A Historical Shift In The Global Economy. A World Polarized By Sanctions. Where Are We Heading?

.png)

Crypto And Gold Are Critical In These Erratic Times

I recently came across a research paper by a Ph.D. candidate in economics at Harvard University. The report headlined “Hedging Sanctions Risk: Cryptocurrency in Central Bank Reserves” argues that central banks, particularly in sanctioned countries, should start buying Bitcoin to protect themselves from sanctions. It seems viable when you consider Russia has announced its intentions to adopt crypto, and others, such as Iran, are reportedly already using it.

Matthew Ferranti, the author of the highly detailed composition, discusses empirical and historical data on sanctions countries, devises complex economic model simulations, and projections of how sanctions could lead to the accumulation of BTC by central banks. He notes that it's the first research paper that analyzes the change in central bank reserves in response to sanctions. He also states he is not a Bitcoin maximalist, nor does he hold any BTC.

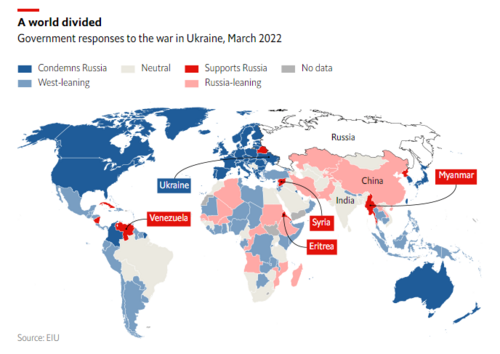

Sanctions More Common But Less Effective

Matthew begins by giving examples of countries accumulating or using BTC. The list includes El Salvador and the Central African Republic, both of which made Bitcoin legal tender, and Ukraine received BTC donations following the inception of the Russia-Ukraine proxy war. He recounts how half of the Russian central bank's international reserves were frozen due to sanctions by certain western countries.

He points out that this sent a warning to central banks worldwide that fiat currencies and cash equivalents like sovereign debt are not safe assets. He explains that sanctions have become more common as the financial system is more centralized. This centralization is due to digitization, which will only increase as central bank digital currencies (CBDCs) are rolled out.

The details of US sanctions, specifically those from the US Treasury Department's Office of Foreign Assets Control (OFAC), basically ban all US individuals and institutions from interacting directly or indirectly with any sanctioned entity. The paper reveals that the US has sanctioned almost 9,000 entities. To put things into perspective, the European Union has sanctioned around 2,000 entities, and the United Nations has sanctioned about 1,000. These figures indicate how money is used as a weapon and point to how trigger-happy the US has been.

Not surprisingly, research suggests that sanctions have become significantly less effective over the last 30 years, with only 30% of sanctions policy objectives being achieved. These policy objectives typically involve human rights and democracy, a term synonymous with US imperialism to many.

Regarding sanctions against central banks, Matthew notes that there are seven that are or have been sanctioned by the United States. These are the central banks of Russia, Iran, Syria, North Korea, Venezuela, Afghanistan, and Iraq, with no expiration date for sanctions. Because the sanctions against these central banks were introduced for various reasons, no central bank can be sure it won't suddenly find itself on the wrong end of US sanctions. This calls for accumulating truly safe haven assets to hedge against this risk.

Gold And Cryptocurrency

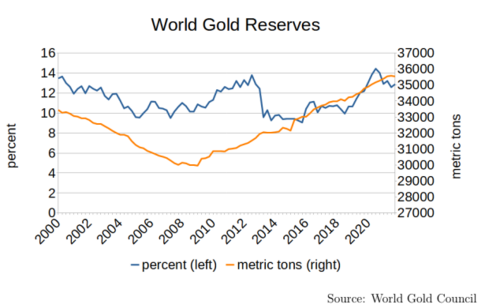

Gold is one of the most popular non-currency assets on central bank balance sheets, and it's impossible for the US or its allies to seize physical gold being held at the central bank of a sanctioned country. Matthew speculates that is the primary reason why central banks continue to hold gold. He also suggests that another reason has to do with concerns with the financial system because central bank gold reserves have risen since the 2008 financial crisis, reaching 14.4% in 2020.

