CRYPTO BEAR MARKET – Why Experts Say It’s A Good Thing

Billions of dollars of value have been wiped off the cryptocurrency market in the last few weeks because of a sell-off in stocks, another rate hike and balance sheet shrinkage by the Fed, and the downfall of algorithmic stablecoin terraUSD. Cryptocurrency and Blockchain industry leaders believe that the recent crash in the crypto market would purge “bad actors.” The executives said the market purge was necessary and characterized it as “healthy.”

There are currently over 19,000 cryptocurrencies and at least 1000 blockchain platforms with four types of Blockchain Networks. Blockchain is the technology underlying these digital currencies and platforms. Still, the question is who will survive this massive bear market that has been happening for at least six months, and the experts are shying away from predicting its short-term future.

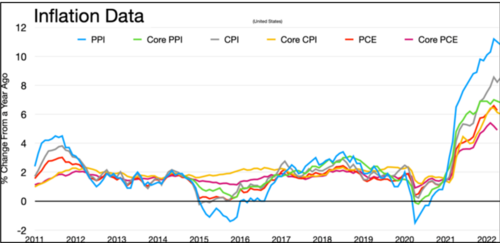

Image source: CNBC

Crypto Industry Welcomes The Bear Market

Many industry executives see the current market situation as unsustainable. Ripple CEO Brad Garlinghouse believes that the future may see “only a handful” of cryptocurrencies remaining, stating that there are around 180 national currencies worldwide. So many cryptocurrencies aren't really necessary.

Bertrand Perez, CEO of the Web3 Foundation, told CNBC,

“We’re in a bear market. And I think that’s good. It’s good because it’s going to clear the people who were there for the bad reasons.”

He went on to say,

“It’s good also because all those projects are gone. So the legit ones will be able to focus only on developing on building and forget about the valuation of the token because everyone is down. During the bull markets, when everything is green, no one thinks about building; everyone thinks about making a fortune, which is the wrong mindset.”

Other executives reiterated the same view that the massive price rally caused people to focus on speculation rather than building products. Michael Gronager, co-founder and CEO of the crypto data analysis firm, Chainalysis, says these down periods help distinguish between the signal and the noise.

Mr. Gronager explained,

“It’s during these bear markets where good new tech gets developed. We’ve seen people get excited about new technology, and suddenly everyone wants to access it, but it’s never as good as people hope for. And then there’s a certain level of disappointment, but it’s when a bear market comes along, and companies are under-funded that real innovation emerges.”

So despite the anguish of speculative investors when the price of cryptocurrency collapses across the board, some argue it is a necessary development to sort the genuinely innovative projects from the pump-and-dump schemes.

Why Do So Many Cryptos Fail?

Although the flagship cryptos, Bitcoin and Ethereum, have fallen substantially from their historical prices, other altcoins have fared even worse, with many that have entirely failed, including Luna, Dogecoin, Squid Game, PayCoin, and many more for various reasons. So many crypto coins have been released into the market and have died and disappeared over time. Why do they keep failing?

Numerous ventures are sure to face challenges in a market that is still emerging. Therefore, after releasing their coins and tokens, the creators often realize that their concepts are obsolete. Developers typically do not invest sufficient time or research when planning their foundational structure for their coins and tokens, only to find out after release that their concept is already on the market.

Many cryptocurrencies are copied versions of previously successful currencies, and many of them aspired to match Bitcoin's success. However, Bitcoin is already on the market and is still in demand, especially now with its emerging Lightning Network.

A Few Key Elements Why Cryptos Fail

Lack of a Defined Purpose:

Most cryptocurrencies do not have a clear purpose or target market. They are like a machine gun firing in all directions, hoping to find a target and hit it. A well-defined purpose will help your cryptocurrency attract the right people and repel the wrong ones.

Lack of a use case:

A cryptocurrency with no actual use case will eventually become obsolete. A cryptocurrency with a clear use case will help people understand why they should own it. Many cryptocurrencies today don’t seem to solve a real problem. They are just trying to find a niche to apply blockchain protocol and take advantage of emerging technology.

Weak Ecosystem:

Some cryptocurrency projects are focused on creating a coin and trading it without building a community that aligns with its vision and mission. The importance of a robust ecosystem cannot be overstated. Without one, a project will have a hard time gaining traction, let alone succeeding. A tenuous ecosystem could cause other problems, such as low liquidity and volatility.

