Could This Company And Its Cohorts Overshadow Cryptocurrency? Look What's Coming

Wall Street titans such as BlackRock and Goldman Sachs have backed a crypto company that has received more funding than almost every prevalent crypto project. In addition, this firm has funded the federal government's spending and has close connections to the Federal Reserve. It's anticipated that its stock will be listed on exchanges later this year.

The company is Circle, the issuer of the USDC stablecoin, and it seems to be setting its sights on slowly dominating the crypto industry. It’s one company we must be mindful of if we value our financial freedom.

Circle’s History

Interestingly, Circle didn’t start out as a stablecoin project; its history is rooted in the crypto industry and runs very deep. Circle Internet Financial Inc., or Circle, was founded in 2013 by Jeremiah Allaire and Sean Neville. Jeremy and Sean have been working together for decades to build and then sell or IPO cutting-edge technology companies, notably the Allaire Corporation and Brightcove.

One of Jeremy's oldest videos on YouTube is a presentation he did shortly before leaving Brightcove to create Circle. In this video, Jeremy explains how the final step of building a successful technology company is to exit. In other words, to sell to a more prominent company or list it on a stock exchange. Jeremy Allaire has also been involved with the World Economic Forum for many years and has videos on the WEF’s YouTube channel and a profile on the WEF’s website.

Circle’s Vision

Jeremy has served as the chairman and CEO of Circle since it was founded, and Sean served as the president of Circle until late 2019, when he stepped down to join Circle’s board of directors. In the beginning, Circle’s focus was Bitcoin payments, similar to other payment companies like Visa and Mastercard, with a vision for bitcoin to become the base layer for a new financial system. However, the concept envisioned was not open and decentralized but closed and centralized.

To set things in motion, Circle effectively tried to force Bitcoin to fit their vision by pushing for all the altcoin innovations, such as tokenization and smart contracts to the Bitcoin ecosystem. They also urged Bitcoin to increase its block size for scalability purposes, along with the founder of the Bitcoin Foundation, Gavin Andresen, and 60 other corporations.

The efforts of these entities to increase Bitcoins block size hit their pinnacle in 2017 with the so-called New York Agreement. Furthermore, Digital Currency Group (DCG) reportedly oversaw the New York Agreement. The DCG conglomerate owns Grayscale and CoinDesk and holds stakes in top crypto projects, including Coinbase and Circle. It’s not surprising that Coinbase CEO Brian Armstrong also wanted to increase Bitcoin's block size. In short, 60 corporations tried and failed to convince the Bitcoin Community to increase Bitcoin’s block size. In short, 60 corporations tried and failed to convince the Bitcoin Community to increase Bitcoin’s block size.

.jpg)

Digital Currency Group

A Rough Start For Circle

In the bull run of 2017, Circle had already raised around $27 million from Goldman Sachs and others. It used this capital to create a suite of crypto services, including an OTC trading desk, and purchased the Poleniex Exchange. Around the same time, Jeremy joined the International Monetary Fund as part of the IMF’s high-level Advisory Group on Fintech.

For context, the purpose of the IMF is to ensure that the current US-centric financial system continues without interference from cryptocurrencies and other such technologies. Curiously, Circle and other Wall Street-funded crypto companies also held a closed-door meeting with the IMF in 2017, much to the scrutiny of the crypto community, and it seems there have been many meetings since.

By this time, Circle realized Bitcoin was not the future of payments, although Jeremy still believes BTC is digital gold and could serve as the world’s next reserve currency and has stated he holds mostly BTC and cash. Central banks also hold alternative currencies as part of their balance sheets, with the US dollar declining.

Since the conclusion that Bitcoin couldn’t be the payment platform, Circle and others turned to Ethereum, the next-best cryptocurrency. Ethereum grew significantly during the previous bull market cycle and established ETH as the second-largest crypto by market cap. They settled on the decision the build a US dollar stablecoin in 2017, and in 2018, Circle raised $110 million from Chinese crypto mining company Bitmain and others to build its stablecoin.

That same year Coinbase and Circle founded the Centre Consortium to set standards for stablecoins issued on public blockchains and to govern the issuance and redemption of the USDC stablecoin. It’s important to note that any entity part of the Centre Consortium can mint and redeem stablecoins.

The USDC stablecoin had a rough start when it launched in September 2018 because it was in the middle of a crypto bear market by then. So there wasn’t much demand for stablecoins, and USDC's market cap remained flat primarily during this period.

Subsequently, Circle sold its suite of products and services to focus on its stablecoin in 2019. The buyers included Kraken’s purchase of Circle’s OTC trading desk and Tron founder Justin Sun, who reportedly purchased Poloniex from Circle.

