Trad-Fi Wants To Dominate Crypto. Is It succeeding? What Does It Mean For Crypto?

.png)

Charles Hoskinson, the founder of Cardano, is a prominent figure in the cryptocurrency industry and is known for his unwavering belief in its potential to revolutionize the financial system, much like Markethive. Throughout the years, I have documented the evolution of Cardano creator Charles Hoskinson's efforts in developing the Cardano protocol and his humanitarian quest.

In a recent video, Hoskinson expressed his concern that the traditional financial system is slowly but surely taking over the crypto industry, a notion that has sparked a heated debate among experts. While cryptocurrency's original intention was to supplant traditional financial systems, some fear that if it continues on its current path, it may ultimately become even more dystopian than any central bank digital currency.

In a live video broadcast on February 13, 2024, Charles passionately shared his thoughts on the intersection of legacy finance and the crypto world, titled "Legacy is Eating Crypto." This article summarizes Charles' insights, supplemented by perspectives from Coin Bureau's crypto experts. We will also explore ways in which the crypto industry can safeguard itself from being overtaken by traditional financial institutions, commonly referred to as "Trad-Fi."

Stablecoins

Charles started by mentioning that he has been discussing the significance of decentralized algorithmic stablecoins in various recent interviews and how they differ from centralized asset-backed stablecoins, which he believes could threaten the cryptocurrency industry.

A stablecoin that relies on algorithms to maintain its value relative to a traditional currency is known as an algorithmic stablecoin. The most well-known example of such a stablecoin is Terra's UST, which suffered a collapse around May of 2022. However, Charles had a different type of algorithmic stablecoin in mind; he was referring to a stablecoin that is backed by another cryptocurrency, such as MakerDAO’s DAI, which can be minted by locking up another crypto as collateral, such as ETH.

The issue is that DAI may not be genuinely decentralized anymore, as it is now primarily backed by centralized assets. This makes it similar to other centralized stablecoins, such as Circle’s USDC and USDT, which Charles categorizes as asset-backed. Like USDC and USDT, DAI's value is supported by real-world assets, specifically US government debt and US dollars, which are susceptible to seizure.

For context, Charles shared some key facts. Firstly, he mentioned that centralized stablecoins constitute approximately 10% of the total market capitalization of cryptocurrencies. While this may not seem significant initially, it becomes notable when considering the second statistic: about 70% of all cryptocurrency transaction volume involves a centralized stablecoin. Charles emphasized that centralized stablecoins such as USDC and USDT are minted and redeemed by centralized companies that are typically subject to strict regulations. He explained that while these regulations are not inherently harmful, they imply that these entities are under government oversight, unlike cryptocurrencies.

