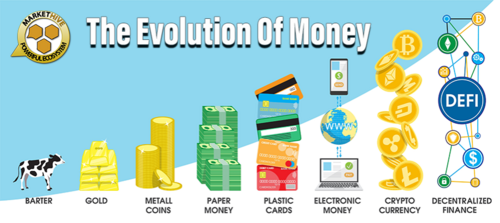

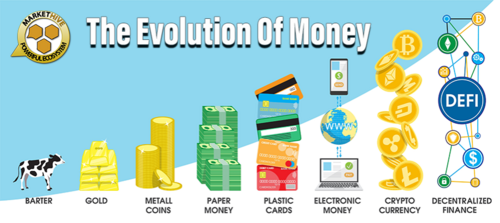

A Glimpse into the World of Crypto Exchange Revenue. Decentralized Exchanges Emerge, including Markethive's Latest Vision. It just makes sense.

The popularity of cryptocurrency exchanges has skyrocketed in recent years, with a massive influx of users globally utilizing these platforms to purchase, sell, and exchange digital assets. The rise of cryptocurrencies has brought about a peculiar phenomenon where centralized exchanges hold a dominant position in various aspects, including profitability, usage, stature, and innovation, with examples such as perpetual swaps, a derivative product pioneered in the crypto space. Meanwhile, decentralized exchanges (DEXs) have introduced innovations like automated market makers (AMMs) to the landscape.

In a previous article, we reviewed how crypto trading exchanges made money and, for the first time, surpassed the traditional stock exchanges in 2021. Now, we’ll outline some of the leading centralized crypto exchanges’ revenue and ponder the emergence of decentralized crypto exchanges, which are imperative for security, legitimacy, and autonomy.

Centralized Crypto Exchanges

Hundreds of centralized exchanges are out there, with many holding their own catering to specific niches. Below is an overview of five leading centralized crypto exchanges, their fortunes, and misfortunes in their efforts to remain successful and serve the crypto community worldwide.

Source: Binance

Binance

Binance has emerged as a leading platform for cryptocurrency trading, with a whopping $7.7 trillion in exchange volume in 2021. Founded in 2017 by Changpeng Zhao, a seasoned industry expert who previously held key roles at Blockchain.info and OKCoin, Binance has solidified its position as a dominant force in the digital asset market.

Initially introduced in Hong Kong, it rapidly gained popularity as one of the premier exchanges. However, it encountered a series of strict regulations, with China issuing a ban on crypto exchanges that led it to relocate its servers and headquarters to Malta. Currently, Binance staff are scattered worldwide and work from home.

Despite facing scrutiny from regulatory authorities in various countries, Binance has managed to maintain its position as the leading cryptocurrency exchange by volume. The company has been investigated in the US and UK, which has led to several banks prohibiting their customers from transferring funds to Binance. Nevertheless, Binance continues to outperform its rival, Coinbase, which has a more extensive user base but lower trading volumes. Binance ranks #1 on CoinMarketCap.

Binance key statistics

- Binance made $20 billion in revenue in 2021, a 263% YoY increase.

- Binance has an estimated 28.6 million users as of October 2021.

- Binance's annual spot trading for 2021 is already seven times larger than its 2020 value.

- Its peak 24-hour trading volume is $76 billion.

Source: Coinpedia

Coinbase

Since its establishment in 2012, Coinbase has been at the forefront of the cryptocurrency industry, holding the position of the largest exchange in the United States regarding trading volume. Currently ranking at #2 on CoinMarketCap, it is primarily recognized as a platform for buying, selling, and storing Bitcoin. Coinbase also provides various options for exchanging different cryptocurrencies and traditional fiat currencies.

Before Bitcoin's meteoric rise, Coinbase seamlessly integrated its payment processing system with prominent platforms such as Stripe, Braintree, and PayPal while also forming partnerships with major merchants, including Dell, Expedia, and Time Inc. This strategic move positioned Coinbase for success in 2017, a year that would prove to be a turning point for both the company and the cryptocurrency market as a whole. In this year, Coinbase expanded its offerings by adding new coins to its exchange and achieved a remarkable revenue milestone of nearly $1 billion.