Inactive Development:

In the crypto ecosystem, things change at a rapid pace. New technologies emerge, new competitors appear on the scene, and user needs and preferences change. If a crypto project is not flexible enough to keep up with these changes, it will not be able to survive in the long term.

Security Issues:

Breaches to cryptocurrency projects can also lead to their failures. From hacking to creating fake nodes, bringing down a coin is easy when its security isn't robust.

Rug Pull:

A rug pull is a malicious maneuver in the cryptocurrency industry where crypto developers abandon a project and run away with investors’ funds. Rug pulls got away with more than $2.8 billion worth of cryptocurrency from victims in 2021.

Tokenomics:

The amount of tokens supplied has a significant impact on the price. If there is a lot of supply, that can depress the price, even more so when demand is low. It's all about the law of supply and demand.

Image source: Cryptoslate

Shiba Inu Has 15 Zeros!

Shiba Inu is one example with a coin supply of 1 quadrillion. Shiba Inu trades for a small fraction of a penny because its supply is so large. There was some speculation it may reach $1; however, there’s currently a supply of 549 trillion SHIB tokens in circulation, giving it a market cap of around $11 billion.

If those tokens were worth $1 each, SHIB's market cap would be $549 trillion, roughly 200 times bigger than Apple, the world's most valuable company, and more than six times the world's annual GDP.

In other words, Shiba Inu reaching $1 would likely require a massive reordering of the world economy, and that's not going to happen. But there is a way to decrease the total coin supply by burning the coin; however, it takes considerable time.

Shibburn, a website dedicated to the project burn of Shiba Inu, said that 410 trillion Shiba Inu coins have already been burned. They were taken out of circulation by Vitalik Buterin, co-founder of Ethereum after the anonymous Shiba Inu founder gave him half of the one quadrillion Shiba Inu coin supply. Buterin said he was uncomfortable controlling so much of the supply.

According to Shibburn, around 63 million Shiba Inu coins have been burned in the last 24 hours, which seems like a lot. However, if that rate continues, it would take just over two weeks to burn 1 billion coins and 40 years to burn 1 trillion. If there were an organized movement among SHIB holders, the burn could accelerate and pick up steam if the value of SHIB continues to drop.

However, there's a clear disincentive to burning the coins. If the value begins to increase, it's in the interest of holders to keep their coins rather than burn them. The decentralized nature of cryptocurrency makes it unlikely that an organized movement will be powerful enough to reduce the number of coins substantially.

And what about the use case? John Wu, president of Ava Labs said, Shiba Inu "wasn't built with a sophisticated use case like borrowing, lending, trading, or gaming. It’s really just the Shib Army rallying behind the coin.”

Why Bitcoin And Other Purposeful Cryptos Will Survive

More and more institutions are paying greater attention to the role of Bitcoin and Ethereum as hedging tools. There is increasing interest in several countries to adopt Bitcoin as their official currency. El Salvador was the first to adopt it in September of last year as their legal tender, the most recent being the Central African Republic.

More individuals, companies, and governments are beginning to accept and adopt Bitcoin, and more investors are noticing its value, so I think it’s safe to say that our digital store of value or digital gold will remain and gain prominence well into the future.

In addition, Bitcoin has faced various attacks and smear campaigns in the past decade in the past decade. Despite everything, Bitcoin has withstood the test of time with great tenacity, providing ample evidence of its ability to overcome challenges and problems.

As mentioned earlier, experts in the industry believe the timing is perfect for getting rid of the weeds. At the same time, emerging projects rise with all the fundamentals and utility to cater to users' needs. So, it’s an excellent time to take stock of more promising cryptocurrency ventures for the remainder of this year. As the crypto world changes rapidly, some of these projects' overall strengths or weaknesses will likely change, while others will be on point.

Although Bitcoin and Ethereum have the first-mover’s advantage, a few Blockchain projects such as Solana, Elrond, and Cardano have the underlying principles and infrastructure to survive the most challenging crypto winters. They all have a strong community and dedicated team of developers with a defined end goal and solutions to some of the most challenging hurdles facing the blockchain and crypto industry.

