Five Institutions Trying To Wipe Out The Crypto Industry

As cryptocurrency adoption continues, the opposition from institutions that control and benefit from the corrupt financial system that cryptocurrency is in the process of replacing also continues. These powerful institutions have significantly increased their efforts to bring down the crypto sector specifically.

Below are five organizations that have been working hard to regulate, restrict, subvert, and tear down the crypto industry for the last few years, and it's time to call them out by name. So, how are they trying to do it? Will they succeed? And what will it mean for cryptocurrency?

1: The Bank for International Settlements

The Bank for International Settlements (BIS) is the first institution trying to destroy crypto. This is the self-described bank for central banks. The BIS is based in Basel, Switzerland, and is owned by the 63 central banks that make up its membership. The BIS was founded way back in 1930 and is technically the oldest International financial institution in existence.

Interestingly, the BIS was supposed to be disbanded in 1944 as part of the Bretton Woods Conference, but it hasn’t happened yet. On its **website, the BIS says this is because the financial elite at Bretton Woods didn't believe the BIS would play a useful role once the IMF and the World Bank had been established.

**Image source: BIS website

Curiously, however, a memoir by one of the economists present at the Bretton Woods Conference revealed that the institution's intended dissolution was because the BIS had allegedly assisted the Nazis in taking gold and other assets from occupied countries. This was proven true in 2013 when the Bank of England declassified documents about how it helped the BIS and the Nazis take gold from Czechoslovakia.

Despite this history, the BIS was never disbanded, partly due to influential economists like John Maynard Keynes. Keynes is famous for pioneering so-called demand-side economics; it’s the theory that the demand for goods and services is what causes economic growth and inflation, fundamentally; a view popular with many Central Bankers.

Today, the BIS has undertaken a similarly disturbing role, and that's to assist central banks in developing their respective Central Bank Digital Currencies, or CBDCs. This financial system will give the central banks the power to decide what you can buy, when you can buy it, where you can buy it, how much money you can spend, and even how much you can save. In the words of BIS manager Agustin Carstens, “The central bank will have absolute control…” and “…will have the technology to enforce that control.”

Image source: Twitter

Not surprisingly, the BIS is opposed to cryptocurrencies of all kinds, especially stablecoins. This is because cryptocurrency undermines the total control of the currency that its associated central banks are explicitly trying to achieve with their CBDCs, which are essentially direct competitors to stablecoins.

The BIS’s anti-crypto activities have been limited to reports about why cryptocurrencies are bad and why CBDCs are better, as detailed in this article and clearly shows that nobody is buying what they’re selling. Many are skeptical and can see through their agenda; still, the BIS has undoubtedly an incredible amount of influence given its history and the advocacy of central bankers worldwide.

2: The Financial Action Task Force

The Financial Action Task Force (FATF), an international organization based in Paris, France, is the second institution trying to stymie crypto. It consists of 40 countries and dozens of other international organizations, including the IMF and World Bank. The FATF was founded in 1989 and was initially established to combat money laundering worldwide.

Its mandate has since expanded to include anything threatening the system's integrity. It achieves this by issuing so-called recommendations about the kinds of financial regulations that countries should implement. The FATF drafted its first set of 40 recommendations one year after it was founded.

The most infamous of these recommendations is the so-called travel rule, which requires financial institutions to collect detailed information about anyone sending or receiving more than a certain amount of money, usually around $1000. Although the FATF doesn't have the power to write national laws, any countries that fail to comply with its recommendations often find themselves on its grey list or, worse, its black list.

Being on the former makes it difficult to interact with the Global Financial System, and being on the latter makes it impossible. That's why more than 200 countries have chosen to comply with the FATF's recommendations.

Now, if you're wondering who writes the FATF’s recommendations, the answer is nobody really knows. That's because the FATF consists of unelected officials who hold meetings behind closed doors, where they decide what recommendations to pass and which countries land on which list.

Image source: Islamabad Post

The FATF officials are also effectively “above the law,” thanks to the Vienna Convention on Diplomatic Intercourse and Immunities passed in 1961. Under the Vienna Convention, folks like FATF officials cannot be arrested or detained, they cannot be charged with a criminal or civil crime, and they do not have to pay taxes. FATF officials are also not subject to pandemic travel restrictions.

