How To Excel At Customer Acquisition Through Content Creation With Markethive

Acquiring customers is vital for a business's success, serving as the main driver for marketing efforts and overall business expansion. However, the process has become fiercely competitive and increasingly costly, with the customer acquisition cost (CAC) rising by over 60% in the last six years. This increase in CAC is due to various factors, such as increased competition, rising advertising costs, and changing consumer behavior, making it more critical than ever for businesses to invest in effective customer acquisition strategies like content marketing.

Navigating the crowded online landscape can be a significant hurdle as businesses flock to establish a presence through various digital platforms. However, these channels present a tremendous chance to stand out and acquire new customers through compelling content. By creating informative and engaging content, businesses can cut through the noise and take control of their customer acquisition strategies, empowering them to shape their own success.

It’s exceptional, customer-centric, search-engine-friendly content that resonates with audiences and drives conversions. Search-engine-friendly content refers to content that is optimized to rank high in search engine results pages (SERPs). This involves using relevant keywords that your target audience will likely search for, creating high-quality backlinks from reputable websites, and ensuring the content is easy to read and navigate, with clear headings, subheadings, bullet points, and short paragraphs.

By creating search-engine-friendly content, businesses can increase their visibility and attract organic traffic. While most companies acknowledge the significance of digital content, it's surprising that only a few prioritize crafting high-performing content that delivers results. Instead, they churn out subpar material that lacks impact, leaving a gap in the market for those who do prioritize it.

The Link Between Customer Acquisition and Compelling Content

Today's discerning consumers are highly selective when choosing brands and making buying decisions, much like forward-thinking businesses that capitalize on digital platforms to identify and win over new customers. The significance of content in attracting customers stems from its ability to establish trust.

More than outdated marketing strategies, including catchy slogans and aggressive sales pitches, are needed to grab consumers' attention or sway them; today, they seek out brands that demonstrate reliability and credibility. Studies have shown that 81% of consumers prioritize trust when making purchasing decisions, ranking it second only to the quality and value of the product itself.

By offering informative and insightful thought leadership content, which refers to content that positions the brand as an industry expert and provides unique perspectives on industry trends and issues, businesses cannot only attract but also earn the trust of potential customers. This reassures them of the brand's credibility and reliability, instilling confidence in the effectiveness of content marketing as a customer acquisition strategy.

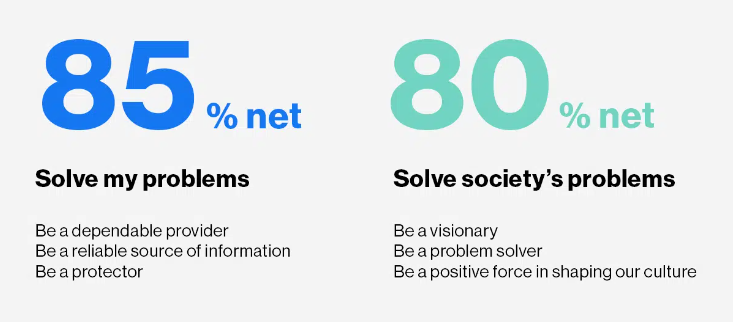

Image source: Edelman

To foster the trust that consumers hold in such high esteem, they turn to one key source: your content. By developing and disseminating consistent, high-quality content, you cultivate a reputation for expertise, infuse your brand with a distinct persona, and offer tangible benefits that assure consumers of your brand's capability to meet their needs.

But how do you know if your content is effective? Measuring the success of your content marketing efforts is crucial. You can track metrics such as website traffic, engagement (such as comments, shares, and likes), and conversions (such as newsletter sign-ups, downloads, or purchases) to gauge the impact of your content.

