What Is Altcoin Season? When Will It Start? Or Is It Already Here?

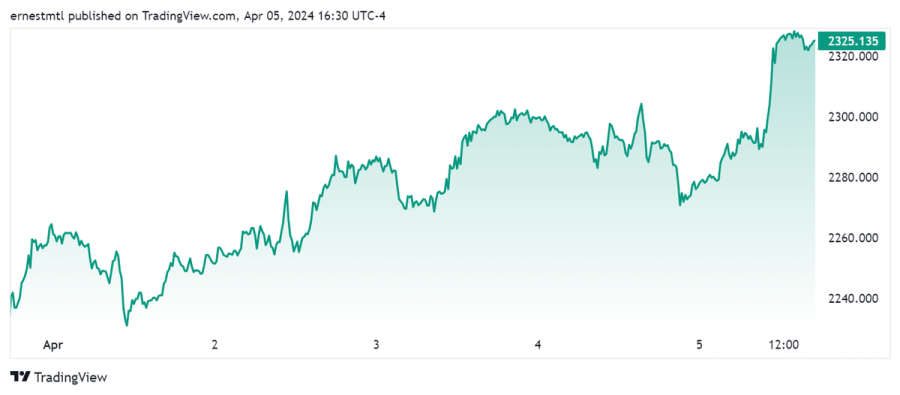

Altcoin season, a term on the lips of many cryptocurrency enthusiasts since Bitcoin's recent surge to unprecedented heights, is a phenomenon many have eagerly anticipated. However, despite this anticipation, only a select few coins and tokens, along with many meme coins, have experienced substantial growth. This has led to speculation that altcoin season may never arrive, as funds flowing into spot Bitcoin ETFs may not be redirected towards the broader cryptocurrency market. But is this the full story?

With the invaluable insights of some highly credible crypto experts, this article takes a deep dive into the current state of the cryptocurrency market. It focuses on the 'altcoin season' concept and its potential impact on market trends. The article explores why altcoin season has yet to occur and predicts when it may begin. It also offers insights on how to recognize its onset. Additionally, the article highlights the types of alternative cryptocurrencies (altcoins) that may be worth watching during this period.

The Concept of Altcoin Season

Firstly, let's touch on the concept of altcoin season, a term that lacks a universally accepted definition. Some assume it refers to a period where numerous altcoins are experiencing a surge in value, with many believing that it's already underway. Given the recent performance of certain altcoins, one could argue that it's already here. However, this definition falls short of accurately capturing the concept, so here’s a more precise and nuanced explanation.

An altcoin season is an extended timeframe during which most alternative coins exhibit notable outperformance compared to Bitcoin. This can be gauged by analyzing the price of an altcoin with Bitcoin, for example, ETH/BTC. When assessing the BTC pair for various altcoins, it becomes evident that their performance has not been particularly strong. However, this does not imply that they have not experienced price increases in fiat currency; rather, it indicates that their gains have been comparatively lower when measured against Bitcoin.

The current situation with ETH and BTC is a significant development in the cryptocurrency market. ETH's value has decreased compared to BTC, which has raised concerns among traders and investors. Historically, increases in BTC's value have often been followed by a shift in investments towards alternative cryptocurrencies, leading to a period where most altcoins perform better than BTC.

Source: Coinmarketcap

In the past, the trend has been to invest in ETH and then move on to other major alternative cryptocurrencies, followed by mid-cap and small-cap altcoins. It is important to note that this progression is not always precise but generally aligns with the idea that investors gravitate towards more speculative crypto assets as market momentum continues. Interestingly, in the current scenario, there has been limited shifting of funds into ETH, as indicated by the underperformance of the ETH/BTC pair mentioned earlier.

