The Five Tenets Of The Great Reset:

What You Can Do To Reject And Counter The New Normal

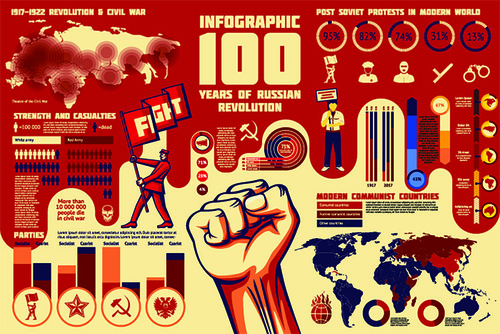

The famous quote by Winston Churchill, “Never let a good crisis go to waste,” has been used in many contexts. The first context was the creation of the United Nations at the end of World War Two. This quote has been touted quite a few times since the start of the pandemic but has become more evident in the context of the World Economic Forum's (WEF) Great Reset.

I started researching and writing about this topic from another perspective two years ago when many claimed that it was “nothing but a conspiracy theory,” with the majority of ordinary people oblivious to what was being planned decades ago.

As it turns out, it isn’t a “theory”; it’s real, with the elites and NGOs conspiring behind closed doors with their plans to implement a global environmental, social and economic shift under the guise of sustainability with a primary focus on Stakeholder Capitalism. Klaus Schwab, the leader of the pack at WEF, has been very open to letting the global population know that “we will own nothing and be happy.”

2020 virtual event in Geneva, Switzerland – Video

It’s all laid out in Agenda 21/30 and based on a 2020 book, The Great Reset, which Klaus Schwab co-authored with a lifelong colleague, Thierry Malleret. Now that the cat’s out of the bag and the new normal is starting to take shape, many more people are becoming aware of what’s happening, but a growing number of us ordinary folks are not in favor of it.

What matters now is that we take the steps needed to secure our personal and financial freedom so that no one can infringe upon them. There are ways in which we can effectively resist any pressure to conform to a “new normal” – whatever that may be. So today, we’ll review the Great Reset, discover ways to resist it and determine which cryptocurrencies will withstand the global shift.

Who Really Created The WEF?

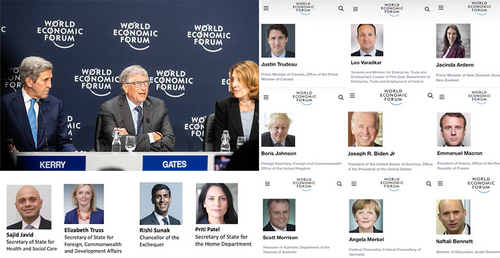

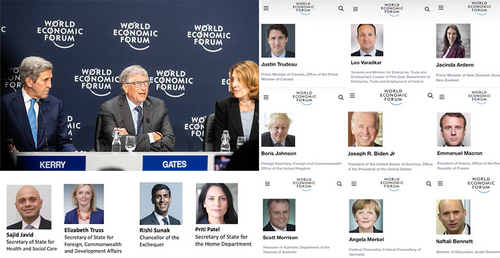

The WEF is an international organization based in Switzerland. It comprises some of the world's most influential individuals and institutions, including current and former presidents, media moguls, big tech CEOs, asset managers, banks, and non-governmental organizations (NGOs). As stated on the WEF’s website, the organization's explicit purpose is to “…shape global, regional and industry agendas.” It does this by supporting individuals and institutions that promote its agenda.

The WEF is headed by Klaus Schwab, a German engineer economist and former professor who served as its chairman since it was founded in 1971. Interestingly, the WEF wasn’t simply Klaus Schwab's brainchild but was born out of a CIA-funded Harvard program headed by Henry Kissinger and pushed to fruition by John Kenneth Galbraith and the “real” Dr. Strangelove, Herman Kahn.

These three powerfully influential men from the American political elite were the driving force behind the European-based globalist organization. They recognized Schwab’s potential and saw a reflection of their own intellectual desires in him. Back in the late 1960s, they recruited and mentored Klaus Schwab, helping him to create the World Economic Forum. You can read this fascinating story here.

