Wall Street throws in the towel on gold after Friday’s rout, Main Street optimism likely a pre-selloff snapshot

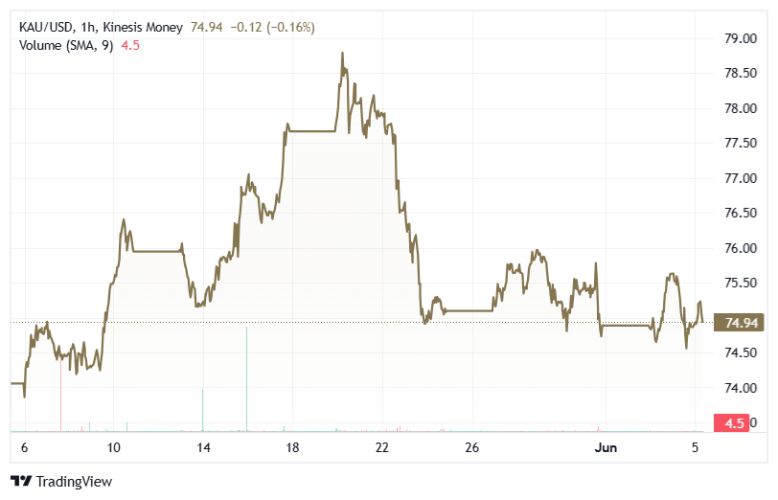

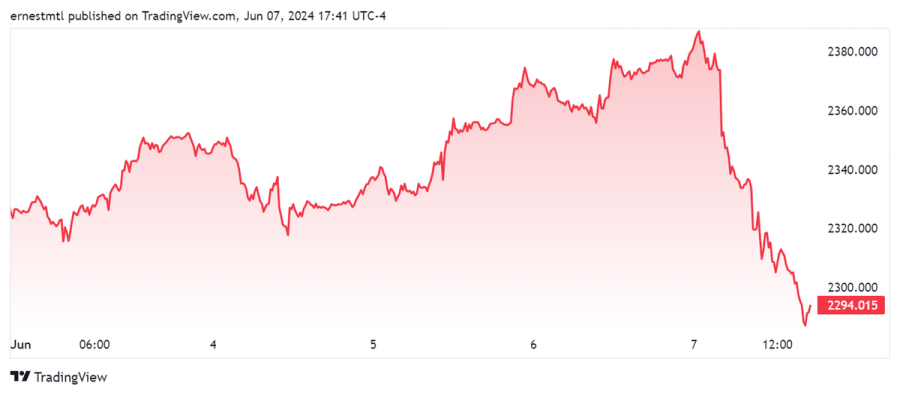

This week, precious metals markets saved all their drama for the grand finale. Spot gold opened the week trading at $2,325.26, and spent much of the first four days trading in a relatively narrow $25 range.

The expected 25 basis point rate cuts from the ECB and the Bank of Canada came and went, with spot gold eventually setting its weekly high of $2,386.75 just after midnight on Friday.

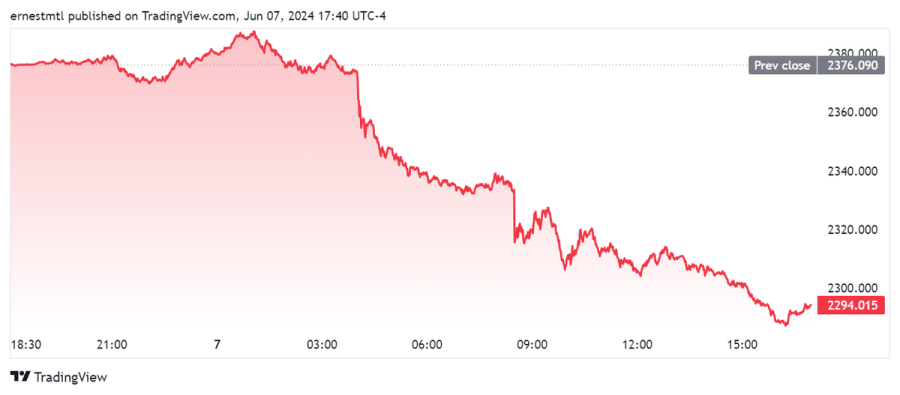

North American traders went to bed Thursday night expecting Friday morning’s nonfarm payrolls (NFP) report to be the week's highlight for gold. But the People's Bank of China (PBoC) stole the spotlight in the early hours, announcing at 4 am EDT that they had broken their 18 months streak of sovereign gold purchases in May and sending metals prices crashing through multiple levels of support as algorithmic stop loss orders were filled in rapid succession.

