The Great Migration of Americans Out of Dysfunctional Cities

by Doug Casey, founder, International Man Communique

International Man: After the outbreak of the Coria and subsequent government actions, many Americans decided to move to a new state.

For example, it's estimated that 319,020 residents fled New York state between July 2020 and July 2021, which amounted to about 1.6% of its population. It was the largest outflow of any state during this period.

What is going on here?

Doug Casey: It's quite simple and obvious: people are getting away from what they don't like.

In essence, that means taxes, regulations, corruption, street crime, and a "woke" social ambiance. These are all things that relate to government. As late as the 1950s, the local government wasn't a major factor when deciding where to live. Now it is.

Some states now have up to a 13% income tax, and some have 8 to 10% sales tax. These are huge considerations where they were once trivial. So there's a huge difference between various states regarding the costs imposed upon you by the government.

Generally speaking, the highest tax states are also the most woke and the most regulated. That's because the wokesters approve of high taxes in principle. They believe a big government is good and necessary. Furthermore, the high taxes go to promote woke policies. So high taxes and woke policies naturally reinforce each other.

The places with the most woke governments and highest taxes generally have the highest levels of welfare spending, which draws in a certain type of person. As a result, they have hundreds, or even thousands, living on the streets.

They used to be termed "bums" or "vagrants." Then you were supposed to call them "the homeless." That sounded better because it didn't imply a moral failing, just the lack of a permanent residence. Now, however, you're supposed to call them "the unhoused." This further softening seems to imply that they just don't have a house for the moment—that sounds no worse than not having a car, airplane, or perhaps a diamond ring, or maybe a pension. They're "underprivileged" and should have a home in our hearts. No moral failing there.

I prefer to call these people bums, the traditional term. But it's almost passed out of the language. It should be re-instituted. It's crazy what the progressives and the wokesters have done to the language. Their euphemisms have made words as dishonest as their policies and philosophies.

Places like New York, Baltimore, Chicago, San Fran, and scores of other liberal bastions have the worst crime because they draw in and retain the worst kind of people—those who want to take advantage of their woke policies. And they scare away people who value the opposite values—hard work, prudence, temperance, self-reliance, justice, and the other traditional virtues. The politicians in these places promise bread and circuses to the degraded hoi polloi in exchange for their votes. They draw in the worst people and scare away the best. It's a self-reinforcing type of situation that can become a death spiral. The US is no longer a democracy but a kakistocracy.

Although moving can be inconvenient, it's insane to stay rooted in a place that's degrading, with the worst conditions but the highest costs. Get a load of this article written by a liberal in "The Atlantic."

International Man: How have the policies the local politicians enacted led to these conditions?

Doug Casey: People who get into politics are generally narcissists. They're interested in popularity. Their priority isn't the good of society but self-aggrandizement. They don't create anything and can only take from some people and give to others. They do what's good for themselves, building their own brand names, hoping that successful manipulation of the hoi polloi will enable them to move from being a big shot in their municipality to a big shot in their county, then a big shot in their state, and finally making the big time in Washington DC.

What's going on here? Why do people support their destroyers? How is it that, of all animals, only humans install the most venal and stupid as their leaders? There must be some basic flaw in humans that, at least when they're in a large enough group, causes them to act irrationally. Why else would people support the kind of people who want to be politicians?

It doesn't matter whether they're Democrats or Republicans. Although I've got to say that in many ways, I respect the Democrats more than the Republicans. That's because the Democrats, as bent as they are, at least have a philosophical center. They actually believe in some things—even if they're bad things. The Republicans, however, don't believe in anything—except that the Democrats are just moving too far and too fast towards statism and collectivism. That makes the so-called conservatives hypocrites, allowing the so-called liberals to masquerade as the party of principle.

Neither the Democrats nor the Republicans are worth the powder it would take to blow them to hell. As H.L. Mencken correctly said, politicians are America's only native criminal class.

