10 Money-Mindset Hacks for Entrepreneurs

Introduction

In this article, we'll cover ten money-mindset hacks that can help you stop sabotaging your own business dreams.

Make a decision about your relationship with money.

-

Make a decision about your relationship with money.

-

Decide what is most important to you and how you want to spend the time, people, and resources that are available to you.

Make lists of your physical and emotional triggers regarding money.

If the phrase “money mindset hack” sounds like a buzzword to you, it might be time for an educational course in self-awareness. One of the best ways to start this process is by taking a look at your physical and emotional triggers around money.

>What are your physical and emotional triggers? Take note of any patterns that emerge as you think about them. How do they make you feel? Do they bring up anger, shame, guilt or another emotion? What causes these feelings?

One common trigger is the sense that someone else has more than you do—and often when someone else has more than us, it's because we're not doing enough with our own money (even if it's just a perception). Another common trigger is fear: fear of missing out on a lucrative opportunity or fear around investing in yourself (and therefore increasing your earning potential) at all costs.

Get clear about what you want to use your money for.

The first thing you need to do is figure out what your goals are. Before you start saving and investing money, it's important to define exactly what you want to use the money for. Do you want it for a new car? A house? To start a family? Or something else entirely? Writing down these goals will help keep your mind focused on how much time and energy they require when making decisions about spending or saving money.

Setting specific goals is an essential part of developing good financial habits, but don't worry if those goals seem incredibly ambitious! Your goal shouldn't be "I want $100 million." Instead, think about what tangible fitness goals could achieve in 3-6 months: maybe running two miles without stopping, or getting up early every day by 6am; or doing 500 pushups by next month. These smaller achievements will help keep your motivation high during times when it might otherwise dwindle away because of setbacks or challenges along the way (like losing weight).

Collect the stories you tell yourself about money (and finances).

This is a very simple exercise that you can do in one afternoon.

-

Write down your inner dialogue about money and finances as it currently stands. The more honest, the better. If this feels like a challenging task, start with something easy: What do I tell myself when I'm buying groceries? Or when my credit card bill arrives?

-

Once you've written down everything, look for patterns and themes in your stories about money (and finances). Are there any common threads between them? Why are these stories important to me? How does each story help me get what I want from life or how does it hold me back from what I want to accomplish?

-

Finally, ask yourself why these particular stories are so important to you; after all, they're just thoughts—they don't have control over our actions or reactions (unless they're really strong ones!).

Set beliefs that are aligned with what you truly want in your life and business.

It's important to understand the power of your beliefs. They're the foundation of your mindset, and they determine how you perceive reality. When you believe something is true, it affects everything in your life—from the way you see yourself and treat others to how successful (or not) your business will be.

For example, let's say that one of your core values is compassion for others. If someone mistreats you or doesn't value what you do for them, it might not bother or upset you personally; instead, it may just make sense that they don't understand how valuable their actions are as an opportunity for growth. On the other hand, if someone gets frustrated with themselves because they aren't doing well enough at something in their lives or business—even though everyone makes mistakes—that person might get angry because there's no easy solution available to fix the situation immediately!

If this sounds like a familiar scenario for some reason…it probably is! In both examples above (the first being compassionate vs non-complacent), both parties have different beliefs about what's happening around them in terms of other people's behavior versus their own performance as individuals/entrepreneurs respectively within those circumstances."

Give yourself permission to receive even more abundance.

Giving yourself permission to receive more abundance is a powerful way to get your mind aligned with what truly matters most: your dreams. When you start thinking about all the good things in life, you build up an inner momentum that makes it easier for everything else—money included—to flow into your life.

This practice can be applied in many ways, including through gratitude and visualization exercises.

First, write down 10 things you're grateful for right now. Do this immediately if possible; otherwise, do it today before bedtime. This exercise helps remind us of the abundance we already have in our lives and helps us focus on what really matters instead of fretting over money problems or daydreaming about leaving town and starting a new life somewhere else (which would only distract from paying off debt).