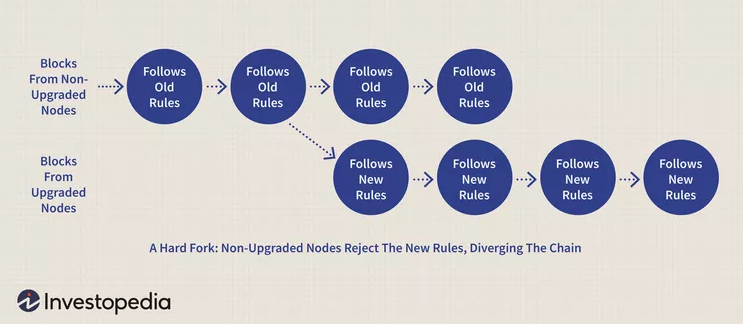

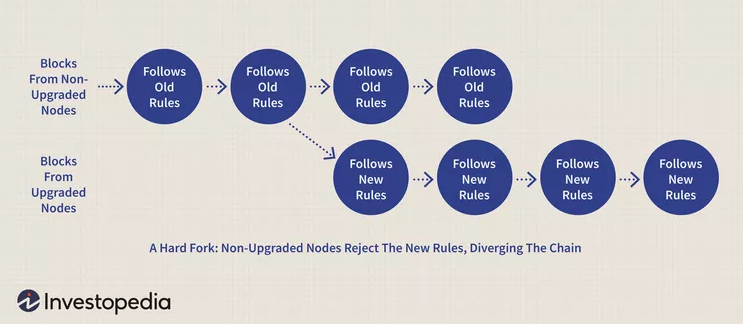

Moreover, these entities are restricted in their ability to drive innovation in stablecoins, as they must operate within the boundaries of regulatory compliance. Additionally, they cannot issue stablecoins in a fractionalized manner, meaning that an equivalent value of US dollars or bonds must fully back each stablecoin in circulation. This poses a significant challenge, as it enables centralized stablecoin issuers to potentially influence the outcome of a hard fork by deciding which chain becomes the dominant one.

Source: Investopedia

In other words, they would have to select which chain to transfer all their stablecoins to, as doubling the supply isn't an option. Interestingly, Vitalik Buterin, the creator of Ethereum, acknowledged this reality in 2022. He opined that Circle, the issuer of USDC, could dictate which chain emerges victorious in the event of an Ethereum fork. It is worth mentioning that Cardano is not exposed to this threat since it does not currently support any centralized stablecoins.

Bitcoin ETFs

Charles then pointed out the possibility of centralized stablecoin issuers implementing KYC at the blockchain level. He also highlighted criticisms regarding the absence of centralized stablecoins on the Cardano blockchain. Charles emphasized that those advocating for centralized stablecoins on Cardano without considering the associated risks are solely focused on increasing the value of the ADA token. He also drew parallels to the situation with spot Bitcoin ETFs, highlighting that these ETFs now hold over 200,000 BTC valued at over $10 billion, and argued that asset managers operating these ETFs wield a similar level of influence over Bitcoin as Circle does over select smart contract cryptocurrencies.

This stance is both intriguing and controversial. On the one hand, it suggests that the forecast about Circle's rise to prominence in cryptocurrency is materializing. On the other hand, there is room for debate as asserting control over Bitcoin involves more than just influencing its price. While Charles posits that the growth of spot Bitcoin ETFs could allow them to control Bitcoin in the event of a fork, this argument is not without its critics. Some argue that controlling Bitcoin requires more than just price manipulation. However, Charles suggested that with the ongoing absorption of BTC by spot Bitcoin ETFs, there is a possibility for these entities to amass enough control to potentially dominate Bitcoin in case of a fork.

For reference, in its ETF filing, BlackRock clearly mentioned that it would decide which Bitcoin fork to back in the event of one. Consider a situation where Bitcoin splits into proof-of-stake and proof-of-work networks. The likelihood is high that BlackRock and other asset managers would choose to support the proof-of-stake fork because their significant BTC holdings would essentially give them control over the new Bitcoin blockchain through their spot ETFs.

The irony is that ESG-obsessed asset managers are more concerned about the government's control over Bitcoin rather than its environmental impact. While proof of stake is praised for its eco-friendliness, the control aspect truly holds significance. Moreover, asset managers like BlackRock could offload their proof-of-work BTC holdings after a fork, causing the price to plummet and making it unprofitable for miners to continue validating transactions. This could ultimately lead to the demise of the proof-of-work chain.

