What Is The State Of Crypto In 2023? A Paradox Unpacked.

We are currently seeing an antithesis in the crypto world and its market. In one respect, proposed crypto regulations worsen; unbalanced, even nonsensical, and interest rates are increasing. Conversely, coins and tokens are hitting multi-month highs, and new crypto projects are raising billions.

Crypto VC firm Andreessen Horowitz, also called a16z, unpacks this paradox in its State of Crypto Report for 2023. It was published on March 11, 2023, revealing which issues are holding crypto back and which cryptos are about to explode. This article summarizes a16z's report and explains what it says and means for the crypto market.

Image source; a16zcrypto.com

The report begins with an overview of what's been happening in crypto. There's been progress in research and development, setbacks from crypto companies collapsing, prices have been following the crypto cycle, bad regulation is creating uncertainty, and decentralization is becoming an opportunity. Note that all of these are related.

Most of the setbacks we've seen have been due to centralization. This centralization occurred because some entities wanted to maximize crypto market cycle gains. It has resulted in harmful regulations, and decentralization is the only real solution to both problems.

Why Web3 Matters

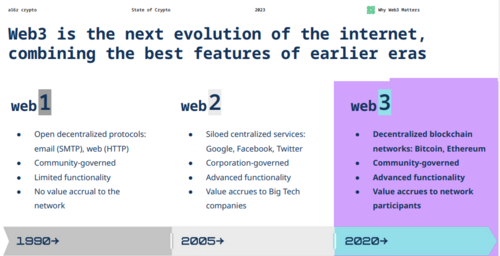

The report's authors explain that they view Web3 as being more than a financial movement; it's an “evolution of the internet.” They see crypto blockchains as computers, not just ledgers, and therefore see crypto itself as a computing platform, not just an alternative to the existing financial system.

Replacing the existing financial system is arguably the top priority of crypto projects and their sponsors. If the existing financial system continues on its current trajectory, it will result in Central Bank Digital Currencies and the loss of our economic freedom. But it widens the scope for upcoming decentralized social market networks and their communities’ sovereignty and potential wealth.

Image source; a16zcrypto.com

The authors explain that Web3 is built on decentralized cryptocurrency blockchains like Bitcoin and Ethereum. It is governed and owned by the communities of their respective projects and accrues value to the community rather than a centralized tech company, as is the practice with Web2.

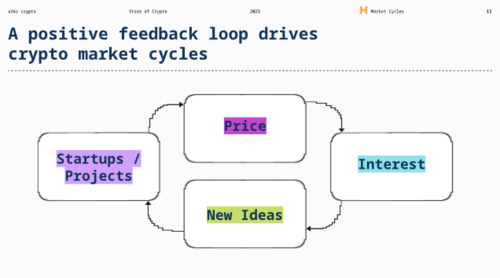

The Crypto Market Cycle

The second part of the report is about the crypto market cycle. According to the authors, crypto market cycles are caused by a positive feedback loop. Prices go up, which drives interest to go up, which generates new ideas to emerge, which causes new projects to appear, which causes prices to go up.

Image source; a16zcrypto.com

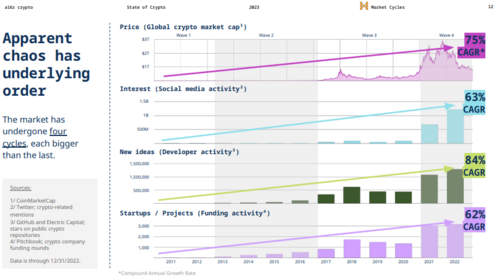

The authors say there have been four crypto market cycles so far. This is consistent with the market cycles driven by the Bitcoin halving, which happens every four years; however, there is no mention of the Bitcoin halving and the vital role it seems to play in crypto market cycles. Instead, they focus on financial and product cycles that also follow a four-year cycle.

For reference, macroeconomic conditions, such as interest rates, drive financial cycles and can fluctuate unpredictably. By contrast, product cycles are driven by supposedly more predictable consumer behavior and tech trends. As stated in the report, great products get built regardless of financial upswings and downswings.

