Initial Coin Offerings: A Crypto Revolution. Whatever happened to the ICO?

Initial Coin Offerings (ICOs) gained immense popularity in 2017 and continued to thrive in 2018; however, they have become a bitter disappointment to many. Nowadays, alternative approaches for token offerings have become more favored due to various factors. A significant reason is that most ICOs have failed due to misdirection, hype, pump-and-dump manipulation, and even fraud. An ICO, which stands for Initial Coin Offering, is a method blockchain projects use to generate funds and introduce a new cryptocurrency.

On the surface, ICOs may seem similar to Initial Public Offerings (IPOs), where companies sell shares to the public on the stock market. Many consider ICOs the cryptocurrency industry's equivalent to IPOs, although this perception is arguably not entirely accurate.

While IPOs are closely monitored by regulatory bodies, Initial Coin Offerings (ICOs) enjoy relatively more freedom, with fewer formalities and documents required. This freedom, however, comes at a cost, as investors must conduct extensive due diligence to separate fact from fiction. Additionally, investing in crypto tokens through ICOs does not necessarily grant ownership in the company, unlike IPOs. The lack of regulation surrounding ICOs has led to some instances of non-compliance with federal securities laws, resulting in legal issues for specific tokens.

Many in the crypto industry would argue that it’s misguided to begin with a securities framework to govern the introduction of crypto tokens. This approach is incompatible and hinders the development of new business models arising from these token use cases.

Hence, it is essential to acknowledge that tokens can represent a unique category of assets, necessitating a dedicated legal and regulatory framework. Unlike the restrictive "security" label often applied by regulators, tokens do not always signify a personal financial stake or equity share in a larger entity. Instead, they serve as a novel proxy for our digital existence, which is constantly evolving.

ICOs Are Predominantly Speculation

In a token sale or Initial Coin Offering (ICO), a crypto startup sells its newly created digital tokens to raise funds for its future ecosystem. The startup's success depends on convincing potential investors of its concept or blueprint, showcasing credible engineers and a sound executive team. A key element of most coin offerings is a company’s “white paper,” a document that outlines the project's goals, technical specifications, and team credentials.

Hardly any ICOs, if at all, can claim to have a working product, service, or protocol in place when the token sale begins. The promise of delivering the intended utility or purpose for its token and future crypto-based ecosystem, coupled with exaggerated promises of profits to unsuspecting investors, has resulted in fraudulent schemes and even exit plans.

With the rise in popularity of utility tokens in 2017, scammers took advantage of the situation by creating fake ICOs. Numerous so-called tech companies managed to raise millions of dollars in the highly enthusiastic cryptocurrency market, employing misleading or dishonest methods to attract investors.

ICO Scams Prevalent

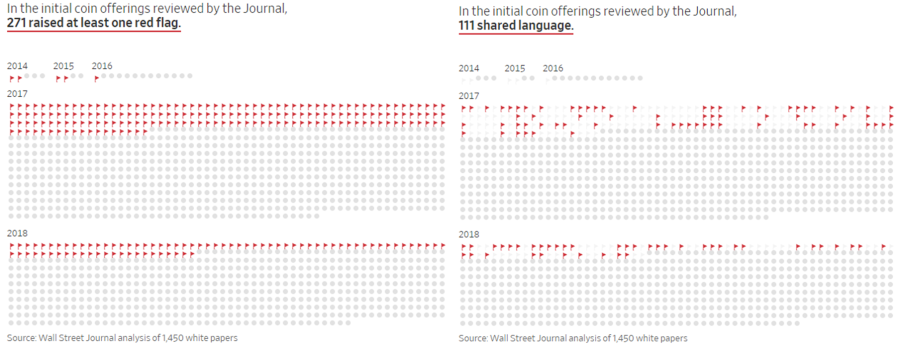

The Wall Street Journal reviewed 1,450 documents related to Initial Coin Offerings (ICOs) in 2018 and revealed several red flags in 271 instances. These red flags included plagiarized white papers, guarantees of returns, and absent or fabricated executive teams.

Investors have injected over $1 billion into 271 coin offerings that have raised red flags, per a review of company statements and online transaction records. Out of the 1,450 projects examined, which have primarily targeted English-speaking audiences since 2014, it’s claimed that they have collectively raised at least $5 billion. Research conducted by Satis Group, a firm specializing in data analysis, reveals that since 2017, cryptocurrency coin offerings have generated over $9 billion in overall proceeds worldwide.

Source: WSJ.com

A considerable number of projects, specifically 124, failed to provide any information regarding the personnel involved. Moreover, several projects listed team members who were either non-existent or real individuals unaware of their names being used. Additionally, 111 projects were found to have copied entire sections verbatim from other white papers, including descriptions of marketing strategies, security concerns, and technical details, such as database interaction methods for other developers.