Spot gold sank like a stone, falling from $2,373.85 just before 4 am to $2,343.68 only one hour later, with much of the move taking place in a matter of minutes.

Then, the yellow metal was trading at $2,333.42 in the moments before the 8:30 am release of the surprisingly strong U.S. jobs report, which drove gold down even further as markets recognized that the Fed would have even less reason to cut in the near term. As gold was already down over $40 at that point, the NFP took the yellow metal all the way down to support near $2,300 per ounce.

Gold saw multiple bounces off the $2,300 level throughout Friday trading, but finally broke through support shortly after 2:40 pm EDT.

.png)

The latest Kitco News Weekly Gold Survey has the majority of industry experts throwing in the towel on gold’s near-term prospects, while most retail traders saw gains for gold in the coming week, though most voted before Friday morning’s fireworks.

“Two forces drove gold to new one-month lows ahead of the weekend,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “The first, and which got the ball rolling, was news that although the dollar value of China’s reserve grew last month, it did not add to its gold holdings for the first time in 18 months. The second, which added insult to injury was the jump in US rates and the dollar in response to the stronger than expected US jobs data.”

“A break of $2300 in the spot market targets the May lows near $2277,” Chandler added. “A break of the $2270 area could send the yellow metal down to the $2220 area.”

“China rugging the gold bulls like GME today,” said Adam Button, head of currency strategy at Forexlive.com. Button thinks gold has further to fall. “This China news is bad,” he added.

Darin Newsom, Senior Market Analyst at Barchart.com, said gold prices are likely to move lower in the days ahead.

“While I’m not reading anything into Friday morning’s spike move, a knee-jerk reaction to the comic relief known as monthly US employment numbers, August gold remains in an intermediate-term downtrend on its weekly chart,” Newsom said. “The contract’s short-term daily chart is also showing a downtrend that didn’t quite complete itself this past week. Much will depend on Friday’s close, though the initial reaction Friday saw August take out its previous 4-day low of $2,334.80. Now we’ll see if there were any sell orders waiting below that mark."

“Positioned in inverse Gold and Silver ETFs as a hedge here, as the market has temporarily turned South,” said Mark Leibovit, publisher of the VR Metals/Resource Letter.

“I’m sticking with up, as support structure is still in place from the weekly chart,” said James Stanley, senior market strategist at Forex.com. “And for the first four days of the week gold held in a fairly strong position until finding resistance at 2378.”

“I think the driver around Chinese gold reserves could possibly be a trap door, and I don’t think the Fed is going to come off as overly hawkish next week,” Stanley added.

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, was weighing the implications of the jobs report ahead of next week’s Fed rate decision.

“The U.S. employment numbers mean it's less likely that the Fed's going to cut rates,” he said. “It's less likely they'll cut rates next week, and they're really under pressure to not cut rates. And that's been propping up the U.S. dollar, particularly in a week where Canada and Europe did cut rates.”

Cieszynski said this will also have a significant impact on the U. S. dollar, and on gold prices.

“That puts a tailwind behind the U.S. dollar and a headwind in front of gold in the near term, and other commodities as well,” Cieszynski said. “Anything that's priced in U.S. dollars has a headwind in front of it now, because this could boost the U.S. dollar a little bit in the short term.”

Looking past the surprising headline number, Cieszynski said that the most significant thing about the jobs report was its inflation data.

“The most important part was actually that wage inflation is going up again,” Cieszynski said. “I think a lot of people were hoping that maybe the Fed would signal a rate cut in July, but yeah… maybe September. You could still do two rate cuts this year, in September and December, one before the election and one afterwards.”

Cieszynski said that the downward price action from gold could be fairly dramatic, as its run-up provided few obvious areas of support. “It broke out over $2,160, and then it very quickly went to $2400, so the support is in at around $2,280ish, $2,285, and if that gets taken out, then back to $2,125, $2,150.”