Choose options that align with your new money beliefs.

If you have money beliefs that are outdated, it's time to let go of them. It's not easy, but it can be done.

The first step is to create a list of all the money beliefs that are holding you back from having the career/relationship/money situation that you want. Then, take this list and look for ways to align your current behaviors with these new beliefs. For example, if one of your top values includes "making more money," then select an option that will help get there:

For instance:

If one of my goals is making more money this month than last month (which it is), then I could start another side hustle or ask for a raise at work!

Work on your relationship with time.

-

Time is a commodity. It's finite, and you can only do so much in a day. So, if you want to become more financially successful, it's important to work on managing your time well.

-

Being more conscious of how you spend your time will help both with personal goals and business endeavors. If you want to be able to go on vacation or take long lunches every once in a while, then make sure that this happens by setting aside blocks of “me time” in your calendar or blocking off specific periods when you won't be available for work emails or calls (or texts).

If your goal is making money as an entrepreneur or freelancer, then remember that there are only 24 hours in a day—and some days those hours are shorter than others depending on what other commitments come up during the week. If something unexpected comes up during business hours like an urgent email from clients requesting changes to their website design before it goes live tomorrow morning at 10 AM PST; don't panic! Instead, focus on prioritizing tasks based on their importance rather than worrying about whether there's enough available time left over after dealing with everything else later; just make sure everything gets done without sacrificing quality just because deadlines have been moved up unexpectedly due!

Stop comparing yourself to others and their success.

-

Stop comparing yourself to others and their success.

-

This is one of the biggest obstacles for entrepreneurs but is also one of the easiest to overcome. There’s no doubt that it can be natural and even helpful to compare yourself with others, especially when you feel like you’re struggling or not getting what you want from your business. But constantly looking at other people’s success stories can be a huge distraction from your own goals, and will leave you feeling bad about yourself instead of empowered by your vision for what’s possible. It also doesn't help if someone else has done something similar in their business before or better than yours—you have no control over what they do (or don't do), so why waste time worrying about it?

Declutter and organize your home and office space.

Declutter and organize your home and office space. Clean, clean, clean. If you have a messy desk or piles of papers on the floor, it is time to get rid of them. The same goes for your home office: clear out all the unnecessary things in your workspace, keep it organized and clean up after yourself. This will help prevent distractions while you're working so that you can focus on the task at hand instead of worrying about other things around you (or feeling guilt because there are too many things on your desk).

It is possible to have a supportive mindset about money

Your money mindset is a choice. You can have a supportive mindset about your business and life, and you can change it if you want to.

Money is a tool. It is not the enemy, but it's also not the solution. One of my favorite quotes about money comes from author Robert Kiyosaki: “Money amplifies your goodness or your badness."

If you're doing something that makes other people happy—like helping them with their problems—and you charge for that service, then there's nothing wrong with charging someone for what they've paid for! To me this feels like an honest transaction where both parties are getting what they need from each other (and maybe even some extra benefit).

Conclusion

Money is a tool that we can use to create the most amazing life for ourselves. The more we are able to move past our limiting beliefs about money and abundance, the more we will be able to focus on what is truly important in life. This will help us live up to our full potential as entrepreneurs.

Tim Moseley

.png)

.png)

.png)

.jpg)

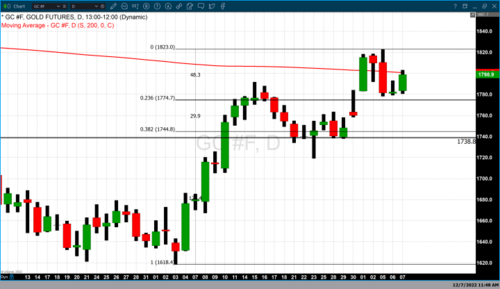

.gif) JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold

JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold.gif)

.gif) Bitcoin price dips below $17K as recession fears rise to the surface

Bitcoin price dips below $17K as recession fears rise to the surface