The WEF, FED, and Synthetic CBDCs

In early 2020, Jeremy attended the WEF’s annual conference in Davos, where he preached about the power of programmable money. He also discussed the importance of a partnership between the public and private sectors to “support the development of global stablecoins backed by central bank money.” Circle also published a stablecoin white paper [pdf] for the WEF.

Image source: Circle Blog

In previous interviews, Jeremy stated that the assets backing USDC would inevitably be held at the FED. As a matter of interest, most stablecoins are backed by US government debt. So, when you buy a stablecoin, you are essentially subsidizing the US government spending. That is a bit of a worry, considering many use stablecoins for safety.

According to Grant Thornton of the Centre Consortium, the USDC in circulation is backed by the following assets: 61% cash and cash equivalents, 13% Yankee certificates of deposit or CDs, 12% US treasuries, 9% commercial paper, 5% corporate bonds, and less than 1% in municipal bonds.

Almost all of the assets backing the largest stablecoins are some form of debt, i.e., money that’s been lent out. If you’re wondering why all these stablecoin companies hold so much debt, the answer is Interest. The companies behind these stablecoins can make money on their clients’ money by lending it. This makes it possible for Circle to make billions of dollars in passive income.

What’s important to understand is that Jeremy’s repeated prediction that the FED will hold USDC reserves relates to a Synthetic Central Bank Digital Currency. (sCBDC). Synthetic CBDCs involve a partnership between a private company, in this case, Circle, and the central bank of a country, the Federal Reserve, to issue a de facto CBDC, in this case, a de facto digital dollar.

Unsurprisingly, the IMF and the WEF are particularly interested in this synthetic CBDC setup. The question is, which Blockchain will they agree on to power a synthetic CBDC? Will it be a private and permissioned blockchain created by a big bank or a cryptocurrency? Jeremy has consistently posited the prospect of a global stablecoin that will be modeled on the IMF’s Special Drawing Rights or SDR. The SDR consists of multiple national currencies, and Jeremy believes it will eventually include BTC.

Image source: Coingecko

A Parabolic Shift For USDC

In mid-2020, the USDC’s market cap was on the move parabolically and continued to grow as USDC expanded to new exchanges and smart contract cryptocurrencies. Algorand was one blockchain that USDC expanded to and seemed to have a very close relationship with both Circle and the Federal Reserve. Interestingly, Circle is based in Boston, Massachusetts, and in the same proximity as MIT, where Algorand founder Silvio Micali is based.

CBDC reports by the FED note that the Central Bank partnered with MIT to develop its digital dollar and that the FED would begin testing quantum resistance on its would-be blockchain this year. As it so happens, Algorand recently achieved Quantum resistance by introducing State proofs.

Shortly after Circle announced its multi-chain framework, Wall Street veteran and former CLS Bank CEO David Puth was appointed the CEO of the Centre Consortium. You may not have heard of the CLS Bank; however, according to Jeremy, the CLS Bank is the “biggest bank that nobody knows” and, apparently, settles more than $2 trillion of transactions per day between the 70 largest banks on the planet.

As per the Centre’s blog post, David's job is to ensure “the most significant transformation of the international monetary system since the formation of the Bretton Woods system.” Oddly enough, David recently stepped down from the Centre Consortium to become a senior advisor to Circle, possibly because of Circle's exponential growth, which began in 2021 as Circle raised a staggering $440 million from various crypto VCs, including DCG and FTX.

During this time, Circle offered high-yield USDC accounts to institutional investors that were returning 8% – 11% yearly, according to an interview with Jeremy from February 2021. This eventually led to allegations by skeptical journalists that Circle was engaging in extremely high-risk, DeFi activities behind the scenes to earn this high yield. Note that this is the same stuff that crypto platforms like Celsius and Voyager Digital did before they went bankrupt.

Stablecoins Scrutinized Over Collateral Quality

Following the collapse of the crypto market and the appointment of SEC chairman Gary Gensler, stablecoins began to experience a lot of scrutiny, including USDC. The backlash prompted stablecoin issuers to publish details about the assets backing all their billions of tokens in circulation. Paxos came out as the winner for collateral quality, and Circle has since changed the composition of the assets backing USDC to match those of Paxos’s BUSD. As it stands, the USDC in circulation is currently backed by around 80% short-term US Government debt, and 20% is backed by cash.

