Which Crypto Narratives Will Dominate The Next Bull Market? Cryptos To Watch In 2024

The key to achieving success in the cryptocurrency realm is to invest in narratives, not just statistics. During the previous bull market, the most captivating narratives were Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and the Metaverse. These narratives propelled certain cryptocurrencies to astronomical heights, with some experiencing growth of over 500 times their original value. The question now is what narratives will dominate the next crypto bull market and when they will experience a similar explosion in growth.

These projections are provided by key figures in the cryptocurrency industry and should be taken as speculative. This article focuses on the key narratives likely to shape the cryptocurrency landscape, their anticipated increase in popularity, and the projects linked to them that are worth keeping an eye on. The ongoing development of crypto regulations will largely influence the sequence in which these narratives gain prominence.

The rise of decentralized finance (DeFi) was a dominant force in the 2020 crypto bull market, with DeFi tokens experiencing remarkable growth, including Yearn Finance's YFI token, which at one point surpassed the value of Bitcoin. However, recent regulatory proposals aimed at DeFi suggest it may not be the dominant narrative in the current market cycle. Instead, other crypto narratives with fewer DeFi elements may gain more traction.

The success of crypto narratives may depend on the regulatory landscape, but some experts suggest that those with minimal DeFi integrations will have an advantage. This is because they will face fewer regulatory obstacles and enjoy greater adoption. Non-fungible tokens (NFTs) are the crypto technology with the least regulatory scrutiny, making it likely that narratives centered around NFTs will dominate.

Crypto Narratives Most Likely To Explode

Decentralized Social Media

The rise of decentralized social media (DESO) is anticipated to gain significant traction thanks to a convergence of factors. Growing censorship on traditional social media platforms, potential failures of popular networks, and challenges with monetization in a high-interest-rate environment have created an opportune landscape for DESO's growth. Governments worldwide have implemented laws to restrict social media content following the impact of the pandemic, as highlighted in this article on online censorship.

The implementation of various regulations, including the Digital Services Act (DSA) of the European Union, is causing a noticeable impact. Consequently, engaging in open and unrestricted conversations on major social media platforms is becoming increasingly challenging. An example of one leading social media platform, such as X, is now prioritizing free speech. Unfortunately, the resistance by these platforms may lead to their eventual downfall. X, for instance, has recently lost advertisers and is expected to incur significant financial losses.

The supposed economic downturn has led to a universal decrease in advertising revenue. In response, Google has taken measures to restrict the use of ad blockers on YouTube and has increased the frequency of advertisements in an effort to boost its ad revenue.

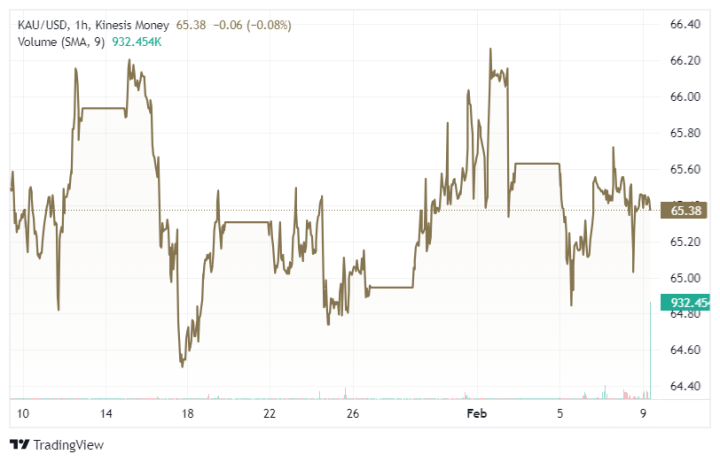

Upon initial consideration, it may appear improbable that the typical individual would transition to utilizing a decentralized social media platform due to concerns regarding censorship and advertisements. Nevertheless, upon further examination, it becomes evident that the adoption of decentralized social media is gaining momentum, with decentralized streaming experiencing remarkably rapid growth, as illustrated in the graph below.

