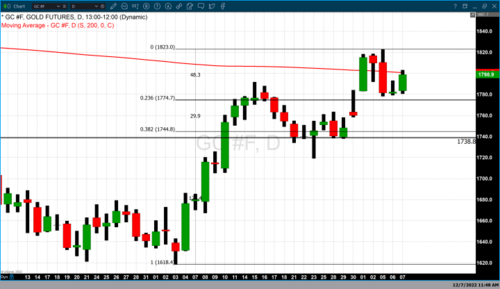

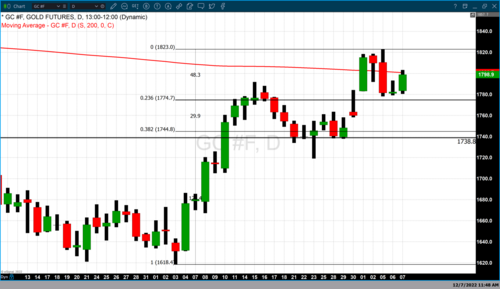

Gold breaks above its 200-day moving average then moves back below it

Gold futures basis the most active February 2023 contract opened in New York at $1783.30 and traded to a high of $1803.20 just above its 200-day moving average which is currently fixed at $1800.70. The price point of this long-term moving average at least for the short term became a technical level of resistance moving gold back below it. As of 4:19 PM EST, the February contract of gold futures is currently fixed at $1798.90 after factoring in today’s net gain of $16.50 or 0.93%.

Today’s double-digit gains came out of a combination of dollar weakness and traders bidding the precious yellow metal higher. Currently, the dollar is down 0.41% with the dollar index fixed at 105.105. Gold’s gain of 0.92% indicates that market participants were not only active buyers but provided just over 50% of the gains realized in gold futures.

That same ratio can be seen in today’s pricing of physical gold. According to the Kitco Gold Index (KGX), spot gold as of 4:23 PM EST was fixed at $1786.70 after factoring in a net gain today of $15.50. Dollar weakness accounted for $6.55 of the $15.50 gain with the rest attributable to buyers bidding gold prices higher by $8.95.

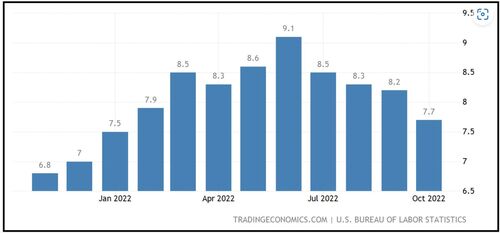

Market participants move gold prices higher today as continued concerns focus on the Federal Reserve’s last FOMC meeting of the year next week and the next inflation report, the CPI. This report will be released during the first day of the two-day FOMC meeting. This will allow the Federal Reserve to see if the fractional decline in inflation reported for October 2022 in November is a continuation of declines in the CPI index after hitting the highest level this year in June when the CPI came in at a scorching 9.1%. From July to October, the CPI has had consecutive declines coming in at 8.5% in July, 8.3% in August, 8.2% in September, and 7.7% in October.

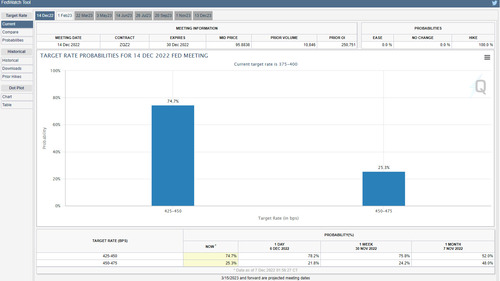

Traders and investors have largely priced in the high likelihood that the Fed will raise rates by 50 basis points, or a ½ %. This will take the current target rate of 375 – 400 basis points to 425 – 450 basis points by the end of the year. According to the CME’s FedWatch tool, there is a 74.7% probability of a 50-basis point rate hike and a 25.3% probability of a 75-basis point rate hike. It is the possibility, although remote, of a fifth consecutive rate hike of 75 basis points that continues to give market participants angst about the upcoming meeting.

Technical levels to watch with gold futures

Our technical studies indicate that the first level of resistance still occurs at $1802 based on gold’s current 200-day moving average. The next level of resistance above that is $1825 based upon the double top that occurred in both August and December.

Minor support first occurs at $1775 which corresponds to the 23.6% Fibonacci retracement. Major support occurs between $1720 the 50% retracement and $1745 the 38.2% Fibonacci retracement level.

By Gary Wagner

Contributing to kitco.com

Tim Moseley