Coinbase has faced numerous allegations, such as excessively charging customers for transactions and delays in making currencies accessible. Additionally, it was compelled to disclose information to the IRS about traders in the United States who held significant amounts of cryptocurrency. Although Coinbase went public in 2021, its worth has become closely linked to the price of Bitcoin, resulting in a continuous decrease in value throughout 2022.

Coinbase key statistics

- Coinbase Global annual revenue in 2022 was $3.194 billion, a 59.25% decline from 2021.

- Coinbase has 98 million users worldwide, and nine million people exchange monthly.

- Coinbase lost $2.6 billion in 2022, a massive swing for the company, which reported $3 billion in net profit the previous year.

- Coinbase global total assets for 2022 were $89.7 billion, a 321.75% increase from 2021.

Source: SignHouse

Kraken

Kraken is among the pioneering cryptocurrency exchanges, with its roots in San Francisco, USA. Founded by Jesse Powell in 2011, the platform aimed to provide a reliable and secure environment for users to trade digital assets. In response to the security breach at Mt. Gox in 2011, Powell saw the need for a robust exchange and launched Kraken publicly in 2013, committed to creating a haven for cryptocurrency enthusiasts.

Kraken ranks #3 on CoinMarketCap and has emerged as the leading crypto exchange in the Eurozone, thanks to its integration with the Bloomberg Terminal and timely involvement in the Mt. Gox saga. Initially, Kraken's growth was fueled by its provision of market data on bitcoin trading, which made it a hit among traders. However, its user base significantly surged when Mt. Gox ceased operations in 2014. As Kraken was chosen to spearhead the search for 650,000 missing Bitcoins and distribute Mt. Gox's assets to creditors, many Mt. Gox creditors opened trading accounts with Kraken, thereby providing the exchange with early liquidity.

Kraken's initial edge as the sole gateway for Euro-based crypto trading has resulted in its position as the leading exchange for Euro trading volume. However, its growth has been outpaced by other exchanges, such as Binance and FTX, which have expanded their offerings and user base faster. Despite being launched later, in 2017 and 2019, respectively, Binance and FTX have now surpassed Kraken in size. This can be attributed to their faster introduction of new features and currencies and their provision of high-risk, high-reward trading options that Kraken does not offer.

Kraken Key Statistics

- Kraken is valued at $10.8 billion, a valuation/revenue of 7.4X

- Kraken’s 2022 revenue reached a new milestone of $47.11 million.

- In 2022, Kraken exceeded 9 million users worldwide.

- Kraken's monthly average trading volume in 2022 is $33.1 billion.

.png)

Source: Coinmarketcap

HTX (formerly Huobi Global)

HTX, a prominent cryptocurrency trading platform, ranks #15 on CoinMarketCap regarding trading volume. Founded in 2013 by Leon Li and Du Jun, the exchange has recently caught the attention of Justin Sun, Tron's founder, who has taken on an advisory role and is considered a de facto owner. To commemorate its 10th anniversary, Huobi Global rebranded to HTX in September 2023, with the letters "H" and "T" representing Huobi and TRON, respectively, and "X" symbolizing the exchange.

HTX Exchange holds significant influence in Asian markets and was initially established in China. However, due to heightened regulatory measures, HTX decided to move its operations to the Republic of Seychelles. In addition to its physical offices in South Korea, Japan, Hong Kong, and Singapore, HTX also established a presence in the United States in 2018. Unfortunately, this office had to be shut down due to regulatory issues. Following the crackdown in China, HTX experienced a decrease of approximately 30% in its revenue, which further fueled its drive for global expansion.

HTX did not benefit from the recent bear market. In 2020, the platform generated approximately $250 million in quarterly revenue, which increased to $1.25 billion in mid-2021. However, by the end of 2022, HTX's quarterly revenue had decreased by 98% compared to 2021. In 2023, HTX focused on burning its HT token to reduce its circulation supply and potentially raise its value. Additionally, HTX adjusted its burning methods to align with other prominent cryptocurrency exchanges.

HTX Key Statistics

- HTX's estimated annual revenue is currently $110.1M.

- HTX is handling over $4 billion in daily trading volume.

- Total assets are approximately $2.35 billion.