It's foolish and a moral, philosophical, and—usually—a practical mistake to support either of them. Both should be decried. Don't feed either Tweedledee or Tweedledum. They're the problem, not the solution.

International Man: While New York saw the largest outflow of residents, Texas and Florida were among the top recipients of new residents.

What do you think the long-term impacts will be on these states, and what are the implications?

Doug Casey: There are two possibilities.

Many of the emigrants are so shallow and thoughtless that they don't realize that it was their own views and habits that destroyed the places they want to get out of. They're likely to take many of their stupid ideas and bad habits with them because they can't change their basic psyche. They can't reform their basic worldview. Most don't think logically about cause and effect.

But some may have been mugged enough by the reality that they've changed their views. Some are ethically upright but have just been buried in a negative environment. I have a number of AnCap friends who started out as Marxists. So there's always hope…

But my guess is that most of the people moving from New York and California to places like Texas and Florida are reasonably conservative, rational people. That's why they're moving. So most of them will actually reinforce and improve the situation in their new states. So it's cause for optimism. Perhaps it will lead to the secession of some regions.

A bigger problem is that the country, as a whole, still seems to be moving more statist. The Blue people—the socialist-leaning people—have control of the State apparatus most everywhere. And once they have control of the apparatus of the State, it's very hard to take it away from them.

Worse yet, as the economy goes into a real crisis with the Greater Depression deepening over the next few years, both the Red people and the Blue people will clamor for a man on a white horse who will claim to kiss everything and make it better—if he has enough power.

International Man: Many formerly prosperous US cities have degenerated into conditions more akin to an impoverished Third World country in certain areas. This trend shows no sign of reversing and seems to be accelerating.

What is the cause of this, and where is this all headed?

Doug Casey: As I've said many times in the past, science fiction is a better predictor than any think tank of what's likely to happen.

Let me draw your attention to the Kurt Russell movies Escape from New York and Escape from LA, showing how dystopian big cities can get. And the earlier Charles Heston/ Edward G. Robinson movie, Soylent Green. Could things get that bad? Yes, they could. The more advanced civilization gets, paradoxically, the more unstable it can become if the foundations aren't sound. We discussed why the foundation is crumbling in our last two conversations (link here and here)

Look at ancient Rome. It had a million or more people at the time of Caesar Augustus. But after the collapse of the empire, the population fell to perhaps 20,000 people during the dark ages that followed. Cows and goats grazed in the forum. The peasants disassembled Rome's buildings to have something better than straw shacks to live in.

Civilizations and cities have collapsed many times in the past 5000 years. It could happen to New York, Chicago, San Francisco, or the US itself—unless they radically change their policies. But, notwithstanding the recent recall of SF's disastrous district attorney, there's no indication that they will. In fact, most jurisdictions are raising taxes so the government can "do more." Which, of course, just makes things worse for the reasons we just discussed.

Take a look at Detroit. There are 20 and 30-story office buildings downtown with market values of only a few million dollars. During the 1950s, Detroit was the fourth-largest city in the country and one of the wealthiest.

How do we turn the situation around? It's not by voting. That just transfers power from Tweedle Dee to Tweedle Dum. But that doesn't mean you should be quiet and say or do nothing. For that reason, I try to speak out whenever I hear people saying things that are commonly accepted but destructive.

In that regard, let me mention a club that I belong to here in Argentina. It's a group of American businessmen who get together for lunch every two weeks and talk about the world at large.

At our last meeting, an American/Argentine dual citizen went on about how politicians ought to say this or not say that—whatever works—to get people to vote for them. Our James Carville lookalike tells politicians how to appeal to the masses. He particularly spoke out against Javier Milei, an AnCap who—rather improbably—has a serious chance of becoming the next president because he threatens to overthrow the country's totally corrupt Peronist/Kirchnerite system.