Source: WSJ.com

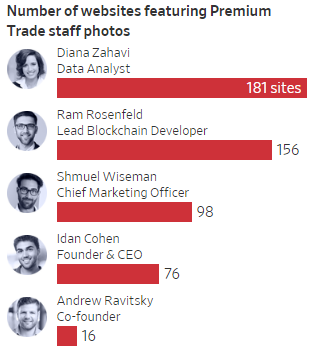

Furthermore, it was discovered that several projects completed their white papers or websites by incorporating executive pictures taken directly from online stock photography or other platforms, such as LinkedIn. One of the most notable examples is Premium Trade, an investment startup. The images of its executive team, consisting of five members, were discovered to be used on almost 500 unrelated websites simultaneously. Interestingly, Premium's co-founder Andrew Ravitsky was also identified as "Dr. John Watsan" in an online cardiology course.

The Premium Trade website portrayed CEO Idan Cohen as an "experienced entrepreneur," but the depiction of Mr. Cohen is indeed Eduardo Carillo, a close acquaintance of the photographer. The images that supposedly depicted Premium Trade's executive team of five members were probably purchased from stock photography websites. In many instances, the photos used by Premium Trade are of individuals who have been seen on various other websites across the Internet.

.png)

Source: Wall Street Journal analysis of Google Image Search results

Photos: Designed by Freepik (stock images)

Premium Trade website (screenshot)

The United States has shown skepticism towards initial coin offerings (ICOs), regardless of their legitimacy. A primary concern is the lack of regulatory oversight, which makes it easy for inexperienced investors to get caught up in fraudulent schemes. The Securities and Exchange Commission (SEC) has issued warnings to investors, citing that many cryptocurrency deals in the private market may violate securities laws. To illustrate this point, the SEC created a fake coin offering website as an example of what to avoid.

As a result of this negative perception of ICOs, Initial Exchange Offerings (IEOs) and Security Token Offerings (STOs) have recently gained popularity as alternatives—more about these in an upcoming article.

Token Utility Is Of Utmost Importance To ICO Startups

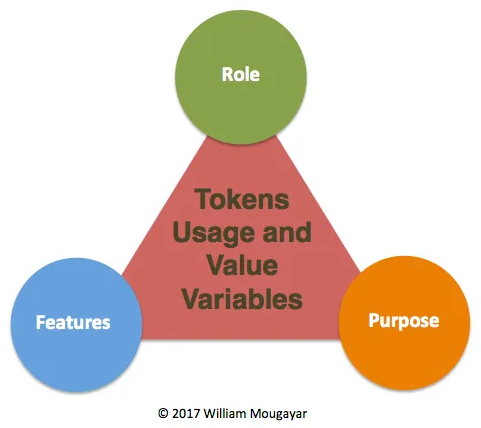

Source: William Mougayar

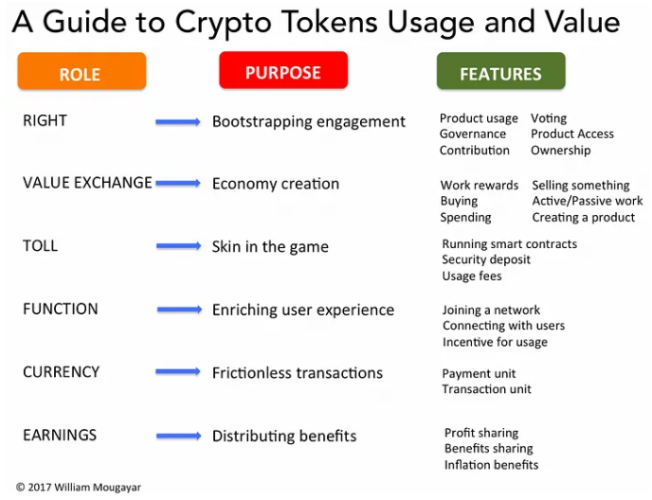

Apart from the outright scams, most ICOs fail because entrepreneurs and developers neglect the three fundamental aspects of a successful ICO: Tokenomics, Utility, and Security. For the purpose of this article, we will focus on Utility, as proposed by William Mougayar, a prominent blockchain theorist and strategist. Mougayar's token utility framework consists of three tenets: Role, Features, and Purpose. Each role serves a specific purpose, as depicted in the accompanying chart.

Source: William Mougayar

When assessing a token-based company, it is advantageous to have as many criteria met regarding the token's purpose. The function of tokens can be likened to nails that secure your business model. Having multiple nails to firmly establish and maintain its defensibility and sustainability is preferable.

