BlackRock Proposes Its New Retirement Plan Using Your Money: How Will This Impact Your Finances? Discover Your Options.

In mid-2019, BlackRock demonstrated its prophetic capabilities by forecasting the financial and monetary implications of the pandemic before it had even occurred. Considering the company's stature as the world's largest asset manager, some may argue we should heed its insights.

Recently, CEO Larry Fink released his yearly correspondence with investors, offering subtle hints about potential future developments and BlackRock's strategies. This article breaks down the key takeaways from the letter, providing insight into what it may imply for individual investors and the market at large. We also explore how you can alleviate concerns and secure your financial future.

To begin with, Larry Fink's yearly correspondence with investors has a distinct tone from his annual address to corporate leaders. BlackRock holds significant stakes in many of the world's largest corporations. Fink's letter to CEOs served as a guide for corporations, outlining what actions they should take. However, this year's letter has yet to be released.

Similarly, BlackRock's CEO, Larry, writes an annual letter to its investors outlining its key objectives. The letter being discussed today is an overview of this annual communication. Notably, the initial section of Larry's letter is particularly striking, bearing the title “Time to rethink retirement.” It's worth noting that this topic is especially relevant, as numerous countries globally are increasing the retirement age due to fiscal constraints stemming from a shortage of taxpayers to fund pension systems.

The Capital Markets

Inspired by his parents' financial struggles in retirement, Larry founded BlackRock to help others build a comfortable nest egg. In his letter, he highlights the importance of investing in capital markets to achieve this goal. Capital markets encompass a wide range of financial instruments, including stocks, bonds, and private investments, providing opportunities for individuals to grow their wealth over time.

Influential investment firms like BlackRock are expanding their reach into multiple areas, including purchasing single-family residences that are subsequently leased to individuals. This trend has sparked concerns about the escalating cost of housing.

In the second portion of his letter, Larry provides a concise overview of the evolution of capital markets in the United States, highlighting two primary methods of wealth accumulation: saving funds in a bank or investing. He attributes the country's impressive performance since the 2008 economic downturn to the size and complexity of its capital markets. Notably, Larry takes pride in his role as one of the creators of mortgage-backed securities, which were instrumental in causing the 2008 financial crisis.

In hindsight, it's not entirely unexpected given Larry's academic background in political science and business administration, which didn't exactly prepare him to be a market expert. Nevertheless, Larry emphasizes that a crucial lesson learned is that a robust banking system alone is not enough to drive economic growth; a country also needs thriving capital markets. He observes that this realization is gaining traction globally, and Larry shares that he has been engaged in discussions with governments worldwide on this topic.

He details his extensive travels last year, visiting 17 countries where he engaged in discussions with top government officials, including presidents and prime ministers. According to him, these leaders are eager to expand their financial markets, and conveniently, BlackRock is poised to assist without any underlying motives, of course. What's alarming, however, is that Larry discloses that Indian authorities are discontent with the widespread practice of Indians using gold to save and store personal wealth. Instead, they want to see this wealth funneled into the banking system, and Larry is likely keen to see it flow into BlackRock's coffers.

In any case, it implies that governments view gold as a threat. Larry appears to share this viewpoint, pointing out that gold has not performed as well as the Indian market and that investing in gold does not contribute to the Indian economy. So, will we see restrictions on gold in the countries Larry advises, citing economic vulnerability as the reason?

Larry proceeds to uncover BlackRock's ultimate objective. He asserts that investing in capital markets is not just desirable but essential for two key reasons. Firstly, it is the sole means of financing retirement plans, and secondly, it is the only way to develop infrastructure that aligns with environmental, social, and governance (ESG) principles. In essence, this constitutes the endgame.

For those who may not be aware, Environmental, Social, and Governance (ESG) is a concept promoted by influential financial institutions such as BlackRock and major banks like Bank of America. ESG's ultimate goal is to support the United Nations' ambitious sustainable development goals (SDGs), which envision global adoption of dystopian technologies like CBDCs, digital IDs, and smart cities by 2030.