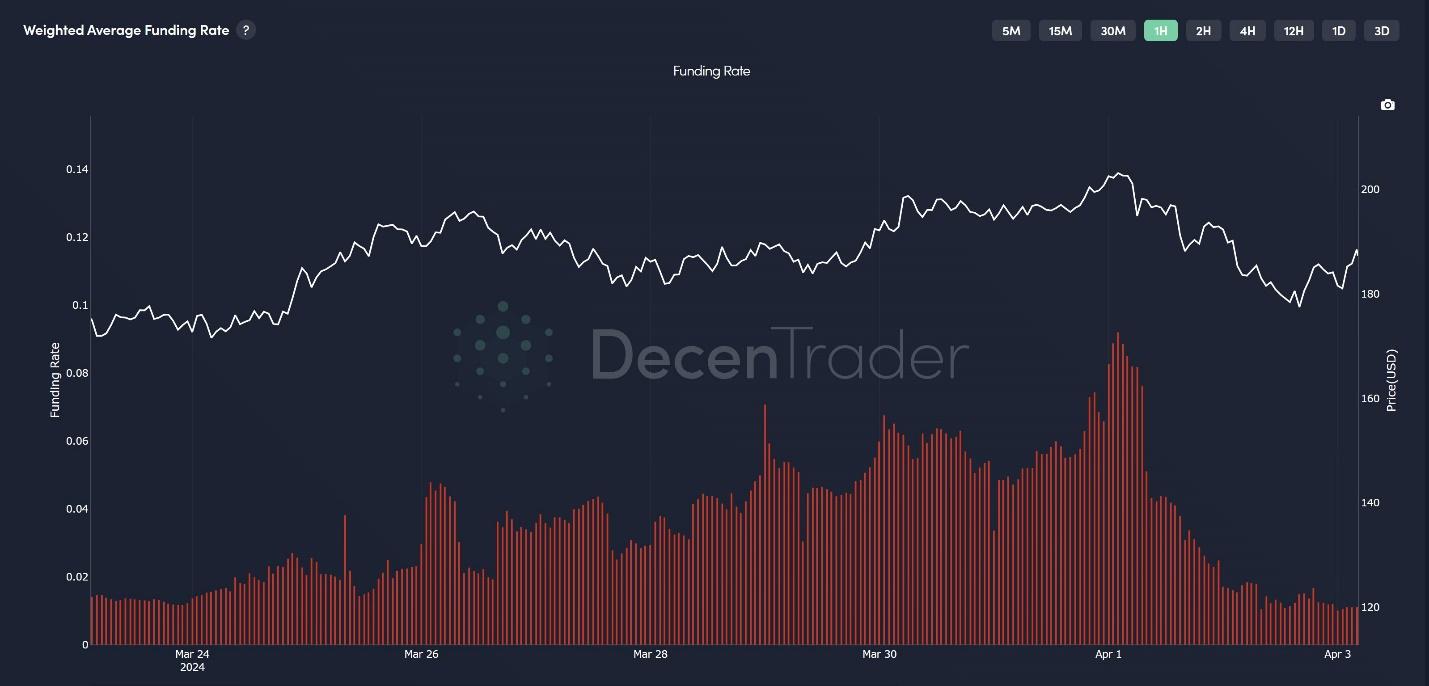

Furthermore, it appears that the influx of capital did not favor midcaps and small-caps but instead directed attention towards micro-cap meme coins for speculative purposes. It is important to note that while certain altcoins like Solana's SOL have shown impressive performance compared to BTC, most altcoins, including ETH, have not surpassed BTC's growth. This suggests that the altcoin season may have yet to arrive fully.

As indicated earlier, cryptocurrencies with smaller market capitalizations tend to be riskier. This is because crypto with a smaller market cap has the potential to experience more significant and rapid price increases compared to those with larger market caps. However, on the flip side, small-cap cryptocurrencies are also prone to more substantial drops in value, highlighting the risk/reward ratio.

The notable 100x returns often associated with certain altcoins are typically achievable with those that have smaller market caps, explaining the hype around the altcoin season. Nevertheless, there are indications that the current cryptocurrency market cycle differs from previous ones, which could have significant implications for the returns on altcoins.

The Question on Everyone's Mind: When Will Altcoin Season Arrive?