Image source; a16zcrypto.com

Some would argue that consumer behavior and tech trends depend heavily on macro conditions. After all, most of the funding for speculative technologies happens during low-interest rate periods. As such, entering a new period of higher interest rates could be bad for more speculative crypto projects.

Trends To Watch

The third part of the report identifies what trends to watch, saying that blockchains are scaling through multiple promising paths. The authors highlight new Layer 1 blockchains, like Solana and Aptos, application-specific blockchains, like Cosmos and Polkadot, Layer 2s like Optimism and Polygon, and data storage cryptos, like Celestia as areas of interest.

The authors then applaud Ethereum for cutting its energy use by 99.9% by changing its consensus from Proof of Work to Proof of Stake, known as The Merge, in September 2022. They then highlight the comparison with YouTube’s energy consumption rather than Bitcoin. The authors pointed out that Ethereum consumes 0.001% of YouTube's energy annually. It seems like an odd choice, but maybe they had emerging decentralized social media in mind.

They reviewed the rising popularity of zero-knowledge proofs, stating that once practically impossible new technologies are becoming very real. The authors then examined the rapid growth of Web3 gaming, which has remained relatively unscathed by the crypto bear market. They say that Web3 games are a huge opportunity to welcome new users to crypto.

Similarly, it's worth mentioning Markethive, a social media, marketing, and broadcasting platform in the decentralized arena, is ramping up its gamification as a way to earn crypto and for people to familiarize themselves and experience the cryptocurrency landscape.

Participation in DAOs has also been steadily increasing. The spike in DAO participation over the last few months may have been due to increasing regulatory uncertainty as well as all the exploits and issues that have resulted in emergency proposals. The recent de-pegging of USDC is one of the many examples.

Regarding developer activity, the authors point out that the United States is falling behind. The percentage of crypto developers in the country has been declining for years due to the initially uncertain and now outright hostile regulatory environment, which could continue for some time.

The authors then say to watch for three proposed crypto regulations. They include the bipartisan crypto bill by Senator Cynthia Lummis and Kirsten Gillibrand, seven pending crypto cases, including the SEC's case against Ripple, and three proposed crypto rules, including the SEC's crypto custody rule.

Image source; a16zcrypto.com

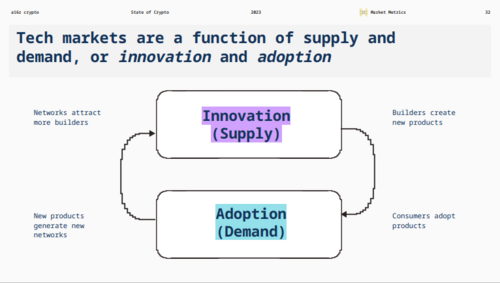

Crypto Market Metrics

The fourth part of the report lays out a series of crypto market metrics. The authors begin with the above image, which essentially means, ‘If you build it, they will come.’ This popular approach to cryptocurrency adoption has been successful for many worthy projects.

The first crypto market metric is the number of active developers. They found that the number of active developers rises during bull markets and stays high during bear markets. The second crypto market metric is the number of smart contracts, which continues to hit new, all-time highs, despite the crypto bear market.

The third crypto market metric is the number of academic research publications related to crypto. The number spiked in 2021 and again in 2022, indicating crypto has become a significant area of academic research.

The fourth crypto market metric is the number of people seeking crypto-related jobs. This statistic peaked soon after the crypto market did in late 2021, suggesting rising crypto prices generate interest in the crypto job market. The number of people looking for crypto-related jobs has remained high ever since.

Crypto Adoption Indicators

The first indicator is the number of active crypto wallet addresses, which grows steadily as Web3 adoption increases. The same is true for the second indicator, the number of blockchain transactions, which also continues to hit all-time highs due to better scaling technologies reducing transaction fees.

The third indicator is the amount of transaction fees paid. According to the graph in the PDF report, it’s been on the decline stating that fees increase as demand rises but decrease as scaling tech supplies more blockspace.