Retirement And Demographics

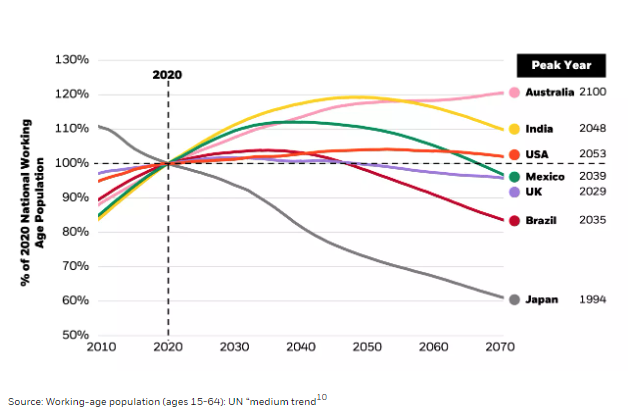

In the third section of his letter, Larry raises concerns about how individuals can financially support their retirement, given the increasing life expectancy. By now, you'll know the answer is to give all your money to BlackRock. Case in point, Larry notes a joint venture BlackRock has with an Indian retirement firm that invests in digital infrastructure. In other words, you will own nothing and be happy, and BlackRock will use your retirement savings and investments to make it happen. It appears BlackRock is making big bets on India, presumably because its workforce population will be one of the last to peak sometime around 2050.

In a surprising turn, Larry shifts the conversation to the United States, likely to address potential concerns about BlackRock's increasing involvement in India. With a hint of irony, Larry acknowledges that the financial difficulties younger generations face directly result from policies implemented by his generation, the Baby Boomers.

As you may have anticipated, BlackRock has devised a solution to rescue the next generation. Following a stark warning that the US Social Security fund will be depleted by 2034 and recommending a delayed retirement age, Larry proposes three methods to address our financial future.

The first approach is to compel employees to allocate a segment of their salaries towards investments in the capital markets, which would be managed by firms such as BlackRock. According to Larry, the U.S. will implement similar legislation next year, mandating companies with 401K plans to automatically register new employees into the program.

This ties into BlackRock's second strategy for securing our financial futures: exerting influence over how we utilize our retirement funds. In essence, BlackRock aims to manage the savings you've set aside for your golden years, effectively gaining control over how you spend them during retirement.

The silver lining is that BlackRock's proposal is a product with no legislative backing or hints of a looming obligation. However, the concern is that a similar law could be proposed in the future. If baby boomers were to withdraw too much of their retirement funds, the entire capital markets system could collapse, a risk highlighted by prominent macroeconomic experts like Mike Green.

Larry refers to BlackRock's plan as a “revolution in retirement” and believes it will dispel fear and instill hope. Earlier in his letter, Larry implied that the third way to fix our financial future is to fix the demographic problem, meaning having more kids or at least increasing immigration. But no, all Larry said was what was mentioned a few moments ago: raise the retirement age.

Larry’s stance might be related to his belief that machines can replace humans. During a recent World Economic Forum discussion panel, he explicitly stated, “Countries will rapidly develop robotics and AI and technology, and the social problems that one will have in substituting humans for machines are going to be far easier in those countries that have declining populations.”

It would seem that BlackRock's interests align with declining populations. This is unsurprising, given that a shrinking population is ESG-friendly: fewer people mean fewer emissions. If this notion disturbs you, Larry doesn't seem to understand why. Per his letter, “There's so much anger and division, and I often struggle to wrap my head around it.” Perhaps he needs to reflect on his role in the matter.

Infrastructure And ESG

In the fourth part of his letter, Larry discusses the ESG-aligned infrastructure that BlackRock aims to develop using your retirement funds. He states, "The future of infrastructure is a public-private partnership,” meaning BlackRock is partnering with your government. Larry asserts that this partnership is crucial for financing infrastructure projects as governments are burdened with significant debt and cannot undertake it independently.