Almost all the WEF’s agendas are based on Klaus and his mentors’ ideas. Today, Klaus and his cohorts consider the pandemic to be on a par with another world war as far as its global disruption goes. It presents an opportunity to replace capitalism with stakeholder capitalism.

Stakeholder capitalism is one of Schwab’s ideas, and it fundamentally replaces shareholders with so-called stakeholders who basically decide what everyone does. If you're wondering who the stakeholders are, Klaus has made it clear in interviews and at many events that the stakeholders are the individuals and institutions who are a part of the WEF.

In crypto terms, you can think of stakeholder capitalism as being the total centralization of control in the hands of the world's most powerful people, corporations, and organizations.

Three Phases Of The Great Reset

According to Klaus, there are three phases to the great reset, and the first two relate to the pandemic. These are “Restrain” (fight the virus), the phase we are in currently. Then, “Recover” is the next phase where the world enters the “new normal.”

Now, the third and final phase is “The Great Reset” itself, which focuses on the following five points;

- Redefining the Social Contract

- Decarbonizing The Economy

- Digitizing Everything

- Implementing Stakeholder Capitalism

- Global Rollout of all the above ensures those first four tenets find their way into every country.

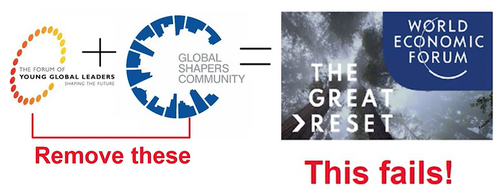

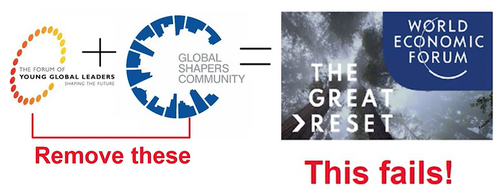

As to how exactly the WEF will roll out the great reset around the world, Klaus states that this will be achieved primarily with the help of the WEF’s network of so-called global shapers and young global leaders who will all push for the great reset in their respective nations. The WEF hopes to have it all in order by 2030.

The WEF’s 2020 virtual event in Geneva, Switzerland, focuses on the great reset and their new book in more depth, and you can hear it straight from the horse's mouth in this video. They blatantly tell you what they want and how they plan to get it, which blows the “conspiracy theory” out of the water.

So now that we know what the great reset is and how the WEF elites plan on rolling it out, we can prepare for its five points outlined above. It’s worth noting that there seems to be quite a bit of overlap between these five points, and it sounds like they will be implemented simultaneously, not in sequential order.

It's also important to remember that these points are already slowly being implemented. This means you must bare in mind how a change in one could affect the other when preparing to avoid or resist them. This could become difficult since part of the WEF’s agenda distorts traditional definitions of inflation, well-being, and economic growth.

This distortion of definitions lies at the core of redefining the social contract, as this involves replacing all of the above with ESG-focused metrics that prioritize diversity and inclusion over actual productivity.

1: Redefining the Social Contract

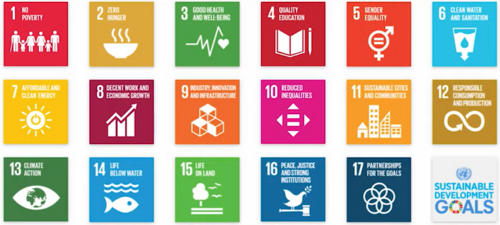

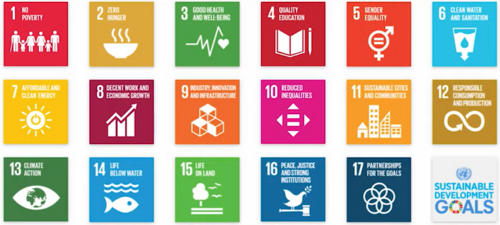

ESG has its roots in an initiative spearheaded by the United Nations and some of the world's largest corporations. As time goes on, the ESG criteria are becoming more aligned with the United Nations sustainable development goals (SDGs).

