Marketing Survival 101: Navigating 2024's Shifting Trends and Tools

Marketing is an ever-changing industry that requires businesses to stay ahead of the curve to remain competitive. As we approach 2024, there are several trends and tools that marketers should be aware of to survive in the industry. With the evolution of marketing, staying up-to-date with the latest marketing trends and tools is essential for businesses to maintain a competitive edge.

Understanding the 2024 marketing trends is crucial for businesses to build effective marketing strategies. Digital marketing tools are expected to become more complex and sophisticated, making it essential for businesses to adapt to these changes. The role of AI in marketing is also expected to grow, with businesses leveraging AI to improve customer experience and drive sales. Building trust and authenticity with customers will also be essential for businesses to succeed in 2024 and beyond.

Key Takeaways

- Staying up-to-date with the latest marketing trends and tools is crucial for businesses to maintain a competitive edge.

- Digital marketing tools are expected to become more complex and sophisticated in 2024.

- Building trust and authenticity with customers will be essential for businesses to succeed in 2024 and beyond.

The Evolution of Marketing

Marketing has come a long way since its inception, and it continues to evolve rapidly. With the advent of digital technology, marketing has shifted from physical to digital. This shift has brought about a significant change in the way businesses interact with their customers. The incorporation of AI and machine learning has further revolutionized marketing, making it more efficient and effective. The emergence of the metaverse has added a new dimension to marketing, creating new opportunities for businesses to engage with their customers.

The Shift from Physical to Digital

The shift from physical to digital has been one of the most significant changes in marketing. With the rise of the internet and social media, businesses can now reach a global audience with ease. Digital marketing has become an essential part of any marketing strategy, and businesses that fail to adapt to this shift risk falling behind.

Digital marketing encompasses a wide range of activities, including search engine optimization (SEO), social media marketing, email marketing, and content marketing. Businesses must have a strong online presence to succeed in today's digital age.

Incorporation of AI and Machine Learning

The incorporation of AI and machine learning has revolutionized marketing, making it more efficient and effective. AI-powered tools can analyze vast amounts of data, providing businesses with valuable insights into their customers' behavior and preferences. This information can be used to create personalized marketing campaigns that resonate with customers.

Machine learning algorithms can also be used to optimize marketing campaigns in real-time. For example, if an ad campaign is not performing well, the algorithm can automatically adjust the targeting parameters to improve its performance.

Emergence of the Metaverse

The emergence of the metaverse has added a new dimension to marketing. The metaverse is a virtual world that is created by the convergence of physical and digital realities. It allows businesses to create immersive experiences for their customers, enabling them to interact with products and services in a virtual environment.

Virtual reality (VR) and augmented reality (AR) technologies are key components of the metaverse. These technologies can be used to create virtual showrooms, product demos, and other interactive experiences that engage customers in new and exciting ways.

In conclusion, marketing continues to evolve rapidly, driven by digital transformation, AI and machine learning, and the emergence of the metaverse. Businesses must adapt to these changes to remain competitive in today's marketplace. By embracing these new technologies and trends, businesses can create more effective marketing campaigns that resonate with their customers.

Understanding the 2024 Marketing Trends

As the world becomes more digitally-focused, marketing trends are shifting to keep up with the changing times. In 2024, businesses will need to stay ahead of the curve to remain competitive. Here are some of the top marketing trends to watch out for in 2024.

Predictive Analytics and Data-driven Decisions

Predictive analytics is a tool that uses data, statistical algorithms, and machine learning techniques to identify the likelihood of future outcomes based on historical data. In 2024, businesses will increasingly rely on predictive analytics to make data-driven decisions. By analyzing data from various sources, businesses can predict customer behavior and preferences, identify trends, and make informed decisions about marketing strategies.

Personalization and Customization

Personalization and customization will continue to be important in 2024. Customers expect personalized experiences, and businesses that fail to deliver will be left behind. In 2024, businesses will use data to personalize marketing messages, product recommendations, and customer experiences. Personalization will go beyond just using a customer's name in an email. Instead, businesses will use data to personalize every aspect of the customer experience, from product recommendations to customer support.

Conversational Marketing and Chatbots

Conversational marketing is a two-way dialogue between a brand and a customer that takes place in real-time. In 2024, businesses will increasingly use chatbots and other conversational marketing tools to engage with customers. Chatbots can help businesses provide personalized customer support, answer frequently asked questions, and even make product recommendations. As chatbots become more sophisticated, they will be able to handle more complex interactions, such as booking appointments or placing orders.

In conclusion, businesses that stay on top of these marketing trends in 2024 will be better equipped to succeed in the digital age. By using predictive analytics, personalization, and conversational marketing, businesses can create more engaging and effective marketing strategies that resonate with their target audience.

