2023 Predictions For The Crypto Industry. Is The Tide Turning?

.png)

Across the board, 2022 was a crazy year and devastating for most. In terms of the crypto market, it was arguably the most unsettling year since its inception. A series of unprecedented events, like prominent altcoins plummeting to almost zero, companies going bankrupt, and $billions being hacked, are just a few.

So what’s in store for 2023? Will it be bullish or bearish for the crypto market? Although many pundits postulate the coming year in crypto, I have outlined ten predictions from a reputable source, Guy, the investigative presenter at Coinbureau.com, which explains why they're likely to occur and how they could affect the crypto market. I offer my 2 cents worth also.

#1. Crypto Market Begins To Recover

The first prediction tends to be positive, with Guy suggesting the crypto market will improve, albeit not a bull market as we know it. The worst of the bear market will be behind us by the end of this year. The primary reason the crypto bear market could bottom in Q1 is that the Federal Reserve is expected to stop raising interest rates. Notably, stopping interest rates is not the same as lowering them, but it will likely be enough to prevent crypto from crashing further.

Likewise, the bottom for BTC will likely come in the first quarter and could be 10K or slightly lower, with the main reason being that the stock market has yet to find its bottom, and the crypto market is highly correlated to the stock market. The stock market is expected to drop by another 20 to 30%, translating to a 40 to 60% drop in BTC's price.

It’s important to point out that BTC could flash crash lower than 10K due to a crypto-specific factor such as a Bitcoin mining ban due to energy shortages. Also, Mount Gox creditors could sell the BTC they were due to receive in Q1; however, more recent news states the Mt. Gox payouts have been postponed till September.

#2. SEC Crack Down Seems Likely

The second crypto prediction for 2023 is that the Securities and Exchange Commission (SEC) will crack down on another big crypto project or company. The presenter opines that another crackdown seems highly likely if Gary Gensler continues to be the chairman of the SEC. Gary's term will expire in 2026, so there's a lot of time for him to do damage, assuming he won't be expelled from the SEC for his close encounters with Sam Bankman Fried and FTX.

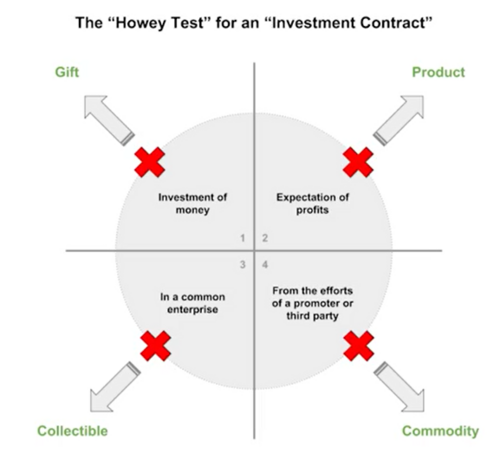

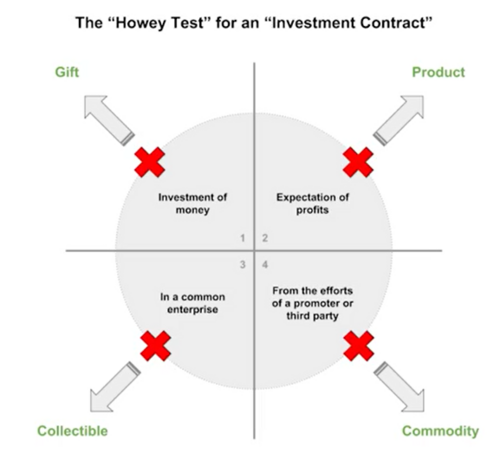

The criteria the SEC has been using to crack down on cryptocurrency have yet to be made clear. These opaque criteria can be summed up as a subjective interpretation of the fourth part of the Howey test. For context, the Howey test is used to assess whether an asset is a security, such as a stock in a company that requires additional regulation from the SEC.

Image source: NickGrossman.xyz

The fourth part of the Howey test is the most relevant to crypto if an asset can identify a third party creating an expectation of profit for a coin or token” Gary Gensler has made it clear that no cryptocurrency is safe aside from BTC. He's even targeted stablecoins, which makes no sense. This could mean that every cryptocurrency besides BTC on an exchange is a potential target, particularly POS cryptos.