Image source: Coingecko

Put in perspective, Odysee boasts a substantial user base exceeding 5 million individuals monthly, which continues to grow. As a decentralized social media protocol, Odysee outshines its competitors significantly. It is worth noting that Odysee is powered by LBRY, a cryptocurrency initiative that faced legal action from the SEC and was subsequently forced to cease operations. Nevertheless, Odysee remains the most prized possession of LBRY, Inc.

Odysee’s assets were recently sold at auction. According to LBRY’s report, while it’s nearly certain the Odysee assets will be assumed by someone interested in resuming its growth, it’s unclear if Odysee will continue to use the LBRY network in the future, switch to another crypto network, or switch to being a traditional web2 platform.

If another crypto network acquires Odysee, you can bet that the crypto project will see explosive growth. Additionally, there is growing interest in decentralized platforms that replicate the functionality of traditional social media platforms like Twitter, as shown in the graph. These platforms concentrate on specific aspects of digital media, such as decentralized streaming and microblogging, and are designed to operate vertically.

One decentralized platform that is not on that list yet encompasses all of the above and more. Markethive and its community are dedicated to building an entire ecosystem for entrepreneurs, including marketing, blogging, curation, email autoresponders, page-making systems, video feed, conference facilities, e-commerce, broadcasting, press releases, social network integration, etc.

Having established a comprehensive financial center for all its users and utilizing the Solana network for its Hivecoin token, Markethive is now preparing to introduce its platform to a global audience. Markethive has also removed itself from the centralized cloud services that continue to stifle platforms at the mercy of third-party APIs serving their interests. Currently, several user interface (UI) and UX components of Markethive's arsenal are being integrated in tandem to provide a sanctuary and empower individuals to regain control of their sovereignty. This year, 2024, is shaping up to be a pivotal time for Markethive, as it aims to reach unparalleled success and give back to the community that has embraced its vision.

GameFi

GameFi, the second prominent crypto narrative, is poised to experience immense growth, with some arguing that it's already underway. A glance at DappRadar reveals that the majority of the most well-liked decentralized applications (dApps) are connected to blockchain-based games. These games have amassed a considerable following, boasting millions of monthly active users. The surging popularity of blockchain games shouldn't come as a surprise, given that the traditional gaming industry grapples with challenges akin to those confronting centralized social media platforms.

To begin with, it seems that older video games are preferred over modern ones. This can be attributed to a variety of factors, such as disappointing visuals, weak storytelling, unnecessary infusion of politics, and overall unsatisfactory gameplay.

In 2022, the video game industry experienced its first year of losses in ten years, resulting in widespread layoffs among major developers. This downturn may be attributed to the pandemic-driven surge turning into a decline or developers ignoring their loyal player base. Regardless of the cause, the gaming industry is struggling financially. Similar to other technology leaders like Google, this situation may motivate game developers to explore alternative revenue streams.

Interestingly, it has been reported that players of Assassin's Creed encountered disruptive pop-up advertisements while playing the game. This occurrence was purportedly a technical glitch, but it shed light on the possibility that the gaming industry is attempting to impose advertisements on players in a similar manner to how YouTube is attempting to do so with its audience. While the typical YouTube viewer might tolerate this, it is highly probable that the average gamer would not welcome having their gameplay disrupted by pop-ups.

The outcome may be that game developers must incorporate GameFi elements to compensate for lost revenue, or players will seek out ad-free alternatives. A mixture of both scenarios will probably occur, which could be why blockchain games have gained significant popularity. If it is indeed the case that game developers are disregarding their primary audiences, then the adoption of blockchain games could even further increase.

This is because crypto technology, such as NFTs, enables gamers to influence the game's design instead of being controlled by ESG-obsessed asset managers like BlackRock. However, there is a limitation: these blockchain games must not involve excessive financialization. If they do, they may attract regulatory scrutiny, similar to what happened to Axi Infiniti in the Philippines.

