Hivemapper Dashcam Earns Crypto

by Ashley Cassell, Editor, The New Digital World

Aims to Compete with Google Maps

The “crypto winter” is thawing out pretty nicely now. Not only are prominent cryptos starting to bounce back in price… Innovation is making a comeback, too. So, if you got bored with all the DeFis and Dogecoin (DOGE-USD) clones, then good news: I think I’ve found the hottest crypto startup for Summer 2022.

The Google Maps Killer

What would it take to beat Google Maps at its own game? Or Apple Maps, for that matter? A worldwide fleet of GPS camera operators… And a vast amount of cash to hire them. It could be a vanity project for a billionaire – although Bezos, Musk, or Branson might find it less gratifying to the ego than, say, going to space!

Or… what if you could recruit an equally vast number of ordinary people to map out their corner of the world – by rewarding them in cryptocurrency? That’s what Hivemapper is all about.

Hivemapper, whose upcoming crypto token will use the ticker HONEY, just completed its Series A fundraising round. Now, it’s about to roll out its first device: the Hivemapper Dashcam. Just affix it to the windshield, dashboard, or exterior of your car… and the Dashcam “automatically transfers collected imagery to the Hivemapper Network” through an app on your phone.

As soon as people receive their Dashcams and hook them up to the Hivemapper Network, their devices will start mining the HONEY token, in proportion to how much map imagery (and GPS metadata) they contribute to the project. Hivemapper is built on Solana (SOL-USD), which founders say provides “the truly global scale that the Hivemapper Mapping Network needs to operate.”

Hivemapper’s crypto rewards are what sets the project apart from, say, Waze, which was absorbed into Google (NASDAQ:GOOG) in 2013.

“There are now something like 25,000 Waze map editors. These are people sitting behind their computer screen editing maps … on behalf of what is effectively a multitrillion-dollar company,” Hivemapper founder Ariel Seidman told CoinDesk. “And they don’t get paid, there’s nothing they get in return for that. They get, maybe, a Google T-shirt or a Waze hat, but that doesn’t sit right with me.”

After all, the global market for geospatial data & analytics is valued at “$256 billion by 2028,” according to Meticulous Research. And as the heavyweight champion of GIS, Google Maps can do things like raising its prices by 1,400% on app developers who need them…leaving customers scrambling for alternatives. (No wonder Google Maps is now under investigation for antitrust violations!)

But what’s the best way to snatch up some of that market share? Simply to keep the map up-to-date.

See, even with the Scrooge McDuck-like hoard of cash sitting at Apple and Google… “Street-level imagery in many parts of the world is only updated once every two years,” Seidman explains in TechCrunch! “This causes cascading logistical, municipal, and political problems. However, maps have the potential to be near real-time. An open-source, community-owned map is the only way to continuously construct a living, breathing, ever-updating view of our world.”

Source: Hivemapper

Hivemapper is just getting started – with the first Dashcams scheduled to ship in July. What’s next for the project? According to its whitepaper:

- Contributors who sign up to review, annotate, and QA the map imagery will earn HONEY crypto, too.

- Any developer can build apps that provide driving directions, traffic warnings, or custom maps (geocoding).

- But to use Hivemapper’s APIs, developers will need to “burn” HONEY to receive Map Credits.

- “These burned tokens then increase the number of tokens available to mint and to pay to map contributors,” capped at 10 billion.

- Manufacturers can “seek approval” to make new hardware for Hivemapper, like cams for drones, scooters, and bikes, and add features like air-quality sensors or 3D.

Bottom line – this roadmap (so to speak) is exciting but long. It’ll take years to grow Hivemapper into a true rival to Google or Apple Maps.

Luckily, Helium (HNT-USD) provides a good model for how these projects can grow and succeed in the meantime.

Another “Proof of Physical Work” Project Grows 50X In A Year!

Helium is not unlike Hivemapper – and has a lot of the same investors, like Multicoin Capital, which provides a good, concise explanation of its investment thesis here.

Here, there’s also a physical device that mines crypto, in exchange for contributing to the network. But in this case, what you’re contributing is actually Wi-Fi coverage. By setting up a Helium Hotspot, you can share your internet connection with the Internet of Things (IoT) devices, like environmental sensors, GPS trackers, personal safety devices, and smart home/office devices. And you receive HNT crypto in return.