Unlocking Customer Acquisition: The Surprising Power of Content Over Advertising

A Common Misconception

Many individuals mistakenly believe that marketing revolves solely around advertising. However, those intrusive messages and images that disrupt our online experiences are often more of a nuisance than an effective means of engagement. For most, attempting to read an informative article only to be bombarded with irrelevant pop-up ads is annoying and distracting. It's no secret that these tactics are largely ineffective, yet they come to mind when most people think of marketing.

The term' content marketing' describes content that genuinely assists individuals. This is the essence of effective marketing, and the primary objective of marketing is to attract new customers. Content marketing is effective because it is created by and for people. It is designed to educate, share insights, and inspire progress. Unlike traditional advertising, which often interrupts and annoys consumers, content marketing provides value and builds trust. It’s more successful in acquiring new customers because it focuses on providing help rather than pushing sales.

Optimize Your Online Presence Across Multiple Channels

Don’t Rely On AI

To improve your search engine ranking, focus on creating content that directly addresses the search intent behind the keywords and questions your audience poses. Avoid depending solely on AI-generated content. Additionally, content that performs well in search engines will likely be effective in email and social media.

The critical insight from AI-driven content marketing is that it should be leveraged as a supplementary resource rather than a substitute for human creatives. While AI platforms like GPT are increasingly adept at producing content that mirrors human tone and style, they cannot replicate the emotional understanding that underlies effective content marketing.

For example, AI can help with content ideation, keyword research, and even content creation, but it’s the human touch that genuinely connects with the audience. Ultimately, the capacity for empathy sets human writers apart and drives successful content marketing strategies.

Content marketing is essentially centered around helping people. By offering valuable information and addressing users' concerns, content helps users even before purchasing. This approach aims to establish a strong connection with the audience, encouraging them to learn more about your brand and potentially become customers who see the benefits of your products or services in enhancing their lives.

In an era when people are bombarded with information, building a connection with your audience by showing you genuinely grasp their needs is crucial for differentiating yourself from the competition. Advanced AI-powered content marketing tools can analyze the vast expanse of existing content and produce remarkably sophisticated, eerily human-like original content inspired by what's already available.

However, these tools lack a deep understanding of your target audience and the subtleties required to craft content that truly speaks to them. They're also unable to grasp your brand's distinctive character or replicate the unique voice and tone that sets you apart. These personal touches still require a human touch, emphasizing the irreplaceable value of human creativity and understanding in content creation. Your role in this process is invaluable and cannot be replicated by AI, making you an integral and irreplaceable part of the content creation process.

Content + Paid Advertising

As explained above, AI-generated content may fall short of achieving the objective businesses want through content marketing, but it’s becoming increasingly prevalent. It’s indeed getting harder, not easier, to acquire new customers through organic means. One way to supplement organic content acquisition is through paid.

Utilizing paid content marketing allows you to promote your existing content to your target audience in the online platforms they frequent. This can include strategies such as sponsored social media posts, pay-per-click (PPC) advertising, and native advertising. It is important to note that paid content marketing is most effective when combined with solid content marketing strategies already in place.

The authenticity of content marketing, once a beacon of uniqueness, has transformed. Content marketing values refer to the principles and beliefs that guide content marketing strategies, such as providing value to the audience, being transparent and honest, and focusing on long-term relationships rather than short-term sales. Integrating a touch of paid advertising doesn't mean compromising your commitment to these values. Instead, it adapts to the shifting external landscape that has altered the playing field.

The landscape of social media platforms like Facebook, LinkedIn, and Google has shifted, posing challenges for brands to reach their desired audience without utilizing paid advertising. Changes in platform policies, such as Facebook's algorithm prioritizing content from friends and family over brand content, and algorithms, such as Google's search algorithm that ranks content based on relevance and quality, have made engaging with the same audience through organic social media content increasingly challenging.

As the internet swells with information, a phenomenon known as Content Shock comes into play. The notion suggests that the quantity of content will continue to rise, posing challenges in capturing consumers' attention amidst their limited time and energy. In response, many companies are incorporating paid advertising into their content marketing approaches to cut through the noise and reach their desired audience.

