The Truth and Lies About Making Money Online: Discerning Fact from Fiction

The internet has opened up a vast array of opportunities to make money online, creating a landscape where the lines between truth and myth often blur. On one hand, stories of successful digital entrepreneurs and freelancers seem to promise endless potential for wealth and autonomy. Yet, on the other hand, the web is rife with misleading information and schemes that overpromise and underdeliver. Understanding this digital terrain requires a discerning eye and solid knowledge of what truly works in the realm of online income.

The Truth and Lies About Making Money Online: Discerning Fact from Fiction To navigate the online money-making landscape effectively, it’s essential to identify realistic avenues and set oneself up for success. This means starting with legitimate freelancing platforms, exploring the ins and outs of blogging and content creation, tapping into the potential of ecommerce, and leveraging social media for influence. Additionally, online education and scalable ventures offer solid pathways for generating income. It’s crucial to recognize that while the internet is teeming with possibilities, not every opportunity is suitable for everyone, and success typically demands hard work, dedication, and a strategic approach.

KEY TAKEAWAYS THE TRUTH AND LIES ABOUT MAKING MONEY ONLINE:

- Success in making money online requires careful navigation and understanding of the digital landscape.

- There are diverse pathways to online income, including freelancing, content creation, and e-commerce.

- A strategic approach and avoidance of scams are essential for sustained online financial growth.

UNDERSTANDING THE ONLINE MONEY-MAKING LANDSCAPE

In examining the online money-making landscape, it’s crucial to recognize the diversity of income streams and distinguish the genuine opportunities from prevalent misconceptions. This section explores the various types of online income, the integral role of the internet in business, and the truth behind common myths about earning money online.

EXPLORING TYPES OF ONLINE INCOME

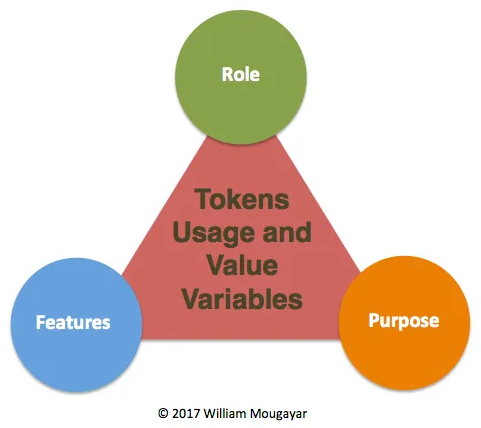

Online income can be classified into several categories, each with its unique characteristics and requirements. Freelancing has emerged as a dominant form because individuals leverage their skills directly to clients through platforms like Upwork or Fiverr. Another form is affiliate marketing, where one earns commission by promoting products or services. Exhibit A of diverse income opportunities is a guide highlighting ways to make money, which includes a list of viable online activities.

THE ROLE OF THE INTERNET IN MODERN BUSINESS

In today’s digital age, the internet serves as an indispensable tool for business operations, marketing, and customer engagement. Companies use the internet to reach a global audience, refine their marketing strategies using data analytics, and operate e-commerce platforms. The internet has also made it possible for individuals to establish businesses with minimal overhead costs, as exemplified by a slew of successful online entrepreneurs who have embraced modern business strategies.

SEPARATING MYTHS FROM REALITY THE TRUTH AND LIES ABOUT MAKING MONEY ONLINE:

While many believe that making money online is effortless, the reality is far more nuanced. True, opportunities for passive income exist, such as dividend stocks or rental profits from real estate investments; however, these usually require substantial upfront investment or previous assets. Contrary to the myth that profits come easily, genuine online income strategies often require hard work, persistence, and a realistic approach to what can be achieved. It’s important to approach such endeavors with a discerning eye and realistic expectations.

SETTING UP FOR SUCCESS

To effectively navigate the online money-making landscape, individuals must adopt proper strategies, deep dive into their intrinsic skills, and carve a distinct personal brand. This foundation is critical for long-term sustainability and true success in the digital realm.

DEVELOPING A BUSINESS MINDSET

- Key Element: Strategy

- Primary Goal: Foster Resilience and Adaptability

Success starts with the right mindset. This involves thinking strategically, much like a seasoned chess player anticipating moves ahead. It’s about understanding the value of patience and resilience. Developing a business mindset means learning from setbacks and constantly seeking new ways to improve one’s approach to online endeavors.

