The Top Five Cryptocurrency Exchanges by Trading Volume And Its Significance

The world's financial landscape is undergoing a profound transformation driven by innovative approaches to economic exchange. This shift is influenced by technological progress worldwide and impacts various aspects of society. The traditional boundaries of finance have been erased, as transactions are no longer limited by physical presence or geographical constraints. The nature of commerce has also undergone a significant shift, with the rise of digital assets and the increasing popularity of buying and selling liquid assets that exist solely in the digital realm.

Cryptocurrency is a popular digital asset that is increasingly used for transactions and debt settlement on a global scale. Given the rapid advancements in the crypto industry and the growing government interest, cryptocurrency is anticipated to replace traditional fiat currencies eventually. In addition to serving as a form of payment, crypto tokens can also be exchanged with one another.

The emergence of cryptocurrency trading has given rise to a specialized market that operates through online exchanges. These exchanges facilitate the buying and selling to engage in transactions within the cryptocurrency space. Without these platforms, it would be highly challenging for individuals to participate in the market, highlighting their crucial role in modern finance.

These exchanges, which play a vital role in the cryptocurrency market, can be centralized, decentralized, regulated, or deregulated. A key metric for evaluating their importance is the total trading volume of transactions executed on these platforms over a specific timeframe. Essentially, trading volume gauges the level of market activity, revealing the number of participants engaged in buying and selling and their willingness to take risks on price fluctuations.