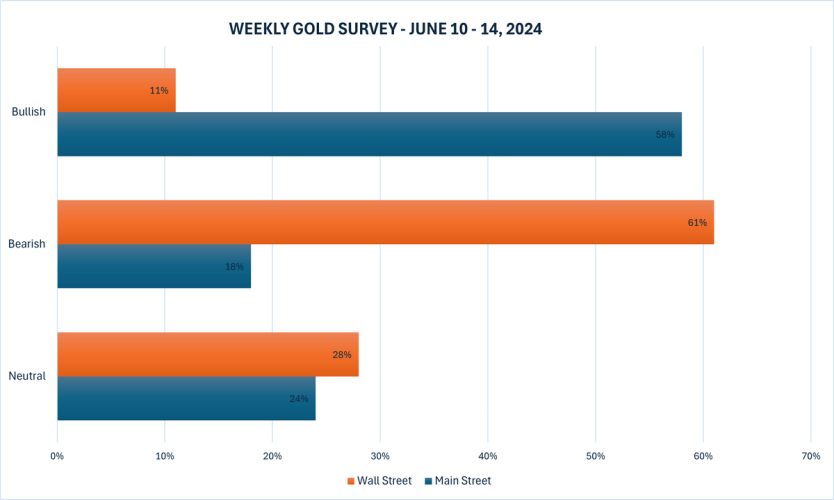

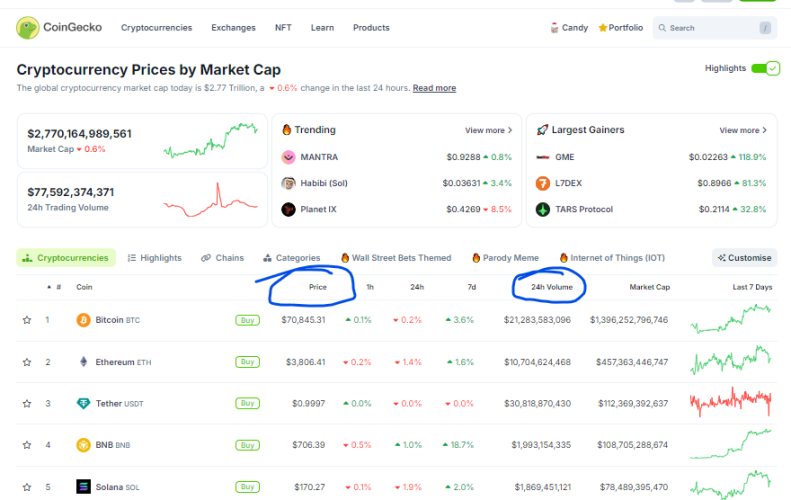

This week, 18 Wall Street analysts participated in the Kitco News Gold Survey, and after Friday’s precipitous slide, few were optimistic about the near term. Only two experts, representing 11%, expect to see gold prices climb higher next week. Eleven analysts, fully 61%, predicted a price decline, and the remaining five, or 28% of the total, see gold trending sideways during the coming week.

Meanwhile, 184 votes were cast in Kitco’s online poll, with Main Street investors representing the ‘before’ picture of a relatively optimistic market. 107 retail traders, or 58%, look for gold prices to rise next week, the same proportion as last week. Another 33, or 18%, expected they would be lower, while 44 respondents, representing the remaining 24%, saw prices chopping sideways during the week ahead.

.png)

Next week will revolve around the Wednesday morning release of U.S. CPI for May, followed by the Federal Reserve’s monetary policy decision in the afternoon.

Then on Thursday, markets will be watching U.S. PPI for May and weekly jobless claims, with the Bank of Japan set to announce their monetary policy decision in the evening. And Friday morning will see the release of Preliminary University of Michigan Consumer Sentiment.

Adrian Day, President of Adrian Day Asset Management, was among the minority who believe gold could stage a comeback next week.

“Friday’s drop after the U.S. payroll report is overdone, and suggests some holders were nervous weak hands,” Day said. “The concern is that the payrolls report pushes back the prospects of a rate cut by the Federal Reserve, but no-one was expecting it at next week’s meeting; September was the earliest when a Fed rate cut was broadly expected. A lot can happen twixt now and then.”