IDENTIFYING MARKETABLE SKILLS THE TRUTH AND LIES ABOUT MAKING MONEY ONLINE:

- Core Assets: Skills & Unique Product Offerings

- Marketing Relevance: High

One should meticulously assess their skills and experience to identify those that are most marketable online. It may involve:

- Technical Skills: Web development, graphic design, data analysis.

- Creative Skills: Writing, social media content creation, video production.

By aligning these skills with current market demands, individuals can create a unique product or service offering, setting the stage for a successful online income stream.

BUILDING A PERSONAL BRAND ONLINE

- Focus: Recognition & Trust

- Marketing Integration: Essential

Building a personal brand requires a strategic marketing approach. One should:

- Craft a cohesive online presence across platforms.

- Engage with their audience consistently to build trust.

This creates a reputation that acts as a badge of trust and authenticity, positioning them as a go-to authority in their niche.

STARTING WITH FREELANCING PLATFORMS

Before venturing into the world of online freelance work, understanding the nuances of different platforms is crucial for success. Each offers unique opportunities, from securing gigs to building client relationships.

UTILIZING UPWORK FOR FREELANCE WORK

Upwork stands out as a leading platform where freelancers can connect with potential clients looking for diverse services. It operates on a bidding system, where freelancers submit proposals for jobs that match their skills. Clients peruse these proposals and select the freelancer they believe is most suited for their project. A robust profile and a compelling pitch are essential for catching the attention of clients on Upwork.

FINDING GIGS ON FIVERR

Fiverr offers a twist on the freelance marketplace model, allowing freelancers to create specific “gigs” that clients can purchase directly. This approach to freelance services streamlines the process for both parties. Freelancers can set their prices and package details, while clients can easily browse offerings to find what fits their needs. Standing out on Fiverr requires a focused presentation of one’s services and the savvy to market them effectively.

EXPLORING ADDITIONAL FREELANCING OPTIONS

Apart from Upwork and Fiverr, there are other platforms worth exploring. Freelancer.com is another popular site that caters to a global clientele and offers a wide array of job categories. For language professionals, Gengo is a platform specialized in translation work. Diversifying one’s presence across various platforms can increase the chances of finding freelance work and building a broad clientele. Freelancers should research each platform’s strengths and align them with their skills and goals.

BLOGGING AND CONTENT CREATION

In the realm of making money online, blogging and content creation stand out as versatile platforms for building a digital presence and generating income. They provide a means for individuals to share expertise, build communities, and monetize their content through various channels.

STARTING A NICHE BLOG

When initiating a blog, selecting a niche is critical. A focused niche allows a blogger to cater to a specific audience, enhancing the chances of attracting dedicated followers. For instance, blogs concentrating on personal finance or health often find more monetization opportunities than those with a broader subject matter. As seen in the narrative by Margaret Bourne, the complexity of making money from blogging is understated, yet attainable with the right strategy.

EXPANDING INFLUENCE WITH A YOUTUBE CHANNEL

Content creators who extend their digital footprint to a YouTube channel stand to increase their influence substantially. A channel serves as a visual extension of a blog, potentially capturing a larger audience with engaging multimedia content. It’s a platform where creators can share their expertise in a manner that appeals to those who prefer watching over reading.

MONETIZING THROUGH AFFILIATE MARKETING

Affiliate marketing is a prominent method for bloggers and YouTubers to earn revenue. By integrating affiliate links within blog posts or video descriptions, content creators receive a commission for products or services sold through those links. The credibility and relevance of the recommended products are crucial, as underscored by a guide from Ahrefs, which emphasizes the need for aligning affiliate products with the creator’s niche and audience interests.

ECOMMERCE AND ONLINE STORES

Ecommerce has revolutionized the way individuals sell products and services online. With a myriad of options available, one can embark on an online venture with varying levels of investment and technical expertise.

DEVELOPING AN ONLINE BUSINESS MODEL

The cornerstone of any successful ecommerce venture is a robust online business model. This involves identifying a target audience, setting up a user-friendly online store, and establishing a clear value proposition. It is imperative to align business operations with consumer needs and incorporate efficient logistics to streamline the purchasing process.