Image Source: United Nations

There are 17 SDGs in total, noting a couple of examples mentioned in the great reset virtual event video above of what the WEF wants to see from a few of them. The 4th SDG is quality education, and co-author of the book, The Great Reset, Thierry Malleret, stated at the virtual event that the WEF doesn't like that a science degree from one University is considered more prestigious than a science degree from another University.

As such, the WEF would like to see all degrees eliminated and replaced with specific skills training that would last until the end of your life. In other words, you'll be in school until you die and never even get a degree. Plus, there’s also the WEF indoctrination you're likely to endure. Now the switch to skills training also ostensibly implies that there will be no more small businesses or entrepreneurs, just mega corporations where everyone is a worker bee.

This sounds ridiculous until you realize it relates to the 10th SDG, which is reduced inequality. Here, the WEF is willing to do whatever it takes to ensure that economic inequalities do not continue to increase. It includes making sure you’ll own nothing and be happy, as brazenly stipulated in the WEF’s infamous video.

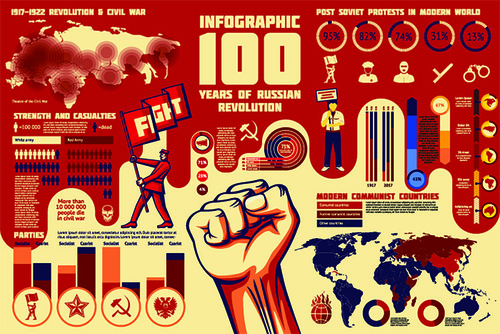

Instead, you'll rent what you use from the stakeholders who will own everything, and remember that these stakeholders are all the folks at the WEF. Historically, attempts at making everyone equal tend to end very badly, as making everyone equal usually translates to making everyone equally poor and miserable except for the select few. The select few in power are subsequently forced to kill anyone who tries to reject that poverty and misery.

Ironically, the WEFs push for eliminating inequality comes from the fears its constituents have about the riots, revolutions, and migrations that will inevitably occur if inequality continues to increase. A few WEF members have admitted this on stage, including at that Great Reset virtual event.

Fortunately, there's an easy way to resist this redefining of social contracts, and that's to reject any ESG or SDG-related criteria, especially when it's being used to redefine what a recession means. Instead, stick to tried and true social contracts, and reinforce them with your friends, family, and community.

Better yet, invest your time, money, and energy in individuals and companies who vocally oppose ESG, SDG, and other top-down decrees coming from technocrats who are out of touch with what life is like for the average person.

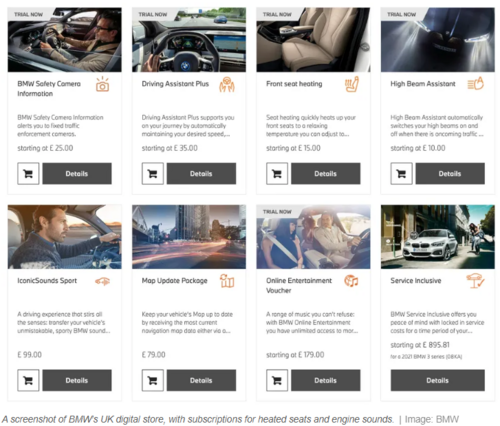

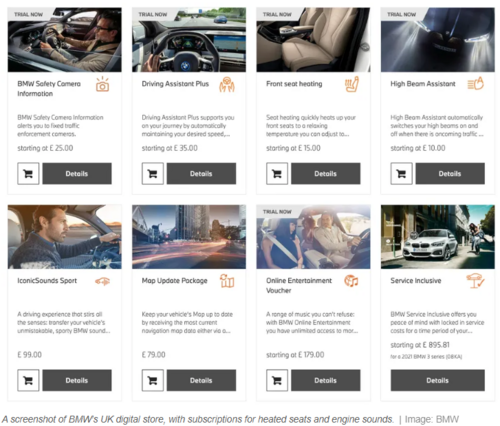

Pro tip – Stay away from companies that force you to pay a subscription service to use a “physical product” that should be entirely in your ownership. The moment you purchase it, your future might just depend on it.

