Wall Street sees gold price declines or consolidation next week, Main Street is more optimistic about gains

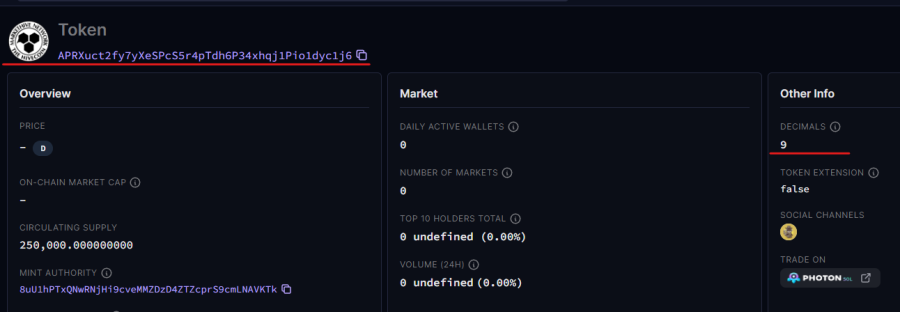

.png)

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

Wall Street sees gold price declines or consolidation next week, Main Street is more optimistic about gains teaser image

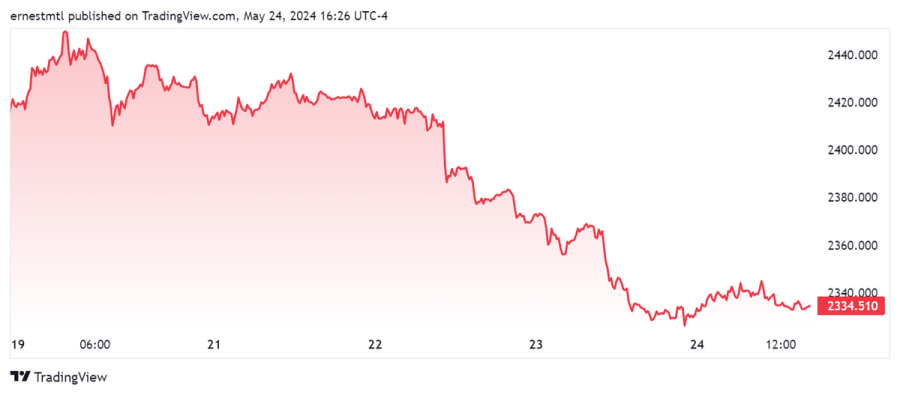

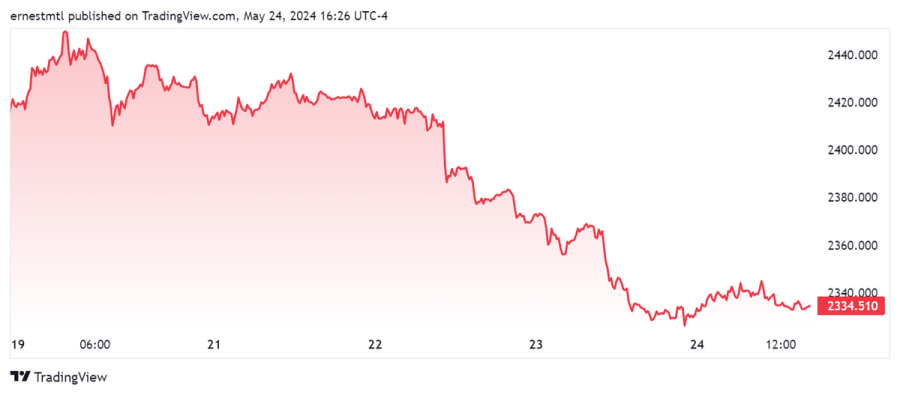

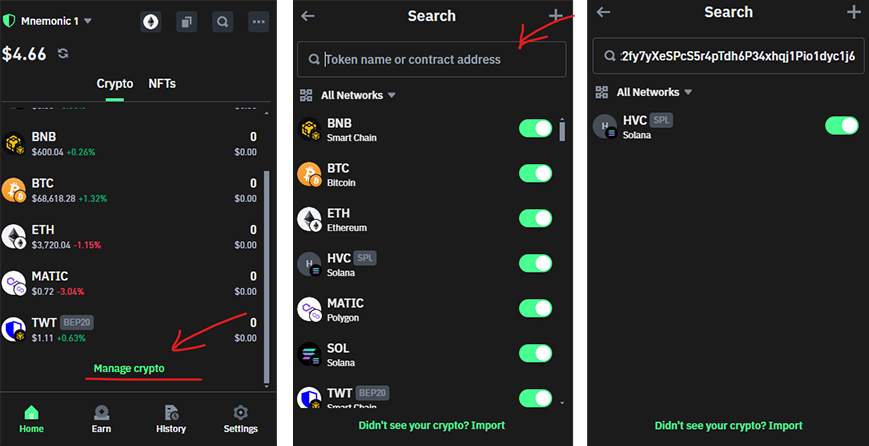

This past week was thin on economic data, so gold prices began the week coasting along at their newly elevated levels coming out of last week's fresh all-time highs.

After opening the week on Sunday evening trading at $2,421.20 per ounce, spot gold stayed comfortably above the 2400 level until shortly after 10:00 am EDT Wednesday morning, when it broke decisively through support and began its steady descent. The release of the minutes from the April/May FOMC meeting later Wednesday afternoon did the yellow medal no favors, as markets digested the news that some voting members were open to hiking rates further if warranted.

Spot gold hit its weekly low of $2,325.46 shortly after 8:30 p.m. EDT Thursday, and as of Friday afternoon, it was trading less than $10 off that level for a loss of over 3.30% on the weekly chart.

