Cryptocurrency Decentralization: What Does It Take To Become Fully Decentralized? Which Crypto Projects Meet The Criteria?

What differentiates cryptocurrency from traditional finance technologies? Crypto is decentralized, whereas the financial system we have been locked into is centralized. It has undoubtedly been a hot topic since the first bitcoin block was mined in 2009, and now with regulators worldwide converging on the crypto industry, decentralization is more critical than ever. This article explains what decentralization means and looks at the different layers of decentralization in cryptocurrency and which cryptos are the most decentralized.

Decentralization Defined

What is decentralization, and why is it so important? According to this dictionary, decentralization is the process of shifting control from one main group to several smaller ones. In business, decentralization describes a structure that distributes control among many smaller groups or locations rather than giving that power to a single, central organization. In government, decentralization is often thought of as a way to move power into the hands of individual citizens.

Image by: Markethive.com

As it happens, decentralization is a political philosophy that emerged in the aftermath of the French Revolution. Decentralization fits under the broader umbrella of Libertarianism, another political philosophy associated with the French Revolution, which puts Liberty Above All Else. Liberty is what cryptocurrency is all about; hence, the blockchain networks underpinning crypto are often designed with decentralization as a focal point.

However, it's not just decentralization at the blockchain level that matters. In many cases, being centralized at other levels makes decentralization at the blockchain level irrelevant. Complete decentralization is of the utmost importance, primarily for two reasons.

- Security: When a cryptocurrency is decentralized from top to bottom, it’s almost always highly secure because there's no single point of failure. It also creates censorship resistance, as no central authority can decide what you can and can't do with your digital property.

- Crypto Regulations: A genuinely decentralized cryptocurrency is next to impossible to regulate as there's no identifiable individual or institution that can be coerced or sanctioned. In other words, if a cryptocurrency is truly decentralized, it's challenging, if not impossible, for a central authority to shut it down.

Regulations will destroy crypto projects that are not truly decentralized, and they are the ones that are really not all that different from existing financial technologies. Below, we look at the five layers of cryptocurrency and how important decentralization is at each layer. CoinBureau.com coined the names depicting the various layers for simplicity.

Image source: Coin Bureau

Layer 1: Decentralization At The Developer Layer

The developer layer involves the individuals and institutions that create the crypto project. Arguably, decentralization at this level means the more unaffiliated individuals and institutions a cryptocurrency has, the more decentralized this layer is. Decentralization is vital at the developer layer for a few reasons. The first is regulation; you may know that the SEC uses the Howey Test to determine what cryptos to track.

In short, this means that if the SEC can identify an individual or institution creating the expectation of profit you have when you invest in a particular coin or token, then that cryptocurrency is a security subject to strict regulations.

So, what does the SEC think about cryptocurrencies with multiple individuals and institutions creating profit expectations for a particular coin or token? According to the now-famous 2018 speech by SEC director Bill Hinman, he stated that Ethereum wasn't a security because it's “sufficiently decentralized.”

The second reason why decentralization is essential at this layer is longevity. Simply relying on a small group of individuals or institutions for development means there’s a high risk a crypto project will sink if the core team disbands. One example is the recent departure of the DeFi star developer Andre Cronje, with many of the crypto projects he left behind now facing severe uncertainty.

The security of the cryptocurrency is the third reason decentralization is important at the developer layer. This is simply because relying on a small group of individuals or institutions for security is much more likely to be compromised by either internal or external actors. A recent example is the hack of Axie Infinity’s Ronin side chain, where the hacker managed to take control of the private keys belonging to Ronin's validators by hacking Sky Mavis, the company behind Axie Infinity and Ronin.

Layer 2: Decentralization Of A Coin Or Token

The second layer, which is coin or token decentralization, ties in with the first, specifically the distribution of a particular coin or token. The coin or token layer is where the definition of decentralization becomes exceptionally nuanced. It varies from crypto to crypto, along with the effects of centralization at this layer on a cryptocurrency’s market cap, governance structure, and blockchain security.