While content marketing isn't solely dependent on paid advertising, incorporating paid strategies into your overall approach can be a valuable addition for some individuals.

Content + Banner Ads

Similar parallels can be drawn with banner advertising. When the first banner ad debuted in 1994, it boasted an impressive 44% click-through rate. Fast forward to today, and that rate has plummeted to a mere fraction of 1%, as internet users have skyrocketed from a mere 30 million to a staggering 5.35 billion.

The internet's content has experienced exponential growth. To put it into perspective, the number of Google searches conducted every minute surpasses the entire online population of 1994, while the number of emails sent in a single minute is ten times that of the 1994 internet user base.

Therefore, the quantity of banner advertisements displayed to various online users has increased. Consumers have become weary of banner ads over the past three decades, ranking them as the second least trusted advertising medium in 2021. Nonetheless, banner display advertising remains the second most heavily funded digital format in the United States.

Banner ad spending reached $58 billion in 2022, representing more than 30% of digital advertising expenditures in the U.S., which is only 10% lower than search ads, which are the leading format. Forecasts suggest that this spending will increase consistently and surpass $78 billion by 2026.

Despite the underwhelming returns, marketers funnel their advertising funds into digital formats without hesitation. I think banner ads still have a place in this modern marketing era, and if we could combine content marketing with banner ads to bring more traffic to our content, that’s a win/win in my book.

Approximately 53% of content creators utilize advertisements to enhance their inbound efforts. They have successfully engaged with quality content by strategically reaching a relevant audience through search and social ads. The key lies in the content itself rather than the advertising format. When crafted into compelling content, ads enhance, rather than hinder, a robust inbound marketing approach.

The digital advertising landscape looked vastly different a decade ago. The majority of online ads were inadequate and annoying. The most advanced format available was the display ad. Unfortunately, most advertisements were intrusive and failed to target their intended audience. Interestingly, research shows that when content is boosted through banner ads, its click-through rate surges by a staggering 800%.

Numerous ineffective advertisements still exist, yet a different type is emerging—ones that could bring value to individuals. These advertisements assist consumers in discovering desired information, ads that amplify great content, and present it to those interested in the topic. Essentially, these ads can be considered inbound in nature.

Maximizing Returns with Content Marketing

Content marketing's proven effectiveness is the primary driver behind leveraging it for customer acquisition. A well-known marketing statistic reveals that leads generated through content marketing come at a significantly lower cost, with a staggering 62% reduction compared to traditional marketing approaches. This is primarily due to content marketing's ability to attract and convert new customers efficiently at a lower expense.

How To Excel In Customer Acquisition Through Content

To acquire customers through content, you must synchronize your content with the stages of the buyer's journey. While all website traffic is beneficial, particularly for new businesses aiming to enhance visibility, a deliberate approach is required for effective customer acquisition through content. This involves aligning your content with the phases of your buyer's journey.

As prospects navigate through the purchasing process, the type of content that resonates with them shifts. Initially, individuals who land on your website after conducting their first online search for a product or service are probably seeking educational resources to understand the challenges they are experiencing better.

As customers progress through their purchasing decision, they may require additional assurance that your brand is the best fit, and a detailed whitepaper or comprehensive case study can provide the necessary persuasion. The following visual aid can help you strategize the most effective types of content to allocate to each stage of the buyer's journey.

As you tailor your content to resonate with customers at each stage of their purchasing path, keep two key objectives in mind: provide potential buyers with the necessary information based on their current stage and incorporate a Call To Action (CTA) or another incentive to guide them to the next stage of the buyer journey.

Elevate Your Content Marketing with a Strong Blog Presence

A blog is the cornerstone of a successful content marketing strategy. While it's common knowledge that having a blog is essential, simply producing content, no matter how industry-relevant, and waiting for results is not a viable strategy.