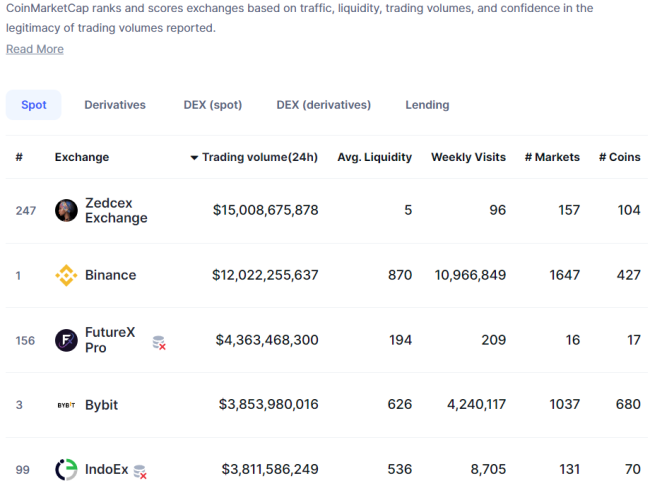

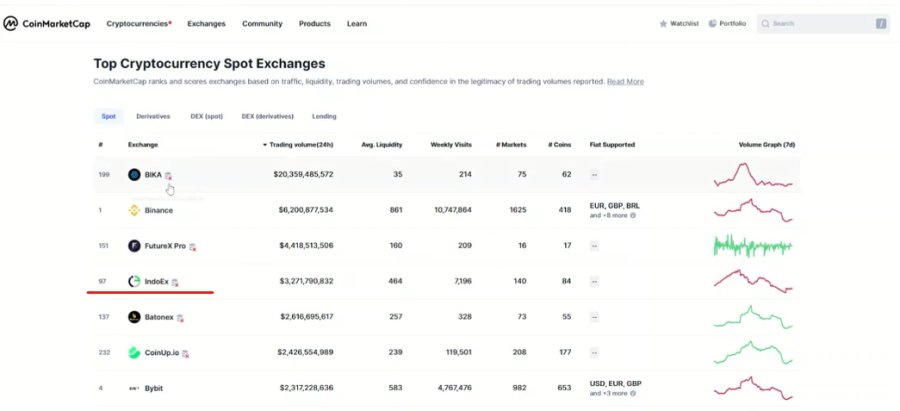

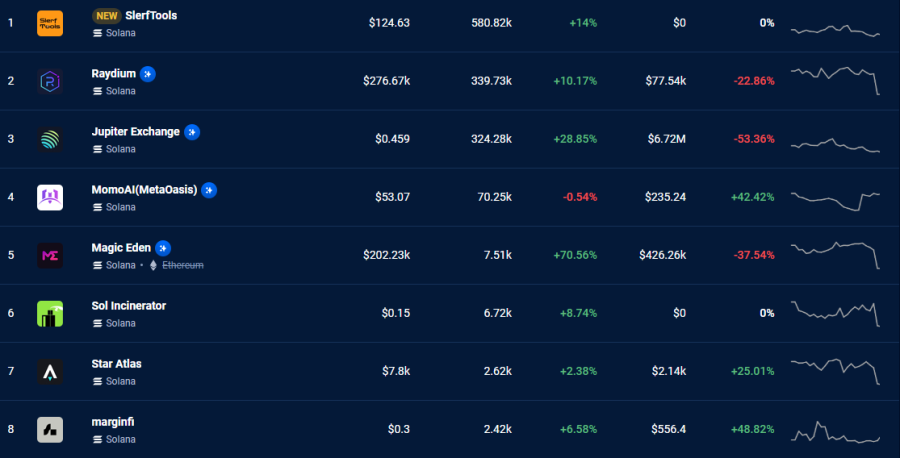

This article highlights the top five cryptocurrency exchanges by trading volume, based on data from CoinMarketCap at the time of publication, noting that the rankings are subject to change due to the dynamic nature of the chart.

Screenshot: CoinMarketCap

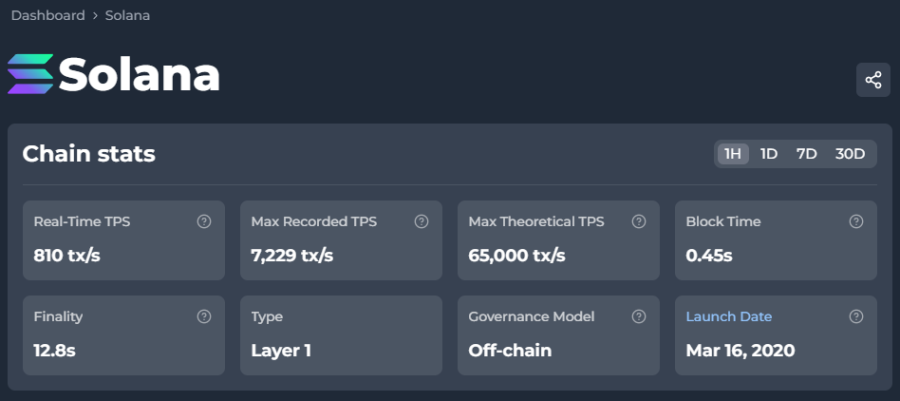

What is the purpose of CoinMarketCap?

CoinMarketCap, established in 2013 by Brandon Chez in New York City, is a prominent platform that offers detailed information on various cryptocurrencies and trading platforms. It has gained recognition as a trusted source for data on cryptocurrency market values, prices, and other pertinent details.

CoinMarketCap evaluates exchanges using criteria such as website traffic, trading liquidity, trading volumes, confidence in the legitimacy of reported trading volumes, and various qualitative considerations such as operational history, industry reputation, transparency through audits and licensing, and user satisfaction. Exchanges that achieve high rankings typically demonstrate these desirable characteristics, exhibit strong performance across metrics like liquidity, volume, and web traffic, and earn high confidence ratings.

Exchange Score

Based on the abovementioned factors, ratings are assigned to exchanges ranging from 0.0 to 10.0, with assigned importance levels. These scores are then utilized to position the exchanges in a ranking order. Moreover, CoinMarketCap imposes penalties on exchanges and trading pairs showing suspicious trading volumes, as determined by their data analysis approach. This ultimately affects the exchange's final score. The scoring mechanism aims to thoroughly and impartially assess each exchange's performance and trustworthiness.

Web Traffic Factor

The Web Traffic Factor is a metric used to evaluate exchanges' online presence. It assigns a numerical value to each one based on its website traffic. This score ranges from 0 to 1,000, with the exchange with the highest traffic constantly receiving a maximum of 1,000 points. All other exchanges are then ranked relative to this top performer, with higher scores indicating a high user count and greater online activity.

Liquidity Score

Exchanges' Liquidity Scores are determined by averaging the top 25 trading pairs, excluding stablecoin/stablecoin pairs. Liquidity in cryptocurrency trading pertains to how easily an asset can be traded without significantly impacting its price. By focusing on the average of the top 25 trading pairs, CoinMarketCap ensures fairness and avoids favoring exchanges with numerous pairs. Emphasizing exchanges with strong liquidity in key trading pairs is crucial for meeting users' requirements.

Qualitative Factors

In addition to quantitative metrics, the exchange score is influenced by various qualitative considerations, including the platform's history, standing in the community, transparency through public, regulatory compliance, and overall user satisfaction.