The paper accurately states that so long as a centralized entity doesn't control a cryptocurrency’s blockchain, there will always be a way to evade sanctions using its coin or token. The only way to censor transactions on proof-of-work Blockchains is to acquire and sustain 51% of the computing power, AKA hash rate.

It’s noted that the only time a Bitcoin mining pool achieved more than 50% of Bitcoin’s hash rate was in 2014, which has not happened since. Matthew implies that executing a 51% attack on Bitcoin today is practically impossible due to how large the network has grown. However, he does note that there have been cases of individual Bitcoin miners complying with US sanctions in the past and gives Marathon Digital as an example.

Marathon Digital temporarily stopped including transactions from sanctioned Bitcoin wallet addresses in May last year. The Bitcoin miner went back to business as usual one month later after all the backlash from the crypto Community. He also explains why stablecoins are not suitable for sanctions evasion. Essentially, it’s because they're centrally controlled, and their issuers have previously frozen token holdings. Notably, centralized stablecoins also back many decentralized stablecoins.

Matthew also claims that Bitcoin mining is terrible for the environment because it uses 0.05% of the world’s total energy, which in my mind, is more proof that he’s not a Bitcoin maxi. According to Cambridge University, he says environmental and energy issues won't be of concern to countries evading sanctions. Anyone who knows the facts about BTC and energy usage knows it’s not a concern to anyone.

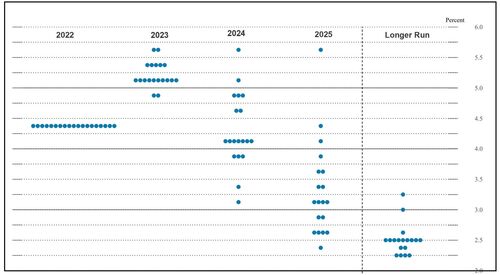

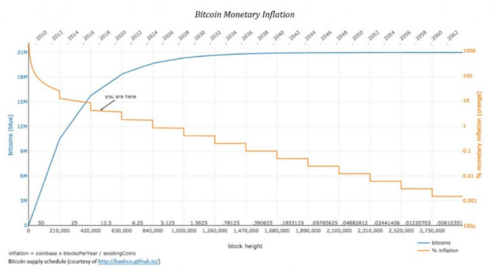

Further into the paper, Matthew discusses how he calculates BTC’s future price. He makes mention of BTC's insane price action since its inception and correctly points out that BTC will provide diminishing returns in percentage terms as it becomes more mainstream. In other words, Bitcoin's halving event every four years induces less supply with a deflationary outcome. Increased adoption causes a rise in demand which in turn increases the price.

Image source: Crypto Valley Journal

This is the purpose of the Bitcoin economic model and has earned the title of “the flagship cryptocurrency.” Bitcoin is crypto’s store of value or digital gold, making it a stable asset class for institutional investors and fueling its long-term rise.

Matthew also accounts for the BTC in circulation, new BTC being created with each new Bitcoin block, BTC trading volume, economic growth, stock market growth, and even estimated yields on government debt in his BTC price model. To be honest, most of this analysis went entirely over my head, but you’re welcome to tackle his 64-page digest.

The Economics Of Sanctioned Countries.

Michael then makes a series of economic assumptions related to sanctions. These include assertions that sanctions don't affect a central bank's gold or cryptocurrency reserves and that the stocks of companies in a sanctioned country will fall significantly in response to sanctions.

He starts by estimating how much BTC central banks will begin to hold in the future without any sanctions. His extraordinary complex modeling suggests 2-3% of Central Bank portfolios will be in BTC. Interestingly, his model suggests that central banks will reduce their gold holdings simultaneously.

The second model suggests that central banks facing sanctions risks will hold at least 5% of their portfolios in BTC and apparently up to 50% in gold. He concedes that such a large gold allocation will be unrealistic for most central banks due to the difficulty of acquiring and securing large amounts of gold.