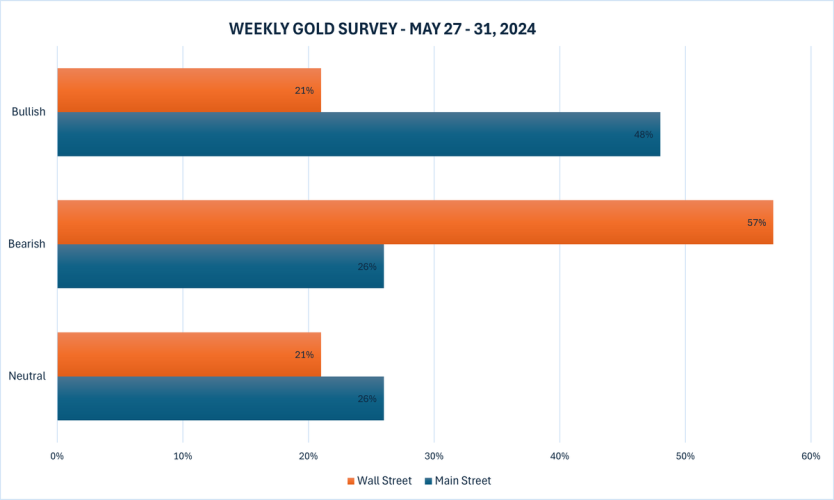

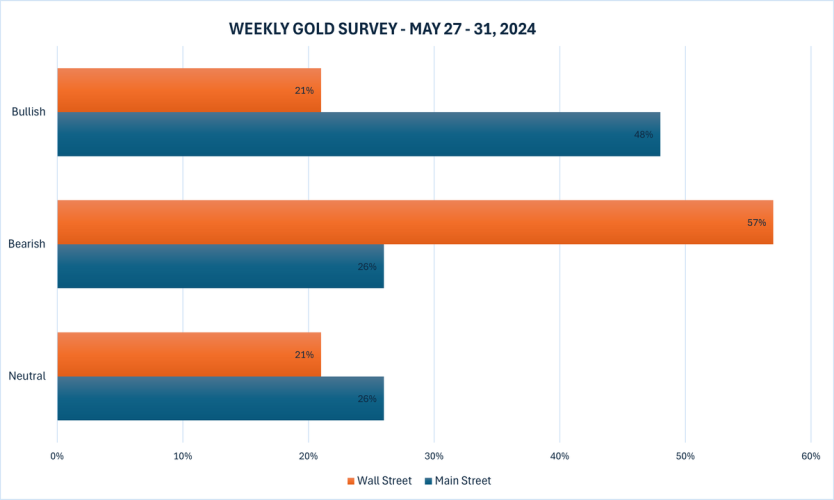

The latest Kitco News Weekly Gold Survey has over three-quarters of industry experts believing gold prices have plateaued or will decline in the near term, while half of retail traders still believe the precious metal could climb higher in the coming days.

“Down,” said Darin Newsom, Senior Market Analyst at Barchart.com. “June Gold has more room to the downside to finish its 3-wave downtrend next week. This means the contract would be expected to take out Friday’s low (so far) of $2,326.30. Daily stochastics (a short-term momentum study) are above the oversold level of 20%, also indicating the contract has time and space to move lower.”

“I am neutral on Gold for the coming week,” said Colin Cieszynski, Chief Market Strategist at SIA Wealth Management. “Between the US holiday and the lack of major events heading into month end, it think it may be a quiet week.”

James Stanley, senior market strategist at Forex.com, believes this week’s price decline was more bump-in-the-road than roadblock.

“This week was a strong pullback but there remains quite a bit of support structure around the $2,300 area in both spot and futures,” Stanley said. “If bears can chew through that next week, there could be scope for a larger reversal, but given how the move priced in after a fresh high on Sunday night, this week seems more like a pullback in a bullish trend, at this point.”

“Up,” said Adrian Day, President of Adrian Day Asset Management. “We would expect a recovery rally from the big sell-off the last couple of days, and another attempt to break $2,400 convincingly. Whether gold will break above that level is not certain, but for next week, we expect a good rally.”

“Gold’s resilience to any pullbacks the last three months has been astonishing,” Day added.

