HOW TO OPTIMIZE YOUR EMAIL MARKETING CAMPAIGNS

Since the dawn of social media marketing, it’s been purported that email marketing will cease to be of any value as a marketing strategy. On the contrary, email continues to be one of the most popular digital channels that marketers can use to communicate with customers and subscribers, bringing in significant ROI for businesses worldwide.

According to Statista, daily email users will climb to 4.6 billion by 2025. Despite the growth and prominence of mobile messengers and chat apps, e-mail is an integral part of everyday online life. Email is a great way to connect with busy clients on the move, eating breakfast, commuting, at work, in bed, or just about anywhere with billions of users per day.

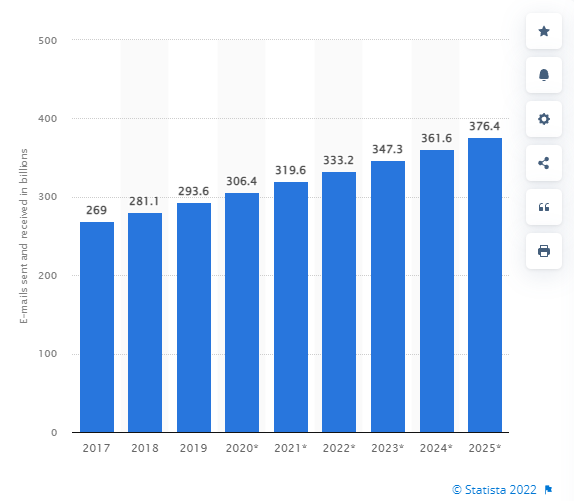

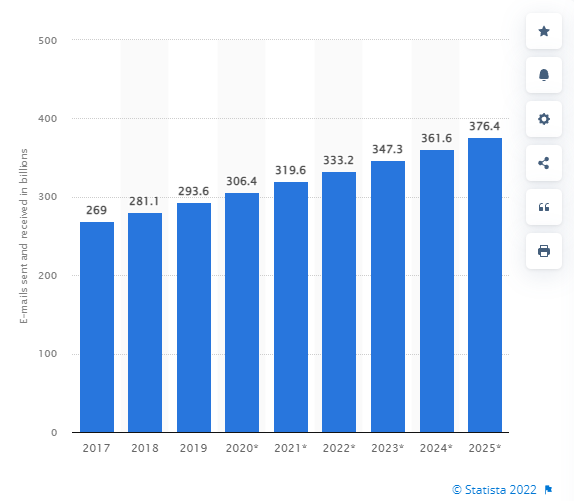

Furthermore, the number of emails sent and received globally has increased since 2017. While roughly 319.6 billion emails were estimated to have been sent and received each day in 2021, this figure is expected to increase to over 376.4 billion daily emails by 2025.

Email Marketing

Email marketing has managed to defy its predicted demise and remain central to digital communication, and continues to grow in acceptance. Notably, email has seen higher click-through rates than social media regarding online advertising.

Past studies and marketing statistics have found that 4.24% of visitors from email marketing will make a purchase compared to only 2.49% of visitors from search engines and 0.59% from social media.

The email has been around for decades, and the concept of email autoresponders as a strategic marketing tool was invented by the Founder and CEO of Markethive, Thomas Prendergast. He subsequently refined and established the system and the concept of Automated Marketing which we now call Inbound Marketing.

Optimize Your Email Campaigns

As the number of emails sent and received each day increases globally, data experts agree that more than 120 business and consumer emails are sent and received by the average person. It would be fair to say not all those emails are read or even opened.