While it's not precisely clear who decides what the FATF does, it's clear that it has strong connections to the United States, specifically, the United States Treasury Department. As recently as 2018-2019, Treasury served as President of the FATF, and two of the three lead authors of the finalized recommendations for cryptocurrency were from the Treasury Department. The document notes that the United States is the primary driver behind compliance with the FATF's recommendations.

This may explain why the United States isn't on the FATF’s grey list or black list even though up to 40% of all money laundering happens in the USA and why the countries that do end up on the FATF's gray and black lists tend to be at odds with the interests of the United States.

Given these facts, it looks like the FATF is another financial weapon the United States occasionally uses against its enemies, and it's a weapon that's being used against cryptocurrency as well.

Having said that, the FATF doesn't actually want to ban cryptocurrency; it just wants no more peer-to-peer transactions and no more privacy and hopes to achieve this by labeling any technology or activity related to these two as high risk. In other words, the FATF wants to turn crypto into another arm of the existing financial system, which the United States, of course, controls.

However, countries and indeed crypto firms are reticent and slow on the uptake of its crypto recommendations, and it looks like there are a few which might not implement the crypto regulations the FATF wants to impose. This might have to do with the fact that its recommendations don't work in combating illicit Finance.

The FATF's own statistics suggest it hasn't made a dent in dark money in over 30 years. If this non-compliance by countries continues, it will be difficult for the fat F to achieve its goal in time. After all, if crypto adoption reaches a Tipping Point, it will be impossible for politicians to pass the crypto regulations the FATF wants to see because the people will vote against such politicians.

It's also possible that by the time compliance starts, the financial system will have fragmented to such an extent that the FATF no longer has any influence. The unprecedented sanctions against Russia have accelerated this fragmentation.

3: The International Monetary Fund – The World Bank

The International Monetary Fund (IMF) and the World Bank are the third institutions trying to cancel out crypto. The IMF was created as part of the Bretton Woods agreement mentioned above in 1944. The Bretton Woods agreement is where the world decided to make the US dollar the world's reserve currency. More accurately, it's where the world decided that the other currencies would be pegged to the US dollar at a fixed exchange rate, and the US dollar would, in turn, be backed by physical gold.

The IMF's initial job was to ensure the exchange rates between other currencies and the US dollar remained stable. But after the US dollar officially stopped being backed by gold in 1971, the IMF turned its focus to financial stability worldwide. The IMF achieves this financial stability by issuing loans to countries in crisis to ensure that the situation the country is facing doesn't become an international crisis.

These loans are known for including all sorts of terms and conditions that benefit certain institutions. Whereas the IMF issues loans, the World Bank provides longer-term financial and technical support to developing countries. You can think of the World Bank as the “unofficial” other half of the IMF, as it was also created as part of the Bretton Woods conference.

It’s clear that the IMF is firmly aligned with the interests of the United States, simply because the USA has the most voting power of the IMF's 190 member countries. Arguably, the IMF's hatred of cryptocurrency has mostly to do with BTC. That's because Bitcoin is starting to be adopted as legal tender by the kinds of developing countries the IMF is trying to control, notably El Salvador and the Central African Republic.

Image source: Cointelegraph

This is why the IMF included a clause in its debt deal with Argentina to discourage cryptocurrency adoption. Something that I'm sure is going to become more common as more countries start adopting crypto and BTC in particular. By the way, the clause didn't work, as Argentinians are still adopting BTC and stablecoins to protect themselves from inflation.

The IMF's report about the decline of the US dollar stated that the IMF knows that central banks around the world are slowly ditching the greenback in favor of alternative currencies and why it's possible other countries could adopt BTC.

Case in point, the chairman of the Central Bank of Switzerland recently noted that it could hold BTC on its balance sheet once it becomes big enough. At that point, it's only a small step to legal tender status. It's safe to say this is something the IMF doesn't want to see in any developed countries, which is why the institution has seemingly focused its attacks on BTC.

