Citibank Report Says Asset Tokenization a “Killer Use Case” for Blockchain and CBDCs. What About Crypto?

Citibank's latest global perspectives and solutions report claims that tokenizing financial and real-world assets could be the "killer use-case" and a multi-trillion dollar opportunity. The report focuses on Asset Tokenization as the “killer use case” that blockchain needs to drive a breakthrough, with trillions of dollars worth of securities tokenized by the decade's end, forecasting up to $4 trillion.

Citi is an investment bank on the list of the “Too Big To Fail” banks. Its 165-page research report is titled ‘Money, Tokens, and Games. Blockchains Next Billion Users and Trillions in Value’ and contains bold projections for Blockchain, NFTs, and Central Bank Digital Currencies.

The report noted that the crypto industry is “approaching an inflection point,” and conversations by a few key figures in the crypto industry were aggregated in the research paper. The list includes Algorand founder Silvio Micali, Aave founder Stanley Kulechov, Ava Labs president John Wu, Polygon Labs president Ryan Wyatt, and even Zooko Wilcox, the founder of Zcash.

The report pdf is very long, so here’s a summary of a few noteworthy sections and some counter-arguments of why it may be a little askew in these areas. Could it be intentional, or maybe it’s just wishful thinking on their part? And what does it mean for the crypto industry?

Image credit: Citi GPS pdf

Report’s Brief Introduction

The report begins with a brief introduction from Kathleen Boyle, the managing editor at Citibank, who, presumably, put this report together. She commences by explaining that the potential of blockchain has been overlooked primarily because it's a back-end technology, not a front-end technology like ChatGPT. She says successful blockchain adoption will be achieved when “Blockchain has a billion-plus users who do not even realize they are using the technology.”

However, she does not say this adoption will come from crypto; it will come from Central Bank Digital Currencies (CBDCs). She also implies that the trillion-dollar opportunity of asset tokenization will come from the blockchains that power these CBDCs, not cryptocurrency blockchains.

This starkly contrasts what the crypto headlines say about the report. – As DeFi Edge points out there are already some prominent crypto protocols focusing on real-world asset tokenization. This underscores the importance of whenever you hear an institution, be it a mega bank or a government, talking about the benefits and potential of blockchain technology, 99% of the time, they are not talking about cryptocurrency. In almost every case, they talk about private and permissioned blockchains they will control.

This is why it's a bit scary to see Kathleen explain that blockchain needs “decentralized digital identities, zero-knowledge proofs, oracles, and secure bridges to achieve mass adoption.” She's probably not talking about the same technology we use in crypto. She's talking about different technology. Kathleen also notes that “regulatory considerations are also necessary to allow adoption and scalability without ‘hindering innovation’.”

.png)

Image credit: Citi GPS pdf

Kathleen and her crew estimate the mass adoption of blockchain, not crypto, is 6 to 8 years away. Some would argue that the mass adoption of crypto will come much sooner than that, and the value of the assets tokenized on cryptocurrency blockchains will exceed the $4 trillion the report is projecting. Moreover, the sentiment of crypto heavyweights et al. believes the adoption of CBDCs and asset tokenization on private blockchains will be much lower than the authors' pitch.

That's because data from the Bank for International Settlements (BIS), the bank for central banks, shows that only 4% – 12% of people will voluntarily adopt CBDCs. The same goes for tokenized assets on private blockchains. If governments control these blockchains, then having all your assets tokenized means you won't truly own them; the government will own them. This is precisely what entities like the World Economic Forum are pushing for. This article explains how you can reject what the globalists are planning.

Central Bank Digital Currencies – CBDCs

The first part of the report worth covering is about CBDCs. The report projects that between 2 and 4 billion people will voluntarily adopt CBDCs. This is inconsistent with the adoption projections from the BIS and actual CBDC adoption in countries like Nigeria, where adoption is a fraction of a percent.

It begins by revealing that the obsession with CBDCs comes from the fact that they will allow governments and central banks to micromanage monetary and fiscal policy. In other words, they can control how much you can spend, how much you can save, what you can buy, and so on. Citi’s authors estimate that as much as 20% of all the currency in circulation will be converted into CBDCs by 2030. They also claimed that;

“The successful launch and adoption of CBDCs would lead to more stablecoin projects becoming mainstream. This is because the stablecoin protocol is now able to hold reserves in CBDCs, which are more stable and liquid than money market instruments.”