What Are The Top Five Cryptocurrency Exchanges?

1. Zedcex

Zedcex is a centralized cryptocurrency exchange (CEX) that offers a professional platform featuring an ultra-fast matching engine, quality customer service, and multilingual community support for crypto traders at all levels. Established in March 2023, Zedcex serves over 100,000 users and institutions, offering access to over 100 assets and contracts across Spot and crypto derivatives.

It offers products such as Spot, Derivatives (USDT perpetual, USDC perps, inverse perps, futures, USDC options, leveraged tokens), NFT marketplace, Zedcex Earn, Buy Crypto, and Options. Zedcex has over 100 crypto tokens listed and over 300 spot trading pairs, including major coins like BTC, ETH, BIT, SOL, APE, DYDX, LTC, DOGE, AVAX, MATIC, DOT and more.

Zedcex was registered in the British Virgin Islands as Zedcex Exchange Limited and is headquartered in the UK. The global platform is available to customers worldwide, except for countries with service restrictions, such as the U.S., Singapore, Cuba, Crimea, Sevastopol, Iran, Syria, North Korea, Sudan, and Mainland China.

2. Binance

Binance is generally recognized as the world’s largest crypto exchange (CEX) by trading volume, with over 200 million registered users in more than 180 countries. Since its inception in 2017, the platform has solidified its position as a reputable player in the cryptocurrency market. It offers users a secure environment to purchase, sell, and manage their cryptocurrencies, with access to over 500 listed assets and thousands of trading pairs.

The Binance ecosystem has expanded to include a diverse range of platforms comprising Binance Exchange, Labs, Launchpad, Info, Academy, Research, Trust Wallet, Charity, NFT, and additional features. Binance has integrated cutting-edge security protocols and rigorous data protection policies across its ecosystem to safeguard user interests while prioritizing adherence to regulatory requirements to uphold its commitment to user trust and responsibility.

According to Binance's Terms of Use, specific regions, including the United States, Singapore, and the Canadian province of Ontario, are subject to access restrictions. Additionally, some countries have limited functionality or restricted access to certain features due to regulatory constraints, such as China, Malaysia, Japan, the United Kingdom, and Thailand. Furthermore, residents of Germany, Italy, and the Netherlands cannot use Binance's futures and derivatives products. Notably, a separate, dedicated platform called Binance.US was introduced in September 2019 to cater to US clients.

3. FutureX Pro

FutureX Pro officially launched into the crypto exchange arena in March 2024, emphasizing user privacy and security. This centralized crypto exchange culminated from a well-established company called Futurex LP, commonly referred to as Futurex. Futurex is a privately held Texas-based information technology company specializing in cryptography, founded in 1981. Futurex provides data encryption solutions for financial institutions, retailers, and terminal manufacturers.

FutureX Pro is dedicated to delivering a streamlined and efficient digital asset trading experience for its users. The platform boasts a comprehensive suite of tools, including futures, peer-to-peer, spot, and copy trading. FutureX remains steadfast in its commitment to revolutionizing blockchain technology and catalyzing financial transformation. It aims to become a prominent player in the global crypto exchange landscape, focusing on innovation, security, and user privacy.

Moreover, FutureX Pro offers strong cybersecurity features such as multi-factor authentication, encryption, routine security checks, and protection against DDoS attacks. The FutureX Pro exchange places a high emphasis on safeguarding crypto assets through the use of cold storage techniques. Additionally, the platform adheres to regulatory requirements to ensure a secure and compliant trading setting. FutureX Pro does not explicitly mention its supported cryptocurrencies and trading pairs.

4. Bybit

Bybit is a centralized cryptocurrency derivatives exchange established in March 2018 and registered in the British Virgin Islands. It’s headquartered in Dubai, having moved from Singapore in 2022, and operates under Bybit Fintech Limited. With a mission to revolutionize the financial system, Bybit has expanded its trading services and introduced cutting-edge security features and innovative tools for new and experienced traders.

The platform offers 24/7 customer service and multilingual community support, serving over 40 million users and institutions. It provides access to various assets and contracts across Spot and crypto derivatives like Futures and Options, launchpad projects, earn products, an NFT Marketplace, and more. Bybit has over 100 crypto tokens listed and over 300 spot trading pairs, including major coins like BTC, ETH, BIT, SOL, APE, DYDX, LTC, DOGE, AVAX, MATIC, DOT, and more.