He points out that the US government's debt is increasing rapidly and that fewer and fewer governments are buying US Government debt. Interestingly, a lack of financial support was the main reason why the precursors to the SDGs, the Millennium Development Goals (MDGs), ultimately failed.

Larry then goes one step further, saying, “More leaders should pay attention to America's snowballing debt. There's a bad scenario where the American economy starts to look like Japan's in the late 1990s and early 2000s when debt exceeded GDP and led to periods of austerity and stagnation.”

Larry argues that there is an alternative solution to addressing the national debt beyond cutting taxes and spending. He suggests that if the US economy grows significantly, it could enable the US to repay its debt. However, he fails to note that this growth will simultaneously cause inflation.

To drive growth in the U.S., Larry suggests focusing on energy investments, particularly in unreliable forms of electricity. Ironically, the current high costs directly result from inadequate investment in dependable energy sources, which can be attributed to the emphasis on ESG considerations. Asset managers like BlackRock have played a significant role in this underinvestment, exacerbating the issue.

Larry's admission that oil and gas will remain essential for “a number of years” is a gross understatement, considering they supply half of the world's energy needs. Surprisingly, Larry praises Germany as a model for effective energy policy despite the country shutting down its final nuclear power plant last year. This decision coincided with Germany's struggling economy, which faced challenges from high energy expenses due to sanctions and renewable energy sources.

Larry highlights Texas as an example of a state struggling with energy issues, attributing the problem to growing demand rather than its shift towards unpredictable renewable energy sources. Ironically, he discloses that BlackRock is investing in initiatives that further increase dependence on these intermittent sources. Moreover, Larry outlines a series of investments BlackRock is making to facilitate a “fair energy transition,” which is primarily focused on maintaining warm homes during winter while seemingly downplaying the importance of other energy-related concerns.

Luckily, Larry discloses that BlackRock is allocating more resources to dependable energy sources than to less dependable ones. This is because the company's clients are driving this demand. It's worth noting that several individuals and institutions had previously threatened to withdraw their investments due to BlackRock's ESG policies, and some actually followed through on those threats.

However, this is just the tip of the iceberg regarding BlackRock's double standards. Larry asserts that renewable energy sources reduce a nation's reliance on foreign powers, but this claim is misleading. The reality is quite the opposite. China supplies 90% of the necessary materials for these renewable energy sources, so every green energy infrastructure depends on the Chinese Communist Party (CCP). This raises questions about who truly holds influence within BlackRock.

BlackRock’s Plans

Larry outlines BlackRock's strategic trajectory in his letter, detailing the company's partnership with Global Infrastructure Partners (GIP), a leading international infrastructure investment firm with which he appears to have personal connections. Additionally, Larry intends to expand his travels and engage with more leaders globally, promoting BlackRock's strategy as the optimal choice. While he doesn't explicitly state it, his comments imply that BlackRock's growth in assets under management is attributed to foreign sources, thanks to his lobbying efforts.

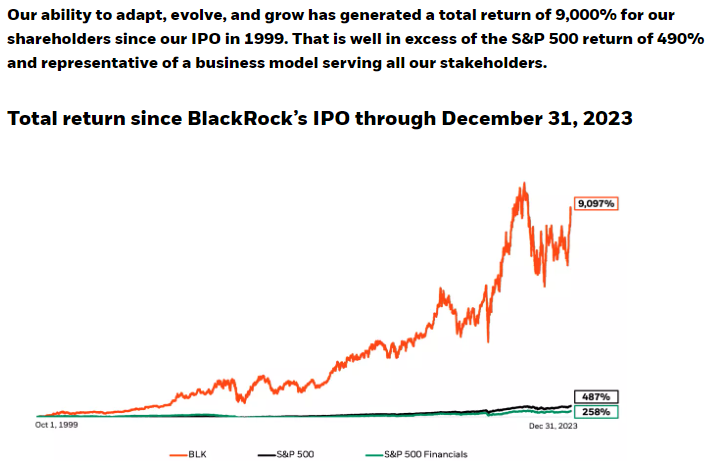

If you weren't aware, BlackRock's portfolio has surpassed a staggering $10 trillion in value and is still growing. To offer a sense of scale, this would make BlackRock the third-largest country by GDP. Furthermore, this immense wealth would be sufficient to acquire nearly half of the US equity market, although BlackRock already wields significant control through its substantial voting shares. According to Larry, the company plans to maintain its investment strategy, which includes early-stage ventures.