Unlike this new startup Hivemapper… Helium didn’t start out as a blockchain project. And without crypto incentives, it spent four years struggling to hawk its Hotspots to enough people for a robust network.

“The company was running out of money in 2017 when an engineer suggested, during an all-hands Scotch-drinking session, that more people might be willing to set up hot spots if they could earn cryptocurrency by doing it,” Kevin Roose reports for The New York Times in his memorably titled essay, “Maybe There’s a Use for Crypto After All.”

Now, the more people that use your Hotspot, the more crypto it earns. And from barely $1.50 in 2020, the HNT crypto reward is now worth over $21, even after coming through the long, hard crypto winter…a nice reward for long-term miners:

Source: CoinMarketCap

No wonder the Helium Network went from just 14,000 to 719,344 hotspots in the past year! The network is now present in 54,840 cities across 170 countries. That’s 12% growth – and 5,471 additional cities – in just the last 30 days!

Also in the last 30 days, the network seems pretty active, with users burning $4.7 billion worth of HNT for transaction fees (called Data Credits).

After all, this level of coverage for IoT devices puts the Helium Network in high demand. So in March, its leadership announced a new Helium Roaming Services program, where it will partner with other networks to provide their clients with roaming coverage through Helium. “Roaming partners and their customers, such as Volvo Group, Cisco, Schneider Electric, Accenture, and more, will dramatically increase overall usage of the Helium Network and will be important drivers of data transfer rewards for Hotspot owners.”