For context, stablecoins are currently backed primarily by US government debt. This is a double-edged sword because it allows the US government to subsidize its spending but also risks crashing the bond market in the event of a stablecoin run. It sounds like stablecoins will soon be backed by CBDCs instead. This is concerning because if CBDCs back stablecoins, it gives governments and central banks de facto control of all the stablecoins in circulation.

This, in turn, would give governments and central banks control of cryptocurrencies, whose ecosystems rely on stablecoins, such as Ethereum. Ethereum creator Vitalik Buterin said that stablecoins like USDC would have the power to decide future blockchain forks. What’s needed is a genuinely decentralized stablecoin to be developed that will protect crypto projects, like Ethereum, from future stablecoin control.

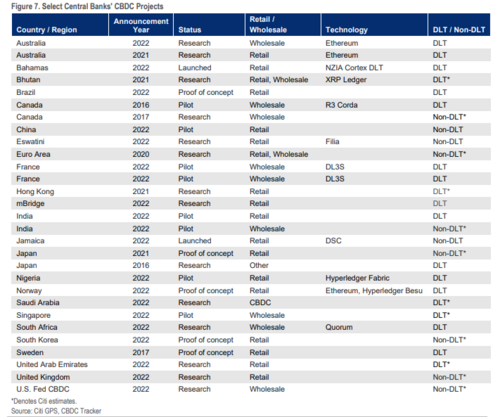

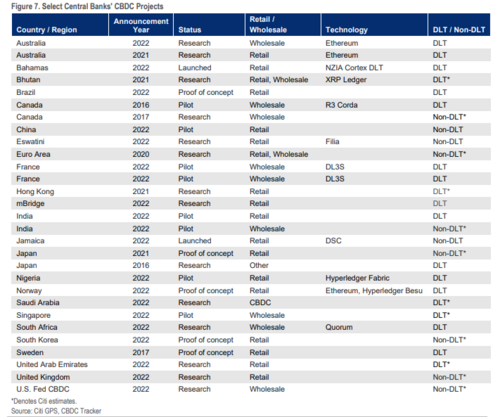

The authors list countries that are working on CBDCs and include notes about which technologies they're using. Australia and Norway appear to use Ethereum as part of their CBDC development. It's safe to assume they will use some private version. To their credit, the authors also list risks associated with a CBDC rollout. These include competition between central banks because of currency competition, a loss of privacy, a loss of bank deposits leading to financial instability, and limited adoption. Critics argue that the latter isn't a risk.

Image credit: Citi GPS pdf

Regarding the adoption aspect, the authors highlight the less than 0.05% adoption rate of Nigeria’s eNaira and the slow adoption of the Bahamas Sand Dollar, with FTX’s collapse and C-19 said to be contributing factors to the loss in momentum. This makes their projection of wide-scale CBDC adoption that much more implausible. They blame the absence of said adoption so far on a lack of financial literacy. Arguably, financial literacy is precisely why people aren't adopting CBDCs.

As explained in this article, it’s important to note the difference between CBDCs and cryptocurrencies. Certain institutions are already trying to market CBDCs as having the same benefits as cryptos as cryptocurrency adoption continues to rise.

Citi’s report presents timelines for when some CBDCs will be deployed. It states a digital Euro will be up and running around 2026. The digital pound will be ready by 2030, but the digital dollar is yet to be determined, and it slams the few brave US politicians for trying to stop its development.

Decentralized Social Media – DeSo

The second part of the report is about decentralized social media (DeSo). Unfortunately, this chapter is relatively short because DeSo is highly critical due to the overwhelming efforts of governments to censor the internet. This article explains that governments worldwide are in the process of passing online censorship laws. In the European Union, these online censorship laws have already passed and are set to go into force in June this year.

Since trust in institutions has been declining for decades and slumped after all the pandemic restrictions, their need for this crackdown makes sense. Trust in institutions is crucial for the financial status quo to continue. The recent banking crisis exemplifies what happens when that trust is entirely lost. This is why the authors note that “Blockchain's ability to create a shared, immutable, digital record of transactions could also help users see where particular information originated in order to judge its credibility. This could help build trust.”

