reserve's monetary policy decision on Dec. 14.

However, he added that he would look to buy gold as it tests the bottom of its new trading range.

"I'm slightly bearish on gold right now, but if it drops $20 from here, then I would be bullish," he said.

Moya added that long-term, although the jobs data remains persistently strong, other areas of the economy continue to weaken.

He said that after the holidays, he expects to see significant demand destruction as consumers try to pay their bills. This environment will force the Federal Reserve to slow the pace of its rate hikes and even lead to the much-awaited pivot.

"Inflation is still going to be sticky and tricky to navigate, but we are not seeing a risk that the Fed Funds rate goes to 6%," he said. "The Fed is still going to downshift and that will be good for gold."

Heading into the weekend, the CME Fed Watch Tool shows that markets see a nearly 80% chance that the Federal Reserve will raise interest rates by 50 basis points later this month. Markets still see a terminal rate between 5.0% and 5.25%.

Along with economic data, market analysts warn investors to keep an eye on headlines surrounding next week's OPEC+ output decision.

The group of 23 oil-producing nations led by Saudi Arabia and Russia will meet Sunday, with markets expecting the group to announce more production cuts, which would increase fears of a recession and higher inflation.

Next week's data

Monday: ISM services PMI, Reserve Bank of Australia monetary policy decision

Wednesday: Bank of Canada monetary policy decision

Friday: Producer Price Index, preliminary University of Michigan Consumer Sentiment

By Neils Christensen

For Kitco News

Tim Moseley