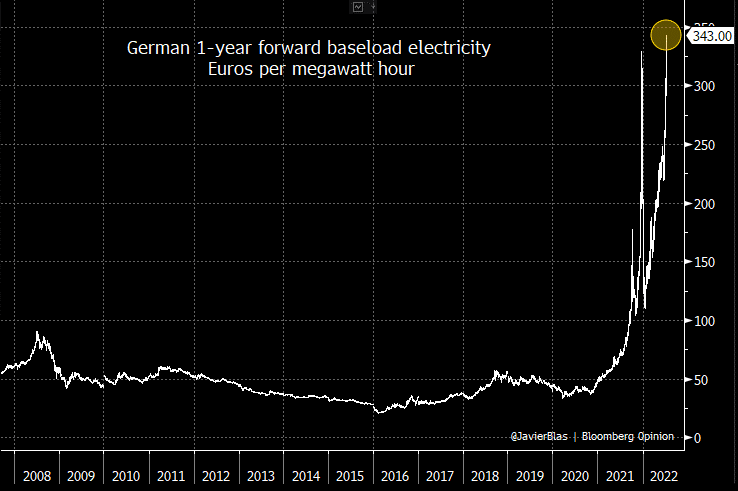

Lately, these attacks have centered around Bitcoin’s energy use, with the IMF claiming CBDCs are superior because they use less energy. What the IMF won't tell you is that Bitcoin’s energy use is negligible in the grand scheme of things.

4: Wall Street

The fourth institution trying to invalidate crypto is Wall Street, which is more of a collection of established financial institutions rather than a single entity. As almost everyone around the world knows, Wall Street’s power is truly unprecedented, and most of this power resides in a handful of asset managers like BlackRock and Vanguard and mega banks like JPMorgan and Bank of America.

Notably, the only reason why these asset managers and banks were able to become so prominent is that they're pretty much first in line at the Federal Reserve money printer. They also have unbelievable influence over politics and regulations in the United States and elsewhere.

You may recall that the Securities and Exchange Commission (SEC) allegedly destroyed documents about the 2008 financial crisis when it was supposed to investigate the asset managers and big banks that caused it.

A 2012 article from The Huffington Post also notes that Wall Street spent more money on lobbying than any other industry between 1998 and 2011. A spending streak that has now been overshadowed by big tech giants like Meta and mega-corporations like Amazon, which are now the biggest lobbyists.

The IMF even published a paper in 2019 about the regulatory capture of bank lobbying and how it led to the global financial crisis. While the authors argued that regulations resolved these issues, I think it's apparent to the average person that Wall Street has only become more powerful.

Like the central banks at the BIS, the asset managers and banks on Wall Street do not want to be replaced by cryptocurrency, which is why most of them have historically been anti-crypto. The thing is that the asset managers and banks on Wall Street also don't want to be replaced by Central Bank Digital Currencies either, and these are quickly becoming a more significant threat than crypto.

Image source: Markets Insider

It’s already been determined that they would effectively cut commercial banks out of the equation. Even though the CBDC Systems proposed by central banks often include commercial banks at the front end, the BIS and its central banks have admitted in multiple reports that it would be next to impossible for commercial banks to remain profitable under such a system.

Furthermore, the roles asset managers and banks play could easily be filled by companies in the financial technology sector, such as Revolut and PayPal. It's even possible that crypto companies like ConsenSys could play this role.

Now this leaves only one option for the asset managers and banks: to take control of the crypto industry and leverage its technology to ensure they remain profitable and ideally leverage it to the point that they can continue to compete with fintech companies. So, how can asset managers and banks take control of the crypto industry?

Well, besides investing heavily in centralized projects with close ties to their constituents, asset managers and banks are also trying to control crypto by forcing it to comply with their ESG agenda, which stands for Environmental, Social, and Governance; in other words, total control.

The inability to control Bitcoin under this framework is ultimately why Wall Street dislikes Proof-of-work. On the other hand, the Proof-of-stake protocol allows them to procure a controlling stake in any crypto project since they have the capital.

A scary scenario is that they will be able to implement whatever rules they see fit. If everyone ends up using Proof-of-stake cryptocurrencies, the asset managers and mega banks would finally have total control of the financial system, eliminating governance, politicians, and their accountability.

I think it’s fair to say many crypto companies would oppose such a takeover from the privileged few, but it's essential to be aware of the game being played and the influential people sitting at the table.