Image source: The Verge

2: Decarbonizing The Economy

The second point of focus for the great reset is decarbonizing the economy, and here's where things get a bit complicated and contentious. That's because many would argue that moving away from fossil fuels is a good thing.

However, there is a right and a wrong way to transition to more renewable energy sources. So telling farmers to stop using fertilizer during a food crisis or shutting down nuclear plants during an energy shortage is not how you decarbonize the economy; It's how you destroy the economy.

It's also important to remember that many environmental elites see the average person as a form of carbon that should be reduced, if not eliminated. It is why they're eager to implement lifestyles and diets that are objectively unhealthy. Such as constantly living in the metaverse 24/7 and eating insects.

Another problem with the WEFs green energy agenda is that the energy structures it envisions will result in the hyper-centralization of the electricity grid, probably by design. That's because if everything runs on electricity, it becomes pretty easy to control everything.

Another thing that's probably by design is the focus on wind and solar, and that's because not every country has the ability or resources to create its own wind farms or solar panels. This forces them to trade with other countries for energy, which promotes the globalized world, the WEF wants to see.

Now, as with redefining social contracts, there’s an easy way to resist the WEFs warped decarbonization doctrine, and that's to advocate for renewable energy solutions that actually make sense. Educate your friends, family, and community about the risks of decarbonizing too quickly.

Additionally, acquire solar panels and power generators to become as energy independent as possible. Also, learning how to build gasifiers will come in handy when they start making it more and more difficult for the average person to buy petrol and petrol-powered cars.

On a good note, Bitcoin will not be banned because of its energy use or carbon emissions. That's because even the WEF knows that the energy and carbon emissions associated with crypto mining are a fraction of a percentage of the global total, as explained in this article.

They're just upset that they can't control BTC like other cryptos, which is why ESG-obsessed asset managers are impelling green energy disclosures from crypto miners. They are also investing in publicly traded crypto mining companies; it's their attempt at taking control, and it will fail.

3: Digitizing Everything

Bitcoin relates to the third focus of the great reset, and that's the digitization of everything. Essentially, every asset will be tokenized on a permissioned blockchain that the government and the central bank run. To clarify, the BIS is heavily involved with the WEF, and many of its members are so-called agenda contributors. This means they are directly engaged with the WEF’s great reset plans.

The tokenization of all real-world assets in such a manner means the government and central bank could turn off your ownership of anything at any given time, for whatever reason it sees fit, including your identity. But having said that, we’re apparently going to own nothing anyway! I go into more detail in this article about the Bank for International Settlements (BIS) and its vision of the future financial system.

Furthermore, the digitization of money, specifically the development of a central bank digital currency (CBDC), is something that just about every central bank is planning on rolling out, courtesy of the BIS.

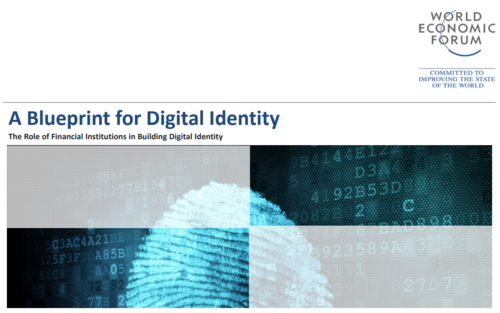

A Blueprint for Digital Identity | weforum.org.pdf

To complete the CBDC puzzle is the dystopian digital identity. This is a prerequisite for the rollout of a CBDC since you need to be able to identify individuals, and it’s no secret that governments have been working hard on proof of concepts for digital IDs during the pandemic.

A digital ID is also a prerequisite for widespread internet censorship, which the WEF apparently wants to implement with the help of artificial intelligence. It’s not surprising, given that information about the WEF and its affiliates is spreading like wildfire these days.