Digital Marketing Tools for 2024

Digital marketing is constantly evolving, and 2024 is no exception. As businesses strive to stay ahead of the competition, they need to keep up with the latest trends and tools. Here are some digital marketing tools that will be essential in 2024.

SEO and Long-tail Keywords

Search engine optimization (SEO) is still one of the most important digital marketing tools. In 2024, businesses will need to focus on long-tail keywords to improve their SEO. Long-tail keywords are longer and more specific phrases that people use to search for something. They are more targeted and have less competition than short-tail keywords. Businesses that use long-tail keywords will have a better chance of ranking higher in search engine results pages (SERPs).

Programmatic Advertising

Programmatic advertising is an automated way of buying and selling digital advertising. In 2024, programmatic advertising will become even more important as businesses look for more efficient ways to reach their target audience. With programmatic advertising, businesses can target specific demographics, interests, and behaviors. This means they can deliver more relevant ads to the right people at the right time.

Social Media Platforms

Social media platforms will continue to be an essential digital marketing tool in 2024. Facebook, Twitter, LinkedIn, YouTube, and TikTok are just a few of the platforms that businesses can use to reach their target audience. In 2024, businesses will need to focus on creating more engaging and interactive content to stand out on social media. This could include live videos, stories, and user-generated content.

In conclusion, digital marketing tools are constantly evolving, and businesses need to keep up with the latest trends to stay ahead of the competition. In 2024, businesses will need to focus on SEO and long-tail keywords, programmatic advertising, and social media platforms to reach their target audience. By using these tools effectively, businesses can improve their digital marketing strategy and achieve their goals.

The Role of AI in Marketing

Artificial Intelligence (AI) has been making waves in the marketing industry in recent years. As technology continues to evolve, AI is becoming an increasingly important tool for marketers looking to stay ahead of the curve. In this section, we will explore the various ways in which AI is being used in marketing, including customer engagement, marketing operations, and generative AI in content creation.

AI in Customer Engagement

One of the most significant benefits of AI in marketing is its ability to enhance customer engagement. Chatbots, for example, are becoming increasingly popular as a way to provide customers with instant support and assistance. By using Natural Language Processing (NLP), chatbots can understand and respond to customer queries in real-time, providing a seamless customer experience.

Another way in which AI is being used in customer engagement is through personalized recommendations. By using machine learning algorithms, marketers can analyze customer data to identify patterns and preferences, allowing them to provide personalized recommendations and offers to individual customers.

AI in Marketing Operations

AI is also being used to streamline marketing operations, making it easier for marketers to manage campaigns and track performance. For example, AI-powered tools can analyze data from multiple sources, including social media, email, and website analytics, to provide insights into customer behavior and campaign performance. This allows marketers to make data-driven decisions and optimize their campaigns for maximum impact.

Generative AI in Content Creation

Finally, generative AI is being used in content creation to automate the process of creating high-quality content. For example, ChatGPT is an AI-powered tool that can generate human-like text based on a given prompt. This can be used to create blog posts, social media content, and other types of marketing materials, saving marketers time and resources.

Overall, AI is becoming an increasingly important tool for marketers looking to stay ahead of the curve. By leveraging the power of AI in customer engagement, marketing operations, and content creation, marketers can improve their campaigns' performance and provide a better customer experience.

Building Trust and Authenticity

In 2024, building trust and authenticity will continue to be important in marketing strategies. Consumers are becoming increasingly wary of companies that do not prioritize transparency and authenticity. Companies that prioritize these values will be more successful in building long-term relationships with their customers.

Transparency in Data Use

One of the ways companies can build trust with their customers is by being transparent about how they use customer data. Customers want to know what data is being collected, how it is being used, and who has access to it. Companies that are transparent about their data use are more likely to build trust with their customers.

To achieve transparency in data use, companies should consider creating a privacy policy that clearly outlines their data collection and usage practices. They should also ensure that customers have control over their data by providing options to opt-out of data collection and allowing customers to access, modify, or delete their data.

Real-time and Engaging Content

In 2024, real-time and engaging content will be crucial in building authenticity with customers. Customers want to feel connected to the brands they support, and real-time content can help companies build that connection.

Real-time content can include live streams, social media updates, and interactive content. By providing real-time content, companies can show customers that they are listening and responding to their needs.

Engaging content is also important in building authenticity. Companies that provide content that is informative, entertaining, or useful to their customers are more likely to build trust and loyalty. Engaging content can include blog posts, videos, infographics, and more.

Overall, building trust and authenticity will continue to be important in marketing strategies in 2024. Companies that prioritize transparency, real-time content, and engaging content will be more successful in building long-term relationships with their customers.