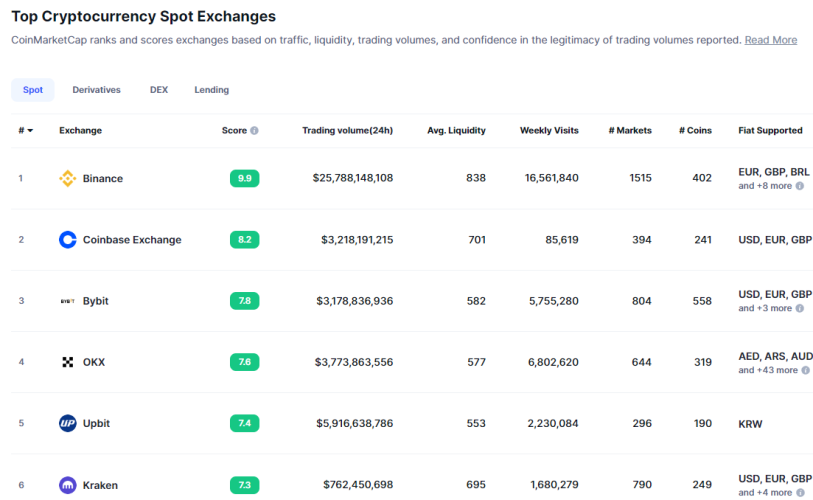

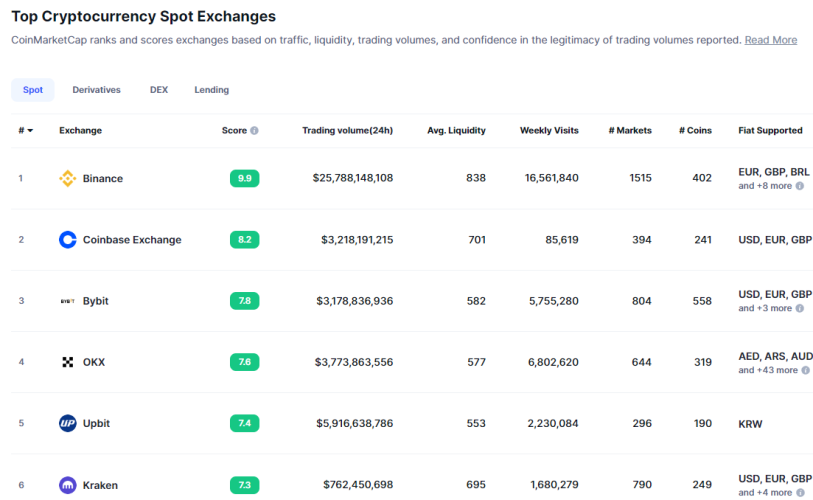

Source: Coinmarketcap

Charles emphasized that the dominance in the crypto industry lies not only with stablecoin issuers and asset managers but also with centralized exchanges where the top three control the majority of trading volume. According to Charles, there are just ten entities that have the potential to control the crypto market. However, considering Blackrock's partnership with Coinbase and its management of USDC's reserves, it's likely that the number of entities with such control is even smaller. Furthermore, Blackrock's influence extends to the US government, as evidenced by a recent lawsuit settlement with Binance granting it extensive oversight over the exchange.

In any event, Charles proceeded to make an intriguing statement, highlighting that if you ignore the advice of these organizations, they will not add your cryptocurrency to their list, and they will not introduce a stablecoin on your blockchain. This brings up the question of whether this is the reason Cardano lacks a centralized stablecoin – due to their unwillingness to adhere to such requirements.

Cardano

Charles noted that Cardano has successfully avoided being controlled by centralized stablecoin issuers and their associates, which has led to it being overlooked and undervalued. He pointed out an explicit prejudice against Cardano within certain industry circles. Charles reiterated that many in the Cardano community are growing impatient with ADA's price action and are “trying to invite the vampires in so that ADA's price will pump.”

Charles expressed that it's not his place to make a decision, but he felt others needed to understand the implications of their choices. He emphasized that if vampires are allowed to enter, they will eventually hold power over everything related to Cardano. However, he also suggested that ADA could be delisted if it doesn't meet the standards of trad-fi-backed crypto elites. Charles stressed that every decision in crypto comes with a trade-off; nothing is free. He posed the question of whether the purpose of crypto is to perpetuate existing inequalities or to stop them.

He questioned whether the goal of cryptocurrency was to conform to the institutions responsible for economic disparity or to break free from their control. To emphasize his point, he noted that increasing centralization in crypto mirrors the corrupt financial system it seeks to challenge, encompassing centralized infrastructure, centralized exchanges, and centralized stablecoins. Eventually, there will be wallet-wide KYC and CBDC integrations.

During a podcast with Bankless, Circle CEO Jeremy Allaire indirectly acknowledged that Circle's USDC ultimately aims to evolve into a central bank digital currency (CBDC). As you may already know, CBDCs will give governments and central banks complete authority over individual saving and spending habits. In fact, some argue that stablecoin issuers already wield such power.