A similar decline is seen with the fourth indicator, the number of mobile wallet users. The authors give one possible explanation: There are increasingly more ways to engage with blockchains and web3 applications. From DeFi to Web3 games, various new applications create addresses for users to interact with without downloading or connecting a wallet.

The fifth indicator is the amount of trading volume on decentralized exchanges. (DEXs) DEX volume has been rising recently, likely due to a crackdown on centralized exchanges. The most recent spike in DEX volume is plausibly from Curve Finance when it de-pegged USDC.

The sixth indicator is NFT buyers. The number of NFT buyers appears to be rising again over the last few months, possibly because NFTs have decreased in price and new buyers have been buying the dip. Also, no official legislation applies specifically to NFTs, so they have been safe from regulations.

The seventh indicator is stablecoin trading volume which continues to grow. This could be due to the crackdown on centralized exchanges and the loss of trust crisis after FTX collapsed in late 2022.

Image source; State Of Crypto 2023.pdf

What’s Next?

The last part of the report is aptly titled, What's Next? The authors commenced by estimating that crypto adoption is where internet adoption was in the 1990s, specifically, the mid-90s. Assuming crypto adoption follows the same trajectory, they forecast it will take until 2031 to hit one billion users.

As per the image above, the authors list 12 things they expect to happen in crypto in 2023 and beyond. The first expectation is that some of the best Web3 products and protocols will be developed during the remainder of the crypto bear market.

The second is that smart contract security will improve. The authors don't discuss the role of AI in this equation, but it can be used to create and audit crypto code. This will supercharge crypto development and security, providing it’s used ethically.

The third expectation is that zero-knowledge proofs will continue to become more popular. This makes sense, considering institutional investors require financial privacy, which is something that zero-knowledge proofs can provide.

The fourth expectation is that big tech will continue to take greater control of the Web2 internet, showing the average person just how vital Web3 is. We've covered this in the Markethive blog in the context of internet censorship; decentralized social media is the only solution.

The fifth expectation is that Web3 gaming will become more popular. In short, there are three reasons why people adopt cryptocurrency; speculation, convenience (possibly necessity), or entertainment. That third adoption category has yet to be tapped, but it's coming.

The sixth expectation is that there will be more crypto-specific hardware, particularly for zero-knowledge proofs. As blockchains have attracted millions of users, two critical demands around privacy and scalability have emerged. There is a movement to optimize algorithms for consumer-grade hardware to preserve decentralization and privacy.

The seventh expectation relates to the fourth: decentralized social networks will become popular due to issues with centralized social media. As previously mentioned, with all the internet censorship and more coming, trust in institutions and legacy media is declining rapidly, and more people will migrate to decentralized platforms.

Interestingly, the eighth expectation is that “light” clients will make it possible for mobile devices to become more involved in crypto infrastructure. As a fun fact, over 90% of people access the internet from a mobile device. Logically, this means bringing crypto to mobile is a massive untapped opportunity.

The ninth expectation is that there will be new forms of community governance in DAOs. Many believe that the existing token-based voting systems are leading to centralization; what's required is a radically new approach to governance.

The tenth expectation is that governments will pass bipartisan crypto regulations. This is a direct reference to US crypto regulations, but it could well apply globally. It won't take long for politicians everywhere to realize that crypto is an economic and social opportunity, never mind all the crypto lobbyists wielding influence with incentives.

The 11th expectation ties into the fifth, and that's that non-speculative crypto use cases will emerge. Hopefully, these non-speculative use cases are related to convenience and not necessity. If they relate to need, it's probably because we're dealing with some seriously dystopian issues.

The twelfth expectation is a relatively new phenomenon: hiring treasury management and sustainable funding will be a focus for DAOs. This seems to be a subtle reference to a new crypto niche called ReFi or Regenerative Finance, which involves investing in tokenized carbon credits.

Image source; State Of Crypto 2023.pdf

What Does A16z’s Report Mean For the Crypto Market?