Daniel Pavilonis, Senior Commodities Broker at RJO Futures, was looking at the factors weighing on the precious metal Friday. “I think a couple of things are pushing gold down,” he said.

.jpeg)

First off, Pavilonis said, a pullback was to be expected after the precious metal made such a strong move higher last week.

“And I think this is just a near-term correction in rates to the upside,” he added, “ten-year yields moving back up to four and a half now, 4.46%. The high today was 4.499. We, we made a move from 4.3 up to around 4.5%, and I think that's really putting some pressure on the metals.”

That said, Pavilonis believes the pullback will be short-lived. “We may go a little bit higher than 4.5%, but I think it's also given an opportunity to buy metals,” he said. “And maybe not so much gold but some of the other metals that haven't caught up with gold, for instance silver. It started to make a move up to $32, $33 [per ounce]. We come back down to $30, if we can stabilize over there, I think we get another run up to $36, $38, somewhere around there.”

Pavilonis said gold might be a different story, however. “I think it'll grind higher up towards $3,000,” he said. “I don't think it's going to be as easy, but if the rate cuts are still in the mix, I think there is a high probability that we continue to move higher.”

“I think you're still going to see a lot of central banks buying, a lot of movement away from the dollar away from U.S. treasuries and into precious metals,” he added. “But in the near term, I think it's had a nice run-up and I'm looking for a little bit of a pullback here.”

“I still believe it’s got some downside, and I think it's appropriate, even on the longer-term move to the upside,” he concluded. “I would say until maybe the tail end of the first week of June, it starts to bottom out, and then maybe the beginning of the second week we can start buying again.”