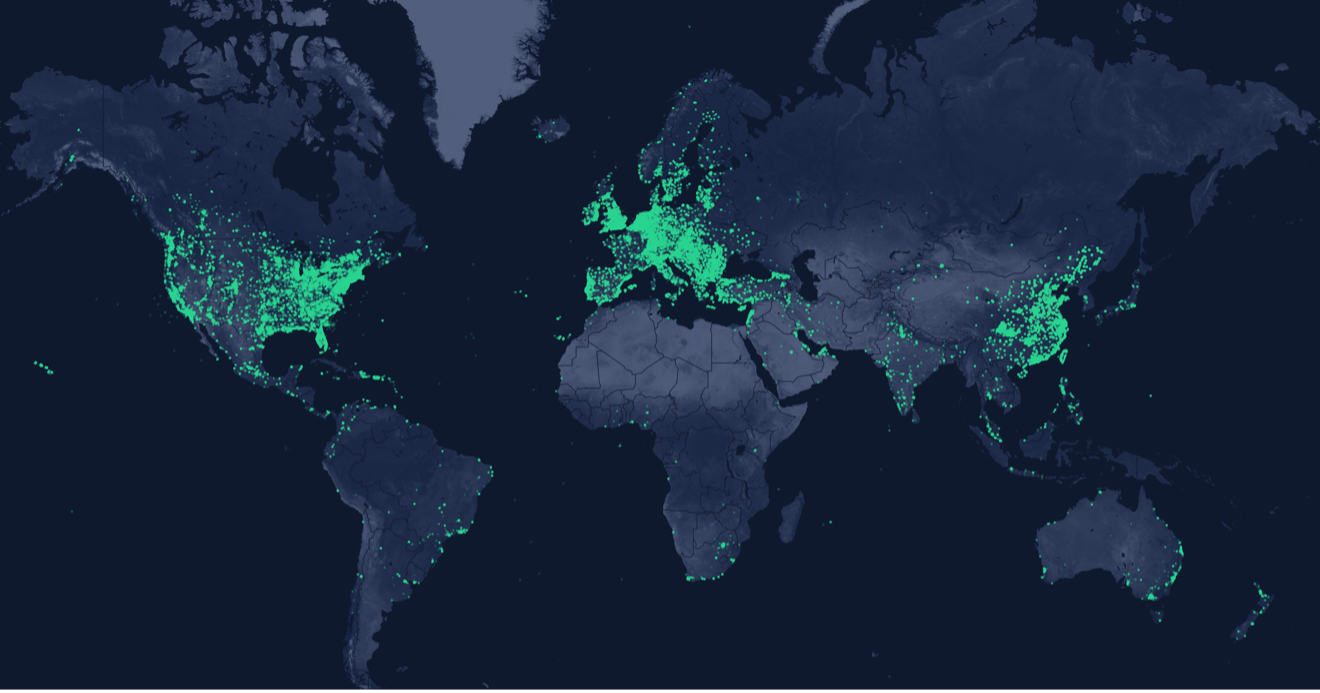

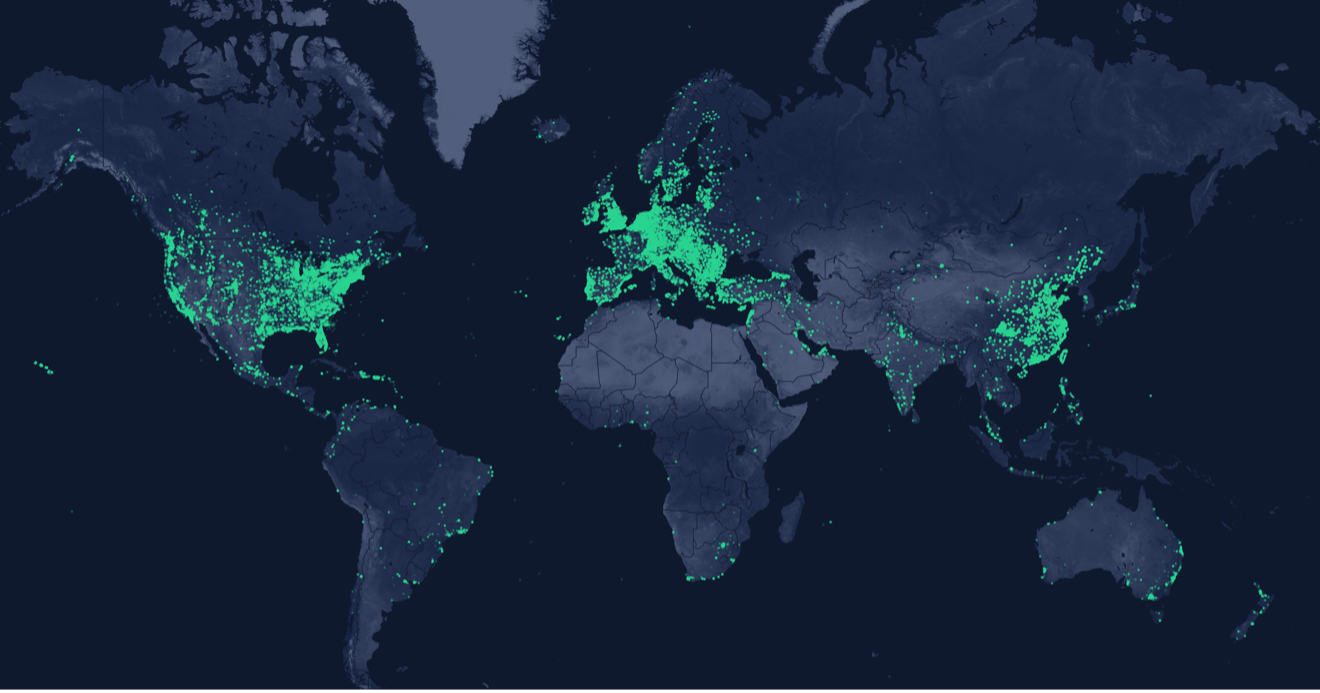

As we see below in its network map, Helium Hotspots are pretty popular in Europe, not to mention the United States and China:

Source: Helium

Helium is further along than Hivemapper in its fundraising, too. Having just renamed to Nova Labs (to emphasize the decentralized, community nature of the Helium Network itself), the company “just closed a $200 million Series D equity round from some big-name investors like Google Ventures, Tiger Global, and Andreessen Horowitz,” as Luke Lango reported in a recent update to his Crypto Investor Network.

“It clearly appears that Helium is firing on all cylinders right now. This remains one of our favorite long-term cryptos,” Luke concludes.

These “proof of physical work” projects also tend to be discussed as possibilities for big institutional investors.

“Where might institutional investors find value in crypto?” wonders Byron Gilliam in his Blockworks newsletter. One “possibility is protocols that provide real-world utility, like Render, Helium, or Livepeer. Those will look more like investable companies to traditional asset managers.”

