.jpg)

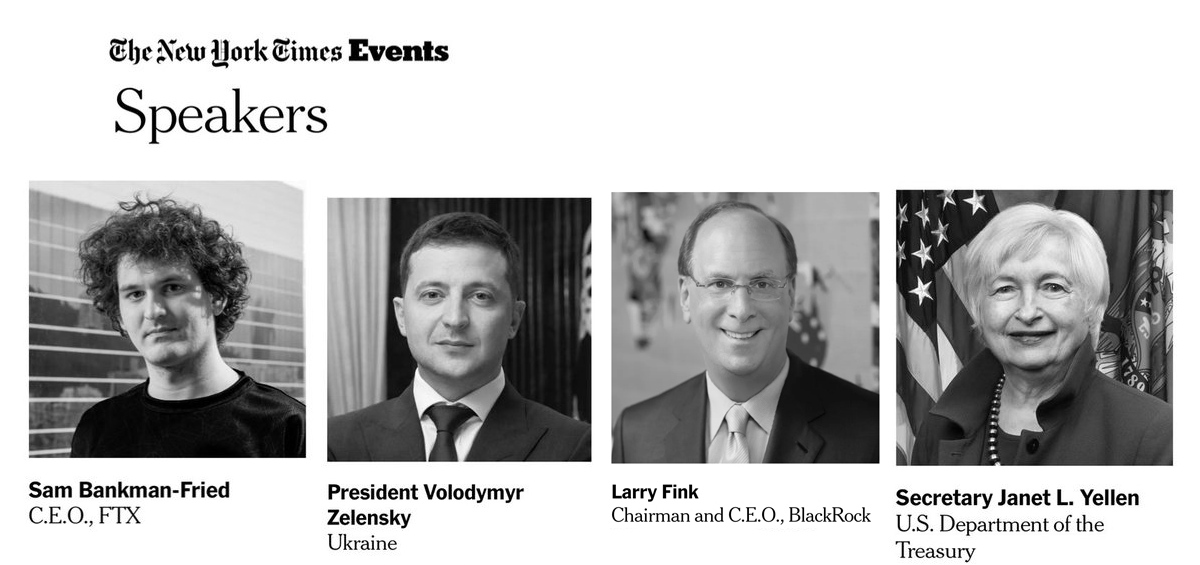

Everything That's Wrong With the Mainstream Media and Finance in One Picture

by Nick Giambruno, contributor, International Man Communique

.jpg)

It’s hard to recall a more despicable and widespread public-relations effort to transform the image of an obvious villain.

Of course, I'm referring to the mainstream media's treatment of Sam Bankman-Fried (SBF).

It’s reminiscent of the movie Batman Returns, where a corrupt media tries to polish the image of the repugnant criminal Oswald Cobblepot—better known as the Penguin.

SBF founded FTX in 2019. The company seemed to come out of nowhere to become one of the world’s largest cryptocurrency exchanges in mere months.

How did this strange newcomer—who didn't know much about Bitcoin—suddenly become the so-called "JP Morgan of Crypto?"

Powerful people in finance, the media, and the government all had a hand in FTX's meteoric rise. So the company was clearly at the nexus of something important—though the whole picture is not exactly clear at this point.

Simply put, FTX was a cesspool.

The company allegedly mishandled customer deposits, was involved in shady activities in Ukraine, sold Bitcoin it didn’t have and had suspicious connections with prominent politicians and regulators.

For example, SBF was the second-largest donor to the Democratic Party, behind only George Soros.

FTX also lobbied the government for special treatment and to suffocate its competitors with regulations.

Tom Brady, Larry David, and other celebrities lent their image to FTX. The company even aired a commercial during the Super Bowl. In addition, FTX acquired the naming rights to the stadium where the Miami Heat basketball team plays.

As a result of all this mainstream publicity, countless ordinary people were suckered into FTX and lost many billions of dollars in minutes as this crooked institution went bankrupt recently.

Instead of treating SBF like a criminal, the media launched a bizarre PR blitz to paint him as some selfless altruist out to save the planet.

It's not uncommon to see the mainstream media bend over backward to gloss over any of SBF's alleged wrongdoing and instead highlight what might make you think he's not such a bad guy.

SBF also appeared on Good Morning America. He denied he knew about the improper use of customer funds—it wasn't convincing. Host George Stephanopoulos was either unwilling or not sufficiently informed to challenge the assertions.

Perhaps the most ridiculous display in this coordinated PR campaign was SBF’s remote appearance from the Bahamas—he hasn’t returned to the US since FTX’s collapse—at the New York Times Dealbook Summit.

Andrew Ross Sorkin, an establishment darling and event host, asked fake hard questions. Clearly, his goal was to do damage control, not discover the truth. In the end, a sympathetic audience gave SBF enthusiastic applause.

When you take a step back and look at the big picture, powerful people and institutions are clearly protecting SBF.

The mainstream media, which already has a well-deserved dismal reputation, is destroying what little credibility it has left with these endless SBF puff pieces. It’s a desperate and foolish move, and I don’t think it will work.

Whatever was really going on with FTX could be exposed soon. And since the media has been working so hard to cover it up, it could be explosive.

The fallout could devastate other cryptocurrency exchanges and companies.

That’s why it’s crucial to hold Bitcoin properly.

If you hold your Bitcoin on Coinbase or some other platform, you don’t really own your Bitcoin and are taking on significant counterparty risk. Instead, you own a Bitcoin IOU, which is something very different—as FTX clients are finding out.

These custodians can freeze and seize your funds for any pretext they find convenient. You need to ask for their permission to use your funds.

Custodians can also go bankrupt, and you can lose all your funds, which has happened countless times. They also know your entire transaction history, so you have no privacy.

The whole point of Bitcoin is for you to totally control your money. Relying on a third party defeats the entire purpose.

It’s much more secure to hold your Bitcoin off the exchange’s website in your own self-custody wallet, where you control the private keys to eliminate this dangerous counterparty risk.

As Bitcoiners like to say, "not your keys, not your Bitcoin."

New Opportunities Are Emerging For Citizens of The World.

Freedom and democracy may appear to be struggling to stay alive in America, but there may be a knock-out punch ready to be released. The evolution of the blockchain-enabled metaverse is going to enable the 'Citizens of the World' to gain their own Freedom by democratizing power and creating a new world with new rules, new players, and new opportunities. For 99.99% of us, the metaverse will improve our real-world lives by democratizing power and opportunity.

Along with the major long-term trend of society towards decentralization and smaller-scale organizations, there are new opportunities developing to help 'Preparers' in the cryptocurrency sector. Businesses are beginning to issue their own Crypto Coins that can be traded on Cryptocoin Exchanges.

Markethive.com will release its HiveCoin (HIV) in the coming weeks. It has tremendous upside potential that is outlined in a Video by Founder Tom Prendergast, "Entrepreneur Advantage…".

Not only that, if you go to their website and register as a FREE Member, you will be given 500 HiveCoins for "FREE" along with access to several Earning Opportunities and online tools to increase your HiveCoin balance.

Be sure to check it out today – Markethive.com

Tim Moseley