Marketing Strategies for Business Resilience

In today's constantly changing business environment, companies must have marketing strategies that can withstand economic downturns, emerging trends, and shifting consumer behaviors. Here are some effective marketing strategies that businesses can adopt to build resilience:

Targeting and Lead Generation

One of the most effective ways to build resilience is by targeting the right audience and generating high-quality leads. Companies can achieve this by understanding their customers' needs and preferences, segmenting their audience, and creating personalized marketing messages that resonate with their target audience. This approach not only helps companies attract and retain customers but also helps them optimize their marketing spend and improve their ROI.

Investment in Digital Transformation

Investing in digital transformation is another key strategy for building business resilience. Companies that embrace digital technologies can improve their operational efficiency, enhance their customer experience, and gain a competitive advantage. This includes investing in tools such as customer relationship management (CRM) software, marketing automation platforms, and data analytics tools. By leveraging these tools, companies can gain valuable insights about their customers, optimize their marketing campaigns, and improve their overall business performance.

Adapting to Emerging Trends

Adapting to emerging trends is also crucial for building business resilience. Companies that keep up with the latest trends and technologies can better anticipate changes in the market and adjust their marketing strategies accordingly. This includes staying up-to-date with emerging technologies such as artificial intelligence (AI), voice search, and augmented reality (AR). By embracing these trends, companies can create innovative marketing campaigns that capture the attention of their target audience and drive business growth.

In summary, building business resilience requires a combination of effective marketing strategies, investment in digital transformation, and adaptation to emerging trends. By adopting these strategies, companies can build a strong foundation for growth, even in the face of economic uncertainty and shifting consumer behaviors.

Conclusion

In conclusion, businesses must adapt to the shifting marketing trends and tools to ensure success in 2024. Marketing strategies must be tailored to meet the needs of the target audience and align with the latest business trends. Digital marketing strategy is crucial in today's world, and companies must embrace new technologies and platforms to stay ahead of the competition.

To survive in 2024, companies must focus on providing value to their customers through personalized experiences and relevant content. They must also keep up with the latest trends in video content, social media marketing, and cookie-less tracking.

In summary, the key to success lies in being flexible and agile in adapting to the changing marketing landscape. With the right marketing strategies and tools, businesses can thrive in 2024 and beyond.

Frequently Asked Questions

What are the predicted macro trends for marketing in 2024?

According to industry experts, the macro trends that are expected to shape the marketing landscape in 2024 include the rise of artificial intelligence (AI), the increasing importance of personalization, the growing influence of social media, and the emergence of new technologies such as augmented reality (AR) and virtual reality (VR).

What are the global marketing trends for 2024?

Global marketing trends for 2024 include a focus on sustainability and environmental responsibility, the importance of mobile-first strategies, and the growing role of voice search and smart speakers. Additionally, marketers are expected to continue to prioritize social media and influencer marketing as key channels for reaching consumers.

What are the top business trends that will impact marketing in 2024?

In 2024, businesses are expected to prioritize customer experience and brand purpose, with an emphasis on building trust and establishing long-term relationships with customers. Additionally, businesses are expected to embrace new technologies and data-driven approaches to marketing, with a focus on delivering personalized experiences across all channels.

What are the predicted design trends for marketing in 2024?

Design trends for marketing in 2024 are expected to include a continued focus on minimalism and simplicity, with an emphasis on bold typography and bright colors. Additionally, designers are expected to incorporate more animation and interactive elements into their designs, as well as embrace new technologies such as AR and VR to create immersive experiences.

What are the top digital marketing trends for 2024?

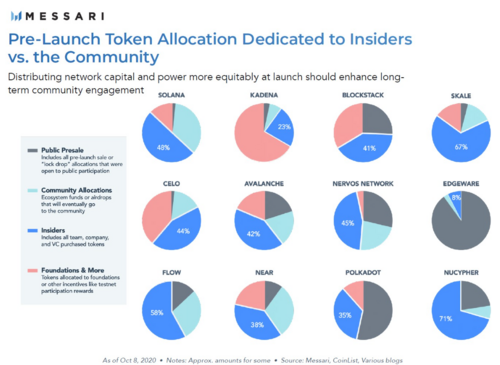

Digital marketing trends for 2024 include the continued growth of social media and influencer marketing, the increasing importance of voice search and smart speakers, and the emergence of new technologies such as blockchain and AI. Additionally, marketers are expected to prioritize mobile-first strategies and personalized experiences across all channels.

What are the predicted LinkedIn trends for marketing in 2024?

LinkedIn trends for marketing in 2024 include a focus on building thought leadership and establishing credibility through content marketing and thought-provoking discussions. Additionally, marketers are expected to embrace new LinkedIn features such as LinkedIn Live and LinkedIn Stories to create more engaging and interactive content for their audiences.

Tim Moseley

.png)

.gif) September sell-off presents buying opportunity for gold investors – WGC

September sell-off presents buying opportunity for gold investors – WGC