DROPSHIPPING: A LOW-INVESTMENT METHOD

Dropshipping stands out for its appeal to entrepreneurs looking to enter ecommerce with minimal upfront investment. In this model, one can run an online store without maintaining inventory. The store acts as an intermediary, taking orders from customers and passing them to suppliers who handle fulfillment. This method reduces risk but requires diligence in selecting reliable suppliers to ensure product quality and delivery standards.

SELLING UNIQUE PRODUCTS ON ETSY

For those with a creative flair, Etsy offers a platform to sell unique products to a global audience. Sellers on Etsy cater to consumers seeking handmade and vintage items, setting up storefronts to showcase their distinctive goods. Success on Etsy demands not just a unique product offering, but also an understanding of how to optimize product listings to attract and retain customers.

SOCIAL MEDIA AND INFLUENCING

In the fast-paced realm of social media, influencers have established lucrative careers through platforms such as Instagram and TikTok, harnessing the power of visual and interactive content. By partnering with companies, influencers generate substantial advertising revenue, shaping consumer behavior and driving online sales.

MAKING AN IMPACT WITH INSTAGRAM

Instagram stands out as a visual platform where influencers can reach millions with striking images and compelling stories. They curate their feeds to showcase a lifestyle or expertise, attracting followers and companies keen on tapping into their engaged audience. A well-crafted Instagram presence not only bolsters credibility but also opens doors to advertising revenue through sponsored posts and affiliate marketing.

CREATING VIRAL CONTENT ON TIKTOK

TikTok’s algorithm favors creativity and authenticity, making it an ideal platform for crafting viral content. With its short-form video format, influencers can rapidly gain visibility by generating content that resonates with the zeitgeist of the platform. This can rapidly amass a following eager to consume and interact with content, making TikTok a powerful tool for influencer marketing.

COLLABORATING WITH COMPANIES AS AN INFLUENCER

Influencers and companies often enter into collaborations to market products or services to a targeted audience. Successful influencers negotiate deals where they receive payment or commissions in exchange for featuring a product, thus creating a symbiotic relationship. This partnership is predicated on the influencer’s ability to authentically integrate the promoted items into their content to avoid alienating their audience.

ONLINE EDUCATION AND TUTORING

In the realm of digital earnings, online education and tutoring have emerged as leading methods for individuals to monetize their knowledge and marketable skills. They provide flexible avenues for educating others while also generating revenue.

TEACHING SKILLS THROUGH ONLINE COURSES

Creating and selling online courses can be a lucrative venture for experts in a particular field. Platforms like Udemy allow individuals to design their own coursework and reach a global audience eager to learn. Those looking to teach should aim to create comprehensive, high-quality courses that deliver value to their students. This often involves:

- Structuring the course into digestible segments

- Including interactive elements like quizzes

- Providing additional resources like downloadable materials

Courses that offer practical, actionable skills tend to perform better as they cater to the learners’ desire to gain abilities that are immediately applicable.

BECOMING A TUTOR ON PLATFORMS LIKE TUTOR.COM

For one-on-one instruction, tutoring presents a personalized option. Websites such as Tutor.com serve as platforms where tutors can connect with students needing help in specific subject areas. Success in online tutoring is driven by:

- Expertise: Tutors must have a strong command of the subject they wish to teach.

- Communication: Tutors need to convey complex concepts in a way that is easy to understand.

- Reliability: Consistency in scheduling and quality of teaching fosters trust and encourages recurring sessions.

Dedicated tutors often build a reputation that can lead to a steady stream of clients and, consequently, a stable online income.

INVESTMENTS AND SCALABLE VENTURES THE TRUTH AND LIES ABOUT MAKING MONEY ONLINE:

When it comes to making money online, investment often plays a crucial role in starting and scaling business ventures. Scalability and sound money management are fundamental to transitioning from a modest side hustle to generating six-figure revenues.

STARTING WITH A SIDE HUSTLE

Establishing a side hustle online requires both an initial investment and consistent hard work. One begins by identifying a niche market underpinned by a strong demand that they can cater to, often while managing other professional or personal responsibilities. Investment takes the form of both time and often, a modest amount of capital to set up the infrastructure necessary for the hustle to grow—be it a blog, an e-commerce platform, or a freelance service. Perseverance plays a key role as most side hustles do not turn profitable immediately; they require dedication and continuous improvement.

