The BIS Vision: The Future Monetary System

There are a few different visions for how the financial world should evolve. Most of us dream of a future where we can be independent and free. On the contrary, some institutions are vehemently opposed to such liberty. The 'powers that be' will never allow us to be free, as eliminating their control would mean cutting their puppet strings.

Central banks are among the most prominent financial puppeteers in the world. The Bank for International Settlements (BIS) is like a member’s club for the central banks, and for the last two years, the BIS has been attacking all forms of cryptocurrency, trying to fault the decentralized system.

However, the cronies at the BIS have been some of the greatest advocates for central bank digital currencies (CBDCs). They have been planning their vision of a future that would radically alter the financial system, verging on the dystopian. Recently, they released their latest report on this vision for the future monetary system.

There is a quote that seems to have become the narrative of the crypto industry;

‘First, they ignore you,

then they laugh at you,

then they fight you,

and then you win.’

It could be that crypto has entered the 3rd phase of the quote and is blatantly obvious in the rhetoric of the anti-crypto institutions, like the BIS, detailed in its report of a dystopian vision of the future of finance. It also documents a flawed and somewhat naive view of the crypto industry.

What is the BIS?

The Bank for International Settlements or BIS is the self-described bank for central banks. The BIS is owned by the 63 central banks that make up its membership and is based in Basel, Switzerland. The BIS's job is to help Central banks coordinate their monetary policies. An informational video by the BIS revealed that all 63 Central Bankers recently met in Basel to discuss monetary policy. A sporadic occurrence that only happens during times of Crisis.

The BIS has been working closely with central banks to develop their CBDCs, and CBDCs will make it possible for them to have total control over the economies of their respective countries by determining how and when money can be spent. It’s important to note that CBDCs are being built from the ground up to maximize financial control.

In contrast, most cryptocurrencies were created from the ground up to maximize financial freedom and, in some cases, financial privacy. It’s no surprise that the BIS is not a fan of cryptocurrency whatsoever and that the report summary in this article can be summarized in one sentence. According to the BIS, everything that cryptocurrency can do, CBDCs can do better.

Image source: Decrypt

The report was formulated by Hyun Song Shin, the economic advisor and head of research. Hyun is as anti-crypto as they come and attended a media briefing about cryptocurrency for the BIS in 2018. He talked about why cryptocurrencies will never replace fiat currencies because they can't scale and don't guarantee transaction finality; the ‘laugh at you’ part of the quote mentioned above.

He did another media briefing about cryptocurrency in early June 2022, specifically about this report. He talked about why CBDCs are better than cryptocurrencies, a considerable shift in tone from four years ago, and the ‘fight you’ part of the quote above. At the media briefing, Shin was asked some critical questions about CBDCs by reporters, to which he had no clear answer.

One reporter asked why are CBDCs necessary when we have alternatives? A second asked about people's privacy concerns about CBDCs, given that the BIS had specified that privacy will not be possible with CBDCs and that the central bank will keep all user data.

A third reporter asked whether CBDCs would see any adoption given their concerning characteristics. A fourth reporter asked whether someone would be blocked from buying the likes of alcohol and tobacco or entirely blocked if they speak out against their government.

Even though he couldn’t answer the reporters’ questions, he clarified and applauded that CBDCs problematic programmability could theoretically be applied to any payment system, providing a government successfully rolls out a digital ID.

BIS REPORT: The Future Monetary System

The BIS report begins with a brief introduction that describes the financial system as it functions today. In short, it states central banks issue the money and creates trust in it, whereas commercial banks make it possible for people to use that money to buy, sell and borrow.

If the idea that it's the central bank that creates the trust in money wasn't bad enough, the authors claim that “private sector innovation benefits society, precisely because it is built on the strong foundations of the Central Bank.”

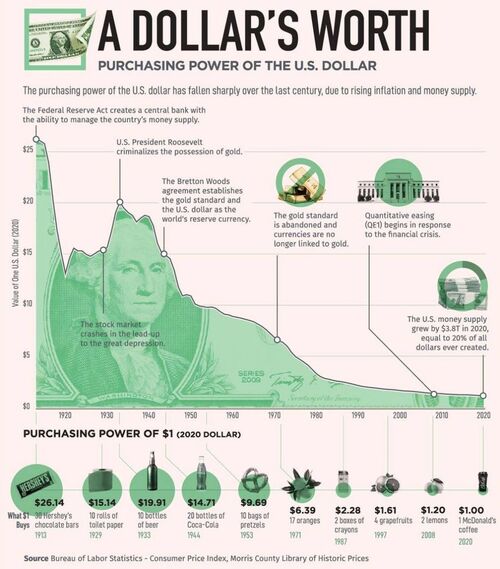

To add insult to injury, the following sentence reads, “the monetary system with the central bank at its center has served society well.” This statement is highly debatable given that central bank money printing has made life even more unaffordable for the average person while enriching the 1%.