To be candid, resisting the WEFs digitization will be extremely difficult. Of the five focuses of the great reset, it's the most critical pillar because if you control the flow of information and the flow of money, you truly control everything.

Case in point, Klaus Schwab explicitly stated at the great reset virtual event that they need digital infrastructure, such as digital identity, facial recognition, human tracking, etc., to enforce ESG criteria and all the upcoming social contracts the WEF cronies are cooking up in the organization's Ivory Tower.

That means that it is imperative that you reject any form of digital identity that is not entirely decentralized from top to bottom. It also means you must acquire some form of currency that cannot be easily tracked, censored, or confiscated by a centralized authority. This includes cash, precious metals, and select cryptocurrencies.

Also, familiarize yourself with decentralized social, video, and broadcasting platforms, like Markethive, the social, market, and broadcasting network, where your information and content are free from censorship. Freedom of speech. liberty, financial sovereignty, and autonomy are the tenets of this ecosystem built by the people and for the people. A sanctuary where entrepreneurs have every form of media at their disposal to further their entrepreneurial goals.

It would be impossible for any so-called authority to shut down distributed data centers globally and sovereign servers which are entirely autonomous. Decentralized blockchain technology and cryptocurrency create an entire ecosystem, ultimately free from subjugation, and the solution for entrepreneurs and small businesses to thwart the opposition and continue to thrive.

Other platforms include Odysee for video, Theta for live streaming, and Arweave for uploading information. These cryptocurrencies will be significant as we endure this tyrannical shift being forced upon us. There are many alternative websites popping up; however, it’s good to be aware that many purporting to be for the people are essentially controlled opposition.

It’s essential to understand the freedom of information and the freedom of money are the ultimate deterrence to the great reset. That's because the truth eventually overcomes indoctrination, no matter how often it's labeled disinformation or misinformation.

Overcoming this depends on the ability to financially support the individuals and institutions speaking and propagating these truths. So it’s time to abandon the tech giants in favor of a new world order and get behind platforms with your best interests at heart.

Pro tip: keep physical copies of all your most important records, such as land deeds, home ownership, documents, passports, driver's license, crypto wallet seeds, and the like. Even if expired, they will help preserve your identity if you become persona non grata for opposing the WEF’s ever-expanding agendas.

And if you think that complying with them will save you, recent events have shown that it will only make things worse for you and everyone else in the end. The only winners in this system will be stakeholders at the WEF, which ties into the 4th factor; the great reset.

4: Implementing Stakeholder Capitalism

It’s unclear how the WEF will introduce stakeholder capitalism, mainly because it's not entirely evident how its stakeholder capitalism governance structure works. The WEF has over 4,000 individual members and hundreds of institutional partners, with 100 of them labeled as strategic.

How they all come to a consensus is anyone's guess. Even if we assume, it's just the 100 strategic partners calling the shots, it's hard to imagine that they're all on the same page about every issue.

It was evident in one of Klaus's speeches from one of the WEF events earlier in the pandemic, where it sounded like he was desperate to keep the interests of these so-called stakeholders aligned. Now you'd think the real stakeholders are governments, but the great reset co-author Thierry Malleret admitted at the virtual event that the private sector effectively controls the public sector through lobbying.

In another article, I discussed the enemies of cryptocurrency and that Wall Street is one of the most prominent lobbyists out there. This means that the real stakeholders are the big banks, asset managers, and the central banks, as they ultimately determine how money moves in the economy.