However, the former director of the SEC’s Division of Corporation Finance, William Hinman, said cryptocurrencies must be "sufficiently decentralized" not to be deemed securities. Coin Center does not believe that the technological differences between POS and POW warrant any different treatment. And that it’s a misconception of policymakers that “staking” and “staking rewards” is some kind of security or interest-bearing lending activity that should be subject to regulation.

It will be interesting to see if Gary Gensler gets his way and if so, a first-quarter crackdown could be a catalyst for crypto lows.

#3. Good And Bad Crypto Regulations

Guy’s third prediction for 2023 is that there will be many crypto regulations, which suggests that most of these regulations will be good; however, a few will not. It’s also very likely that crypto regulations will vary from region to region, despite attempts to create global crypto rules. The European Union's Markets In Crypto Assets (MiCA) finalized its laws to be released in early 2023. Although they won't be coming into force for another one to two years after that, they will give institutional investors regulatory clarity for crypto.

The absence of regulatory clarity is why institutions have been hesitant to invest in crypto, especially altcoins. Establishing regulatory clarity in the EU and elsewhere could result in lots of inflows and contribute to a Q1 recovery for crypto. More importantly, crypto regulations will effectively force crypto projects to decentralize. This is because the only way to avoid many of these regulations will be to be decentralized from top to bottom.

Some crypto regulations are likely to be adverse concerning payments, DeFi, and privacy. That's because all of these niches are a threat to the traditional financial system. Fortunately, the crypto industry is likely to grow significantly with sound regulations. Furthermore, an increase in adoption and capital will likely make it possible for the crypto industry to lobby to remove the harmful rules. Keep in mind that powerful individuals and institutions want privacy the most.

#4. DeFi To Go Mainstream

The fourth crypto prediction is that DeFi will go mainstream due to better front-ends, regulatory clarity resulting in increased liquidity, and proof of resiliency from some DeFi protocols. This will increase trust in DeFi and decrease confidence in centralized entities in the crypto industry. Guy also states that the caveat is that harmful crypto regulations could slow the adoption of DeFi. So far, however, DeFi has yet to be included in most crypto regulations providing the protocols are genuinely decentralized.

Thankfully, most of the most significant DeFi protocols are, in fact, indeed decentralized, notably those on Ethereum. Most of the prominent DeFi protocols on Ethereum have also been tested by institutions in permissioned environments, namely Aave. It’s interesting to note that DeFi is technically a direct competitor to the traditional financial system, as it makes it possible to trade, borrow, lend and save.

Guy expresses that institutional adoption of DeFi is inevitable because many institutions have acknowledged that the advent of new technologies, such as blockchain, means there will be a race to the bottom regarding transaction fees and settlement times.

#5. Crypto Payments More Common

The fifth crypto prediction for 2023 relates to the third, and that's that crypto payments will become more common. This will again be due to a combination of better front-ends, regulatory clarity, increasing liquidity, and, most importantly, an increase in scalability that finally makes crypto payments feasible. Guy notes that his prediction comes from headlines about Ethereum founder Vitalik Buterin saying how Layer-2 scaling on Ethereum will power crypto payments.

Moreover, developers will reportedly implement Ethereum Improvement Proposal (EIP #4844) in March 2023. For those unfamiliar, EIP 4844 will increase the scalability of Layer 2s on Ethereum by between 10 and 100x. Given that most Layer 2s already process thousands of TPS, such an increase will put them on par with Visa. The author believes it’s very likely that Layer 2s on Ethereum will be ground zero for crypto payments once EIP 4844 is implemented.

He also stipulated that other smart contract cryptocurrencies will play a role, but they'll likely have to find their own niches. The catch is that increasing crypto payments could lead to more regulatory scrutiny. His greatest fear is that regulators will eventually require you to complete KYC if you want to use stablecoins on a smart contract cryptocurrency like Ethereum, quoting,

“This has been mentioned by a few regulators already. The scariest part about this possibility is that it would be easy to implement since the larger stablecoins are centrally controlled.

The silver lining is that a KYC crackdown on payments would drive innovation in the decentralized stablecoin niche. And some DeFi protocols are ahead of the curve. So to speak.”