After briefly describing cryptocurrencies, the authors turned to Terra’s recent collapse as evidence that crypto can't beat the central banks. They claimed that the crypto industry constantly needs a “nominal anchor” such as fiat-denominated stablecoins.

They believe the only solution to this crypto dilemma is to switch everything over to permissioned blockchains run by central banks with CBDCs and so-called fast payment systems that commercial banks will leverage the same way they leverage the central banks today.

What Do We Want From A Monetary System?

The second part of the BIS report is titled, “What do we want from a monetary system?” It's important to remember that this report is intended to be read by powerful individuals and institutions, not the average person. So the authors aren't really asking what we want; they’re asking their wealthy and influential cronies.

Below is a table the authors provided that identifies eight monetary system goals. These are safety and stability, accountability, efficiency, inclusion, control over data, integrity, adaptability, and openness. It would seem that all eight of these can be rolled into one, and that's total control.

These boxes explain how well these eight “wants” are satisfied by the current financial system, cryptocurrency, and the BIS’s dystopian vision of the future of finance. Given that the BIS is the author and creator of this table, it’s no surprise that crypto fails on almost all metrics, whereas the BIS’s future system succeeds on all eight.

Image source: bis.org

This ties into the third part of the BIS report, which relates to cryptocurrency problems. Not surprisingly, the authors have no shortage of crypto criticisms, and they start with all the volatility in the crypto market and the fact that most cryptos are down more than 90% from their all-time highs.

Of course, the authors don't explain the reason why crypto is so volatile and that its implicit goal is to replace the financial system, which is a massive undertaking. The authors also don't acknowledge that the volatility of most major cryptocurrencies has been on the decline over the years.

The authors seem to imply that crypto can't replace central banks because their blockchains are fragmented. Meaning they can't interoperate, which just isn't the case. Most crypto holders know the industry will be multi-chain, and interoperability innovation has been explosive.

They highlight that new cryptocurrencies are pretty centralized, and many existing cryptocurrencies have started to centralize to increase their speed and competitiveness. The authors then turn to decentralized finance. Notably, there’s growing awareness that the central banks and commercial banks alike see Defi as the biggest threat because it has the potential to play both of their roles.

Because centralized exchanges somehow fall under the umbrella of Defi, the authors list a few critiques of them, too, including the lack of transparency around crypto holdings, a lack of oversight compared to regular exchanges, and the fact that they let you withdraw your crypto.

The Financial Action Task Force (FATF), whose so-called recommendations aim to make self-custody next to impossible by labeling anyone who tries to hold their own crypto as high risk because they believe only the banks are allowed to preserve your assets, comes to mind.

Regarding the “structural limitations of crypto,” the authors argue that cryptocurrencies are incentivized to keep their fees high because it's the only way they can adequately compensate miners and validators. This is an interesting albeit flawed argument.

This is an argument that Hyun Song Shin made in his first media briefing about cryptocurrency in 2018. He and the authors of this report fail to realize that economic incentives and self-interest are why anyone does anything at all, ultimately.

While it's true that there are risks associated with securing a cryptocurrency blockchain, there are even more considerable risks related to giving control of the financial system to a small group of central bankers. And crypto’s inherent value is increasing as people start to realize this.

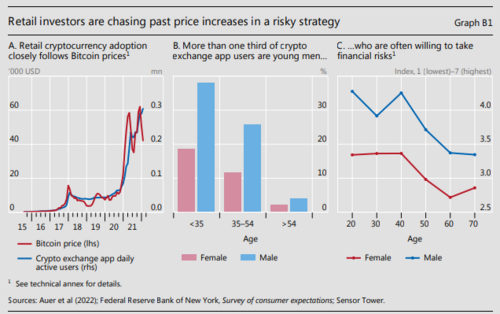

In the graph below, the results of a crypto study conducted by the BIS found that “a rise in the price of Bitcoin is associated with a significant increase in new users, i.e., the entry of new investors, with a correlation coefficient of more than 0.9. It analyzes the age and gender of users, exogenous shocks, and risk factors, which could convince the reader that crypto is dangerous.

The authors proclaim that “regulatory action is needed to address the immediate risks in the crypto monetary system and to support public policy goals.” These regulations the authors want to see include;

- Regulators to crack down on stablecoins, especially decentralized stablecoins, which is no coincidence, given that stablecoins compete directly with all kinds of fiat currencies as per the BIS’s own admissions.