“Moreover, the U.S. and the Fed are not the only game in town,” he added. “Both the European Central Bank and the Bank of Canada have cut rates in the last weeks, with a few other small central banks. The global trend is definitely to lower rates.”

Day said that while gold might see some follow-through from today’s selloff, he thinks it will only be for a day or two, and only shallow. “By the end of the week, I would expect gold to be moving up again.”

Kevin Grady, president of Phoenix Futures and Options, was looking at the market dynamics on Friday after the sharp overnight selloff.

“When the market dumps like that, the rest of the day is no longer about the news,” he said. “The rest of the day is people hitting stops, and in that market, it gets into a rhythm of the day where people are liquidating. So when you enter a day as a trader, and you see people are liquidating positions, it just changes the day. People are thinking, are there more stops under the market? Did we hit all the stops? Where's the buying coming in?”

“As a trader, that's what I look for,” Grady said. “I remember standing in the trading pit for years and years, and that's what I would watch for. Where are the stops? The market sells off… are they continuing? When you see another dip in the market and it doesn't continue, and strong buying comes in, who's doing that strong buying? Where's it coming from?”

Grady said that the payrolls report just exacerbated an already declining market, but soon all eyes will move to next week’s data.

“Let's see what the CPI looks like,” he said. “I think that's going to be the key for us. We have to wait and see.”

He’s also very interested in what Federal Reserve chair Jerome Powell will say at next week’s post-FOMC press conference.

“No one's anticipating any rate movements, but it's all about the verbiage, and the dot plot,” Grady said. “Everybody wants to know, where do these guys all stand as far as their projections and how many rate cuts are coming in, or will there be [cuts]? You saw the ECB cut rates this week. I still say that inflation is hot. Everything that touches, every single person, food, rent, education, insurance, any of those prices. Inflation is 15 percent at least on most of those metrics and I think that these guys see it.”

Grady said he thinks it’s increasingly likely that the Federal Reserve will decide to bite the bullet and raise the inflation target above 2%.

“I don't know if these guys at some point are going to start raising their target a little higher and say, our number is no longer 2 percent that we're going to target, we're going to try to say maybe it's 3%. I think that discussion is being kicked around, and I think that discussion has to be had, because right now, I don't think it's prudent to cut rates. I just don't think it's warranted, but they're in a really tight spot because on all the servicing debt that they have, they're paying exorbitant interest rates, and especially if the ECB is cutting rates, the entire world is flooding into U.S. Treasuries at 5.2%.”

Grady said that the Fed will need to do something at some point. “We're holding up the world, and we're going to continue to pay an exorbitant amount for our debt to service our economy?” he asked. “That's why I think these guys are in a real pickle.”

“I think they'd like to [cut], but I think the only way they're going to be able to lower rates is if they say, our target’s raised a little, we're going to go to maybe 3%,” Grady concluded.

“Gold's chart looks really weak, which is not surprising,” said Phillip Streible, Head of Market Strategy at Blue Line Futures. “If you are looking for metals exposure, copper and silver have better fundamentals. Gold investors should take a bit of a break for now.”

“We are likely in higher timeframe bearish correction against the move up from 19001,” said Michael Moor, Founder of Moor Analytics. “The trade below 24343 (+1.3 tics per/hour) has brought in $122.3 of pressure. The trade below 24216 (+4 tics per/hour) projects this downward $60 (+)—we have attained $109.6. On 5/22 we left the minor bearish reversal warned about, and on 5/23 left another bearish reversal above. These rolled into the (Q) and are OFF HOLD. Decent trade below 23642 (-1.2 tics per/hour starting at 6:00am) should bring in decent pressure, likely for days.”

“Neutral,” said Naeem Aslam, Chief Investment Officer at Zaye Capital Markets. “Consolidation with a grind to the downside.”

And Kitco Senior Analyst Jim Wyckoff sees further declines for gold next week. “Steady-lower as chart damage inflicted recently,” he said.

Spot gold last traded at $2,294.01 per ounce at the time of writing, down 3.45% on the day and down 1.43% on the week.

Kitco Media

Ernest Hoffman

Tim Moseley

.png)

.png)