Image source: cryptoslate.com

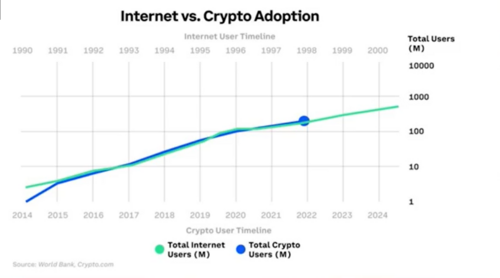

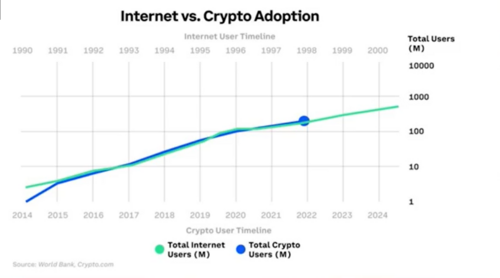

#6. Crypto Holders To Increase

Guy’s sixth crypto prediction for 2023 is the number of crypto holders will increase significantly. For context, crypto adoption currently stands at around 4% of the global population. It doesn’t sound like much, but the growth has been exponential, and there are many reasons why this trend will continue this year.

A significant reason is that media platforms have been integrating crypto features, such as Meta’s Facebook and Instagram, which have tested NFTs on multiple smart contract cryptocurrencies. Even Starbucks has been working on NFT loyalty and member programs on Polygon. Notably, free speech-focused social media platforms, like Telegram and Signal, have been integrating crypto features with TON coin and MobileCoin, respectively.

Markethive has taken privacy, free speech, and sovereignty on one decentralized platform to a new level involving social media and inbound marketing, including email broadcasting, content creation, press releases, sponsored articles, and page-making systems. Also, a video channel and conference room facilities make it a complete entrepreneurial ecosystem underpinned by blockchain technology and its native currency, Hivecoin.

All these companies have billions of users combined. Even just a tiny percentage of crypto adoption by their users would be significant. There are three reasons why people adopt crypto;

- Speculation, in other words, profit.

- Out of necessity.

- Just for fun.

Given the current sideways climate, there isn't going to be too much speculative adoption in 2023. This leaves “out of necessity” and “just for fun.” While much of the crypto adoption this year will potentially be driven by “just for fun” factors such as those mentioned above with social media, there could be a surge in necessity-related crypto adoption. Many countries are on the brink of collapse due to economic, social, and political issues.

We've already seen a few of them fall, such as in Sri Lanka. Cash and crypto will be the only options when financial systems fail, especially as foreign currencies fall against the US dollar.

Hence, an ecosystem like Markethive catering to a cottage industry of entrepreneurs, business owners, and the rank and file worldwide needs a sovereign base to facilitate their operations with the opportunity to be involved in a crypto monetary system that pays the user. Markethive enables everyone to realize their potential regardless of what is happening.

#7. More Countries To Adopt BTC As A Legal Tender

The seventh crypto prediction ties into the fifth: at least one additional country will adopt BTC as legal tender. Tonga is top of the list since the island nation announced it would make BTC legal tender by Q2 and begin mining BTC with volcanoes by Q3 of 2023. The assertions for this move are a need for more financial infrastructure, reliance on remittance payments, and using a foreign currency whose monetary policy cannot be controlled, such as the US dollar.

These are the same reasons El Salvador adopted BTC as legal tender in September 2021. It's also why some Latin American countries are the most likely to follow suit. It's even why the Central African Republic adopted BTC as a legal currency in April 2022 and uses it alongside the Central African CFA Franc.

The countries adopting BTC as legal tender doesn't mean they will ditch their national currencies. It's more than likely they'll continue to use their national currencies alongside BTC, assuming there isn't a total collapse of the financial system. It's also possible that some countries will adopt cryptocurrency alongside a new central bank digital currency (CBDC). This seems unlikely, given that crypto and digital currencies are a blatant contradiction, but it has been hinted at in various reports, including one from Harvard University.

#8. Big Tech Companies Ramp Up Crypto Integrations

Guy’s eighth crypto prediction for 2023 ties into the previous two, and that's that big tech companies will continue to announce crypto Integrations. Like the countries that could espouse BTC, big tech giants are ultimately adopting crypto because they're losing money and are trying to find ways to plug the hole.

Tech giants such as Apple and Amazon have been seeking to hire people for crypto-related positions over the last couple of years. Although there haven’t been any meaningful developments from them or the other big tech companies with similar job openings as yet, those could all come sometime this year.