Image source: Cointelegraph

Assuming short-term US Government debt means 2-year treasuries, it implies that Circle is earning a yield of around 4% on almost $40 billion of reserves. If you crunch those numbers, that equals over $100 million in pure passive income every month. This incredible potential for passive profit is probably why Circle managed to secure a Special Purpose Acquisition Company (SPAC) deal for its stock to list on US exchanges.

Towards the end of 2021, Circle started to call for reasonable crypto regulations and seems to have lobbied to that end. The company also continued to expand USDC to other blockchains and started looking into stablecoins for other fiat currencies, notably the Japanese Yen and the New Zealand dollar.

Also, in late 2021, Terra’s algorithmic UST stablecoin began to gain serious ground in DeFi protocols, where USDC had reigned supreme for almost two years. According to Decrypt, decentralized stablecoins try to avoid governance issues by maintaining their pegs through algorithms instead of through vast reserves of cash and debt. It also means their creation and destruction are done via voluntary free market arbitrage, and nobody can freeze or confiscate these tokens.

Note that all centralized stablecoin issuers have frozen tokens in the past. This occasional freezing of tokens is just the tip of the iceberg because, in a 2020 interview, Jeremy confirmed that Circle has the power to freeze all its stablecoins in circulation. This prospect is disturbing when you remember that Circle has uncomfortably close ties to Wall Street, the IMF, and the WEF. It's also disconcerting to consider that supposedly decentralized stablecoins, like MakerDAO’s DAI, are backed mainly by USDC. MakerDAO’s founder actually called for DAI to drop its peg to get off of USDC after Circle froze a bunch of tokens related to Tornado Cash.

Digital IDs And BlackRock Emerge On The Scene

In February 2022, Circle announced the release of the Verite platform, which is instrumental in the rollout of digital identities in cryptocurrencies. Two months later, Circle announced that it had received another $400 million of funding in a round led by BlackRock, the world's largest asset manager. BlackRock and circle also entered a “strategic partnership,” which would see BlackRock manage Circle’s cash reserves.

.png)

Image source: Decrypt

BlackRock's buy-in bought Circle’s total funding to well over $1 billion, and Crunchbase suggests that this figure is much higher, though the details of all these investments were apparently not disclosed. In any case, the market cap of Circle’s USDC hit an all-time high of over $55 billion in the aftermath of the collapse of Terras UST and the concerns around Tether’s USDT that arose during the chaos.

Incidentally, in previous interviews, Jeremy had admitted that both stablecoins were competitors to USDC. As expected, Terra's collapse and the temporary de-pegging of USDT led to renewed calls for stablecoin regulation worldwide. It appears Circle has been involved in influencing the regulations relating to the EU’s final draft of the MiCA Bill. According to CoinBureau, this could be very favorable for Circle, in Europe anyway, and opines that it could also be the catalyst for the next bull run.

Competition Is Rife

It’s nothing new if Circle is leveraging regulations, as incumbents have often used regulation to prevent competition. Even the Goldman Sachs CEO admitted that “burdensome regulation protects our business from startups” shortly after the bank invested in Circle in 2015. What’s interesting is that XRP is a top competitor to the global system that Circle and the Centre Consortium are trying to create.

And it’s not just regulations these stablecoin issuers are competing with; Cryptocurrency exchange Binance recently announced it would end support for USDC and has since de-listed Circle’s prominent stablecoin. USDC's market cap has been slipping, but it took a plunge when Binance dropped USDC in September 2022.

This means that Circle has to sell assets behind the scenes to ensure that the supply of USDC is in line with the lower level of demand for USDC following its de facto delisting. It's well within Binance’s right to make this move, and it just goes to show that crypto is hyper-competitive, and every crypto project and company has its way of cementing itself in the industry.

In Circle’s case, this involves working with questionable global organizations and expanding on-chain, including issuing stablecoins denominated in currencies besides the USD to appease foreign governments and regulators. At this rate, it's more than likely that every national currency will have its own stablecoin issued by the Centre Consortium, a perfect synthetic CBCD.

As with USDC, all these synthetic CBDCs will be backed by the government debt of their respective regions. It means we’ll all be subsidizing our government’s spending along with lower interest rates for institutions when the “powers that be” inevitably phase out cash.

But Wait…There’s More

Image source: Coindesk

More recently, Circle announced that it would expand to five additional smart contract cryptocurrencies and introduce a cross-chain interoperability protocol for its stablecoins. It also announced that it had partnered with Jack Dorsey’s Block to bring USDC to Bitcoin and to think Jack Dorsey is a Bitcoin maximalist!