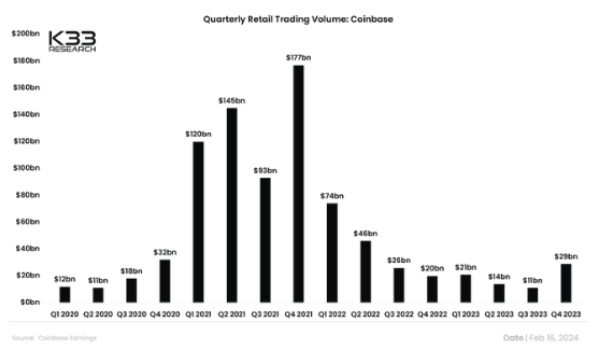

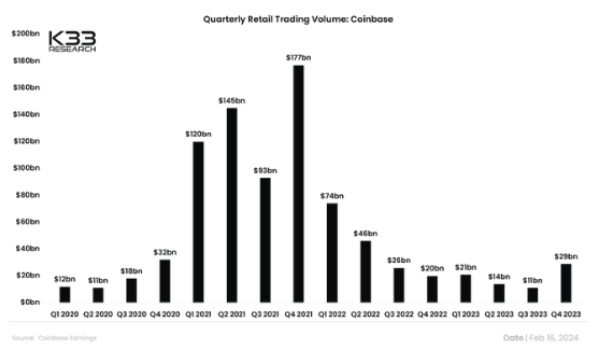

Many wonder why the current market cycle hasn't followed the same pattern as previous ones, with altcoins yet to take center stage. To understand this, we must first acknowledge the unique factor setting this cycle apart: spot Bitcoin ETFs. As discussed earlier, some believe these ETFs are hindering the rotation into altcoins, as investors cannot easily switch from ETFs to altcoins, at least in theory. However, some investors may be cashing out their ETF gains and moving their funds to cryptocurrency exchanges like Coinbase, where they can invest in altcoins.

The catch is that most investors in spot Bitcoin ETFs are not your average retail investors but seasoned institutional investors. These institutional investors, also known as TradFi whales, have a significant influence on the market. As a result, their preferences for alternative cryptocurrencies may diverge from those of the typical crypto enthusiast. Notably, there has been substantial institutional interest in SOL, which could explain its outperformance compared to BTC.

However, the crypto market is not solely composed of institutional investors. There are two other types of crypto investors: crypto whales and retail investors. Crypto whales, which are large holders of cryptocurrencies, have been the primary influencers in the crypto market so far. Their shift from Bitcoin to alternative coins has led to past cycles in altcoins, while retail investors have pushed these coins to their peak values. Put simply, the crypto market has not lost anything. It has merely introduced a new main character, figuratively speaking.

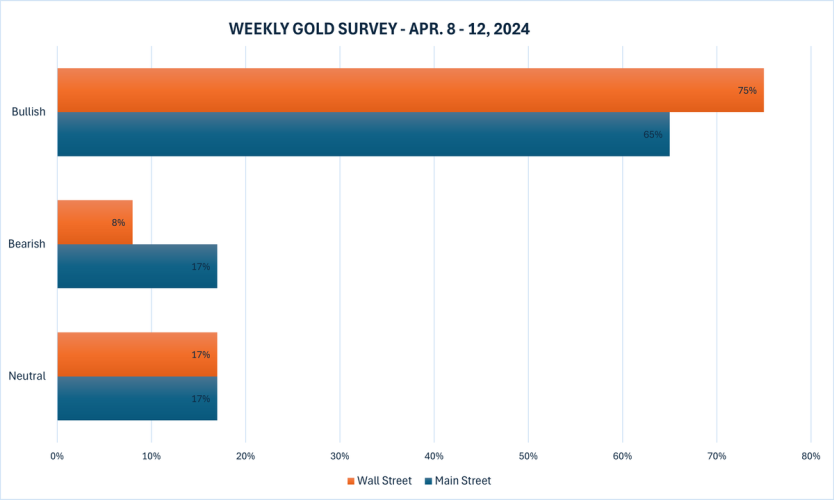

The lack of an alt season is not caused by the introduction of ETFs but rather by the actions of crypto whales and retail investors. The analysts at Coinbureau suggest that these crypto whales are not shifting their investments or rotating into altcoins because there currently needs to be more retail investors interested in purchasing them.

Source: Crypto Max on X

Numerous indicators suggest that retail investors are gradually becoming more interested in cryptocurrency despite their limited participation in the current market upswing. This is evidenced by increased retail trading activity on cryptocurrency exchanges, the growing popularity of crypto exchange apps, rising search volumes for crypto-related terms, and heightened social media engagement with crypto content. However, these metrics have not reached the levels indicating a massive influx of new retail investors into the cryptocurrency market.

The crucial factor here is the influx of new retail investors. While millions of retail investors from previous cycles are still active or returning, we need to see more new entrants into the market. This is a significant concern, as altcoins rely heavily on new investors to drive their growth and create upward momentum. As a retail investor, you can influence the altcoin season. There need to be marginal buyers.

As Coinbureau states, “We need new people for our altcoin bags to pump, probably because most of us have already allocated as much as we can to our favorite coins and tokens. In the absence of these new people, there's not that much for us to do except speculate on memecoins, and it's quite possible that the memecoin pumps we've seen have been coordinated by the crypto whales. They probably know that the only retail investors around right now are experienced enough to use DEXs.”