Image by Markethive

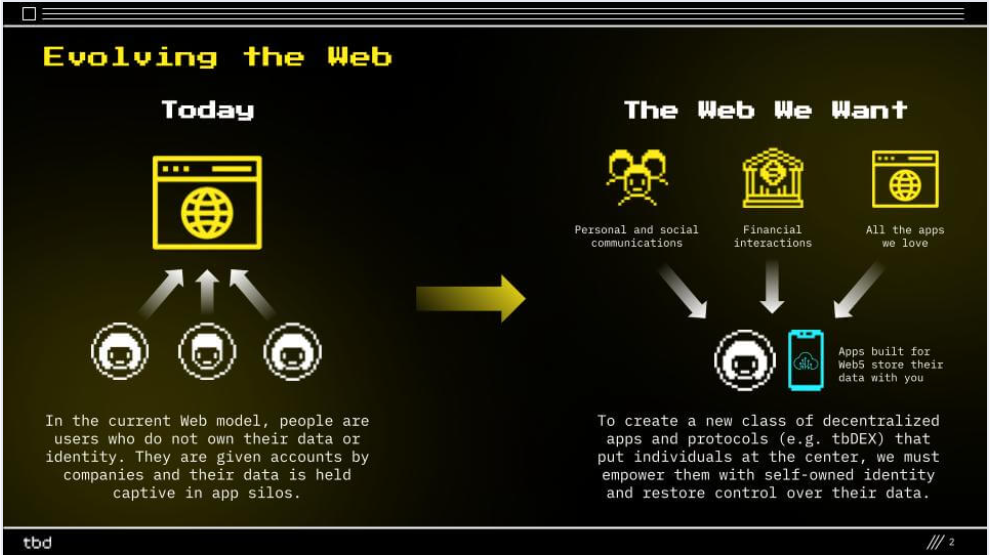

An Emerging Sector For the Blockchain Crypto Industry

Another sector overcome by centralization and severely lacking in blockchain technology is the social media and marketing niche, until now. Markethive is a blockchain-driven social media, inbound marketing, and broadcasting network rapidly building a dynamic ecosystem for the entrepreneur.

Markethive is a crypto project with extensive and varied use cases that significantly drive demand for its token. (HVC) It has developed the much-needed solutions for marketers, influencers, business owners, and the like. We have all been victims of the current state of the media and tech companies where monopolies have been created.

A decentralized and open media ecosystem, by definition, requires it necessary to have different options to broadcast and consume information free from censorship. Where content remains the creator's property, and the culture embraces self-sovereignty.

Markethive is an entirely different animal and one of the most promising and potentially disruptive projects in the entire social media and marketing industry. It is a project with a large number of real-world applications, and it has the potential to change the media landscape.

Image by Markethive

With its comprehensive wallet and member merchant accounts nearing completion, the timing couldn’t be better to distinguish itself and gain a foothold in the crypto market. This bear market will see weak projects and unscrupulous players fall, and the meaningful, intense, and focused projects will survive and thrive.

Some argue that the best bear strategy is to hoard cryptos, but a better approach is to earn more cryptos with one's existing holdings, which resembles receiving interest on bank deposits. This strategy is just one of the ways Markethive rewards its users who are part of the community.

The whole ecosystem revolves around earning and accumulating your crypto holdings by being active on the platform and conducting ecommerce via their business facilitation, thereby creating traction and velocity that is very likely to propel the coin.

As Markethive is a first-mover for the blockchain-related social media and marketing sector with its proprietary technology, it is poised to become mainstream in the next phase of cryptocurrency and blockchain technology in the aftermath of the massive cleanup of all useless altcoins. Many experts in the cryptocurrency space have said they expect thousands of cryptocurrencies to collapse.

Some exchanges have already folded or laid off employees, including Coinbase. Much of this is due to the crypto crash and the fact they hold many of these dead coins on its exchange. Perhaps it’s time for them to rethink their strategies when listing cryptos.

We are currently experiencing a collapse in traditional financial markets and many unprecedented events that are being hailed as “the storm”; spiritual, social, political, and economic – a storm affecting every aspect of our lives.

As the volatility of the global socioeconomic conditions continues on a downward trend, Markethive, guided by Divine inspiration, is here to pave the way as one of the new innovative technologies that will rise in the wake of this bear market.

There is a large contingent of people that believe that cryptocurrency can offer a more stable alternative. With more people investing and utilizing crypto, the market has more stable prices and less chance of being manipulated by outside forces.

When looking beyond the shortcomings and issues of nascent technology, there are many positive benefits with new technology constantly emerging and the philosophical approach of many entrepreneurs heading the upcoming sophisticated projects. It makes sense why crypto is becoming an increasingly popular alternative for investing in the face of instability in traditional markets.

References:

Newsbtc.com

Benzinga

Also published @ BeforeIt’sNews.com: https://beforeitsnews.com/economy/2022/06/crypto-bear-market-why-experts-say-its-a-good-thing

Tim Moseley

.jpeg)