Circle is also quickly taking over every smart contract cryptocurrency. With its stablecoin reserves being held by the FED, Circle could potentially have access to unlimited liquidity, aka the money printer. With the money printer in its grip, Circle will have the power to control every proof of stake smart contract cryptocurrency. Case in point, Ethereum creator Vitalik Buterin recently admitted that Circle would have the power to decide the future of forks on Ethereum due to its stablecoin liquidity.

For what it's worth, it looks like Bitcoin’s BTC and physical cash will offer protection from the upcoming dystopia that Circle and its affiliates are not so subtly rushing to roll out. Which begs the question, why else would Jeremy hold most of his wealth in cash and BTC? Maybe, he knows what's coming?

To Jeremy's credit, he wants stablecoins to be as cash-like as possible, meaning transaction privacy and no KYC. The problem is that the regulators will probably never allow this. As we already know, the institutions' that Circle has aligned itself with explicitly want to take control of every transaction we make forever.

As mentioned earlier, Circle’s co-founders have a history of building up and then exiting cutting-edge tech companies. This raises the question of whether Jeremy and Sean will do the same with Circle once its stock has IPO’d via the SPAC. Circle could become the most valuable company on the planet if it succeeds in its mission of literally recalibrating the global financial system around stablecoins.

The only issue with this analysis is that fiat currencies are failing, and stablecoins probably won't help much. Jeremy seems to be highly aware of this, and that is ostensibly why he's so bullish on BTC. As such, it's probably wise to watch whether he leaves Circle after its IPO. If he does, it probably means he knows that Circle will inevitably fail.

On another note, if you’re wondering which blockchain Jeremy believes will support all of Circle stablecoins, the short answer is all of them. The Circle team seems to be genuinely blockchain agnostic, and Jeremy thinks each smart contract cryptocurrency will have a piece of the financial puzzle. In sum, Circle will probably become the most influential company in cryptocurrency, maybe even the entire world, but it will arguably fail because it's fundamentally leveraging failing fiat currencies.

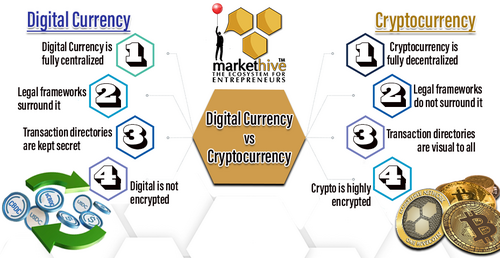

Image Source: Markethive

The Optimistic Approach

A redeeming feature is that Circle’s domination will make the average person comfortable with cryptocurrency. With special thanks to Guy at CoinBureau for his insights and his take on the final objective, he postulates,

“If I had my tinfoil hat on, I’d tell you that was the end game all along. Partner with all international organizations and the financial system, convince them to adopt stablecoins, sneak BTC in through the back door with an IMF SDR stablecoin and turn BTC into the world's next Reserve currency.”

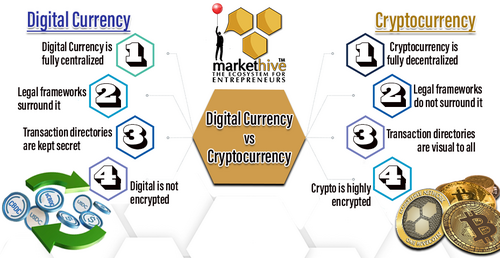

That is an outcome we would all love to see because the alternative will see us perpetually enslaved by these technocrats. We must also remember that decentralized cryptocurrency is vastly different from a centralized digital currency and extremely difficult for so-called authorities to over-regulate. I doubt they even know what they’re dealing with to the full extent.

We have committed and robust communities that are creating ecosystems with crypto utility, built on supply and demand with a free market principle, and will always have a place in society, even if it’s in a Parallel Economy. This is where entrepreneurs rise, reclaim their sovereignty and freedom, and thwart the misaligned, agenda-driven elite. I’ll follow up with an article where we’ll discover what the individuals in power are planning about a new kind of social credit score. It’s wise to be aware.

(13).gif)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

Gold and manipulation: The Ultimate Gold Panel with Frank Giustra & Rick Rule

Gold and manipulation: The Ultimate Gold Panel with Frank Giustra & Rick Rule

.jpg)

.png)

(13).gif)

Gold price to trade at $1,700 next year as Fed, dollar outlooks shift, says Capital Economics

Gold price to trade at $1,700 next year as Fed, dollar outlooks shift, says Capital Economics .]

.]

.gif) Expect a '75 bps hike,' as Powell zeroes in on inflation – Chance Finucane

Expect a '75 bps hike,' as Powell zeroes in on inflation – Chance Finucane