Source: Coingeek

OKX (formerly OKEx)

Since its inception in 2013, OKX has undergone various iterations. Mingxing "Star" Xu established it as the OKCoin.cn Bitcoin exchange in China. Subsequently, an international variant called OKCoin.com was introduced, which continues to operate as a fiat-supporting exchange in select markets. In 2017, OKEx, an all-digital-asset platform, was launched concurrently with the International Digital Asset Exchange (IDAX). Over time, OKX has expanded its presence to encompass the European Union, the United States, and Latin America. The company's headquarters are located in Seychelles.

In 2022, OKEx rebranded and changed its name to 'OKX' to adapt to decentralized services. According to OKX, this change in name and image will guide the company toward a decentralized future where digital assets merge with other innovative experiences. The letter "X" symbolizes the uncharted and yet-to-be-discovered opportunities in the financial and virtual domains. OKX holds the rank #5 on CoinMarketCap

The company has made the strategic decision to enter the emerging world of cryptocurrency and delve into DeFi offerings, NFTs, gaming, and metaverses. This expansion signifies OKX's desire to explore the possibilities within the crypto realm fully and transform it into a comprehensive destination for all types of cryptocurrency enthusiasts.

OKX Key Statistics

- OKX’s year-to-date is $50 – $75 million.

- OKX's year-to-date volume is $960.9 billion.

- OKX has over 20 million users worldwide in over 100 countries.

- Total assets: Nearly $11.8 billion

Decentralized Crypto Exchanges

Over the past few years, decentralized exchanges (DEXs) have become strong contenders to the conventional centralized exchange (CEX) model. Blockchain technologies like cryptocurrency are based on a philosophy of decentralization. As a result, it is only natural that decentralized exchanges have emerged to challenge the established centralized exchanges. These recent developments have fostered a distinctively unique ecosystem for crypto assets, attracting a growing community of traders and investors.

What makes DEXs unique is that they're peer-to-peer marketplaces that let cryptocurrency traders make direct transactions — without an intermediary managing their funds. Instead, DEXs use smart contracts that self-execute their agreements, and innovative solutions have been devised to solve liquidity-related issues.

Source: IQ.wiki

The 1inch Network

The 1inch network was introduced in May 2019, while its token, 1INCH, was launched in December 2020 by its founders, Sergej Kunz, and Anton Bukov. Before co-founding 1inch, Kunz was employed full-time as a cybersecurity specialist at Porsche and worked as a senior developer at a price aggregator. Bukov, on the other hand, has experience in software development and has recently been involved in decentralized finance.

The 1inch network uses multiple protocols: Aggregation, Liquidity, and Limit Order Protocol. The synergy of these protocols ensures fast and protected operations in the DeFi space. It unifies numerous decentralized exchanges (DEXs) into a user-friendly platform. This lets users compare and optimize their crypto trades and swaps without navigating multiple exchanges separately. The network's initial protocol, a decentralized exchange aggregator solution, scours various liquidity sources to provide users with the best possible rates, exceeding those offered by any individual exchange.

The 1inch Aggregation Protocol leverages identify the most optimal paths across a vast network of over 300 liquidity sources spread across ten different blockchain platforms, including Ethereum, BNB Chain, Polygon, Avalanche, Optimistic Ethereum, Arbitrum, Fantom, Gnosis Chain, Klaytn, and Aurora.

Even though the cryptocurrency market was experiencing a downturn and chaos due to the collapse of centralized entities, UST, and a well-known crypto hedge fund, users are still actively trading on the 1inch Network. Despite the market decline, the increase in trading volume on 1inch indicates that users strongly desire to adjust their investment portfolios to withstand the market conditions. 1inch has proven its value to users during a challenging economic environment by consistently growing its trading volumes.

1inch Key Statistics

- Total earnings for 2022-’23: $12.5 million

- Total volume 2022-’23: $175.1 million.

- 1inch has approximately 4.9 million users, accommodating 54,300 users per day.

- 1inch’s Market cap is $377.2 million and ranked 110th out of all 8,819 active cryptocurrencies listed on CoinMarketCap.

Source: Ailtra

dYdX

dYdX has established itself as a leading decentralized exchange platform globally, supporting over 35 cryptocurrencies. Founded by Antonio Juliano, a California-based entrepreneur and former Coinbase engineer, in July 2017, the platform provides various services such as trading, lending, and borrowing and initially operated on the Ethereum Layer-1 network. dYdX also introduced its native currency, DYDX, in August 2017.