As such, Michael presents a third model where sanctioned central banks prefer BTC over gold for these reasons. In this third model, BTC holdings of central banks could be as high as 40% of their portfolios when facing a very high risk of sanctions.

According to the International Monetary Fund (IMF), most central banks have already been moving away from the USD and other US dollar assets for years and loading up on alternatives which set the stage for some significant BTC adoption.

In the paper's final section, Michael reiterates that no central bank can be confident that the US, the EU, or some other entity won't sanction their country and seize its assets. He also stresses that, in truth, there is no safe asset when sanctions are indeed severe. Regardless, gold and cryptocurrency are the best assets for central banks to hold under such circumstances.

Michael admits that much more research is needed, especially in simulating how central bank portfolios will change over time with and without sanctions risks. He also believes some central banks may already hold BTC on their balance sheets but refuse to disclose them publicly. This could be because they want their Bitcoin wallet addresses to be private or fear public scrutiny.

Michael points to the opacity of some central banks about their fiat currency reserves as evidence of this. He also points out that central banks tend to underreport their gold holdings when the price of gold is falling as additional evidence.

Why Central Banks Are Likely To Accumulate BTC

What is the reason for central banks to start accumulating more BTC? In short, their fiat currencies are collapsing, and not all of them can develop their own CBDCs. Adopting cryptocurrency could very well be the only alternative for these central banks.

For central banks capable of producing their own CBDCs, their interest in cryptocurrency might increase due to having to leverage similar technologies. Case in point, the Central Bank of Switzerland said earlier this year that it could hold BTC as part of its balance sheet in the future.

As pointed out by the research paper, we've just been looking at the central banks that are most likely to accumulate BTC, and other cryptocurrencies are those in countries facing sanctions. The list of countries targeted by the US, EU, and other western powers is likely to grow as globalization breaks down and political poles emerge.

Image source: Economist.com

Although the analysis cited that the effectiveness of sanctions has been declining for decades, this begs the question of why the need to flee to safe-haven assets like BTC and gold. The answer may be because of economic cohesion. Consider a world where almost every central bank has its own CBDC; this digital centralization means that the risk of sanctions could be much higher, even if the effects are less severe due to financial fragmentation.

The standoff between central banks is probably in the context of international trade. They would constantly be skeptical of whether they can safely process payments using highly controlled foreign currencies. The bottom line is that central banks want an alternative currency they can trust. That would be the trustless decentralization of cryptocurrency.

One of the most prominent asset managers in the world, Fidelity Investments, reports there is a very high-stakes game theory at play here. If bitcoin adoption increases, the countries that secure some bitcoin today will be better off competitively than their peers. They elaborate by saying, “Therefore, even if other countries do not believe in the investment thesis or adoption of bitcoin, they will be forced to acquire some as a form of insurance.”

Given central banks' opacity concerning their portfolios, a theoretical approach could mean a push for more privacy because central banks won't want to reveal their BTC holdings. Bitcoin’s recent Taproot upgrade could well be the solution.

Bitcoin’s upgrade made all complex transactions look identical, increasing privacy for institutions or anyone using Bitcoin’s Lightning Network. Meanwhile, Litecoin has introduced a privacy-preserving side chain. Note that Litecoin has a history of introducing upgrades before bitcoin as its de facto test net.

That concludes the overview of Matthew Ferranti’s research analysis; however, another situation is brewing.