Although Twitter’s new owner Elon Musk is currently balancing free speech and censorship in the face of government scrutiny, he has clarified that he intends to integrate crypto features on the platform. It’s becoming clear that this is the direction big tech is moving. The crypto or NFT adoption by Facebook, Instagram, et al. mentioned above will almost certainly inspire the rest of big tech to do the same.

He also posits that big tech adoption of crypto could be related to the Metaverse because very few are fans of the centralized Metaverse that Meta has created. They know that they're nothing more than a means of extracting even more data to be sold to advertisers and shared with governments obsessed with surveillance and censorship.

Meta and others will eventually understand that the only way they can make money on this new technology is to integrate it with existing decentralized alternatives. Big tech’s role will likely involve providing hardware and access points that enhance user experience.

#9. Wall Street To Acquire Blue Chip Crypto Company

The ninth crypto prediction is that the wolves on Wall Street will acquire at least one blue chip crypto company. Guy speculates this is highly likely given that Goldman Sachs and others are interested in buying up a few subsidiaries of FTX that remain solvent. Moreover, other crypto exchanges and platforms have gone bankrupt over the last year. Celsius, BlockFi, and Voyager Digital are easy examples, and some of their business assets may be acquired by a traditional financial institution looking to offer crypto services.

There's even speculation that a megabank could acquire Coinbase like JP Morgan, because the potential collapse of troubled crypto companies in the United States, like Digital Currency Group, Greyscale, and Genesis Trading, could have knock-on effects on Coinbase. Coinbase is also involved with USDC issuer Circle, which posted a surprisingly small profit in Q3 last year.

If Coinbase stock goes low enough, there's a scenario wherein a takeover of some kind could occur. After all, Coinbase is the largest cryptocurrency exchange in the US, and the big banks on Wall Street have been watching billions of dollars flow from their accounts onto the exchange over the last two years. They've also seen how much money Coinbase can make and probably how much data it can gather.

Image source: Forbes

#10. BTC To Be Used For International Trade

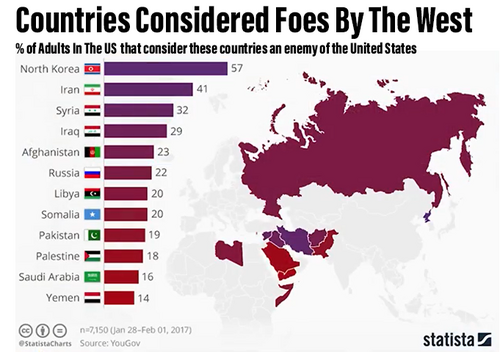

The tenth crypto prediction for 2023 is that BTC will start being used for international trade. Some countries have signaled their interest in using BTC for international trade, including those that face sanctions or scrutiny from the United States and its allies. The sanctioned list was once limited to a few so-called rogue actors, but it's quickly expanding as we enter a multipolar world.

At one pole, we have the United States and its allies; at the other, we have the BRICS, Brazil, Russia, India, China, and South Africa, plus their allies. As mentioned in this article, the BRICS are reportedly working on their reserve currency, a combination of their existing currencies.

Iran has already officially approved the use of cryptocurrency for international trade, and Saudi Arabia has a renewed interest in crypto as its central bank has hired a crypto chief to boost digital ambitions. Hong Kong will also ease restrictions, and Russia appears to be working on crypto legislation. This apparent crypto adoption by the BRICS could see them add BTC to their reserve currency basket.

Once it becomes clear that BTC is a viable option, it won’t be just the so-called naughty or sanctioned nations adopting it. When that tipping point occurs, we'll see what Fidelity has called Bitcoin, a “very high stakes game theory” where countries will rapidly adopt BTC.

My Thoughts

All things considered, as I am a "glass half full" kinda gal, this year could see a positive turn for crypto on various levels. Given the turmoil and backlash crypto has received for over a decade. All the predicaments the crypto industry has found itself in have inspired new technology to mitigate the bugs and growth in maturity.

It takes decades of trial and error to implement a robust and sound financial system, and all it takes is a couple of years of onerous or corrupt leadership to bring the global economy to its knees. Although the crypto market is currently deemed low, compared to the historical highs, we see a more stabilized price action, and BTC and authentic altcoins will be considered less volatile going forward.

In other words, crypto can and will be used as intended, not for speculation but as a comprehensive cross-border payment system and a store of value inherently deflationary given its limited money supply. It will find an equilibrium and be decentralized enough to withstand the failing traditional finance systems with its inflationary fiat currency.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.png)

.png)