The end result of this shift towards centralization will be identical to the permission systems and de-platforming present in the financial sector today. One needs to look no further than the COVID-19 protests in Canada for proof of this. Protesters and their supporters found their bank accounts frozen. Charles emphasized that cryptocurrency will become inconsequential if it integrates with trad-fi and that they will do everything in their power to ensure that it does, whether by influencing regulations or using other means.

Finally, Charles explained that Satoshi Nakamoto's motivation for creating Bitcoin was a response to the extraordinary measures taken during the 2008 financial crisis and the concerning precedents they established. Satoshi believed that cryptocurrency could offer a unique alternative, but first, it's essential to recognize how it's still mirroring the same patterns as traditional finance. Unfortunately, Charles did not elaborate on how cryptocurrency could diverge from these patterns, whether through algorithmic stablecoins or other means, to avoid falling under the control of traditional financial systems.

Why BTC Could Be Unscathed

Thankfully, the task is relatively simple, although implementing it will be challenging and involve tradeoffs, as Charles pointed out. Your viewpoint will ultimately determine the approach. To elaborate, let's revisit the premise of Charles's video, which suggests that ‘legacy’ or trad-fi is ‘eating’ or integrating cryptocurrency rather than vice versa. Some believe that incorporating crypto, to some extent, is crucial for promoting awareness, acceptance, and progress in the field.

The current state of crypto privacy regulations is a prime illustration of this issue. Globally, regulations surrounding cryptocurrency are heavily leaned against privacy, with the supposed reasoning being that it creates an environment conducive to illicit financial activities. However, the true motivation behind this stance is that powerful financial institutions desire total visibility into all transactions, allowing them to maintain control over the economy and suppress any potential competition.

The main point is that these influential financial organizations' primary desire for privacy comes from them. This is evident in Blackrock's and other companies offering Bitcoin ETFs' decision to keep the wallets containing the BTC supporting their ETFs undisclosed. In contrast, Bitwise chose to reveal this information preemptively rather than waiting for blockchain analysts to uncover it.

Consider the possibility that stablecoin payments will become widespread globally, thanks to the lobbying efforts of stablecoin issuers like Circle. It won't take long for individuals to realize that their stablecoin transactions and balances are transparent to everyone, which may raise concerns among trad-fi elites. Moreover, with central banks permitted to hold cryptocurrencies on their balance sheets starting from January 2025, there will likely be growing pressure on regulators to enhance privacy in the crypto space.

The rise in crypto privacy use will lead to the creation of additional privacy solutions. Cryptocurrency operates on universal principles, applying the same rules to all blockchain users. As long as this remains true, influential individuals and organizations will likely advocate for crypto values as they align with their self-interests.

If you are still in the process of being convinced, consider that various central banks globally are in the stages of creating their individual digital currencies. Given their ease of seizure or freezing, will these central banks rely on each other's digital currencies? The answer is no. Consequently, there'll be a significant need for a reliable, mutually accepted digital currency, especially as the world becomes increasingly geopolitically divided.

Coinbureau believes that Bitcoin's BTC is well-suited to serve this purpose and is currently used for trading by certain countries. Moreover, there are reports of countries engaging in Bitcoin mining activities. This could lead to a situation where nations using BTC for trade may compete in mining to maintain the neutrality of the Bitcoin blockchain. Fidelity, a different asset manager, has made a similar prediction.

This relates to Charles' assertions regarding asset managers' influence over Bitcoin through controlling its value. Recognizing that BTC's main advantage is its status as a trustworthy and impartial digital currency beyond anyone's control, it becomes clear that attempting to control Bitcoin would have negative consequences. To clarify, if Blackrock and other asset managers were to gain control of Bitcoin, its fundamental appeal would cease to exist.

The potential outcome of this situation is substantial funds being redirected to alternative assets, such as gold and other cryptocurrencies, which are beyond the control of asset managers. Notably, these outflows could potentially include investments in the proof-of-work BTC fork. It's important to remember that Blackrock's significant wealth and influence are largely predicated on the dominance of the US and its currency.