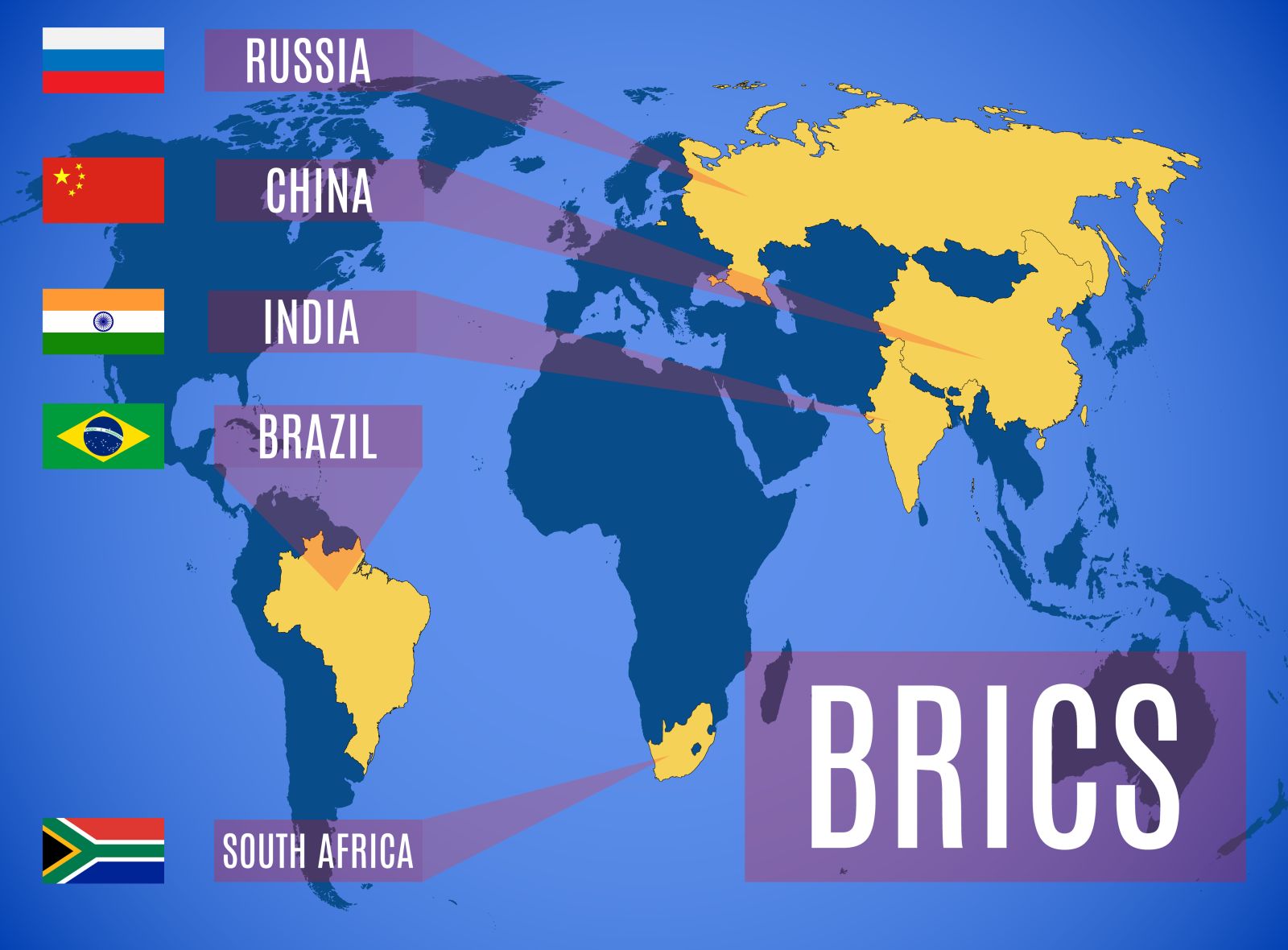

BRICS Breaking Away From The US Global Reserve Currency

Are the BRICS countries the United States Nemesis? BRICS is a collective body composed of five countries; Brazil, Russia, India, China, and South Africa. It was initially an informal group of the leading emerging economies of the early 2000s.

BRICS has since become more of an institution and is expanding in light of the geopolitical uncertainty polarized by sanctions as more countries have applied for membership. A historical event leading to a restructuring of global economic power may be on the rise.

Recently, Egypt was accepted and officially part of the BRICS New Development Bank (NDB). Egypt initially joined the bank sector of BRICS and has now applied for full membership in the BRICS alliance. Turkey and Saudi Arabia are also expected to apply for full membership to move away from the US dollar as a reserve currency.