The Onset of Altcoin Season

After analyzing the delay in the arrival of altcoin season, the next question is when we can expect it to begin. The straightforward answer is that it will start when a sufficient number of retail investors take notice. This will prompt crypto whales to shift their focus from Bitcoin to altcoins that retail investors will then eagerly buy into, leading to a chain reaction of FOMO (fear of missing out). However, a more in-depth analysis, which necessitates a look back at the previous cycle, reveals a more intricate scenario. Most of us envision the upcoming altcoin season as a repeat of the last cycle, but the reality may be more complex.

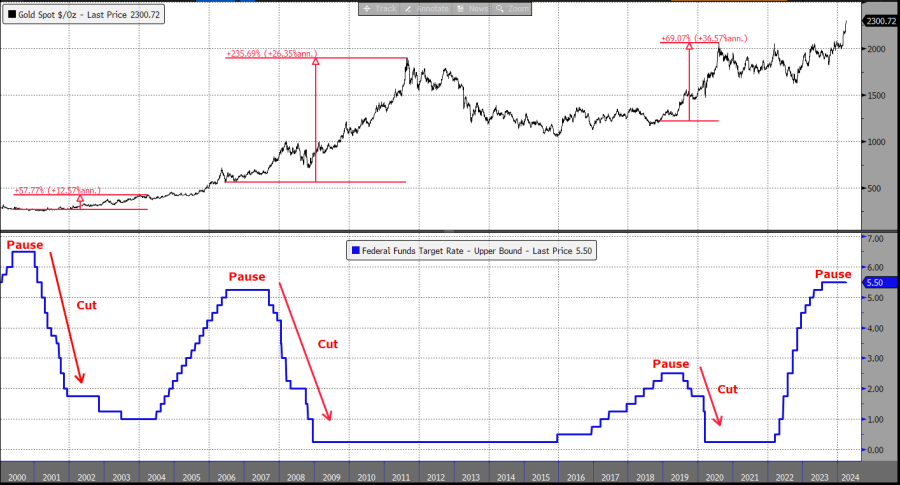

The issue lies in the significant differences observed in the previous cycle. Due to a worldwide pandemic, billions of individuals were confined to their homes while a few hundred million received a stimulus payment, providing them additional funds. These events led to widespread speculation in both stocks and cryptocurrencies. Today, the situation is starkly contrasted as interest rates across various nations are at their highest levels in years. Unofficial inflation rates are soaring in most countries, reaching double digits. Several countries are experiencing or nearing recession.

Above all, most individuals are reportedly accumulating unprecedented levels of debt to maintain their standard of living. This trend starkly contrasts with the circumstances observed during the previous alt season. A positive aspect is that the prolonged persistence of these conditions may prompt governments and central banks to provide comparable forms of economic support, never mind the possibility of an existential shock.

This means that there will likely come a time when economic conditions mirror those seen during the pandemic, with similar fiscal and monetary support levels. The exact timing is uncertain, but it may take a significant event to prompt such action. Identical to past patterns, this could cause a brief decline in cryptocurrency and other asset values, followed by a stabilization period and a sharp price increase as the stimulus takes effect.

If the current state of the market persists, altcoins may suffer under unfavorable circumstances. If trends continue, including high interest rates, rising inflation, recurring recessions, and mounting retail debt, the subsequent altcoin season may fall short of expectations. It's essential to recognize that the cryptocurrency market has undergone significant changes since the previous cycle, with factors beyond spot Bitcoin ETFs contributing to its evolution.

Regulations in the US, UK, and other countries have made it more difficult for retail investors to reach offshore trading platforms where highly speculative altcoins are traded. The upcoming EU stablecoins regulations are anticipated to impact the cryptocurrency market significantly. It has been announced that USD stablecoins will no longer be allowed in the EU by the end of the year, potentially reducing the options for retail investors to trade cryptocurrencies.