This week, 14 Wall Street analysts participated in the Kitco News Gold Survey, and sentiment on the precious metal has largely soured for the near term. Only three experts, representing 21%, expected to see gold prices climb higher next week, while eight analysts, fully 57%, predicted a price decline. Another three experts, representing 21% of the total, see gold trending sideways during the coming week.

Meanwhile, 195 votes were cast in Kitco’s online poll, with Main Street investors decidedly sunnier in their outlook for the yellow metal. 94 retail traders, or 48%, looked for gold prices to rise next week. Another 50, or 26%, predicted they would be lower, while 51 respondents, representing the remaining 21%, expect prices to remain rangebound during the week ahead.

Next week will be another slow one for economic news releases, with U.S. markets also closed on Monday for the Memorial Day long weekend. Highlights will include the U.S. Conference Board’s Consumer Confidence report on Tuesday, the release of preliminary U.S. Q1 GDP, weekly jobless claims, and pending home sales on Thursday, and Friday’s U.S. PCE and personal income and spending report.

“Best guess is more of a pullback after the holiday, but holding long positions,” said Mark Leibovit, publisher of the VR Metals/Resource Letter.

Marc Chandler, managing director at Bannockburn Global Forex, also sees further downside risks for gold in the near term.

“Gold set a new record high to start the week, reaching $2450, perhaps in reaction to the crash that took the life of the Iranian president,” he said. “However, a stronger dollar and higher rates saw gold sell off hard and reach nearly $2325.”

“The new highs in the spot market were not confirmed by the momentum indicators, which are still headed lower,” Chandler observed. “We note some reports suggesting China’s demand has slackened. The week ahead sees lighter data, and this could facilitate some consolidation. The US two-year yield extended its recovery from 4.70% recently to nearly 5%. The light calendar suggests that the 5% area may hold.”

“A bounce in gold may be challenged initially in front to $2375,” he said. “Support is seen in the $2275-$2300 area.”

Michael Moor, Founder of Moor Analytics, was looking at both the short- and longer-term technical picture for gold on Friday.

“Technically speaking, we are likely in a higher-timeframe bearish correction against the move up from $1,876.60,” he said. “The trade below $2,434.30 got this bearish, and we've seen 108 points from that, and then the trade below $2,421.60 also projected this downward $60 an ounce-plus, and we've seen 95.3 of that. On 5/22, we got the minor bearish reversal above, and then yesterday left another bearish reversal above.”

“We are currently holding exhaustion, final exhaustion is at $2,330 to $2,321.40,” Moor said. “Now, if we take that out and settle below there, then this is going to head down to $2,285.20 and it will confirm that we're in a larger correction as well. Then those next levels of possible exhaustion are going to be down at $2,239.60, to $2,235, and then lower.”

“Right now, I think that we're in a lower-timeframe bearish correction, and likely in a higher-timeframe bearish correction,” he explained. “So what does that mean? The lower-timeframe bearish correction means we're correcting against the most recent move up from $2,285.20. The higher-timeframe correction means we're also likely correcting against the move up from $1,876.60.”

“I think we're in both at the same time,” he said. “It's just that we could always run up and make another higher high and then correct from there. But right now, it looks like we're in a bearish direction in both time frames. And if we're in the higher-timeframe bearish correction, the ideal time for one of these lower exhaustion levels to hold is not until after the 21st of June. So we may see this coming off and consolidating and chopping around with big swings until that point.”

“If it's a new bear trend, it's a bear trend and it's going to blow through all of them,” he added. “But if it's going to hold one of them and start a new bullish structure, the likely timeframe for one of these exhaustion levels to hold more than temporarily is probably not until after the 21st of June.”

And Kitco Senior Analyst Jim Wyckoff sees gold prices declining further next week. “Steady-lower as serious near-term chart damage inflicted this week, including bearish double-top reversal on daily chart,” he said.

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

Tim Moseley

.png)

.png)

.png)

.png)

.png)

.jpeg)