- Cryptocurrency exchanges that hide transacting parties' identities and fail to follow basic know your customer (KYC) and other FATF requirements should be fined or shut down.

- Regulators should consider restricting retail access to certain altcoins, banning Defi, and even crack down on crypto oracles like Chainlink for daring to provide data to decentralized applications without approval from the government.

- Regulators should ensure that cryptocurrency doesn't become too big as it could compromise the integrity of the fiat financial system. To that end, the authors advised that regulators focus on the centralized entities in cryptocurrency, be they exchanges, custodians, or otherwise.

Because crypto is global, the authors even call on governments to create a new international regulatory authority and present the BIS as the ideal institution to play this role.

The authors also revealed that the BIS is developing a “cryptocurrency and defi analysis platform” that combines on-chain and off-chain data to produce vetted information on market capitalization, economic activity, and international flows. They concluded the crypto section of the report with;

“Overall, the crypto sector provides a glimpse of promising technological possibilities, but it cannot fulfill all the high-level goals of a digital monetary system. Central Bankers can provide such foundations, and they are working actively to shape the future of the monetary system.”

BIS Vision: Four Roles Of Central Banks

The report explains the central banks' four specific roles in the BIS's eyes. These are;

- Issue Money

- Provide Transaction Liquidity

- Ensure Liquidity (also known as money printing)

- Assist In Regulations

According to the BIS, the future of finance takes the four roles of the central bank to the next level by introducing Wholesale and Retail CBDCs. Select individuals and institutions will use the wholesale CBDCs, whereas the average person will use retail CBDCs.

Essentially, we will have two systems, and the BIS is OK with that because, as far as it is concerned, “central banks are mandated to serve the public interest” and are totally not influenced by politics or influential individuals and institutions in the private sector.

Image Source: Technode.global

The authors then outline the different components of their vision of the future of finance and highlight concepts like programmability, composability, tokenization, interoperability, instant payments, open platforms, and inclusive designs. Wait a minute… It sounds like they’re describing the future of cryptocurrency!

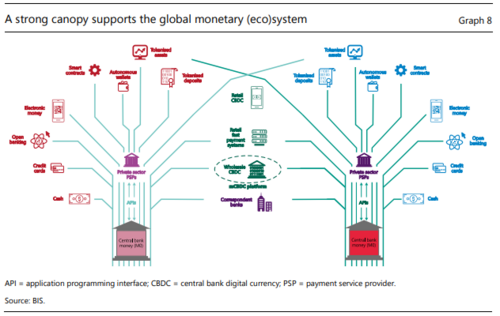

The image below displays the metaphor they use to explain their vision of the future of finance. They paint a picture of trees with central banks as the trunk, showing how all the different central banks will lock branches, calling it the Forest of the Global system.

It seems a bit ironic as the report simultaneously claims that a fragmented financial system of this kind would never work. The authors also commented that putting central banks at the center of the financial equation is a “prerequisite for private innovation that serves the public interest,” which seems to imply that private innovation is incapable of serving the public interest in the absence of central banks.

Wholesale CBDCs

Regarding wholesale CBDCs, the authors note that they can be used to govern the inner workings of the financial system and promise their audience, which is again primarily powerful individuals and institutions, that their privacy will be protected, thanks to zero-knowledge proof—also used in the cryptocurrency industry.

The authors also described how a wholesale CBDC would be used to settle a digital currency transaction that’s not done in a retail CBDC. They gave someone buying a house with privately issued eMoney with the deed automatically transferred as an example. They suggested that “the same system could also allow for digital representations of stocks and bonds.”

In other words, they would be tokenizing all real-world assets on their permission blockchains. Some would argue that if this happens, the central bank and, by extension, the government would own your assets. They would be able to revoke your ownership of anything and everything. And if you don't have physical evidence that it was once yours, you will have no way of proving to anyone that it ever was.

People in crypto communities that understand crypto know that buying and holding cryptocurrency in your own wallet is the way to circumvent this, as no one can take it away from you.

Retail CBDCs

There’s no need to worry just yet because the next section of the BIS report talks about the real problem for us; the retail CBDC. It points out the mass adoption of Brazil's fast payment system as proof that the average person will voluntarily adopt a retail CBDC, even though the BIS’s own research shows that only 4-12% of adults in developed countries would voluntarily adopt a retail CBDC.

The authors also applaud the Federal Reserve Bank of Boston's milestone of reaching 1.7 million transactions per second in its CBDC trials, noting that this is faster than payment networks like Visa and cryptocurrency blockchains.