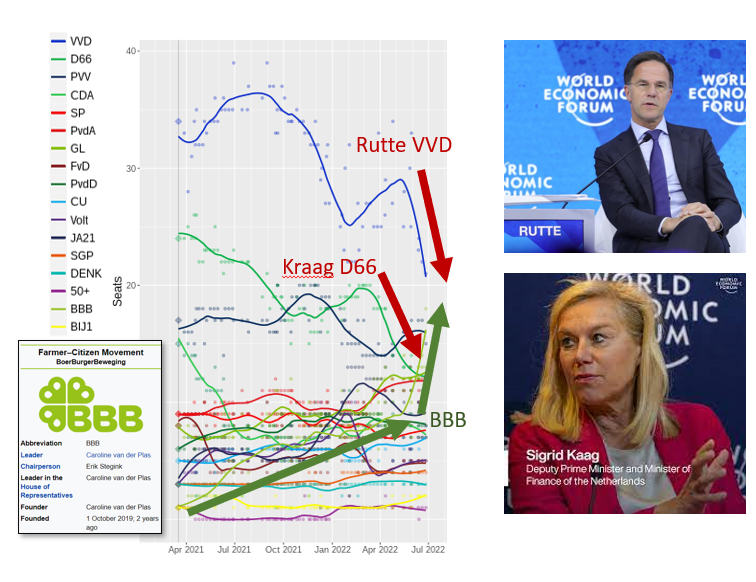

5: The World Economic Forum

The World Economic Forum (WEF) is the fifth institution trying to eradicate crypto. A non-governmental organization or NGO based in Geneva, Switzerland. Klaus Schwab founded the WEF in 1971, and he has served as its executive chairman ever since.

As its website states, the WEF’s purpose is to “ shape global, regional and industry agendas. The WEF has the power to do this because it consists of over 4,000 of the world's most influential individuals and institutions, including all the ones mentioned in this article.

In a previous article, I explain its plans for the world, and they are intensely at odds with the average person. It has astonishing ideas such as “you’ll own nothing and be happy,” which comes directly from the technocratic brain of Klaus Schwab himself.

The WEF is where ESG standards were established. The recent annual meeting in Davos included a few crypto companies and personnel and a series of panel discussions about crypto-related topics. Seemingly, the WEF had cryptocurrency on its radar since 2013, when crypto bull runs started to occur. However, the WEF isn't all that interested in cryptocurrency per se. Its interest is in the powerful technology that cryptocurrencies use.

A historical example is the WEF’s Tipping Points Report from 2015, highlighting Smart contracts as a point of interest. Note that this report was published not long after Ethereum was created. A more recent example is this year's Davos meeting, where the Metaverse was almost as big a topic as ESG, with multiple discussions and articles produced by the WEF.

What the WEF wants is to use technology, like Blockchain, Smart contracts, and the Metaverse, to create the dystopia its constituents want. Regarding the Blockchain, the WEF wants to use it for digital ID, social credit scores, and tracking everything and everyone. Also, tokenizing real-world assets so that their ownership can be controlled and engaging in “stakeholder capitalism via proof of stake consensus mechanisms.”

If you're wondering who the stakeholders will be, Klaus has stated in many interviews and speeches that he created the WEF so that stakeholders could gather. Let that sink in.

Image Source: World Economic Forum

Now, when it comes to Smart contracts, the WEF wants to use them for things like automated censorship to prevent the purchase of specific goods and services and to create the kinds of incentive structures the WEF wants to see—for example, artificially increasing meat prices to decrease meat consumption.

When it comes to the Metaverse, the WEF wants to use it to limit population growth, pacify people in developing countries, and in the words of Schwab's closest advisor, Yuval Noah Harari, “…to give all the useless people something to do.”

Image source: Mind Matters

The 99% Wake Up And Withstand

Fortunately, the world is starting to wake up to what the WEF is trying to do with cryptocurrency and other technologies intended to free rather than enslave the average person. There's no shortage of individuals and institutions starting to push back, including from the world of crypto and the next giants in social and market media, where freedom, liberty, financial sovereignty, and the entrepreneurial spirit are paramount.

The few that think they have the right to control every living soul are trying their best to extinguish the entrepreneur and oppress their spirit. A path to self-sovereignty is here with Markethive and brings a whole new level to empower people. Entrepreneurs are the lifeblood of liberty and freedom; liberty and freedom are a gift from God. In today’s world, Markethive is a blessing and unrivaled by any other platform out there today.

(7).gif)

Reference: Coinbureau.com

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.jpg)

(7).gif)

Ghana's central bank to buy domestic gold in September to strengthen nation's foreign reserves

Ghana's central bank to buy domestic gold in September to strengthen nation's foreign reserves.gif)

.gif)

.jpg)