For all cryptocurrencies, the distribution of a coin or token must be decentralized. In other words, evenly spread out because if a handful of whales hold most of the supply, they can easily manipulate the price. For coins or tokens used in voting for changes to a cryptocurrency’s project, blockchain, or protocol, centralization at the coin or token level means that a handful of token holders can easily monopolize significant decisions about the project.

For coins belonging to a proof-of-stake cryptocurrency blockchain, if a handful of wallets hold most of that coin supply, they pose a security threat to that cryptocurrency’s blockchain. Although many have come close, there’s yet to be a proof-of-stake cryptocurrency subject to this type of corruption. That’s why Solana actively monitors how much its largest validators are staking to ensure their blockchains remain secure.

Note that decentralization at the coin or token layer is also essential for proof-of-work cryptocurrency coins because of the price manipulation factors. If too much of the supply of a proof-of-work coin is held by a handful of whales, they could crash the price below the point where it would still be profitable for miners to process transactions on its blockchain.

Layer 3: Infrastructure

The third layer of decentralization in cryptocurrency is the infrastructure layer. This refers to the different technologies you use to interact with or access cryptocurrency blockchains. Although many may think crypto wallets, cryptocurrency exchanges are arguably first on the list in any cryptocurrency infrastructure. That’s because it's challenging and sometimes impossible to acquire a coin or token without using a centralized exchange.

It may seem a bit of a paradox, but for quite a while, centralized cryptocurrency exchanges were surprisingly decentralized as many didn't have an official headquarters. Sometimes, even the company running the exchange didn't even exist. It was just a series of subsidiaries registered in countries with little to no regulation.

Often, these subsidiaries were established by various individuals or institutions where the people and the physical infrastructure were spread out worldwide in mostly unknown locations. However, this isn’t the case today, as most cryptocurrency exchanges have been forced to register with regulators and impose KYC on their users. The KYC aspect isn’t necessarily bad but leads to centralization as the non-compliant exchanges are shut down.

Decentralization at the infrastructure layer has also been problematic for some of the most significant crypto projects. It’s an issue for Ethereum because many of Ethereum’s applications rely on Infura for infrastructure to interact with the Ethereum blockchain, including the Meta Mask browser extension wallet.

As a result, many of Ethereum's services go offline whenever Infura has an outage. It’s only happened twice in the last few years, but it continues to be a wake-up call for the Ethereum community. Another big wake-up call has been in Infura’s recent decision to begin blocking access to any services using its technology where the end user lives in a sanctioned country.

Layer 4: The Blockchain Layer

The fourth layer of decentralization in cryptocurrency is the Blockchain layer. It’s often the layer that's referred to when you hear or see anything related to decentralization in cryptocurrency. Similarly to the coin or token layer, decentralization at the blockchain layer can look very different depending on the cryptocurrency in question; in some cases, the number of nodes doesn't necessarily matter.

Algorand is an excellent example of this, as its blockchain has thousands of participation nodes involved in consensus. However, all transactions on Algorand are processed by a smaller group of 120 relay nodes, most run by the entities behind Algorand and its affiliates. Some would argue that Algorand is technically decentralized because its relay nodes don't participate in consensus, but others disagree.

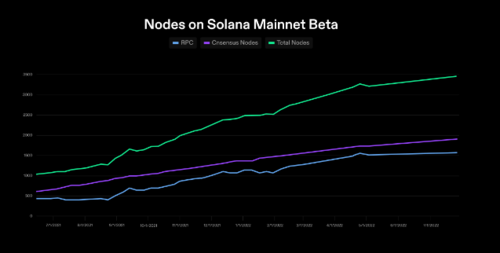

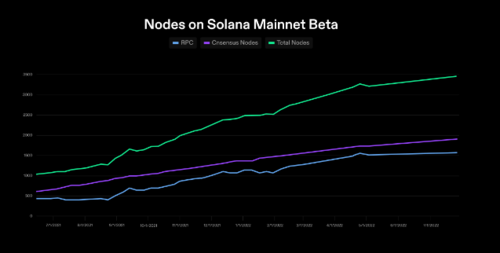

Solana, whose mandate is to support its blockchain's decentralization, security, resilience, and adoption, has over 3,400 validator nodes across six continents, including over 1900 consensus nodes, according to its first-ever “Validator Health Report.” Furthermore, an average of 95 consensus nodes and 99 RPC nodes have joined the network every month since June 2021. A large, diverse set of validator operators are essential to maintain a resilient, distributed and credibly neutral network for global usability.