As explained in this article, the emergence of a new commodity cycle could potentially elevate the influence of the BRICS nations. Consider a scenario where one of these countries introduces a Bitcoin exchange-traded fund (ETF) that tracks the price of the proof-of-work version of Bitcoin derived from Blackrock's proof-of-stake fork. If this were to happen, it could attract tens of billions of dollars in investments.

Image: Markethive.com

How Crypto Strikes Back

This scenario is conjecture right now, and it is essential to take a broader view. This analysis considers long-term aspects and does not encompass the entire cryptocurrency market. In the shorter term, there is a possibility of integration between the rest of the crypto market and trad-fi in a manner that may present challenges. Small Blockers actually predicted this during the block size wars.

Notably, trad-fi investors attempted to take control of Bitcoin by increasing its block size. However, they were unsuccessful in their efforts and shifted their focus to other cryptocurrencies, such as Ethereum. Since then, events have unfolded as predicted by proponents of Small Blockers. Essentially, if crypto aims to rival trad-fi in aspects like speed and cost, it will ultimately result in greater centralization, as it becomes a race to the bottom.

In the past ten years, we have witnessed a trend where each new generation of cryptocurrencies has become increasingly centralized. This has made them vulnerable to regulatory capture. As with Blackrock potentially controlling Bitcoin, centralized cryptos becoming subject to trad-fi regulations will essentially make them the same as existing traditional financial solutions, leading to decreased user adoption, with no one using them. Recognizing this risk, investors in these cryptocurrency projects are now shifting their focus toward achieving maximum decentralization.

Decentralization goes beyond just the quantity of nodes and validators. It encompasses the level of developer involvement in the blockchain, the dispersal of the coin or token, particularly in proof-of-stake blockchains, and even the infrastructure utilized by miners and validators, as detailed in this article.

The decentralized nature of cryptocurrency comes with inherent trade-offs, such as slower transaction speeds and higher costs. This brings us back to the root problem: that most crypto companies are attempting to compete with traditional finance in terms of cost and speed. However, this has created a problematic trend towards centralization, which risks undermining the fundamental principles of decentralization that define cryptocurrency. If left unchecked, this race to the bottom could result in the most widely adopted cryptocurrency being managed by a single entity, such as the Federal Reserve. This outcome would be at odds with the vision of crypto enthusiasts, who seek to maintain the decentralized nature of cryptocurrency. So, what steps can be taken to address this issue?

As opined by Coinbureau, the solution is to let the crypto industry learn the importance of decentralization the hard way. As with most things in modern society, the only way you'll get change is with some kind of shock. In this case, it could be Circle deciding which Solana fork we could see in the future. It could be Tether freezing everyone's USDT holdings until they complete KYC. It could be Coinbase banning crypto transfers to and from personal wallets like many regulators want to do. It could be Blackrock’s spot Ethereum ETF taking control of Ethereum with all the ETH it will inevitably hold.

The average investor and user will likely realize the significance of decentralization in the crypto space only when confronted with situations that highlight its importance. As previously mentioned, this realization will also dawn on influential individuals and organizations. Subsequently, new cryptocurrencies that prioritize decentralization will emerge, hopefully without the need for a catalyzing event.

The cryptocurrency sector is anticipating potential threats and adapting accordingly. Early indicators of this trend include the emergence of decentralized privacy protocols and venture capitalists' financial support for algorithmic stablecoins. Initially, this may come as a surprise. Still, upon closer examination, it aligns with the motivations of major players like BlackRock, Coinbase, and Circle, who are ultimately driven by the desire to generate profits, just like many others in the cryptocurrency space. By investing in innovation, they will likely yield financial gains, which explains their support for pro-crypto regulations.

It's interesting to note that the institutions that have been perceived as obstacles to the growth of cryptocurrency are actually the ones that stand to benefit the most from its innovation. Governments, megabanks, and central banks are feeling the pressure of competition from crypto, and they are the ones hindering the progress of cryptocurrencies and working against it to maintain their power and control. It may seem far-fetched, but major players like Blackrock & Co. could be aligned with the interests of cryptocurrency enthusiasts in this battle despite their questionable reputation and difficulty in trusting them. Consider the potential profitability of displacing governments, megabanks, and central banks – it's food for thought.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.png)