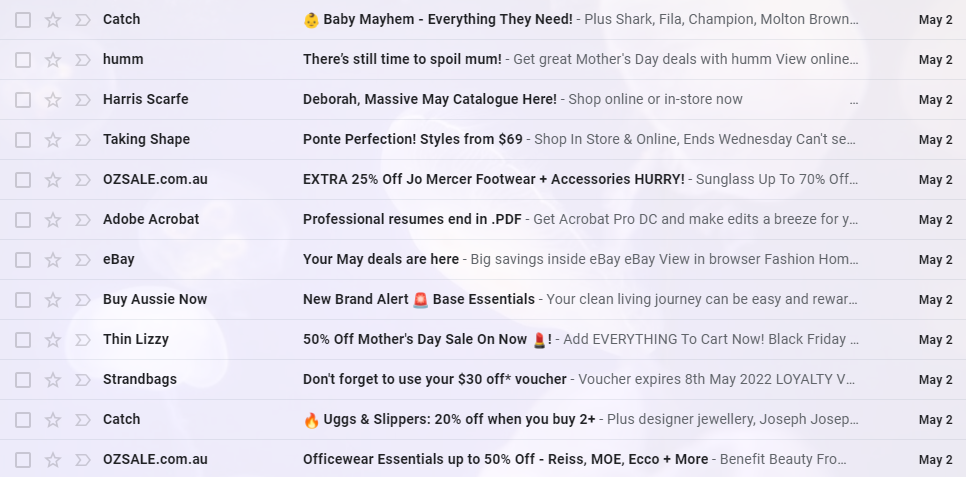

Given the statistics above, it's crucial to reevaluate your email marketing campaigns periodically and look for ways to make your emails stand out. To capture your recipient’s attention, you need to craft an intriguing subject line, purposeful salutation, and opening sentence.

Almost two-thirds (59%) of B2B marketers say email is the most effective channel, and marketing through email is the most effective tactic. The same group of B2B marketers surveyed claimed there are some dynamic tactics they can take to make their emails even more effective.

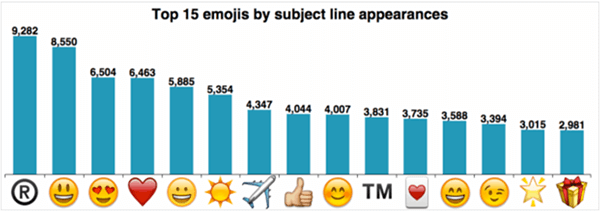

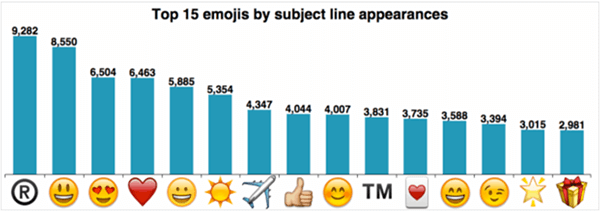

For example, according to Experian, 56% of email marketers who use emojis in their subject lines have a higher open rate. When used in subject lines, emojis stand out and separate your email from the mountains of other emails.

Adding emojis to headlines started in 2015 and has become more prevalent in subsequent years. Studies have shown that emotional content can increase the effectiveness of a marketing campaign by as much as 70%. Emojis show a facial expression related to the message conveyed or an icon related to the product or brand.

Emojis help break the language barrier as they generally hold the same meanings. They also create a more visual element and can retain your customer's attention. They can generate urgency or trigger emotions when used in a subject line, particularly for B2C.

Be sure to keep it relevant to your email subject and not overdo the number of emojis. More than two will look spammy and can put people off. You will need to discern what works for your brand and audience. In some cases, emojis might not be the best option.

Industries considered serious like law, accounting, and B2B may see it as unprofessional. However, your industry shouldn’t dictate what may work for your emails. Many emojis could be suitable, like calculators, clip boards, stop signs or dollar symbols, etc. There are many options to find the right emojis for your company.

Appboy conducted a poll and found that people enjoy emojis in general. More than 64% like or love emojis, compared to only 6% who dislike them. Consumers are exposed to emojis regularly in their everyday life: 87% use them in their texting and messaging, and 68% receive a message with emojis from friends or family once a day or more.

The good news for marketers is that 39% of participants thought the emoji touch in emails from brands was fun. Although there has been a steady rise in emoji-focused email campaigns, 60% said they received emails from brands only once a month, and 35% have never received an emoji campaign.

Image source Optinmonster

Tips For Using Emojis In Your Email Marketing

- Use sites such as Emojispedia to find emojis. Simply copy and paste the emojis you want to use in your email subject line.

- Don’t use emojis just for the sake of using them. Make sure the emojis are relevant to your audience.

- When using emojis, tone and context do matter. Use emojis that complement your message.

- Ensure your audience responds well to emojis before sending them in emails to all your subscribers. A/B test emails with and without emojis allow the difference in open rate to help you determine what is working.

- Finally, don’t go overboard. While emojis are fun to use, it’s easy to overdo them. Maybe just reserve them for special occasions.

By using emojis in the correct context, you could create the top email subject lines in your industry. Not only do emojis capture interest, but they can boost your email's response rate, too.

Why Are Engaging Email Introductions Important?