Image source: Solana

There are 1,900 block-producing nodes on the Solana network, but that doesn’t mean all 1,900 are separate entities running each of these nodes. Several companies have built businesses off of running multiple validators on multiple chains. However, it’s critical for the health of the blockchain that no single entity builds up too much control over the validator network of the chain, even if their running multiple validators.

The Solana Foundation has verified that of 1,915 consensus-producing validators, at least 1,688 (88.14%) are run by independent entities. The remainder may also be independent of each other, but it has yet to be verified.

The other critical issue is centralized Cloud Computing Services, and almost every cryptocurrency uses servers like Amazon Web Services (AWS) for their Blockchain operations. The decentralized exchange (DEX) protocol, dYdX, went down during the AWS outage last December, and a handful of other cryptocurrencies were also affected.

Some crypto projects took the AWS outage as a sign that they must ensure all their validator nodes aren't all relying on the same centralized infrastructure. Others have gone as far as integrating with decentralized cloud providers, like Akash Network.

On another note, AWS and Azure have been guilty of banning or suspending newly established free-speech platforms from their hosting services, leading to some forward-thinking crypto social network platforms building their own independent cloud servers.

Another centralization issue at the blockchain layer for many crypto projects is the storage of their complete transaction histories. You could have a blockchain with thousands of validators leveraging all kinds of computing services, but if only a handful of them have access to the entire transaction history, it’s possible it may result in transaction manipulation, so it would be difficult to determine that the Blockchain is decentralized.

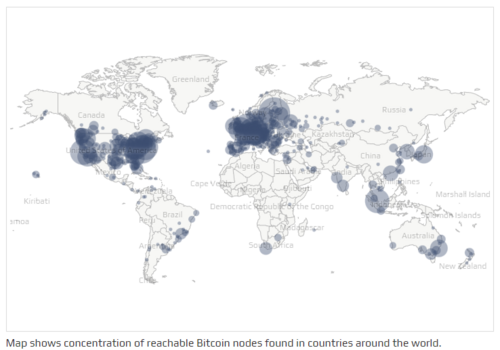

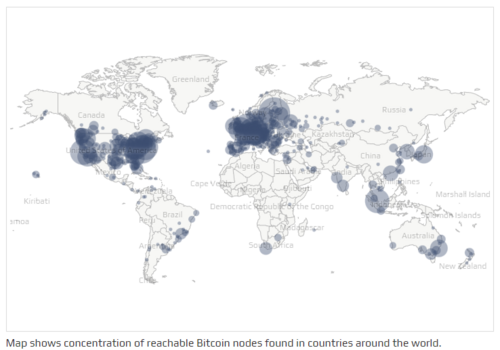

Only a few crypto projects have been transparent about how their full transaction history is being stored. One of them is Bitcoin, whose full nodes store its full transaction history. There are currently around 15,000 Bitcoin nodes worldwide, arguably making it the most decentralized at the blockchain layer.

Image source: https://bitnodes.io/

Layer 5: The External Layer

The fifth and final layer of cryptocurrency decentralization is the external layer. As the name suggests, the external layer is everything cryptocurrencies rely on that isn't necessarily exclusive to cryptocurrency. This is where the definition of decentralization gets complicated because the external layer includes websites, internet service providers, and in some cases, financial institutions.