Identifying the Arrival of Altcoin Season

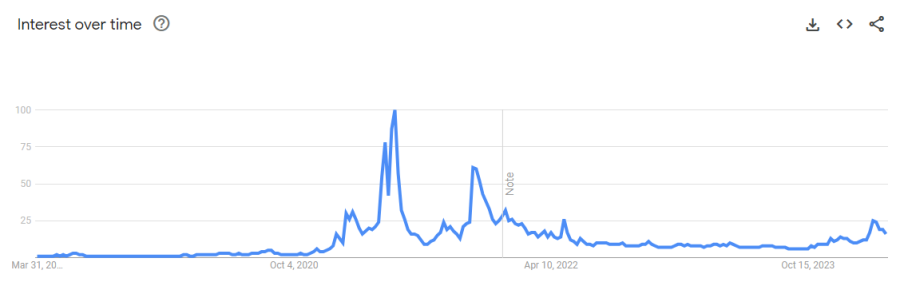

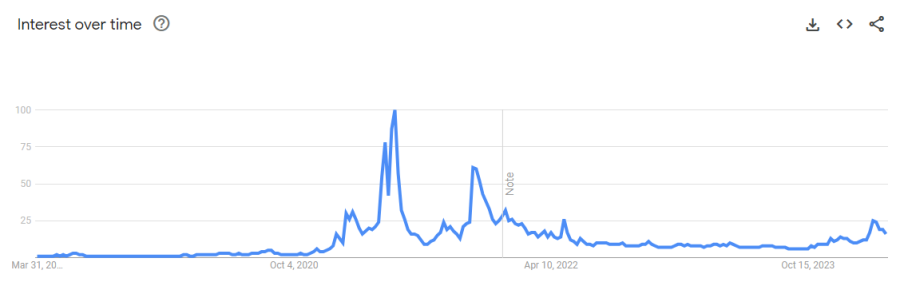

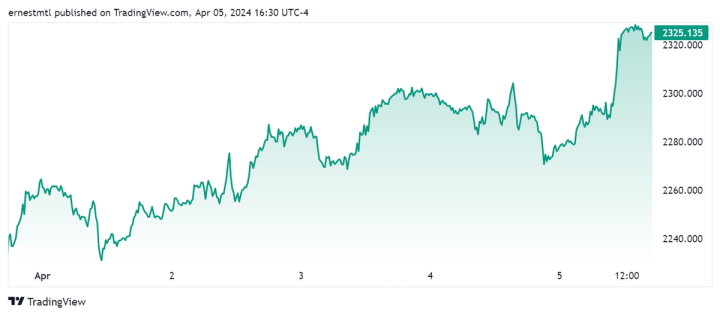

To determine the onset of the altcoin season, keep a close eye on several key indicators. These include retail trading volume, the popularity of crypto exchange apps, Google searches, and social media views related to cryptocurrency. When you observe a steady increase in these metrics, alt season is likely imminent. Interestingly, there are signs that this trend may already be underway. For instance, search queries related to buying cryptocurrency have started to rise after years of stagnation, although they still have a long way to go before reaching their previous peak.