It seems the authors conveniently forgot about Bitcoins Lightning Network, which can process an estimated 40 million transactions per second.

So, if you're wondering, how will the central banks convince anyone to adopt this? The authors clearly state that by allowing non-bank entities to offer CBDC wallets, they can also overcome the lack of trust in financial institutions that holds back many individuals in today's system.

In other words, central banks will use private companies that people trust to roll out their retail CBDCs. This is funny, considering the authors spent the earlier part of the report trying to convince the reader that the central banks and their financial systems are the pinnacles of trust.

What's even funnier is that the BIS actually reported on how much people trust the financial system. The figure is only around 60% in developed countries and possibly even lower now.

The authors then reiterate what's been said in other BIS reports about the privacy of retail CBDCs, stating that “central banks have no commercial interest in personal data and can thus credibly design systems in the public interest.” Put simply, privacy for them but not for us. They also quote that transactions would not be recorded on a public blockchain visible to all.

If all of this wasn't bad enough, the authors discuss a global “multi CBDC platform” that the world's central banks will govern in the following subsection. And the cherry on top is that the privacy of these entities will be insured, so the public will have no idea who controls this powerful system.

Although these statements are made in the context of a wholesale CBDC, the authors make sure that the reader knows that the same global platform could be put in place for retail CBDCs and similar types of digital currencies.

BIS Report Conclusion

The authors conclude by briefly commenting on the progress being made on the BIS’s explicitly stated goals and list the following statistics,

- 90% of central banks are exploring CBDCs.

- Three retail CBDCs are currently live

- 28 CBDCs in development

- Sixty countries are working on Fast Retail Payments.

This list includes the United States Federal Reserve’s plans to roll out the “FED NOW” fast payment system in 2023. It will have many of the same qualities as a retail CBDC, especially if the US government manages to roll out a digital ID system as per Shin’s remarks in his media briefing.

Meanwhile, France and Switzerland are working on a multi-CBDC platform, as are Singapore, Malaysia, Australia, South Africa, Hong Kong, Thailand, China, and the United Arab Emirates.

“In sum, central banks are working together to advance domestic policy goals and to support a seamlessly integrated global monetary system with concrete benefits for their economies and end-users.”

And because the authors still need to bash crypto and drive home the conclusion,

“Instead of serving society, crypto and defi are plagued by congestion fragmentation and high rents, in addition to the immediate concerns about the risks of losses and financial instability.”

This statement might be the most hypocritical of the report because many central banks are testing their CBDCs using cryptocurrency blockchains.

What Does This Mean for Crypto?

So, the big question is, what does all this mean for the crypto market? Many believe this news is insanely bullish for crypto because nobody is buying into the BIS’s “BS” except the central bankers.

Other previous BIS reports could be considered shamelessly evil, and the average individual and institution would not adopt this technology voluntarily. The only way you could convince the average individual and, or institution to adopt this technology would be through force or a crisis, and, conveniently, there's no shortage of those these days.

It's also fascinating how the authors hold up the central banks as the center of the universe and how they are willingly or unwillingly unable to acknowledge just how fast innovation in crypto has been. Four years ago, the BIS laughed at crypto. Now, it's starting to fight it. Does this mean that crypto will win in four years' time?

Let's just say that it's interesting that this is around the time we would see the next crypto bull market top. This obviously doesn't mean that fiat currencies will be defeated in four years, but it could mark the tipping point where crypto adoption becomes so widespread that it genuinely can't be stopped.

References:

Bis.org

Coinbureau

This information is provided for informational purposes only. Nothing herein shall be construed as financial, legal, or tax advice.

Also published @ BeforeIt’sNews.com

Tim Moseley

"As long as there are concerns about the euro, there is room for gold and the U.S. dollar to both trend higher," he said.

"As long as there are concerns about the euro, there is room for gold and the U.S. dollar to both trend higher," he said.

Jim Rogers: A 'positive development' in Ukraine 'in the next few weeks' could cause a big rally, before a huge crash in stocks

Jim Rogers: A 'positive development' in Ukraine 'in the next few weeks' could cause a big rally, before a huge crash in stocks

.jpg) Investors lose more than $42 million to fake crypto apps in less than a year, says FBI

Investors lose more than $42 million to fake crypto apps in less than a year, says FBI.gif)

.gif)

Copper/gold ratio shows Fed monetary policy is too tight – MKS PAMP

Copper/gold ratio shows Fed monetary policy is too tight – MKS PAMP.gif)

.gif)

The gold market has turned bearish

The gold market has turned bearish.gif)

.gif)