The likelihood of this scrutiny is likely the reason why there have been limited GameFi integrations. Aside from regulatory hurdles, scalability and speed pose a significant challenge to widespread adoption, as seen in the case of Axi Infinity. Only a few blockchains can effectively accommodate millions of users simultaneously.

In Axi's situation, they had to develop their specialized layer two solution called Ronan. This implies that you should prioritize the underlying layer one and layer two blockchains that support blockchain games rather than focusing on specific games. Thanks to its subnet architecture, Avalanche is notably gaining popularity as a preferred choice in this area.

Artificial Intelligence (AI)

The emergence of Artificial Intelligence (AI) as a dominant force in the tech industry is a narrative that has gained significant traction recently. While some argue that the AI explosion is already underway, others believe the real breakthrough is yet to come. The current AI hype in crypto and stocks is largely considered just hype, as there have been minimal actual changes thus far. It is widely believed that it will take at least two years for innovative AI companies to release their products and even longer for the general public to embrace and utilize them fully.

The current AI-fueled market frenzy may eventually subside as regulatory measures take effect or other factors come into play. If this bubble does burst, it may create a prime investment opportunity for crypto projects centered around AI technology. These projects will likely perform exceptionally well when the AI narrative regains momentum. Currently, everyday investors like us are unable to capitalize on AI innovation, making these cryptocurrency projects an attractive prospect.

While investing in established companies like Nvidia and Microsoft is possible, their massive valuations limit their potential for significant growth. As a result, private equity remains the most viable option for those seeking substantial returns on AI investments – but this avenue is only accessible to high-net-worth individuals. If this trend persists, investing in AI-related cryptocurrencies might be the only way for everyday investors to generate meaningful profits from the AI sector.

The emergence of new AI companies may be hindered if industry leaders such as Nvidia and Microsoft restrict access to their hardware and software. However, crypto tech's decentralized and open nature could provide an advantage in this scenario. Interestingly, some crypto projects have enabled individuals to access the previously exclusive hardware needed to run AI models, thereby promoting greater accessibility and competition in the field.

Among the projects in this category is the Akash Network. Additionally, numerous cryptocurrency initiatives have been making advancements in the software aspect of artificial intelligence. By merging this open-source progress with decentralized AI hardware, the result is a foundation for robust crypto AIs capable of rivaling those developed by Google and other companies.

In this instance, the main point to note is that if crypto AI were to become popular, the existing players would probably try to influence government regulators in order to prevent the development of decentralized artificial intelligence technology. It is important to note that these incumbents are already campaigning for policies that would hinder their centralized rivals from creating AI technology.

The upside is that AI in the crypto sector is still largely under the radar. This means there aren't many established factors to consider when evaluating its potential. Nobody knows yet whether the crypto industry can support the development of these models. Nevertheless, just as no one anticipated Bitcoin becoming the de facto digital gold, we find ourselves in that very situation. This demonstrates the potential for unexpected developments in the crypto landscape.

Crypto Infrastructure

Infrastructure in the crypto industry is expected to experience significant growth, particularly in the areas of decentralized storage cryptocurrencies and crypto oracles that provide external data to the blockchain. It is important to note that infrastructure cryptos will play a crucial role in the success of other crypto narratives. For example, decentralized social media will likely demand substantial data storage capacity, while decentralized gaming will rely on extensive data feeds. Additionally, crypto AI will heavily rely on decentralized computing, which differs from decentralized storage regarding technical requirements.

Data storage, data feeds, and computing processes must be decentralized to ensure seamless operation and avoid potential regulatory or technical issues. This is particularly important given that a prominent centralized cloud platform banned crypto in August 2022. Moreover, Meta's use of Arweave for NFT storage demonstrates that decentralized infrastructure can be just as effective as its centralized counterpart. If discriminatory practices persist at the infrastructure level, such as app stores refusing to list certain apps, decentralized alternatives are likely to gain traction

In addition to Arweave, other cryptocurrencies worth keeping an eye on include cutting-edge oracle systems like Pyth, which may have a role in the gaming sector (GameFi); video encoding protocols such as Livepeer, which could have a role in decentralized social networks (DeSo); and data indexing protocols like The Graph, which could have a role in artificial intelligence (AI) development. It's important to note that this list is not exhaustive, and there may be other promising cryptocurrencies beyond these examples.