To engage your target audience, it's essential to maintain a cohesive and customer-centric tone in your blog posts. Be deliberate and purposeful in your approach. Utilize categories to structure your content to match your content objectives, customer search intent, and buyer journey.

Begin by conducting SEO keyword research and evaluating your current content. From there, establish a strong foundation for your blog by incorporating content optimization strategies and paying careful attention to the technical aspects contributing to its performance. This includes ensuring your blog is prominently featured on your homepage and main navigation, utilizing article page templates, setting up proper URLs, and other essential steps.

At the heart of a successful content marketing approach lies a website with a blog, which has outperformed all other marketing methods. Moreover, studies have shown that blog-equipped websites boast an impressive 434% increase in search engine-indexed pages, resulting in a staggering six-fold rise in revenue.

Image Source: First Page Sage

Utilize Valuable Gated Content

Valuable gated content, commonly called lead magnets, collects visitor details by providing them with something of great worth in exchange. Gated content takes various shapes, yet it consistently delivers a distinctive and superior offering compared to the content available for free to your visitors.

For instance, if your blog delves into the significance of content audits, consider offering a comprehensive downloadable resource that provides a step-by-step walkthrough of the process. Popular types of gated content that are widely utilized and proven effective include ebooks, whitepapers, checklists, templates, and instructional videos.

Produce Engaging Videos

Video has become crucial in digital marketing as the most sought-after form of online content. Most businesses (86%) have incorporated video into their marketing plans. Furthermore, industry experts forecast that a staggering 82% of internet traffic will be driven by video content by next year.

Explore innovative video marketing strategies, such as documenting daily experiences through vlogs, hosting virtual events and webinars in real time, and showcasing customer testimonials through user-generated videos.

Markethive is poised to revolutionize these formats with its comprehensive video platform, virtual conference spaces, e-commerce storefronts, and broadcasting tools. Moreover, its decentralized blockchain infrastructure, spanning multiple cloud systems, offers a distinct advantage over traditional centralized cloud services like AWS and Cloudflare.

Showcasing Social Proof

Are you someone who reads reviews and testimonials before making a purchase decision? Well, you're not alone! Studies reveal that 88% of consumers place as much faith in online reviews as in personal referrals from friends or family. They typically peruse multiple reviews before finalizing a buying decision.

Showcasing social proof in your content can boost your customer acquisition potential. Practical strategies for achieving this include:

- Interspersing customer testimonials and rave reviews throughout your online platform or website.

- Showcasing in-depth success stories that highlight your achievements with previous customers.

- Featuring authentic content created by satisfied users, such as online reviews, product photos, and video testimonials. (User-generated content)

Building trust with potential buyers is crucial, and social proof helps achieve this by providing tangible evidence that you’ll deliver on your promises. Many customers rely heavily on social proof to make a purchasing decision. By including social proof material in your customer acquisition plan, you can significantly boost the chances of turning leads into paying customers, ultimately driving revenue growth.

Markethive’s Role In Customer Acquisition

Markethive, the blockchain-driven social market broadcasting network, is revolutionizing the media landscape. Its unique iterations, integrations, and upgrades will make it the ultimate tool for customer acquisition for large companies, small businesses, and solo entrepreneurs seeking to craft and disseminate compelling content that resonates with their target audience. This will include press releases and sponsored articles.

In contrast to traditional social media platforms, you retain ownership of your content, assets, and resources. On centralized social media platforms, the content you share becomes the property of the platform itself. They may redistribute it for profit without informing you or seeking your consent despite your view that your content is proprietary.

Watch as this behemoth of all things digital media unfolds and grows, dominating various aspects of marketing and advertising, including customer acquisition, social media, inbound strategies, video advertising, content creation, email campaigns, banner display, and more. Equipped with customized storefronts for individual businesses, SEO optimization, and its crypto, Hivecoin, the currency of Markethive, it is a complete ecosystem tailored for entrepreneurs.

Tim Moseley

.png)