The gold price is up nearly 19% in this rally, but you haven’t seen anything yet – abrdn’s Robert Minter

Although Western investors continue to ignore gold even as prices continue to hit record highs, they are no longer actively getting in the way of higher prices, which means the current rally has legs to run higher, according to one market analyst.

In an interview with Kitco News, Robert Minter, Director Of Investment Strategy at abrdn, said that gold’s rally to record highs above $2,350 an ounce is just getting started, and it's only a matter of time before retail investors jump into gold-backed exchange-traded funds to kick off the next major leg higher.

Minter’s comments come as abrdn celebrates a significant milestone with its gold-backed ETF. Last week, assets under management in abrdn Physical Gold Shares ETF (NYSE: SGOL) surpassed $3 billion for the first time.

Although investment demand remains somewhat lukewarm, Minter said gold investors should be content that at least the selling has stopped.

Minter explained that since April 2022, ETF investors have sold around 750 tonnes of gold, creating a massive supply in the marketplace that was met with two years of historic demand from central banks.

Minter pointed out that central bank demand hasn’t gone away; however, the supply of gold has dried up as ETF selling has slowed to a trickle. Although central bank gold buying has slowed in recent weeks, Minter said the overall trend in official purchases remains higher.

“If you were a prudent central bank fund manager in some of these countries, you would diversify away from the dollar to reduce your risk, plain and simple,” he said.

However, the broader question remains: when will Western investors embrace gold again? Minter said that he expects Western investors are waiting for an actual rate cut from the Federal Reserve.

Despite new insight from a bevy of central bankers last week, the Federal Reserve has remained somewhat coy on the start of the next easing cycle. Some monetary policy committee members have said they would be reluctant to cut interest rates as inflation remains elevated.

While the timing of the Federal Reserve’s easing cycle remains a moving target, Minter said that there is no question that interest rates will have to come down.

With credit card debt at record highs, insurance premiums rising across the board, and government debt growing out of control, the U.S. economy can’t afford to keep interest rates in restrictive territory much longer, Minter said.

“The Fed has made enough mistakes in the last three years that I think they're very cautious not to make another,” he said. “If you were the Chair, you would have to know the impact of the magnitude of the rate rises you've done in a short time will have on the economy. This kind of monetary policy usually breaks something in the economy on a structural level, and you have to play catch up really quickly. You certainly wouldn't risk much higher unemployment just to bring housing inflation down a few tenths of a percent.”

Even if the Fed holds rates unchanged through the summer, Minter said that he still expects to see rate cuts and the start of a new easing cycle before the end of the year.

Since holding support at $2,000 in early February, gold prices have rallied nearly 19%, with prices hitting a new intraday-day at $2372.50 an ounce early Monday. However, Minter said there is still significant value in the gold market even after this rally.

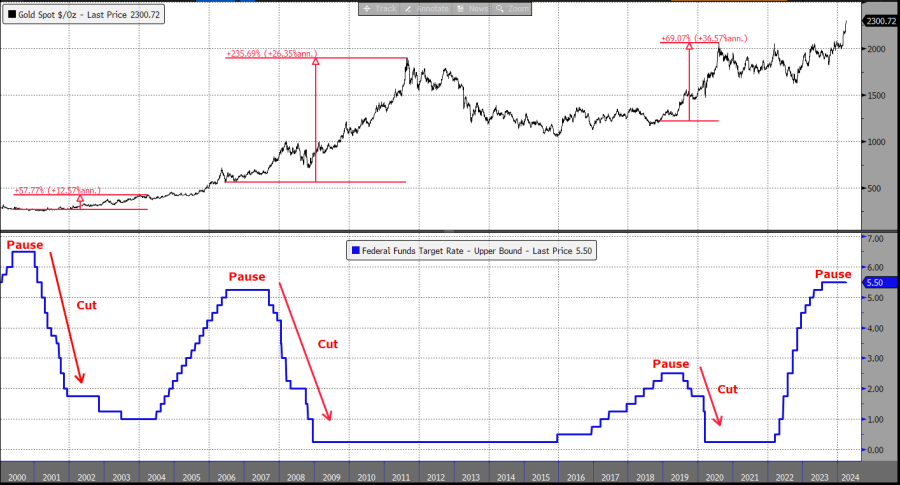

“Regardless of timing or magnitude, the next Fed funds move is a cut, and historically, that led to 57%, 235%, and 69% gold price increases in 2000, 2006, and 2018,” he said. “Even with prices up 18%, we haven’t seen anything yet.”

Kitco Media

Neils Christensen

Tim Moseley