Right now, though, any crypto that’s smaller than Bitcoin (BTC-USD) and Ethereum (ETH-USD) is a no-go for most institutions. This is the early advantage that we have as “retail investors”: We have the flexibility to invest like a venture capitalist in great projects like Helium – and, soon, Hivemapper.

With a $265 billion total addressable market (TAM), Hivemapper has enormous opportunities ahead. Let’s say they grab 10% or even just 5% of the market share from Google and Apple. If we put Hivemapper’s valuation similar to Helium’s ($1.2 billion today), then this is easily a 10X opportunity for a company with a cool, unique idea – that brings huge utility.

New Opportunities Are Emerging For Citizens of The World.

Freedom and democracy may appear to be struggling to stay alive in America, but there may be a knock-out punch ready to be released. The evolution of the blockchain-enabled metaverse is going to enable the 'Citizens of the World' to gain their own Freedom by democratizing power and creating a new world with new rules, new players, and new opportunities. For 99.99% of us, the metaverse will improve our real-world lives through the democratization of power and opportunity.

Along with the major long-term trend of society towards decentralization and smaller-scale organizations, there are new opportunities developing to help 'Preparers' in the cryptocurrency sector. Businesses are beginning to issue their own Crypto Coins that can be traded on Cryptocoin Exchanges.

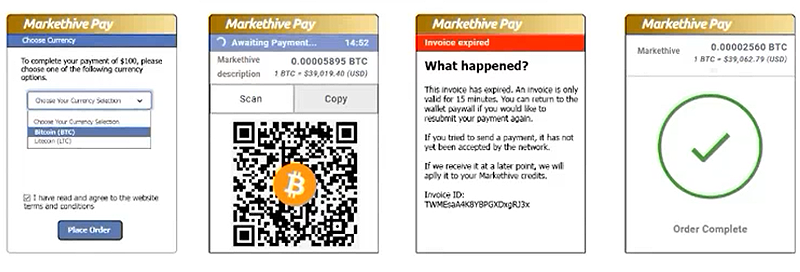

Markethive.com for example will be releasing its HiveCoin (HIV) in the coming weeks. It has tremendous upside potential that is outlined in a Video by Founder Tom Prendergast, "Entrepreneur Advantage…".

Not only that, if you go to their website and register as a FREE Member, you will be given 500 HiveCoins for "FREE" along with access to several Earning Opportunities and online tools to increase your HiveCoin balance.

Be sure to check it out today – Markethive.com

Tim Moseley

Ukrainians waiting on border

Ukrainians waiting on border

IMF's warning: Russia's war in Ukraine severely hurts global growth, adds to decade-high inflation

IMF's warning: Russia's war in Ukraine severely hurts global growth, adds to decade-high inflation.gif)

.gif) May silver futures bulls have the firm overall near-term technical advantage and have momentum. Silver bulls' next upside price objective is closing prices above solid technical resistance at the March high of $27.495 an ounce. The next downside price objective for the bears is closing prices below solid support at $24.045. First resistance is seen at $26.00 and then at today’s high of $26.195. Next support is seen at today’s low of $25.21 and then at $25.00. Wyckoff's Market Rating: 7.0.

May silver futures bulls have the firm overall near-term technical advantage and have momentum. Silver bulls' next upside price objective is closing prices above solid technical resistance at the March high of $27.495 an ounce. The next downside price objective for the bears is closing prices below solid support at $24.045. First resistance is seen at $26.00 and then at today’s high of $26.195. Next support is seen at today’s low of $25.21 and then at $25.00. Wyckoff's Market Rating: 7.0.

.jpg)

46%

46% 31%

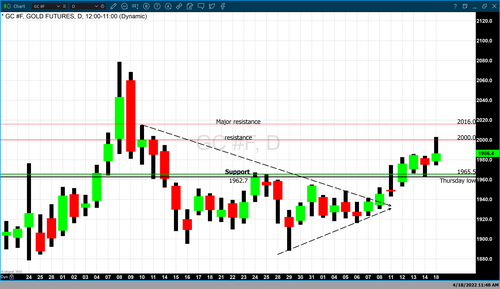

31% As gold price eyes $2,000 again, its 'big test' is yet to come, says MKS

As gold price eyes $2,000 again, its 'big test' is yet to come, says MKS