Looking ahead, Larry emphasizes that “Our strategy remains centered on growing Aladdin, ETFs, and private markets, keeping alpha at the heart of BlackRock, leading in sustainable investing, and advising clients on their whole portfolio.” For those who may not know, Aladdin is BlackRock's proprietary trading platform.

Larry mentioned that moving forward, BlackRock's primary focus on the private market will be ESG infrastructure. In terms of ETFs, they plan to increase ETF adoption further and launch new ones, particularly highlighting Bitcoin ETFs. This shift hints at the possibility of more crypto ETFs in the pipeline, including those for Ethereum. Additionally, Larry highlighted that BlackRock will increasingly prioritize fixed income, specifically government bonds, now that interest rates are “near long-term averages.”

BlackRock's move is noteworthy as it indicates that the company anticipates that interest rates will remain stable, which goes against the views of those who predict rate decreases. Following a boastful mention of BlackRock's impressive 90-fold increase in stock value over the past 25 years, Larry highlights the company's acquisition of GIP, an ESG infrastructure firm, and the subsequent appointment of its CEO, who happens to be a friend of Larry's, to BlackRock's board. Who needs crony capitalism when you've got nepotism disguised as ESG?

In all seriousness, Larry concludes by asserting that BlackRock is merely a tiny component of a broader, global phenomenon that he believes is improving the lives of ordinary individuals. However, in reality, this phenomenon primarily enriches the wealthy elite. Larry credits the capital markets and their investors for making this possible, but he fails to mention that a staggering 93% of all stocks are concentrated in the hands of the top 10% of the population.

What Does All This Mean for The Markets And You?

What implications does this have for you and the financial markets? It is crucial to understand that these are distinct entities. One viewpoint is that BlackRock's decision-makers seem alarmingly out of touch with the real world, which is a daunting prospect considering the vast amount of assets they control. The fact that they're holding up Germany as a model for other countries to emulate in terms of energy policy is either a staggering display of ignorance or a cynical ploy, with most people leaning towards the latter interpretation.

Regardless of the circumstances, the outcome remains consistent: wealth becomes increasingly concentrated among the affluent, while the disadvantaged fall further behind. This phenomenon frequently occurs in economies with centralized planning, and BlackRock's most significant mistake stems from this approach. The asset manager assumes that centralized control is the sole means of addressing issues and fostering prosperity to the extent that it collaborates with governments, introduces initiatives such as CBDCs, and limits access to gold, all in the name of economic growth.

This action is not a method for addressing issues and fostering economic growth. Instead, it seems more like a strategy to avoid the collapse of a financial Ponzi scheme. Despite their shortcomings, governments have significantly less debt than banks and asset managers.

Globally, there is a staggering $315 trillion of outstanding debt. Still, the liabilities stemming from complex financial instruments held by banks and asset managers are projected to be exponentially higher, reaching the quadrillions. These instruments are contingent upon the appreciation of underlying assets; if these assets fail to increase in value, the entire derivatives debt structure will collapse, triggering a catastrophic financial meltdown.

Upon closer examination, BlackRock's proposals all boil down to a single premise: entrusting them with your money and allowing them complete discretion over managing it, including determining when it will be returned to you. The ESG narrative may merely be a ruse to convince people that by handing over their money to BlackRock, they'll be contributing to the greater good. What's particularly unsettling is that Larry appears to have successfully duped many in the US and is now shifting his focus to international markets, where numerous countries eagerly seek investment opportunities, making them vulnerable to his influence.