The company is widely acclaimed for its cross-margin perpetual trading, making it a comprehensive hub for decentralized financial transactions. As a DEX offering derivatives, dYdX was an early mover, rolling out its first perpetual swap (perp-swap) offering in 2020. Three years later, most DEX trading activity is still on spot-trading venues. The leading exception is dYdX.

The high trading volume on dYdX can be attributed to two significant developments in 2021. Firstly, dYdX migrated from the Ethereum mainnet to utilize layer-2 rollups powered by Starkware, resulting in faster and more affordable transactions. Additionally, introducing the dYdX protocol token boosted the platform. It is a governance token that allows the dYdX community to own and govern the protocol truly, aligning incentives between traders, liquidity providers, and broader stakeholders. These enhancements, known as dYdX v3, have contributed to a substantial increase in trading activity, with the number of listed pairs growing from 3 to over 30.

In June 2022, dYdX v3 was replaced with a new version, the dYdX v4. The dYdX Chain (currently on the public Testnet from Sept. 2023) marks a significant milestone in the company's development as it shifts towards a decentralized, community-driven model. Leveraging the Cosmos SDK, dYdX creates a transparent and trustless central order book exchange governed by validators and stakers. The ratio of fee distribution will be determined by on-chain governance, ensuring that holders of the dYdX token will receive a share of the fee revenues.

In a move towards true decentralization, dYdX Trading Inc. and other central parties will not have access to trading fees on dYdX V4, as promised by the core team in their January 2022 announcement. It’s interesting to note that considering the recent market downturn, the exchange has seen volume and revenue while focusing on development, which can help the platform grow when the activity returns in the crypto market. dYdX currently sits at #1 of the DEX listings on CoinMarketCap.

dYdX Key Statistics

- dYdX’s semi-annual report states that dYdX’s trading volume has surpassed $230 billion, with a daily volume of $1 billion. The v3 platform recently exceeded $1 trillion in cumulative trading volume.

- dYdX has generated $71.1 million in revenue in 2023 to date.

- dYdX’s user base is over 60K, with 1.8K active daily users.

Successful Crypto Exchanges Have A Community-First Ethos

The backbone of a thriving cryptocurrency exchange lies in its dedicated community. Beyond the utility of its token and the services provided by the exchange, the involvement and support of its community are crucial in fostering the widespread adoption of cryptocurrency. Crypto communities have become instrumental in promoting digital assets and driving mainstream adoption worldwide.

Some projects and exchanges in the industry have taken a community-first stance. This shift has led to the rise of community-driven initiatives, where open communication and shared decision-making are the cornerstones of project development. By placing the reins in the hands of the community, developers can harness the collective power of the crowd, fostering a spirit of collaboration and shared ownership. This emphasis on community building has, in turn, given rise to the creation of social networks explicitly tailored to the needs of the crypto community.

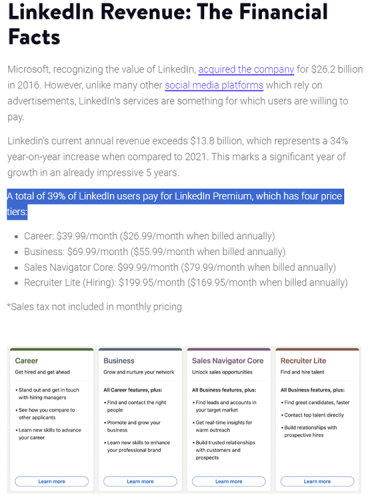

Thomas Prendergast, the founder and CEO of Markethive, firmly believes that community-driven approaches will shape the future of businesses. Markethive, a pioneering social market broadcasting platform built on blockchain technology, is set to launch its cryptocurrency, Hivecoin (HVC), on the crypto market. Moreover, the company offers a unique opportunity to early adopters through its Founders Token, representing the ILP and allowing them to be a part of the emerging Markethive ecosystem and share in its value and revenue.

The Markethive system fosters community engagement and growth by recognizing and rewarding contributors who share a common purpose. By leveraging the collective enthusiasm of like-minded individuals, we can create a self-sustaining ecosystem that benefits its members and extends its impact to the broader communities they are a part of. This approach will have a transformative impact on our professional and social lives and unlock unforeseen opportunities.

