Gold Price News: Gold Falls Back Below $2,330 An Ounce

Gold News

Market Analysis

Gold prices fell back on Tuesday, giving up Monday’s gains, as the US dollar rebounded from a two-month low seen the previous day.

Gold prices fell as low as $2,317 an ounce on Tuesday, before edging back up to $2,325 an ounce later in the session. That was down sharply compared with around $2,351 in late deals on Monday.

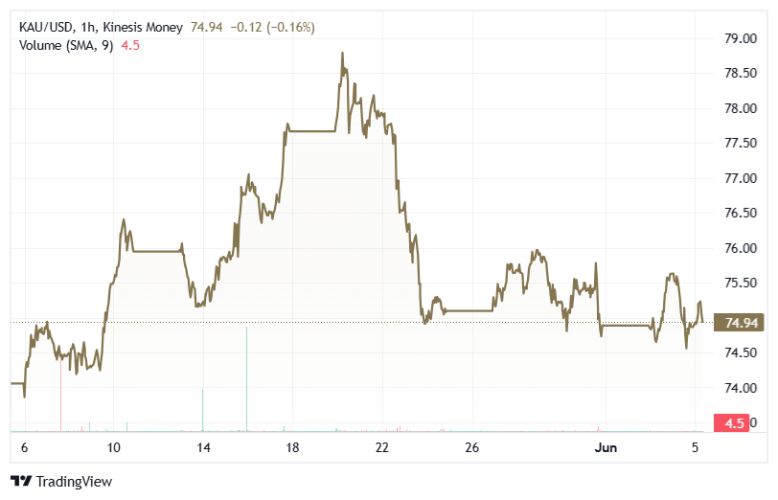

KAU/USD 1-hourly Kinesis Exchange

The sharp downward reversal came as the US dollar rebounded against other major currencies on Tuesday, making gold more expensive for buyers in other currencies, and weighing on demand. The US dollar had hit more than a two-month low against the euro on Monday, but found a firmer footing on Tuesday.

In addition, US factory orders figures for April came in on Tuesday showing a 0.7% increase compared with March, and slightly above market expectations of a 0.6% gain. Any signs of a stronge-than-expected economy suggest the need for central banks to maintain higher interest rates, which tends to be bearish for non-yield-bearing assets like precious metals.

On the geopolitical front, the US expects that Israel will accept a ceasefire deal with Palestinian militant group Hamas if it too approves the agreement, a White House official was quoted as saying this week. The deal, which would start with a six-week halt to hostilities, would help pave the way for a permanent end to the conflict, which has injected a risk premium into precious metals markets.

Looking ahead, the markets will be watching out for Wednesday’s US ISM Services PMI figures for May, for the latest reading on the state of the economy. Also of interest will be the European Central Bank’s expected interest rate decision on Thursday, which is widely expected to be a 25-basis point cut to 4.25%. The ECB in April maintained interest rates at record-high levels of 4.5% for a fifth consecutive time.

Frank Watson

Tim Moseley