Bybit prioritizes security by dividing its system into two types of wallets: cold storage, which holds most of its assets offline, and hot wallets, which are used for active trading. This setup minimizes the risk of large-scale cyber attacks. While Bybit is a global platform, it is not accessible to users in certain countries due to regulatory restrictions, including the US, UK, mainland China, Hong Kong, Singapore, Canada, North Korea, Cuba, Iran, Uzbekistan, and specific regions of Ukraine and Syria under Russian control.

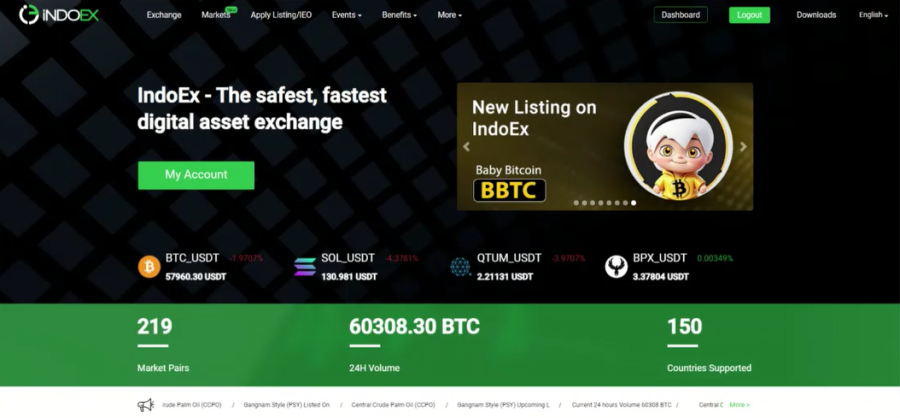

5. IndoEx

IndoEx is characterized as a decentralized exchange (DEX), yet it also depends on centralized infrastructure and services provided by third parties. The platform highlights the significance of users retaining private keys, having 100% fund management rights, and securing assets through smart contracts with multi-signature protection in all supernodes. This indicates a level of decentralization, categorizing IndoEx as a hybrid or semi-decentralized platform that integrates features from both centralized and decentralized exchanges.

Launched in January 2019, the IndoEx trading platform operates from dual headquarters in Estonia and the United Kingdom. It provides round-the-clock customer support through multiple channels, including phone, email, and online assistance. The platform supports trading in EUR/USD fiat currency pairs and strives to be the most secure and fastest digital asset exchange, catering to the needs of seasoned traders, industry professionals, and institutional investors and serves as a learning environment for crypto novices, offering a high-end trading experience that helps them develop their skills and expertise.

IndoEx offers a wide range of popular cryptocurrencies, such as BTC, ETH, and XRP, as well as prominent altcoins like DASH, LINK, and LTC. In addition, it supports lesser-known coins and tokens like NEO, Cardano, and EOS, totaling 180 cryptocurrencies and almost 300 crypto pairs. The platform operates in 150 countries and includes features like an ICO launch pad, trading competitions, and a secure cold storage wallet. Furthermore, it has implemented robust security measures, including third-party and co-insurer policies, to protect users' assets from potential hacks, thefts, and security breaches.

The Significance of Trading Volume in Crypto Exchanges

Trading volume is a key performance indicator in cryptocurrency exchanges that reflects the market's overall vitality, the ease of buying and selling assets, and investor sentiment. A high level of trading activity fosters a liquid market, enabling market participants to execute trades at favorable prices with minimal slippage. This is for investors requiring swift and seamless entry and exit points for cryptocurrency transactions.

Higher trading volumes are crucial in determining market trends and changes in direction. In cryptocurrency exchanges, trading volume plays a vital role in generating income. Transaction fees, often calculated as a percentage of the overall trading value, serve as a critical revenue stream for exchanges. More significant trading volumes result in more fees and increased profitability.

The level of trading activity in a cryptocurrency market gauges investor enthusiasm and trust. When many people actively buy and sell a particular crypto, it suggests a high level of interest and a strong market presence. In contrast, low activity may signal a lack of traction or a struggling asset. Trading volume helps determine the fair market price of a cryptocurrency. With more buyers and sellers participating, the exchange price tends towards equilibrium, reflecting the collective sentiment of the market.

Tim Moseley

.png)

.png)

MARKETHIVE – Entrepreneur One Upgrade Explained – UPDATED 2024

MARKETHIVE – Entrepreneur One Upgrade Explained – UPDATED 2024

.png)

.png)

.png)

.png)