So, the next logical step for Markethive, with all its ducks in a row, is to embark on a project that will complete its ecosystem: a decentralized crypto exchange.

Image: Markethive.com

Markethive Crypto Exchange: It just makes sense.

Thomas has a clear vision for Markethive's next venture: a cutting-edge crypto exchange that leverages the platform's unique strengths, including innovative inbound marketing strategies, blogcasting capabilities, dynamic social engagement, and community-driven support. This new endeavor is a natural progression for Markethive, allowing it to expand its reach and provide users with a seamless trading experience that integrates the platform's proven features.

The decentralized crypto exchange will be a separate offshore company collaborating with Markethive that can offer a strategic partnership that includes integrated traffic and a built-in community, gamification, promotional support for new coin listings, press releases, and custom articles to create a dynamic trading platform. The exchange will also provide automated memberships, airdrops, and promo codes to encourage sign-ups, all of which will be supported by a vast and engaged community that can help promote and establish new coins on the exchange, potentially attracting millions of interested users to Markethive.

Markethive's new exchange will significantly benefit all E1s and community members with ILPs as that membership represents revenue, which increases Markethive's revenue. So even if you’re not in an ownership position with Markethive’s new exchange, the exchange is a revenue engine for Markethive and will drive the membership in Markethive into the stratosphere and thereby increase the revenue so it is to everyone’s benefit. It will increase the value of your Hivecoin and produce revenue to fund the ILPs. This fulcrum will send Markethive into another realm, becoming a giant in the crypto exchange industry, and will solidify Markethive's position as a leading ecosystem.

The emergence of a multi-polar world is evident, with the growing influence of the BRICs and the potential for others to offer similar solutions. This shift presents an opportunity for Markethive to establish itself as a neutral and apolitical platform capable of facilitating cross-border transactions without the constraints of sanctions or political allegiances. By operating offshore, its crypto exchange can enable the seamless exchange of payments from all countries, promoting financial inclusion and accessibility for the benefit of people worldwide.

Markethive offers a refuge from the harmful strategies of authoritarianism, which persist in threatening the stability of nations worldwide. As an alternative economic system, we are committed to promoting individual freedom and autonomy, in contrast to the oppressive and centralized control advocated by fascist and communist ideologies. Our goal is to empower individuals and communities rather than submit to the dictates of a single, all-powerful authority.

Markethive is set to revolutionize the cryptocurrency exchange landscape by inviting its community members to participate in this groundbreaking project. By engaging its community in this innovative endeavor, Markethive aims to offer an unparalleled opportunity for involvement at an unprecedented low cost, promising remarkable rewards. Stay tuned for more updates on this exciting development.

Join us on Sundays at 10 am MST as we reach new heights in revenue-generating integrations. Be a part of the excitement and witness the cutting-edge technology and innovative concepts of Markethive firsthand. Get your questions answered and participate in the conversation as we work together to create the ultimate ecosystem. Don't miss out – join us in the meeting room. The link to this can be found in the Markethive Calendar.

We look forward to seeing you there!

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

(35).gif)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.gif) Gold needs to break above $2,010 for prices to have a chance at ATHs

Gold needs to break above $2,010 for prices to have a chance at ATHs.gif)

The gold market has managed to reclaim the $2,000 level as it looks to end its second consecutive week in positive territory. However, analysts have said that gold's momentum remains limited, and prices are unlikely to break current resistance levels as the Federal Reserve maintains its tight monetary policy bias.

The gold market has managed to reclaim the $2,000 level as it looks to end its second consecutive week in positive territory. However, analysts have said that gold's momentum remains limited, and prices are unlikely to break current resistance levels as the Federal Reserve maintains its tight monetary policy bias.(1).gif) Gold and silver prices stuck, waiting for a catalyst – Quant Insight's Huw Roberts

Gold and silver prices stuck, waiting for a catalyst – Quant Insight's Huw Roberts

Gold needs to break above $2,010 for prices to have a chance at ATHs

Gold needs to break above $2,010 for prices to have a chance at ATHs

.png)

%20copy(1).png)

.png)

(1).gif)

Massive money printing coming in 2024, the Fed to 'catastrophically' break something – Preston Pysh

Massive money printing coming in 2024, the Fed to 'catastrophically' break something – Preston Pysh

.png)

(35).gif)