SCALING TO SIX FIGURES AND BEYOND

Scaling a side hustle into a six-figure business is a testament to one’s ability to strategize and execute effective money management tactics. It involves expanding one’s customer base, streamlining operations, and often injecting additional capital for marketing and product development. Achieving revenue in the six figures typically doesn’t happen overnight. It involves careful planning, the willingness to reinvest back into the business, and maintaining the perseverance to overcome challenges. Scalable ventures particularly benefit from automation, staff expansion, and data-driven decision making to ensure sustainable growth.

AVOIDING ONLINE SCAMS

Engaging in online money-making ventures requires vigilance to sidestep scams and verify legitimate opportunities. Effective strategies include scrutinizing the veracity of reviews, understanding the role of luck versus skill, and recognizing the competitive nature of digital entrepreneurship.

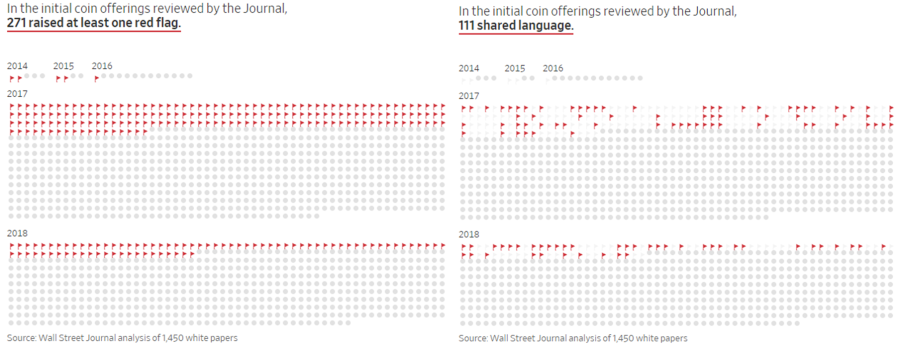

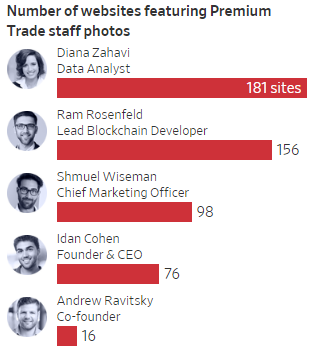

IDENTIFYING AND AVOIDING GET-RICH-QUICK SCHEMES

Get-rich-quick schemes often make extravagant promises of substantial profits with minimal effort or time. These fraudulent programs typically use high-pressure sales tactics and misleading testimonials.

- Warning Signs:

- Promises of high returns with little risk

- Aggressive marketing and urgency claims

- Lack of detailed company information

To protect oneself, individuals should:

- Research the company and offer thoroughly.

- Read reviews from multiple sources, looking for consistent patterns indicating potential problems.

- Beware of the role of luck; legitimate businesses are built on strategic planning and execution, not chance.

For further reading on avoiding these types of scams, visit FTC Consumer Advice.

ENSURING THE LEGITIMACY OF AN ONLINE BUSINESS

Determining an online business’s legitimacy is crucial before engaging in any financial transactions or investment of time.

- Verification Steps:

- Check for credible contact information and physical addresses.

- Seek out authentic and balanced customer reviews.

- Investigate the business on official consumer protection sites.

It’s advisable for individuals to:

- Understand the marketplace and competitive landscape; a legitimate business should have clear differentiators and value proposition.

- Document all transactions and communications for future reference.

An informative guide on safeguarding against internet scams can be found at Norton’s avoidance tips for 2024.

DIVERSIFYING INCOME STREAMS

Diversifying income streams is not just a strategy; it’s a necessary approach to maintain financial stability and growth. It involves expanding one’s earning potential beyond a single source, engaging in multiple ventures to secure a more robust and reliable income.

THE IMPORTANCE OF MULTIPLE REVENUE SOURCES

In the realm of online entrepreneurship, relying on a single source of income can be akin to walking a tightrope without a safety net. Multiple revenue sources not only provide a cushion against the unpredictability of the market but also open up opportunities for increased earnings. For instance, a blogger might not only rely on ad revenue, but also branch out to affiliate marketing, e-books sales, and online courses. This diversification helps mitigate risks and ensures that if one income stream falters, others can sustain their financial foundation.