The catch is that trust only exists when the blockchain is trustless. The report also notes that with DeSo, “ownership of content and control over the distribution channels remains with users.” This is required to resist online censorship, and it's the same principle that underlies all crypto. You are only financially free when you own and control your assets.

The report’s authors include a conversation with Aave founder Stanley Kulechov; the remainder of the section is an interview with him. This is primarily because Stanley and the Aave team are working on the Lens protocol, a decentralized social media protocol that will serve as the backend for future DeSo platforms. Stanley believes that games and social media might be how most people become aware of blockchain technology.

They are unaware that a monolithic crypto project in the DeSo space has been in development and is now up and running for the most part. The founder and architect of Markethive, Thomas Prendergast, envisioned the dystopian system we are experiencing currently and is ahead of the curve with a decentralized platform incorporating a social, marketing and broadcasting network for entrepreneurs that services as a cottage industry. Markethive is an ECOcentric DNA system.

The Markethive ecosystem culminates with its unique, comprehensive economic center housing the wallets and account facilitation for the user, with merchant accounts for eCommerce facilitation, and enables creators to monetize their content. Its cryptocurrency, Hivecoin, is the cornerstone of this decentralized economic sanctuary and is a portal to sovereignty and financial freedom with gamification thrown in. This is where people are learning about and experiencing crypto and blockchain technology.

Decentralized Digital Identity – DID

Another section of the report is about decentralized identity. Citi starts with a spooky sentence: "Decentralized identity is a core technology component that will enable regulatorily compliant uses of blockchain while still preserving anonymous/pseudonymous access.”

They seem to suggest that the purpose of decentralized digital ID is not to do things like interact with cryptocurrency protocols but to be the “identity layer for the entire internet.” Logically, this means whoever controls this identity layer will have unprecedented power.

Moreover, the report specifies that decentralized digital ID “Does not imply a lack of centralized parties in identity issuance or verification, but that the mechanism of owning, sharing and verifying identity is done in a permissionless, decentralized manner.”

This is a problem because if the issuance and verification of a decentralized digital ID are centralized, the issuer or verifier can revoke your ability to interact with online services. That's not decentralization, underscoring the need for crypto to find a way to issue and verify digital ID in a decentralized manner.

Consider that a decentralized digital ID tied to a government-issued document is no different from a centralized stablecoin. Ponder a scenario where your government-issued ID is digitized like the CBDCs backing stablecoins. Additionally, governments worldwide are actively working on rolling out Digital IDs. Countries are at different stages, but skepticism and pushback have existed.

Naturally, the authors say that the need for digital ID comes from the relentless data collection by big tech. They don't say that most of these big tech companies are aligned with governments and that these so-called decentralized digital IDs will likely just provide this data directly to said governments.

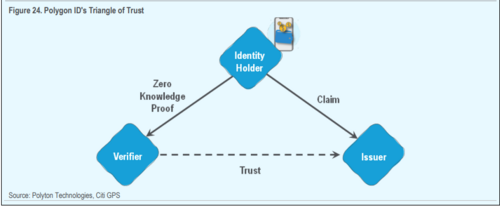

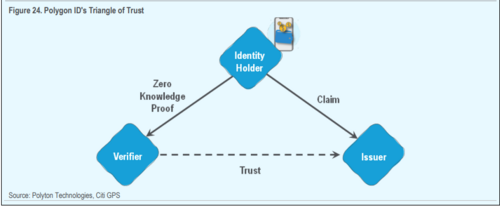

The authors showcase the recently released Polygon ID as an example of a decentralized digital ID solution, and the infographic suggests that it's built exactly how the authors describe it. There's a centralized issuer and verifier – you only control what you reveal on-chain.

Image credit: Citi GPS pdf

The report also provides an example of an actual decentralized digital ID: the Ethereum Name Service (ENS). ENS lets you buy a decentralized domain name ending in .eth for those unfamiliar. It has no central issuer or verifier; it's entirely decentralized and is run by a DAO. With that said, you could argue that DAOs aren't that decentralized due to their governance structures.