Source: Google Trends

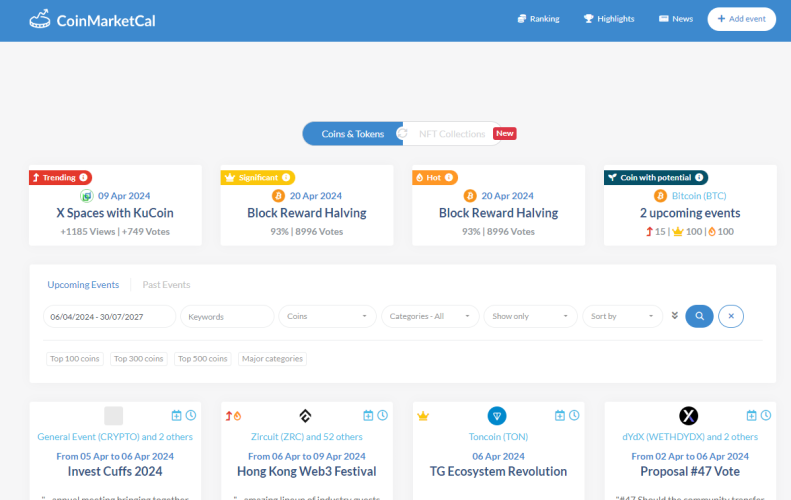

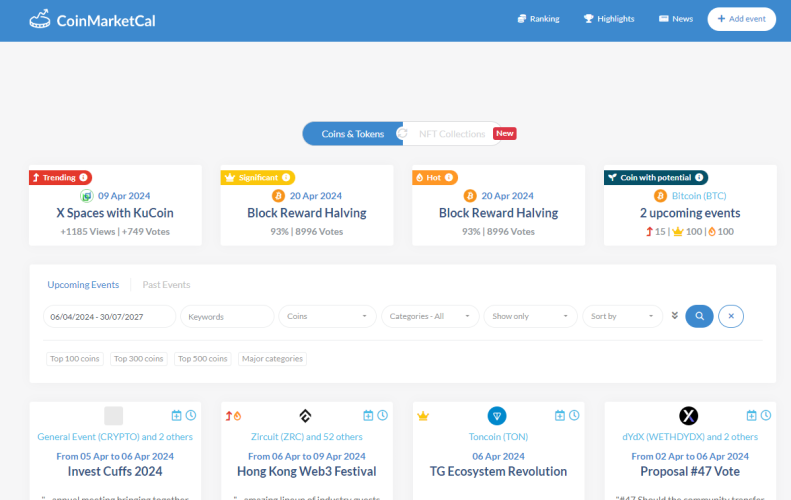

The current market dynamics are making it challenging to determine whether we are witnessing the inception of a new alt season or a fleeting speculative surge. A valuable approach to shed light on this puzzle is examining how cryptocurrency projects promote themselves, specifically during periods of heightened attention. A typical pattern among cryptocurrency projects is to unveil significant announcements when public interest is at its peak.

There have been instances where crypto projects have postponed significant updates and announcements due to a lack of interest from retail investors. Despite this, numerous crypto projects have been making notable announcements, which could suggest the beginning of a new altcoin season. However, these announcements have not resulted in significant speculative buying, indicating that retail investors remain scarce.

Source: CoinMarketCal

As the popularity of cryptocurrency projects grows, you may notice a surge in big announcements and subsequent price increases for their coins or tokens. This is often a sign that retail investors have entered the market. When these altcoin announcements start making headlines in mainstream news, it could indicate that the market is nearing its peak.

Some of you have probably encountered additional key indicators, like inquiries from friends and family regarding the crypto market or, worse, seeking advice on investing in meme coins. However, these signals may not hold much weight unless individuals actively invest. Suppose widespread media coverage of altcoins is not leading to a substantial market increase, and your acquaintances are not showing significant interest. In that case, it may not truly be an alt season.