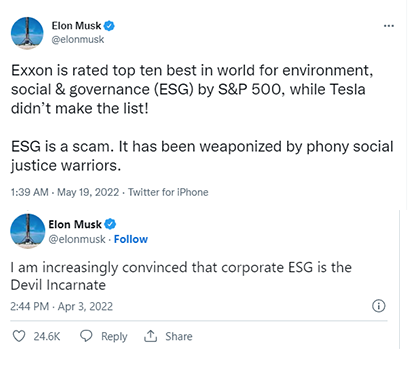

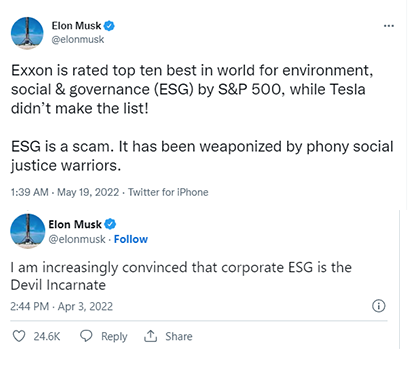

BlackRock and Bank of America have been explicit in their intentions to direct capital to anyone advocating ESG and remove capital from anyone or anything that offends their sensibilities, regardless of ESG status, such as Tesla. So, this is how stakeholder capitalism can be fought, and that's to exacerbate the differences in interests between the different stakeholders at the WEF wherever possible.

Image source: Twitter

It's important to point out that centralized power is inherently unstable. That's because, as more power gathers, in one place, the more profit someone stands to gain if they stab the other participants in the back, especially if it earns them the support of the people.

Arguably, elite figures like Elon Musk fall into this category. He may be seen as benevolent, or maybe because he figured out that he stands to gain much more by siding with “we the people.” He’s already richer than all the other elite figures, so he’s won their hierarchical game.

So, supporting breakaway figures like Elon might be our best bet at encouraging more of them to defect from the WEF and ruin its stakeholder capitalism. There’s a strong possibility there are more stakeholders who are not happy with being hated by the public and can't stand Klaus and his clown company, who would love the get the same sort of fanfare as Elon Musk.

5: The Global Rollout

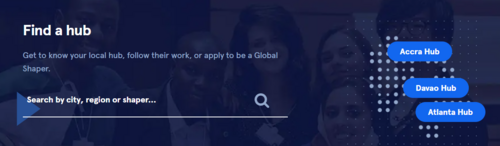

The final factor of the great reset is the export of the WEF’s endgame to every single corner of the earth. Klaus explicitly stated during that virtual conference that the WEF would leverage its network of global shapers and young global leaders to ensure the great reset is implemented in every country. Klaus also specified that over 10,000 of these recruits are slowly slipping into various positions of power worldwide. And he repeatedly stated that the great reset’s success depends on this.

This makes sense because there's only so much the WEF can achieve from the top down, and the pandemic proved this. Klaus and his cult followers saw the pandemic response as a “test of the great reset philosophy.” But, this top-down test didn't go nearly as well as the WEF had hoped, which seems to be why they are leaning so heavily on the global shapers and young global leaders lately.

It's an inorganic bottom-up approach that pushes the WEF’s agenda in major social and economic hubs, and it's no coincidence that most of them seem to have been on-boarded during the pandemic.

Notably, it’s convenient that the global shapers and young global leaders' websites are searchable. The former lets you see which WEF agents are looking to change things in your city, and the latter lets you see which WEF agents are looking to change something in your country or region.

If you see a global shaper or young global leader running for public office, vote for a different candidate who represents your views but isn't aligned with the WEF. All it takes to double-check is a quick search on the WEF website, the Global Shapers website, and the Global Leaders website.

Interestingly, the WEF blocked someone on Twitter for commenting on just two posts saying to vote against its young, global leaders. Note that the WEF gets lots of hate on Twitter daily and doesn't block everyone. So it would seem that undermining the WEF’s subverters may well be the organization's Achilles heel.

Klaus Schwab admitted at the end of that virtual event that they might not succeed, so let's ensure they don't. And remember that we only have until 2030. So, make the next eight years count through your selective spending, full attention, directed energy and informed voting. That's really all we need to do to defeat the WEF at the end of the day.

Once the WEF has been defeated, the next order of business will be to create robust decentralized, autonomous organizations to replace institutions like the WEF and its affiliates. We need to prevent this degree of centralized power from ever happening again so that the average person can finally live in peace. Also, fix the monetary system, which has been the driver of this centralization since the dawn of time.

(10).gif)

Reference:

Coin Bureau

World Economic Forum

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Also published @ BeforeIt’sNews.com

Tim Moseley

(10).gif)

.gif)

.gif)

.gif)