The authors appear to argue that an actual decentralized digital ID isn't a solution because it's not tied to so-called verifiable credentials such as government-issued IDs. Instead, they shill their version of decentralized digital ID, which they also call “Self-sovereign identity. They then provide examples of self-sovereign identities and include digital IDs developed by Microsoft and the European Union. To add insult to injury, the authors omit centralized control as one of the risks associated with this technology but imply that crypto is a risk.

Smart Legal Contracts – SLC

The last part of the report is about so-called Smart Legal Contracts (SLC), also called Contracts 2.0. The authors start with a statistic, and that's that 60% – 80% of all business transactions involve a contract. They note that companies lose 9% of their profits and miss out on an additional 40% of profits from bad contracts. Nick Szabo is the creator of Smart Contracts; however, SLCs are not the same as his smart contracts. It’s the authors that deem them an official subset of Smart Contracts but with different characteristics.

They clarify that smart legal contracts have no universally agreed-upon definition, but the main difference is they don't involve blockchains. Smart legal contracts are also legally enforceable in their countries of origin. By contrast, legal enforceability is rarely a consideration in smart contracts.

This begs the question of why smart legal contracts are required at all, and the authors reveal the answer. “Smart legal contracts are more dynamic to changing circumstances – to achieve legal compliance, they must include terms that allow them to be paused, modified, or rectified.”

It sounds like the authors are insinuating that smart contracts cannot be legally compliant due to their immutability. If smart legal contracts don't exist on blockchains, can be adjusted on a whim, and occasionally require human execution, as noted by the authors, then it begs the question of what makes SLCs different from a standard digital contract. The authors don't have a clear answer here.

To their credit, they concede that smart contracts are likely to be much more popular than smart legal contracts because they provide the following benefits.

- They can exist indefinitely.

- They are transparent.

- They are tamper-proof.

- They are secure.

- They are built on a single source of truth.

This section of the report is long and consists of the authors tripping over themselves to try and explain why smart legal contracts are the future despite being objectively inferior to smart contracts.

Image credit: Markethive.com

What Does This Mean For Crypto?

So here’s the big question – What does Citibank’s report mean for crypto? If anything, it reveals that institutional investors are looking at the crypto industry through a radically different lens from us retail investors. CBDCs, de facto digital IDs, and changeable smart contracts are not crypto.

The few sections of the report about crypto were much shorter than those about dystopian technologies inspired by crypto. As mentioned, the chapter about decentralized social media was the shortest of all and could be interpreted as not a coincidence.

Consider that the purpose of cryptocurrency is to replace megabanks like Citi, as well as most of the institutions that the other authors of this report work for. The first step to this replacement is the awareness of what crypto offers and why it's valuable. This information can be found on social media for now; however, with all the plans and legislations to continually broaden censorship of what authorities deem as mis/dis-information may see it disappear from the mainstream.

In fact, leaked documents from the Department of Homeland Security stated that the US government was looking to censor information on social media, which fosters distrust in the financial system. Whoever still doubts that the government would resort to censoring financial information look no further than the recent banking crisis. In the subsequent hearings about the crisis, multiple US politicians pointed to social media as the cause of the bank runs that precipitated it.

If you read this article about bank bail-ins, you'll know that US government officials discussed censoring discussions of bank runs on social media in their bank bail-in simulation late last year. It's more than likely that other governments would secretly consider the same behind closed doors. Now, I mention all of this because Citibank's report is part of what can only be described as an ongoing information war against cryptocurrency by the establishment.

Another example is mainstream media articles about how Bitcoin mining is killing the planet, which is untrue. When it becomes clear to the establishment that they are losing this information war, they will resort to censorship to ensure that the trust in their increasingly unstable financial system remains.

This crossroads is coming sooner than people think because everyone is waking up to CBDCs. People are also starting to wake up to the fact that not all cryptocurrencies are created equal, and the establishment is co-opting some crypto projects, companies, and technologies to usher in a dystopian new system. This system requires a digital ID; their fake decentralized digital IDs are the trojan horse.

Always remember that blockchain does not equal crypto, and take every statement about crypto from megabanks and central banks with a massive grain of salt. The same goes for headlines about how mega and central banks embrace crypto. The likelihood is that they're doing the exact opposite.

(27).gif)

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.

.

.gif)

.png)

(27).gif)