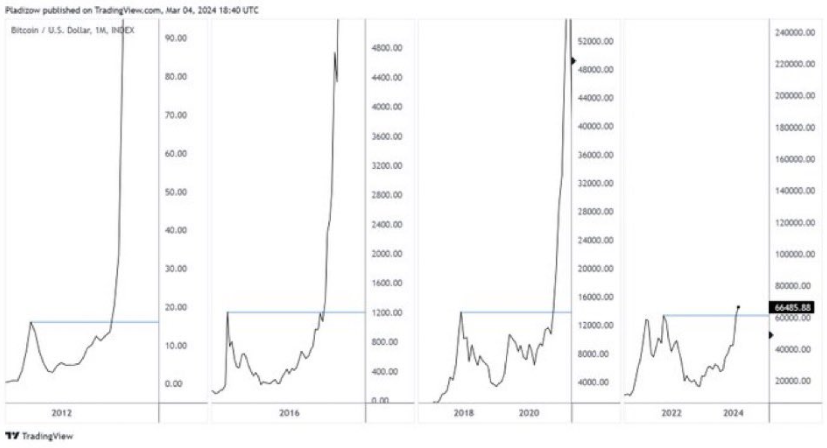

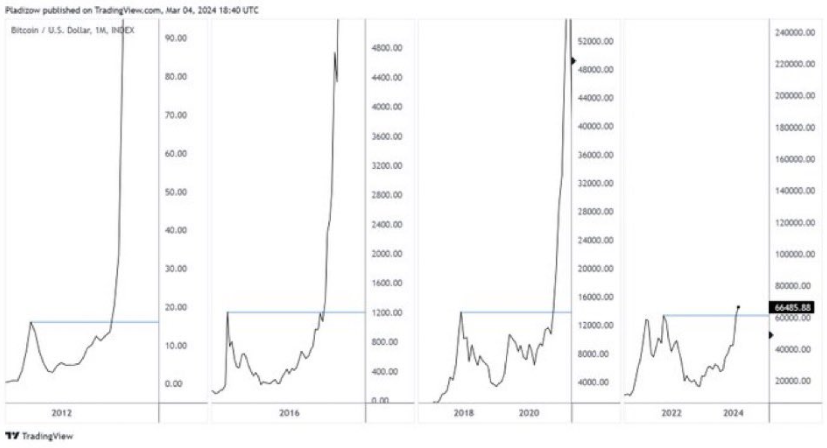

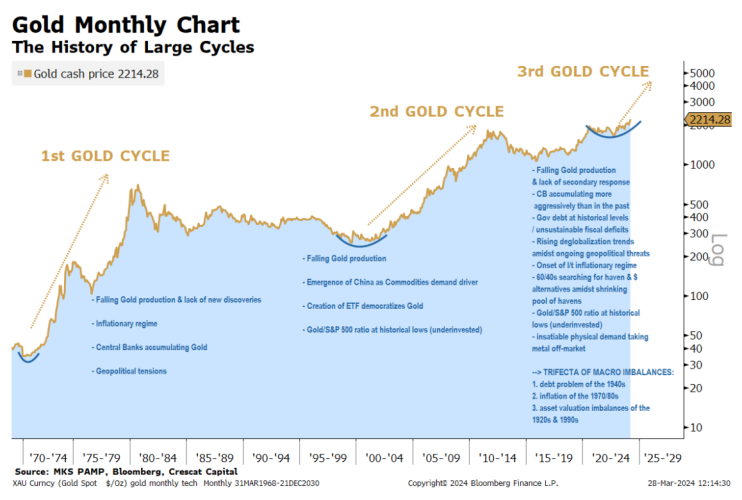

A possible indicator of an impending alt season is to evaluate whether these signs are present when, based on historical patterns, an altcoin season would be expected to occur from a cycle perspective. However, this can be difficult to determine as the introduction of spot Bitcoin ETFs has disrupted the typical cycle. For reference, the current phase of the cycle should resemble the early 2020 period, characterized by gradually increasing prices followed by a sudden crash triggered by an unexpected event before ultimately continuing their upward trend.

It's worth considering that our timeline may be advancing at an accelerated pace. Specifically, we could be closer to the late 2020 stage of the crypto market cycle, irrespective of the introduction of Bitcoin ETFs. With two completed crypto cycles (2017 and 2021) under their belts, millions of individuals are now familiar with the narrative and its subsequent developments.

Source: Bitcoin News on X

The impact is that we won't have to wait 12 months for the altcoin season to begin like we did in 2020. Instead, it could start in just a few months. However, this is based on the assumption that we're on an accelerated timeline. It's possible that cryptocurrency is still following the same schedule, which means we might be ahead of schedule for alt season.

Which Altcoins Should Be Monitored

Which altcoins should you watch this season? I concur with Coinbureau that it might be ideal to start building up your portfolio if we are in the early stages of the altcoin season. However, it's essential to note that this is not financial advice, and it's equally possible it's not the best time to do so.

Coinbureau analysts suggest that the altcoins you must watch this season will be the most accessible to retail investors. As mentioned earlier, EU regulations and, consequently, the structure of the crypto market will ensure that most retail investing will take place on onshore exchanges like Coinbase. In light of this potential scenario, focusing on altcoins listed on Coinbase may be prudent.