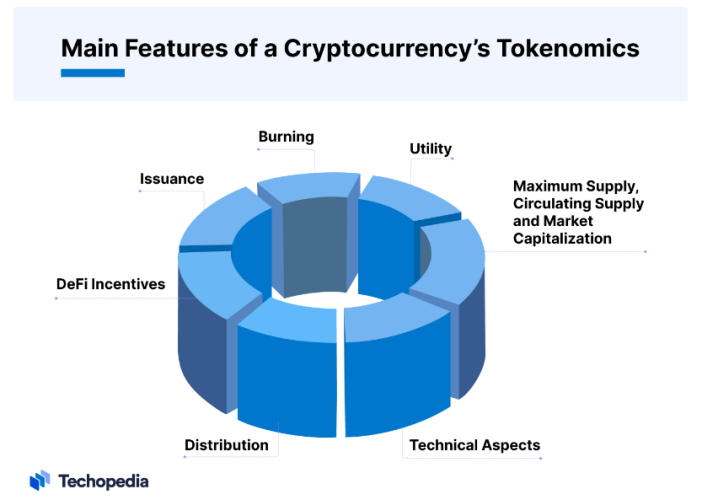

The level of adoption of the three previous narratives will influence the demand for these cryptocurrencies and their competitors. If there is significant adoption, there will be ample demand for these cryptos, potentially leading to an increase in price. However, it is essential to conduct thorough research on the tokenomics of these cryptocurrencies before investing, as this will determine whether the demand translates into a price surge.

Image source: Techopedia

Two More Narratives with Potential

Concluding the discussion, two additional crypto narratives may grow significantly. These narratives can potentially surpass the combined impact of the previous four. The first is the concept of crypto payments, while the second is the tokenization of real-world assets (RWAs), which has recently generated much hype. These two narratives are presented together as the final topics in this article due to the numerous regulatory challenges they face, specifically in the case of RWAs for crypto payments.

One of the main challenges involves the regulations surrounding stablecoins, which remain uncertain in numerous jurisdictions, especially in the United States. Congress is currently considering a proposed bill that could facilitate the use of stablecoins for payments, but its passage is unlikely until after the upcoming election due to the political divisions within the legislative body.