Part of the alliance is the Shanghai Cooperation Organization (SCO), an eight-member Eurasian security and economic bloc, including Russia, China, India, and Pakistan. The SCO was founded in 2001 by Russia, China, Kazakhstan, Uzbekistan, Kyrgyzstan, and Tajikistan. India and Pakistan became full members in 2017.

Moscow sees the increasing role of blocs like the SCO and BRICS as countermeasures against western sanctions imposed over the Ukraine conflict. Foreign Minister Sergey Lavrov said in July,

“We are talking about countries that together account for 80% of the world’s population. Which is why it is clear to any unbiased person that there is no such thing as an isolation of Russia.”

In November of this year, Lavrov confirmed that “more than a dozen” countries are eager to join BRICS, including Algeria, Argentina, and Iran.

Image source: rt.com

The five BRICS economies currently account for more than 40% of the world’s population and nearly a quarter of the world's GDP (31.5%), heading for 50% of global GDP by 2050. They are building their own reserve currency backed by gold and other commodities like uranium, graphite, and copper.

BRICS is also working on its own financial infrastructure, including a joint payment network. Some member states have already switched to trade in the local currency in order to reduce dependence on the US dollar and the Euro.

The US dollar is also called the petrodollar. As its name suggests, the petrodollar is pegged to oil and was created through a deal between the US and Saudi Arabia in 1973. This was just two years after the Nixon Administration abandoned the gold standard resulting in the US dollar going into freefall as inflation soared.

With oil standardized in terms of dollars, any country that purchased oil from Saudi Arabia would have to use dollars. This led many other oil-producing countries to standardize oil prices in US dollars – and the petrodollar system was born.

The drawbacks of the petrodollar are the need for the US to run account deficits to maintain liquidity in a continuously expanding global economy. Stopping these deficits will slow down the global economy, but continuing the deficits may cause other countries to downgrade the dollar's value. This is already happening, along with the added dilemma of strained relationships with major oil producers like Russia, Iran, and China.

The US dollar is built on debt and “the nothing.” What is “the nothing”? Just like the movie The Neverending Story, it’s the “emptiness that’s left.” The nothing, in this case, is the failure of the western hegemony, which is built on a house of cards. It’s game on as these countries develop a separate currency backed by gold.

Why is Saudi Arabia turning its back on the United States? It can be traced back to one single big event; the start of the war in Ukraine. The Organization of the Petroleum Exporting Countries (OPEC Plus) and Saudi Arabia specifically warned the United States not to impose sanctions on Russia.

The US didn’t heed the warning, neither did Europe, and they pigheadedly did the opposite, thinking its relationship with Saudi Arabia would continue unabated. Well, that wasn’t the case and is considered a failure of the Biden Administration of the highest order and set to hurt America’s ability to secure low-cost oil.

The world is currently in a state of change as it shifts into a golden age eliminating the evil surrounding us. Ecosystems are being built; They are sanctuaries for all people who see the horrific deceit and are hurt by the powers that be and their egomaniacal decisions that have wrecked the global economy and societal culture.

It’s good news regarding Bitcoin and all cryptocurrency adoption. Bitcoin is the store of value (like gold was) and is on its trajectory to becoming a crypto asset class with less risk for people and institutions with a long-term investment strategy. Utility-driven altcoins and platform tokens will benefit and thrive as the market begins to appreciate the value of blockchain ecosystems and services.

All is as it should be, and God is watching over us as this all plays out.

Also published @ BeforeIt’sNews.com; Substack; Steemit.com

Tim Moseley

(16).gif)

Hawkish central banks will test gold bulls' resolve into year-end

Hawkish central banks will test gold bulls' resolve into year-end

The ECB's aggressive monetary policy stance gives gold a lifeline as euro makes a move against U.S. dollar

The ECB's aggressive monetary policy stance gives gold a lifeline as euro makes a move against U.S. dollar