Now that we’ve caught the recipient's attention with a fetching and novel subject line, a robust email introduction encourages your reader to continue scanning the body of your message.

The best emails have an engaging greeting and opening sentence that secures the recipient’s interest and buy-in. Ideally, a captivating introduction ultimately leads readers to take action.

A thoughtful email opening sentence is helpful when asking recipients to:

- Click on a link

- Respond to a question

- Participate in a survey

- Provide additional clarity

- Review a document or other information

- Provide business-related support

- RSVP

A compelling opener sets the tone for your message, and it can also entice recipients to spend more of their time with the message and help your email sidestep the terrible “trash bin.”

Six Strong Ways To Start An Email

Below is a list of email greetings and opening sentences that keep recipients and their time a priority.

Appropriate Salutations

1. Dear %%Name%%

This email greeting is an appropriate salutation for formal email correspondence. It’s typically used in cover letters, official business letters, and other communication when you want to convey respect for the recipient. Personalization can improve open rates by up to 26%

Although honorifics like “Mr.” and “Mrs.” were once accepted, they risk misgendering or erroneously assuming the reader’s marital status. So, just use either first name or full name to be on the safe side.

2. Hi or Hello

As far as email greetings go, an informal “Hi” followed by a comma is acceptable in most work-related messages. If a slightly more formal tone is preferred, consider the salutation “Hello.”

Although this is considered an informal greeting, it also conveys a straightforward and friendly tone.

3. Greeting A Group Of People

When writing an email message to two or more people, you have a few options. “Hi everyone,” “Hi team,” or “Hi %%department name%% team” are informal yet professional ways to greet a group of people.

They also avoid gender-specific addresses to a group, like “Hi guys,” “Hi ladies,” or “Gentlemen,” which might not accurately describe the recipients.

Engaging Email Opening Sentences

4. I hope your week is going well, or I hope you had a lovely weekend

These are effective email opening sentences because they acknowledge your reader first and help build rapport with a colleague you already know or with whom you want to develop a friendly working relationship.

5. I’m reaching out about . . .

Beginning an email with “I’m reaching out about . . . ” is polite and direct and clarifies the purpose of the email. With hundreds of email correspondences transmitted in a single business day, this approach shows you’re being conscientious about the recipient’s time by getting straight to the point.

Stating your intent also avoids miscommunication or confusion about what you need from the reader.

6. Thanks for . . .

Expressing gratitude is another way to put the reader first. If the email you’re writing is in response to an email or action by the recipient, acknowledging that at the start builds on workplace companionship.

Six Ways Not To Begin An Email

The salutations and opening sentences below carry a stiff tone and, in some cases, suggest a careless approach. If your goal is to come across as genuine and thoughtful, it’s best to avoid these phrases.

Salutations To Avoid

1. To whom it may concern

Although “To whom it may concern” seems like a professional salutation, it’s impersonal and overused. It suggests that you didn’t care to confirm who your recipient is or whether your message pertains to them.

This also applies to the email greeting, “Dear Sir or Madam.” In this case, the gender-binary greeting is dated and could be considered noninclusive.

2. Hi %%Misspelled Name%%

Confirm that you've used the correct spelling when using the recipient’s name in an email salutation. Typos happen, but misspelling a person’s name sends a red flag that you didn’t write your message with care or attention to detail.

3. Dear %%ENTER NAME HERE%%

Misspelling a recipient’s name in an email greeting should be avoided, as should another salutation blunder: entirely forgetting to enter their name into a prewritten template.

Using an email template without any personalization in the hope of captivating your reader will likely be ineffective. If you must use a templated message for efficiency, always double-check that you’ve changed any placeholders in the salutation with the recipient’s correctly spelled name.

Opening Sentences To Avoid

4. Can you do me a favor?

When you don’t know the recipient and email them for the first time, an opening sentence like “Can you do me a favor?” can feel abrupt and has a self-serving tone.

Instead, consider an email opening sentence that concisely explains the problem you’re hoping to solve with their assistance, like “I’m reaching out about . . . ”

5. I know you’re busy, but . . .

This email introduction, at best, assumes the reader’s time is precious. At worst, it suggests that you’re aware of that fact, but you deserve their attention nonetheless.

Regardless of your relationship with the reader, avoid this introductory sentence and briefly explain why you’re messaging them.

6. Let me introduce myself

This email opener is typically used for email recipients for the first time. Beginning an email with “Let me introduce myself” is like narrating your introduction, and it sounds declarative but wastes time. Instead, cut to the chase.