Websites for almost every crypto project are hosted on a centralized service. Although some crypto projects are okay with it, it creates a real problem for decentralized applications and other interactive Web3 technologies. The world’s leading decentralized exchange, Uniswap, was forced to delist 100 tokens from its interface, which calls its purported decentralization into question. This has prompted other DeFi protocols like Aave to migrate their front ends to decentralized storage solutions, like the Interplanetary File System. (IPFS)

It gets interesting with internet service providers (ISPs) mainly because banning ISPs from allowing their users to access cryptocurrency-related websites, albeit limited to select countries, has proven that it’s possible. Although it’s presumably unlikely to be enforced elsewhere, the worst-case scenario is that we could see governments dictate that ISPs stop serving cryptocurrency miners and validators. Fortunately, Blockchain projects are hoping to decentralize the internet itself using peer-to-peer signals on open-source infrastructure.

Banks also fit into the external layer with their defacto digital dollars. These are the Stablecoins like USDT, USDC, and BUSD and have some of the largest market caps in cryptocurrency. This is because there's always demand for stablecoins, regardless of market conditions. Also, most of the crypto market's trading volume involves stablecoins. And that means they are one of the core technologies that make most of the cryptocurrencies possible in their current form.

This is why a stablecoin crackdown is one of the biggest threats to the crypto industry. All regulators would have to do is restrict access to the reserves backing the stablecoins in circulation, which centralized financial institutions hold. In fact, most of the reserves backing the USDC stablecoin are in the custody of the world's largest asset manager, Blackrock. More about that in a forthcoming article.

Image by: Markethive.com

Which Cryptos Are The Most Decentralized?

According to a survey conducted by Cointelegraph of various experts in the crypto industry, there aren’t any cryptocurrencies that come close to Bitcoin's overall decentralization. Bitcoin is leading the charge because dozens of individuals and institutions are building on Bitcoin. Also, BTC supply is broadly distributed, there's no shortage of infrastructure available to interact with the Bitcoin blockchain, and the Bitcoin blockchain has over 15,000 full reachable nodes.

Considering the five layers explained above, no cryptocurrency has yet scored ideally on all criteria. Even Bitcoin falls short at the external layer. Also, some believe Ethereum’s decentralized applications are more critical as users can participate in fully-fledged economies, whereas that’s not possible with Bitcoin.

So we could say Ethereum is a runner-up, along with Monero, but as mentioned above, Ethereum decentralization still seems to be lacking on some layers. As for Monero (XMR), it’s constantly at risk of getting delisted from centralized exchanges due to unreasonable crypto regulations.

It’s evident that most of the more decentralized cryptocurrencies have been around for a long time, and many believe that it’s ultimately ‘time’ that has allowed Bitcoin to decentralize so much. However, technology is evolving at a much faster pace today, and it looks like Solana and Cardano may well be the next runners-up.

A Lifeline For Emerging Decentralized Social Media and Marketing Platforms.

This is good news for other sectors like social media, marketing, and digital broadcasting. With all the events and censorship issues around social media and tech giants, given their propensity to ban or suspend their services to individuals and companies that go against their narrative, a decentralized blockchain that can handle large crypto-based communities and be part of a parallel economy is of the utmost importance.

The crypto and blockchain projects that uphold the interests of entrepreneurs and advocate for free and critical thinking are paving the way. They will ensure that individuals and the developing ecosystems will have the financial freedom, liberty, and sovereignty that is fundamentally our right of passage, which seems to be all but forgotten by the monopolies and so-called authorities and their over-zealous regulations.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Also published @ BeforeIt’sNews.com; Steemit.

Tim Moseley

.png)

LBMA delegates see silver prices rallying 54% in the next 12 months

LBMA delegates see silver prices rallying 54% in the next 12 months

The Crypto Winter will end once innovation and these other key developments reignite – Sean Mackay

The Crypto Winter will end once innovation and these other key developments reignite – Sean Mackay

Bitcoin could fall to $3.5K as recession intensifies and stocks collapse – Gareth Soloway

Bitcoin could fall to $3.5K as recession intensifies and stocks collapse – Gareth Soloway.gif)

. ]

. ]