Entrepreneurs' resourcefulness is showcased in the various practical applications they devise for tokens, effectively bridging the gap between concept and implementation. It's a display of ingenuity at the token level, where creative ideas come to life.

If the way the token is used is unclear, poorly described, or can be defended, then that model has a flaw. Listed below are questions to determine if an organization can be categorized as ICO-based.

- Is the token tied to a product usage, i.e., does it give the user exclusive access to it or provide interaction rights to the product?

- Does the token grant a governance action, like voting on consensus-related or other decision-making factors?

- Does the token enable the user to contribute to a value-adding action for the network or market being built?

- Does the token grant an ownership of sorts, whether it is real or a proxy to a value?

- Does the token result in a monetizable reward based on an action by the user (active work)?

- Does the token grant the user a value based on sharing or disclosing some data about them (passive work)?

- Is buying something part of the business model?

- Is selling something part of the business model?

- Can users create a new product or service?

- Is the token required to run a smart contract or to fund an Oracle? (an oracle is a source of information or data that other than a smart contract can use)

- Is the token required as a security deposit to secure some aspect of the blockchain’s operation?

- Is the token (or a derivative of it, like a stablecoin or gas unit) used to pay for some usage?

- Is the token required to join a network or other related entity?

- Does the token enable a real connection between users?

- Is the token given away or offered at a discount as an incentive to encourage product trial or usage?

- Is the token your principal payment unit, essentially functioning as an internal currency?

- Is the token (or derivative of it) the principal accounting unit for all internal transactions?

- Does your blockchain autonomously distribute profits to token holders?

- Does your blockchain autonomously distribute other benefits to token holders?

- Is there a related benefit to your users resulting from built-in currency inflation?

A company's success is likely assured if it confirms and implements the procedures for most items listed above. The more usage scenarios they can confirm, the stronger their Token-to-Market fit will likely be.

Evolutionary and Successful ICO-based Projects

Most ICOs fail to meet the expectations they initially generated or encounter difficulties during their implementation, so it’s crucial for potential investors to thoroughly scrutinize and evaluate these ventures before committing their resources. However, it should be noted that a few ICOs have successfully delivered on their promises.

ICO-based projects that have evolved and succeeded have utilized Initial Coin Offerings to secure the necessary funding to create the groundwork for a decentralized and digital future. These projects range from establishing extensive data storage systems to implementing more equitable payment systems for artists and creating innovative financial products.

The influence of prominent blockchain ventures such as Ethereum, EOS, Telegram, Tezos, and Filecoin cannot be overstated, as they have garnered substantial financial support and yielded significant impact. Projects like Cardano, Solana, TRON, and Polkadot have also achieved remarkable success in their ICOs, etching their names in the annals of history as some of the most successful ICOs ever.

These pioneering initiatives have not only blazed a trail for nascent projects but have also offered valuable lessons in crowdfunding and decentralized platform development, demonstrating the vast potential of decentralized platforms and the innovative ways in which they can be financed, showcasing the enormous potential of blockchain technology.

At the heart of these successful ICOs is a dedicated and driven team of talented developers who put in long hours to ensure their success. Also, their transparency and a genuine desire to contribute to an emerging industry and technology parallel to the centralized bodies that the broader community is now recognizing as corrupt and oppressive.

In Closing…

As previously stated, the majority of ICO startups merely possess an idea, a concept. They haven't even developed an alpha version of their final product; it is all founded on speculation and the project's potential. What if an emerging crypto industry project already had a working beta version? A platform and protocol that were already constructed, along with a robust community, and then decided to launch an ICO-like campaign for iterations, further development, and marketing strategies?

Markethive is gearing up to accomplish precisely that. This is a big deal as it’s never been done before, and it will propel Markethive and its Hivecoin token to unprecedented heights, making them a pioneering force in the industry. Introducing a cutting-edge crypto ecosystem and blockchain technology to the marketing, social networking, and broadcasting sectors is a trailblazer in this uncharted territory, revolutionizing how entrepreneurs approach marketing and communication.

I will provide more comprehensive information in my upcoming article. In the meantime, join us for the Markethive webinar on Sunday at 10 am MST, where we discuss the history, current status, and future developments of everything pertaining to Markethive.

This article is provided for informational purposes only and should not be relied upon as legal, business, investment, or tax advice. Furthermore, however plausible, the contents of this article may include speculative opinions. Of course, there is nothing wrong with speculation as long as its premises are made clear. Speculation is the customary way to begin the exploration of uncharted territory as it stimulates a search for evidence that will support or refute it.

Resources: WSJ.com, William Mougaya, Doubloin.com.

Tim Moseley

.png)