Additional tips for an engaging email introduction

- Know your audience. The email salutation and opening sentence for your message should reflect your relationship with the audience. Consider whether you’re writing for a client, a professional acquaintance, or a close colleague.

- Make your purpose clear. When the purpose of your email is unclear, it can leave the reader confused or frustrated. To avoid missing this critical factor, try incorporating the intention of your email into the opening sentence.

It’s essential to realize what you need to do to get the attention of your customers when their inboxes are already saturated with messages. Take the time to think about improving your email marketing strategy to ensure your emails rise above the clutter.

Markethive – The Holistic Approach

Email marketing is the undisputed leader in terms of ROI. From a marketing perspective, the statistics on reach and engagement show email open rates are generally 20-30%, unlike the organic reach on Facebook at only 2-6%. (i.e., the number of your fans who see your posts in their Newsfeed)

Likewise, click-through rates (CTR) from email are generally in the 3% range, while CTR on LinkedIn is in the 0.6% range. However, email marketing is not in competition with social media, nor are they separate entities. Combined, they offer a more holistic approach and provide a seamless experience for customers.

Markethive offers a comprehensive, inclusive platform integrating a social interface, remote broadcasting to other social media and digital sites, and inbound marketing mechanisms that bring brands and customers together.

Email delivery is a top priority at Markethive and a powerful aspect of our inbound marketing system. It has earned the reputation of producing an emailing system that delivers your messages to 97% of your recipients’ accounts with 100% delivery to their INBOX.

The Markethive email autoresponder system is free when you join Markethive and is built for beginners through to Entrepreneurs and Business Owners at any level. There are no limitations on the amount or size of your list of subscribers and no upcharges.

Email reaches your customers one-on-one, and the social aspect of Markethive is ideal for driving customers as communities. Markethive has paired them together for the most effective and dynamic marketing strategy.

What’s Coming To Markethive?

The current email autoresponder in Markethive sends a series of emails out linearly. Segments are sequenced to be delivered every day, alternate day, or whatever day you choose when configuring your email campaign.

The great news is that we have an alternative new email system being developed, consisting of more in-depth programming that will make the delivery of your emails more dynamic and intuitive. The program will identify what emails were opened and send out the following email aligned with the first email.

The recipient's actions within that email will determine which type of email will subsequently be delivered to them. If the email is not opened, it will not follow up with a second email. So the system will fork off the original email depending on any given outcome.

The report on your email delivery will have more concise data displaying how many overall emails went out, how many were delivered, how many were opened, and how many bounced back as rejected due to errors in the address or full inbox issues.

The whole purpose behind this is not to spam people or hit them with messages they don’t want but to produce quality material that helps educate people and those looking for answers to their particular problems through systems like this. By using these methods, you establish authority, and the credibility that your sphere of influence you create will appreciate what you are doing.

You will be able to keep using Markethive’s original autoresponder; you will now just have a choice.

For all the latest updates on what’s happening in Markethive, come to our weekly meetings on Sundays at 10 am Mountain time. The link to the meeting room is in the Markethive calendar.

See you there and God Bless You

Tim Moseley

Uranium price has a lot more runway left and needs to double for supply to meet demand – Sprott's Ciampaglia

Uranium price has a lot more runway left and needs to double for supply to meet demand – Sprott's Ciampaglia

.jpg&ehk=o7BoQLZ2PHLaq0V3kueGPXS68zq8OAIVYzq7d9d8W%2fk%3d&risl=&pid=ImgRaw&r=0)

Getaway from oneself – or being alone to create directly

Getaway from oneself – or being alone to create directly Enjoy alone? Get in touch with yourself

Enjoy alone? Get in touch with yourself Aloneness transforms

Aloneness transforms

Gold remains on track as Federal Reserve lays out path for 50-bps rate hikes – State Street's Milling-Stanley

Gold remains on track as Federal Reserve lays out path for 50-bps rate hikes – State Street's Milling-Stanley.gif)

.gif)

Commodities at risk of reversing massive gains with 'wild run' similar to 2008, gold price to take on $2k – Bloomberg Intelligence

Commodities at risk of reversing massive gains with 'wild run' similar to 2008, gold price to take on $2k – Bloomberg Intelligence.gif)

.gif)

Paul Tudor Jones: 'Capital preservation is the most important thing' right now

Paul Tudor Jones: 'Capital preservation is the most important thing' right now.gif)

.gif)

.png)

.png)