One of the takeaways stated in the a16zcrypto overview of the report states that,

“Prices have steadied this year from the dizzying highs of 2021. The industry seems to be settling: speculation has cooled, and the story of how people durably, organically use, and interact with Web3 is starting to unfold.”

To others, the report reveals a lot more about how institutional investors are seeing the crypto market rather than how the crypto market is doing or how it's likely to perform in the future. Institutional investors are interested in being on the cutting edge of Web3 and cryptocurrency. However, they're also interested in ensuring they have some say in running these projects and protocols. This is fundamentally at odds with their decentralization imperative.

It is also why institutional investors are so focused on crypto regulation. Some argue that they don’t care about how these regulations impact financial freedom. Ultimately, they want to know how to legally invest in and influence these projects and protocols.

The incumbents are hyper-aware of this and are actively trying to prevent sensible crypto regulations from being passed. They know that the actual end game of the crypto lobbyists is to replace the old financial system with a new, primarily centralized financial system, not a new decentralized one.

A prime example is Circle; the stablecoin issuer has been aggressively lobbying politicians worldwide to pass regulations that set up its stablecoin as the gold standard and ban the circulation of decentralized stablecoins. This is not in the best interests of crypto; it is a blatant traditional finance tactic.

That said, mass crypto adoption won’t happen overnight. Most proposed crypto regulations may be inconsistent with cryptos' core philosophies, but they are a necessary first step. Over time the centralization issues they cause will become more evident, and better crypto regulations will be passed.

More importantly, the average person will start to understand the significance of things like decentralization. But before they understand the importance, they must know what they are and be comfortable with the associated annex. This will take years, per the author's projections.

The upside to this situation is that we are, in fact, still in the early stages of crypto adoption, considering the relative absence of crypto regulations in developed countries. Ultimately, crypto regulations are required for institutions to invest in the industry; realistically, institutions have most of the money. They have the means to turn the crypto into a multi-trillion dollar asset class.

A Favorable Scenario

According to Coinbureau, the best part is that retail investors like us will eventually have the advantage because most understand there's more to crypto than paper money profits. The institutions don't see it that way, meaning they will sell every time a coin or token hits some arbitrary number in fiat currency terms. Meanwhile, retail investors will continue to buy regardless of the paper price, and for once, they won't be the ones getting dumped on.

The money institutional investors get in return will lose value until it's converted into a CBCD, and all their assets will be tokenized on a blockchain the government controls. And when their CBDCs and tokenized assets are frozen because they did or said something against the state, they'll realize that crypto is the only asset that offers true financial freedom. By then, it'll be too late for them. All the retail investors who realize this early on will become the new institutional investors.

In closing, the report has identified an opportunity that recent setbacks emphasize the failure of opaque, centralized systems in contrast to the resilience of decentralized infrastructure. Decentralized crypto computing platforms can also counter the trend of power consolidating into the hands of a few giant tech corporations. The internet needs web3, and those who understand this will fight for the future of these technologies.

Tim Moseley

S&P 500 will crash 20% as 'panic' sets in and gold hits $2,300 in 2023, Fed will cause 'more tremors' in banking sector – Gareth Soloway

S&P 500 will crash 20% as 'panic' sets in and gold hits $2,300 in 2023, Fed will cause 'more tremors' in banking sector – Gareth Soloway

Mastercard has announced the launch of Crypto Credential in an effort to establish a set of common standards and infrastructure that will help attest trusted interactions among consumers and businesses using blockchain networks.

Mastercard has announced the launch of Crypto Credential in an effort to establish a set of common standards and infrastructure that will help attest trusted interactions among consumers and businesses using blockchain networks.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OWITMSMCYJGCBNTQKZSX3CAKLA.jpg)

.gif) Gold consolidates but remains on a 'golden cross path' higher – NDR's Tim Hayes

Gold consolidates but remains on a 'golden cross path' higher – NDR's Tim Hayes

]

]

QE isn't over and will drive gold to $3,000 and Bitcoin to $100,000 in the next decade – Crossborder Capital

QE isn't over and will drive gold to $3,000 and Bitcoin to $100,000 in the next decade – Crossborder Capital