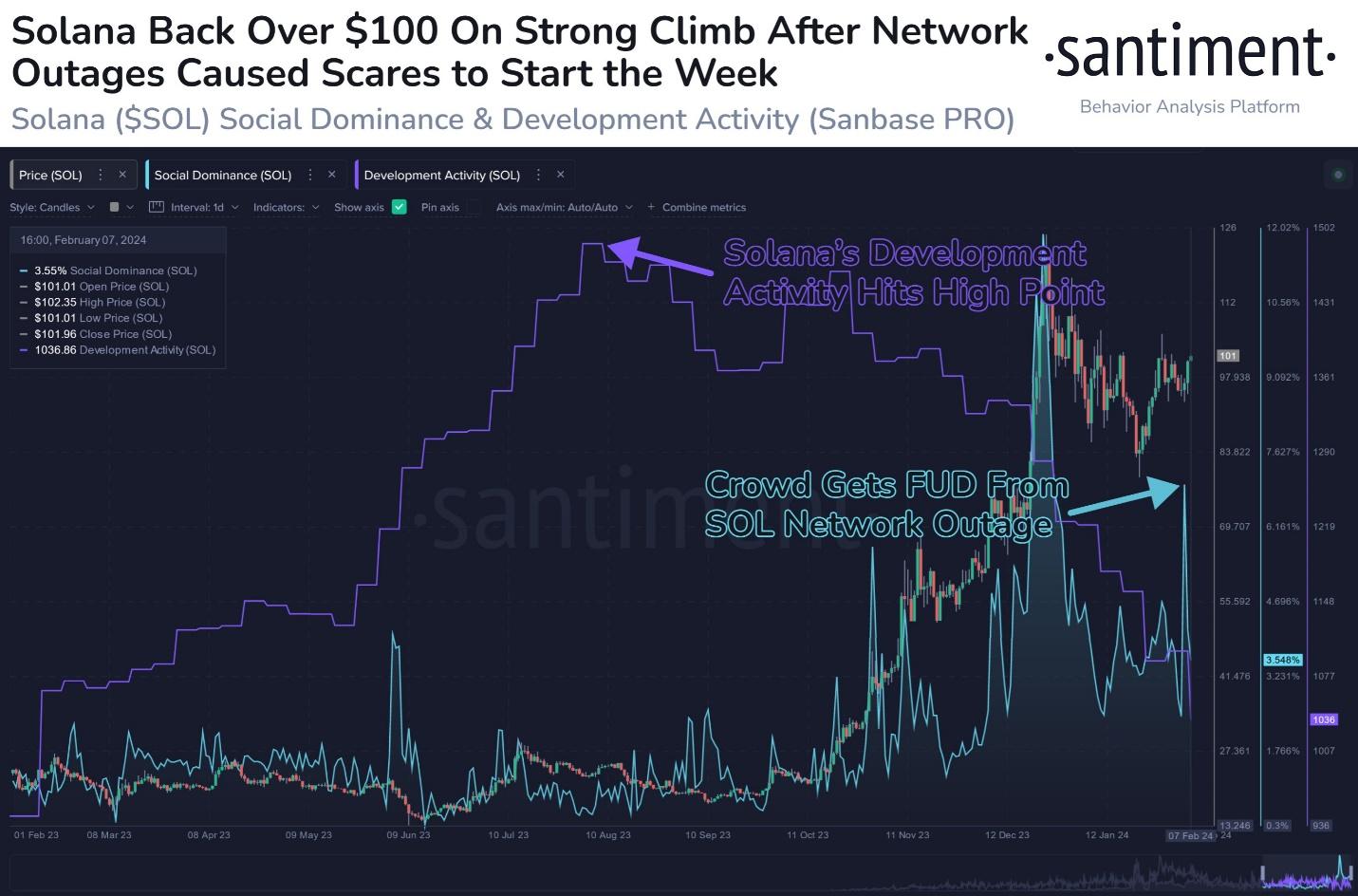

In the European Union, the Markets In Crypto Assets (MiCa) regulation technically allows stablecoins to be used for payments. However, the use of stablecoins will be restricted to Euro-backed stablecoins, which some argue are not all that popular. Despite this, regulatory clarity could lead to the adoption of crypto payments, positively impacting high-performance blockchains primed for payments, such as Solana and layer two solutions on Ethereum.

This relates to the regulations around RWAs, which are much further away. Some would say that this is debatable, given that stablecoins are technically RWAs; there are already tokenized fiat currencies and commodities. However, some argue that these differ from the RWAs on which the narrative truly focuses. The RWAs that most people have in mind involve tokenizing assets such as real estate, stocks, and bonds. If this is the situation, then tokenizing these assets on public blockchains is a distant prospect.

Significantly, major organizations and wealthy individuals would likely feel uneasy about revealing their RWA assets on transparent blockchains accessible to the public. As a result, they would opt for private and permissioned blockchains or public blockchains that ensure compliant privacy. When considering this, the transparency of cryptocurrency blockchains could pose a major challenge for narratives centered around institutional interests such as RWAs, which is why we're seeing growing interest in crypto privacy solutions. However, this particular market segment may not experience significant growth until the next cycle; it's an area that holds promise for the future.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Tim Moseley

.png)

.png)