BALANCING ACTIVE AND PASSIVE EARNING METHODS

Diversification should also strike a balance between active and passive earning methods. Active income requires one’s direct involvement, like providing services or selling goods. In contrast, passive income is the goal for many self-employed individuals because it generates revenue with minimal ongoing effort after the initial investment. Interest from savings, dividends from investments, or royalties from written works are examples of passive income which, while often requiring considerable upfront hard work and investment, can eventually lead to a more liberating financial life. Successful online entrepreneurs often combine both active and passive methods to build a comprehensive and resilient financial portfolio.

OPTIMIZING YOUR ONLINE PRESENCE TRUTH VS. MYTHS ABOUT MAKING MONEY ONLINE

Online businesses must prioritize their digital visibility to succeed. The process of making your website more attractive to search engines and users alike involves a strategic approach to SEO, site development, and community engagement.

LEVERAGING SEO AND ONLINE MARKETING THE TRUTH AND LIES ABOUT MAKING MONEY ONLINE:

Effective SEO ensures a website ranks well on search engines, increasing organic traffic. Businesses should focus on two aspects: on-site SEO which involves optimizing content and meta tags, and off-site SEO which includes building backlinks and online reputation. For online marketing, deploying targeted advertising campaigns on social media and search engines can significantly boost visibility and traffic.

BUILDING EFFECTIVE WEBSITES AND HOSTING

A website is the cornerstone of an online business. It should be user-friendly, fast, and mobile-responsive. Securing reliable hosting is crucial, as uptime and load time directly impact user experience and SEO ranking. Regular maintenance and securing a memorable domain name enhance website efficacy and brand recognition.

ENGAGING WITH CUSTOMERS AND BUILDING A COMMUNITY

An engaged community can transform the reach of an online business. This involves consistently interacting with customers through social media, forums, and email. It is essential to create content that resonates with the audience to encourage shares, comments, and engagement. Businesses should foster trust and loyalty, potentially turning each customer into a brand ambassador.

FREQUENTLY ASKED QUESTIONS TRUTH VS. MYTHS ABOUT MAKING MONEY ONLINE

This section addresses common inquiries about the reality of earning money online, including the success rates, legitimate methods, and how to sidestep usual pitfalls.

WHAT ARE LEGITIMATE METHODS FOR EARNING MONEY ONLINE?

Earning money online can be achieved through various reputable avenues such as freelancing, running an e-commerce store, blogging, affiliate marketing, or providing digital services like graphic design or writing.

CAN BEGINNERS GENUINELY MAKE A PROFIT THROUGH ONLINE VENTURES, AND HOW?

Yes, beginners can indeed make a profit online by choosing a method that aligns with their skills and learning how to effectively market those skills or products. Starting with a blog or an online shop, creating valuable content, and utilizing SEO can welcome success.

HOW MANY INDIVIDUALS SUCCESSFULLY GENERATE INCOME ON THE INTERNET?

Countless individuals earn money online, but success varies widely. Many create supplemental income, while others build substantial livelihoods. The exact number is fluid due to the ever-changing internet landscape and the varying definitions of “success.”

WHAT ARE COMMON MISCONCEPTIONS ABOUT EARNING MONEY ONLINE?

Misconceptions include believing that making money online is quick or easy, and that it requires no initial investment. The reality is that, like any business, it often requires time, effort, and perseverance.

WHY DO SOME PEOPLE FAIL TO MAKE MONEY ONLINE, AND HOW CAN THAT BE AVOIDED?

Failure can often be attributed to chasing quick-rich schemes or having unrealistic expectations about the effort required. Avoiding failure involves setting realistic goals, continuously learning and pivoting strategies based on results, and avoiding scams.

ARE THERE SECRET OR LESSER-KNOWN PLATFORMS THAT CAN BE LUCRATIVE FOR MAKING MONEY ONLINE?

While there are no secrets to success, emerging platforms or niche markets may offer opportunities for profit if recognized early. Staying informed about industry trends can lead to finding such lesser-known platforms before they become mainstream.

What is a legit way to make a $100 a day

Tim Moseley

.png)

.png)