Inflation driving momentum in gold. but Fed rate hikes remain headwinds

The gold market remains caught in a tug of war between rising interest rates and inflation; however, momentum could be shifting to the bullish side as prices end the week at the top of their range above $1,850 an ounce.

Gold prices have hovered around $1,850 an ounce for the past three weeks. After some intense selling pressure early Friday, the precious metal saw a dramatic rebound as prices bounced off support just above $1,825 an ounce.

August gold futures are looking to end the week with a 1.5% gain, last traded at $1,876.50.

According to some market analysts, disappointing economic data, including hotter-than-expected inflation, provided new bullish momentum for the precious metal. At the same time, further weakness in equity markets is improving gold's safe-haven allure.

"Gold is doing exactly what it should be," said Bob Haberkorn, senior market analyst at RJO Futures. "Investors are once again looking at gold as an inflation hedge and a safe-haven asset."

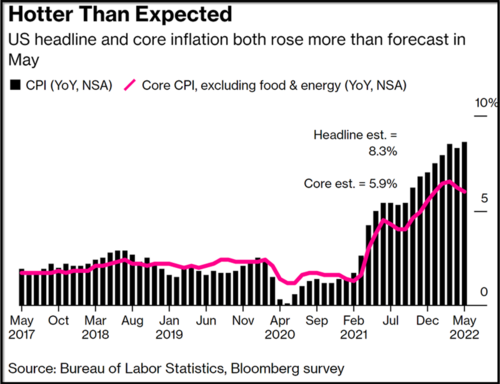

General market sentiment turned negative Friday after the U.S. Labor Department said its Consumer Price Index rose 8.6% for the year in May. Consumer prices have hit a 40-year high, driven by rising food and energy prices.

A little later Friday morning, the University of Michigan said its consumer sentiment index dropped to 50.2, its lowest level in 50-years. At the same time, consumers expect inflation to rise by 5.4% in the next 12 months.

Haberkorn said that the selloff in equities and the gold rally indicates that the market is starting to realize that there is nothing the Federal Reserve can do to tame inflation.

Although the U.S. central bank will continue to raise interest rates, they will be nowhere high enough to match inflation.

"In this environment, what you really want is gold," he said.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, said that rising consumer prices are raising the risk of a policy mistake, not just from the Federal Reserve but from central banks worldwide.

Gold sees record bullish sentiment among European retail investors – Spectrum Markets

Gold sees record bullish sentiment among European retail investors – Spectrum Markets

Gold still needs to deal with the Fed and rising interest rates

Although momentum currently favors gold bulls, the market still faces some challenging headwinds as the Federal Reserve is expected to raise interest rates by 50 basis points next week.

Hansen said he is neutral on gold next week as the market is trying to figure out how high interest rates will eventually go.

"Right now, investors don't know which way the market will go," he said. "I don't want to get involved with gold until we see a sustained move above $1,875."

Bart Melek, Head of Commodity Strategy at TD Securities, said that gold prices could drop back below $1,850 an ounce next week following the U.S. central bank's monetary policy meeting. He added that in the short-term rising interest rates are still negative for gold.

However, Melek added that the question remains just how committed the Federal Reserve will be to taming inflation and if they will risk pushing the economy into a recession.

Long-term, Melek said that he remains bullish on gold as he expects the Federal Reserve "to flake out on interest rate hikes.

"The Federal Reserve is not prepared to do what it takes to get inflation under control," he said.

Watch consumption data next week

While markets are paying close attention to inflation, analysts and economists also say that investors need to keep an eye on consumption numbers with U.S. retail sales in focus next week.

Hansen said that if inflation continues to take its toll on the consumer, weaker consumption will lead to lower economic growth.

Economists note that a strong labor market and elevated savings have helped support consumers so far this year; however, savings have dwindled due to waning purchasing power.

"The squeeze on real incomes from higher prices will weigh particularly hard on goods spending ahead given the excesses in that area of the economy relative to services. And with higher interest rates limiting demand for big-ticket items and housing-related spending, total consumption growth is set to slow in the second half of the year," said economists at CIBC.

Next week's data

Tuesday: U.S. PPI

Wednesday: U.S. Retail Sales, Empire State Manufacturing Survey, FOMC monetary policy meeting

Thursday: Swiss National Bank monetary policy meeting, Bank of England monetary policy meeting, Philly Fed Survey, weekly jobless claims, U.S. housing starts Bank of Japan monetary policy meeting

Friday: Federal Reserve Chair Jerome Powell gives welcoming remarks at conference on the International Roles of the US Dollar

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

Tim Moseley

(1).png) Gold market is waiting for next week's Fed meeting – StoneX's O'Connell

Gold market is waiting for next week's Fed meeting – StoneX's O'Connell.gif)

.gif)

.png) Gold price remains chained to $1,850 as OECD lowers growth forecasts

Gold price remains chained to $1,850 as OECD lowers growth forecasts