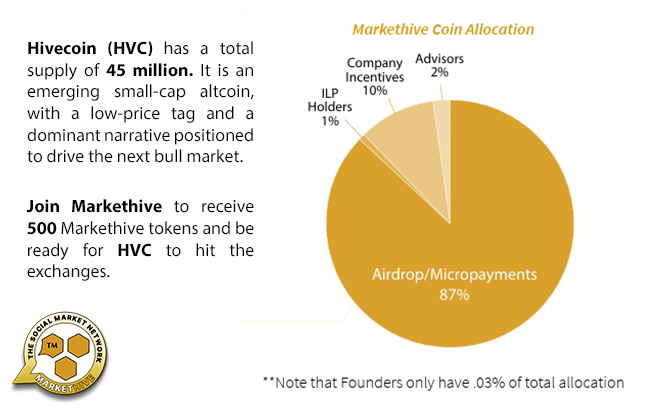

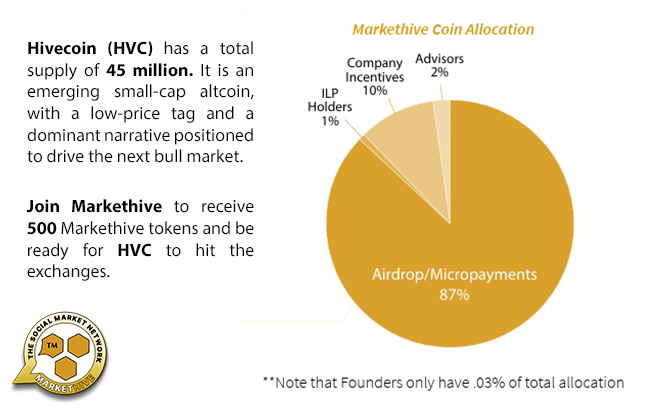

This is connected to a previous point about market capitalization. The higher the market cap, the lower the risk and the potential reward. The smaller the market cap, the bigger the risk, but the bigger the reward. Selecting a cryptocurrency with a lower price tag may also be advantageous. Many individual investors assume that a lower price indicates the possibility of more significant price increases, but the market cap is the most important. Therefore, by choosing a low price and market cap cryptocurrency, you can establish some solid fundamentals, often referred to by some influencers as "pumpamentals."

While being listed on Coinbase and having a low price point and market capitalization can benefit an altcoin, more is needed to guarantee success. For an altcoin to truly thrive, it must fit into a broader, bullish narrative that resonates with the average retail investor. This article explores the dominant narratives likely to drive the next bull market.

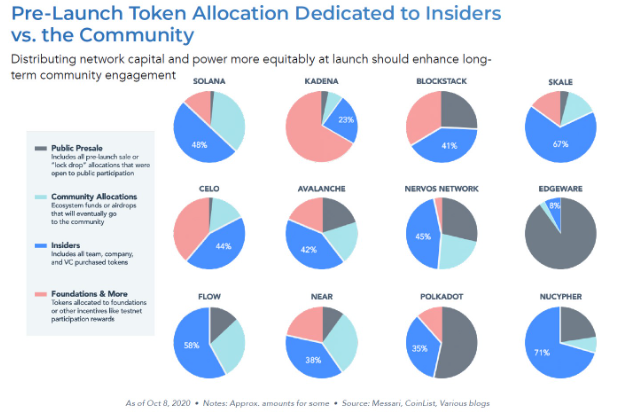

Image: Markethive.com

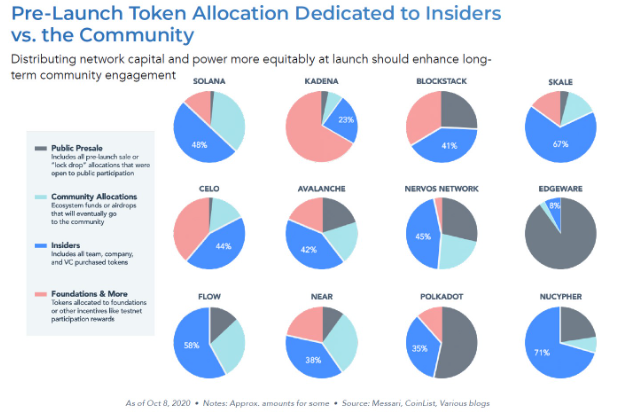

Researching the tokenomics of the crypto you want to invest in is vital to ensure it is genuine and has maximum potential. This involves examining the future circulation of coins or tokens, as you wouldn't want to invest in a promising altcoin only to face a sudden sell-off by the developers and their venture capital supporters. Also, you need to select a smart contract cryptocurrency on which the most promising tokens are trading.

Image: Cointelegraph

It is essential to understand that holding onto a promising altcoin for a longer term could be beneficial if you enter the market at the right time. Numerous cryptocurrency enthusiasts can confirm that they would have been equally successful today if they had kept their altcoins during the market downturn. Cryptocurrency, at its core, is designed to revolutionize various systems, so it's important to have a long-term perspective on your investments.

Although many of these systems and their associated projects may fail, a few will endure. The ones that survive have the potential to become extremely valuable, possibly even worth trillions of dollars in the future, much like Bitcoin, which is currently valued at over $1 trillion. It is crucial to note that BTC boasts the lengthiest and most proven track record among all coins and tokens, rendering it the most secure cryptocurrency to retain in comparison.

Other cryptos will more than likely someday achieve the same safe haven status as BTC, so considering all the key indicators along with a crypto’s community, utility and purpose, ecosystem, and solutions it offers in the spectrum, it shouldn’t be too hard to work out which ones to watch out for. For that large-cap security, you might want to consider investing in the original cryptocurrency that has the potential to become the global reserve currency.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

(2).jpeg)