It's clear that BlackRock's assets under management (AUM) increase whenever Larry travels, and it’s not an exaggeration to label it as deceitful when it leads to insufficient energy infrastructure that financially benefits BlackRock and other venture capitalists. The collapse of Sri Lanka, which previously held the highest ESG score, serves as a cautionary tale. Despite this, BlackRock continues pushing forward with its investments, making the average person worse off.

This has significant implications for the market landscape. Essentially, poorly conceived ventures will continue to attract excessive investment if they align with ESG criteria. What's particularly irritating is that BlackRock is channeling its ESG investments into startup ventures and private companies, making it challenging for us regular folk as investors to tap into these lucrative opportunities, likely by intentional design.

One approach to capitalizing on BlackRock's ESG fixation may lie in cryptocurrency. A similar trend has emerged in the AI sector, where many companies remain privately held, limiting investment opportunities for the general public. As a result, AI-related cryptocurrencies have become a viable alternative, serving as indirect investment vehicles for those seeking to benefit from AI's growth and development.

It's worth noting that a specific area of crypto, known as ReFi or Regenerative Finance, has garnered attention. While some crypto experts have raised doubts about the legitimacy of certain projects within this niche, they align with ESG criteria. If BlackRock's ESG trend experiences a resurgence, many of these projects could rapidly gain traction.

Final Thoughts

The reality is that primary energy is scarce due to inadequate investment from BlackRock and similar entities, and the emerging alternatives, except nuclear power, are insufficient to bridge the gap. As this reality becomes apparent, BlackRock will likely face significant investment withdrawals unless its strategy is altered. However, with Larry at the helm, a change in direction appears unlikely, making divestment a probable outcome.

Hopefully, we won't witness another asset manager arising, proclaiming to be the solution to all of humanity's problems. The truth is that most people simply want to be left alone to live their lives without interference. The idea of being "saved” by a grandiose plan or product is unrealistic and ignores the diversity of individual preferences and values. Instead of imposing a one-size-fits-all solution, providing people with the tools and resources they need to live well and make their own choices is more productive.

A Perfect Opportunity For Individual Investors Is Here

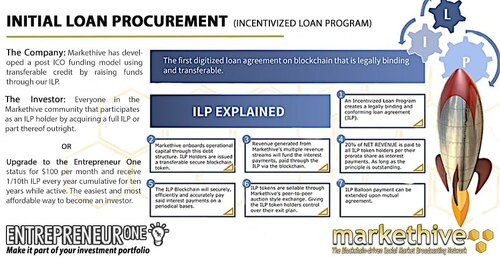

Standing out as a beacon of hope against the forces of globalization and corruption is Markethive, a pioneering platform that has been empowering entrepreneurs for years. As a trailblazer in the marketing sphere, it has conceptualized and executed innovative, high-impact strategies tailored to its users. With its sights set on the future, Markethive has transformed into a groundbreaking decentralized ecosystem rooted in blockchain technology and fueled by its cryptocurrency, Hivecoin. Additionally, it aims to expand its offerings by establishing a decentralized crypto exchange. (DEX)

Markethive is actively seeking individual investors to support its mission and vision of becoming a prominent decentralized social media, marketing, and broadcasting ecosystem. According to crypto experts, this is an upcoming crypto narrative in the next bull market. This is significant as it will pay huge dividends in the mid-to-long term for everyone, particularly those participating in the Entrepreneur One Upgrade, which includes the Incentized Loan program. By focusing on its path and purpose, Markethive remains dedicated to providing economic empowerment and identity to all, especially those lacking it.

Markethive is a grassroots project built for the people, by the people, and is of the people that empowers individuals by allowing them to become stakeholders. Markethive is revolutionizing how we approach social media, broadcasting, inbound marketing, and eCommerce, providing a comprehensive system for long-term success, financial autonomy, and a strong community bond. So take advantage of this chance to claim your spot in this pioneering network, where you can positively impact the world and build a lasting legacy of wealth.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Tim Moseley

.jpg)