I couldn't let that pass and commented that not only is politics itself the problem, but the worst people go into politics. And those who instruct politicos on how to manipulate the hoi polloi are the worst of all. I took the opportunity to broach the thought that the State was their enemy, and its powers to tax, regulate, and inflate the currency should be ripped out by the roots, with Agent Orange poured on the ground they grew in.

Will my words change anything? No. But I told them that these things need to be said. Otherwise, the enemy's victory is certain. We're fighting a psychological and philosophical war.

International Man: What is your advice to people considering moving to a new city, state, or country.

Doug Casey: Things will continue to deteriorate for the foreseeable future. Trends in motion tend to stay in motion, and this trend is still accelerating. Actual Jacobins and Bolsheviks will be running the US for at least another 30 months.

However, if you want to stay in the US and you live in a major city—it doesn't matter where—I would move to a rural area. People in rural areas are closer to the earth and reality. They have more traditional values and fewer bad habits. Their general worldview is more conservative. In big cities, it's always more liberal. Like tends to draw like. In cities, urban gangs may start taking over in "no go" zones.

Let me draw your attention to another seminal sci-fi movie from the early 1980s, The Warriors. You'll recall that New York seemed on the edge of collapse back then. One of the movie's subplots posited the gangs of New York uniting to take over the city and how they almost do it. It could happen.

There's every reason to move to a rural community. Costs are always much lower, while modern telecommunications, FedEx, Amazon, Walmart, and the rest of it give you all the material advantages of living in a big city with much less crime and fewer wokesters.

The only reason not to move to a small town is if you're still in your twenties or maybe thirties, unmarried, and want to be in the dating scene. Small rural towns aren't very active from that point of view. But otherwise, there's every reason to live in the countryside as opposed to the big city today.

If you're going to stay in the US, move out of the city, pick a nice small town, and beat the last-minute rush.

New Opportunities Are Emerging For Citizens of The World.

Freedom and democracy may appear to be struggling to stay alive in America, but there may be a knock-out punch ready to be released. The evolution of the blockchain-enabled metaverse is going to enable the 'Citizens of the World' to gain their own Freedom by democratizing power and creating a new world with new rules, new players, and new opportunities. For 99.99% of us, the metaverse will improve our real-world lives through the democratization of power and opportunity.

Along with the major long-term trend of society towards decentralization and smaller-scale organizations, there are new opportunities developing to help 'Preparers' in the cryptocurrency sector. Businesses are beginning to issue their own Crypto Coins that can be traded on Cryptocoin Exchanges.

Markethive.com for example will be releasing its HiveCoin (HIV) in the coming weeks. It has tremendous upside potential that is outlined in a Video by Founder Tom Prendergast, "Entrepreneur Advantage…".

Not only that, if you go to their website and register as a FREE Member, you will be given 500 HiveCoins for "FREE" along with access to several Earning Opportunities and online tools to increase your HiveCoin balance.

Be sure to check it out today – Markethive.com

Tim Moseley

.jpg)

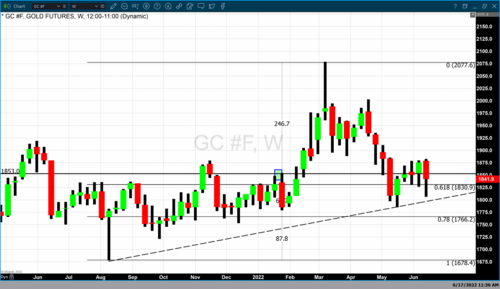

Gold hasn't lost its luster even as the Fed continues to raise rates – State Street's George Milling-Stanley

Gold hasn't lost its luster even as the Fed continues to raise rates – State Street's George Milling-Stanley.png) Image courtesy of

Image courtesy of  âââââ Image Courtesy of

âââââ Image Courtesy of

.gif)

.gif)

Entire financial system is 'a black hole,' crypto will become the dominant force – Garry Kasparov

Entire financial system is 'a black hole,' crypto will become the dominant force – Garry Kasparov.gif)

.gif)