Understanding and Identifying the Different Types of Cryptocurrencies is a Must for Sound Investing

The value of cryptocurrencies is a question that has likely been posed to you before and perhaps that you have also wondered about. The answer varies depending on the specific crypto coin or token being discussed. With over 11,000 cryptocurrencies in existence, each one has its purpose or intended use case that adds to its value. However, it is essential to note that not all cryptocurrencies are currently active or hold value. By disregarding the many "dead" cryptos, we are left with approximately 8,000 active cryptocurrencies.

Most cryptocurrencies can be grouped into various categories, including those that serve as a means of storing value, facilitating smart contracts, providing oracle services, enabling payments, ensuring privacy, acting as exchange tokens, and even serving meme coins.

Identifying the category a cryptocurrency belongs to when investing in the crypto market is crucial. This is because each category has its advantages and disadvantages, and they tend to experience different patterns of price surges and declines during a bull market. This guide provides an overview of the different types of cryptocurrencies and offers insights on how to leverage this information to optimize your investment strategy and mitigate potential losses.

Image source: Business Today

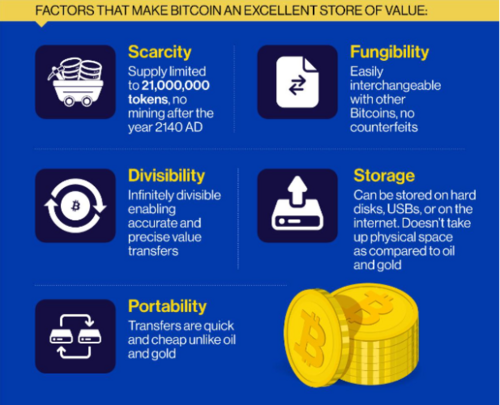

Store Of Value Cryptos

Cryptocurrencies that fall under the store of value category are intended to maintain or enhance their buying power as time passes. Although there is usually a gradual rise in their price over time, it is important to note that price and purchasing power are two different concepts.

Traditional currencies lose about 2% to 3% of their purchasing power yearly due to governments printing more money to stimulate economic growth. Therefore, if you invested in a stock that increased by 23% last year, the actual purchasing power of that stock remains the same despite the increase in its dollar value.

The government's excessive money printing diminishes its value, which is why cryptocurrencies like Bitcoin were created. Bitcoin, launched in 2009, reacted to the 2008 financial crisis and the subsequent government money printing. It's the only cryptocurrency that fits the store-of-value category, although some argue that others, like Litecoin, also qualify. Litecoin is also known as silver to Bitcoin’s gold.

Bitcoin differentiates itself from traditional currencies by having a limited supply of 21 million BTC, in contrast to conventional currencies, which are subject to continuous printing and subsequent devaluation. This 21 million BTC is created gradually, thanks to miners who solve intricate equations to facilitate transactions on the Bitcoin blockchain and are rewarded with BTC.

A decentralized payment network has been established by allowing anyone to mine Bitcoin and receive BTC as a reward for processing transactions. This network comprises millions of computers located worldwide. The presence of economic incentives makes Bitcoin the most secure payment network globally. It cannot be shut down by targeting a single location.

Although Bitcoin was initially intended to function as a form of virtual currency, its economic characteristics and the relatively slow speed of its transactions have resulted in it being more comparable to digital gold than digital cash. Within the cryptocurrency market, Bitcoin holds the highest market capitalization, and the price of Bitcoin influences the prices of almost all other cryptocurrencies.

If Bitcoin's value experiences a sharp decline, it also leads to a decline in the value of other cryptocurrencies. Conversely, if Bitcoin's price remains stable or gradually increases, it increases the value of other cryptocurrencies. Furthermore, if Bitcoin experiences a significant surge in value, it outperforms other cryptocurrencies by a substantial margin. The ongoing fluctuations in Bitcoin's dominance can be observed in real-time through the Bitcoin dominance chart.

The main benefit of store-of-value cryptocurrencies is that they tend to be less risky investments than other cryptocurrencies and have a higher potential to appreciate in value over time. However, the critical factor determining their success is a fair launch, where a community of miners collectively starts mining the cryptocurrency from the beginning.

Many store-of-value cryptocurrencies have been pre-mined, where the development team and private investors hold a significant portion of the supply, which can lead to centralization and decreased trust in the network. To verify if a store of value cryptocurrency is genuinely decentralized, you can check its supply distribution using a Blockchain Explorer. Bitcoin and Litecoin are examples of store-of-value cryptocurrencies with relatively equitable supply distributions.

One major drawback of cryptocurrencies that serve as stores of value is their lack of extensive features. This is why some individuals compare Bitcoin to a pet rock. These types of cryptos primarily focus on preserving purchasing power and facilitating peer-to-peer transactions without intermediaries. The limited functionality of store-of-value cryptocurrencies is why many individuals anticipate that Bitcoin will eventually lose its position as the most prominent cryptocurrency in market capitalization. The crypto that surpasses Bitcoin is expected to emerge from the second category.

Smart Contracts Cryptos

Smart contract cryptos, which belong to the second category of cryptocurrencies, are specifically created to be programmable and prioritize functionality over value preservation. The reason this is important is as follows.

If you are currently viewing this article on either your computer or phone, it means you are utilizing a specific program, whether it be a web browser or a mobile application. The distinguishing feature of the programs you rely on daily is that they are centrally controlled. A major technology company is typically responsible for developing and overseeing these browsers or apps. Additionally, these programs are not particularly secure. There is a risk that an individual could hack or alter the program to gain access to your personal information, finances, identity, and so on.

The influential tech conglomerates and financial institutions are constantly monitoring your digital activities. Whether you're spending, saving, or trading your funds, you must utilize a centralized medium, such as a bank or a brokerage firm. However, cutting-edge smart contract cryptocurrencies present a revolutionary replacement for the digital and financial systems we rely on today. This innovative approach is known as Web3, representing a significant upgrade from the existing Web2 internet.

Image source: globalxetfs.com.au

Smart contracts are self-executing programs that automate specific actions when predefined conditions are met. They can be used to create various cryptocurrency tokens, such as fungible tokens similar to traditional currency or non-fungible tokens that are unique and rare, like a collectible baseball card. What sets smart contracts apart from regular programs is their immutability and decentralization. Once created, smart contracts cannot be modified, and their decentralized nature means they cannot be shut down as they exist on a vast network of computers globally.

A decentralized application (dApp) is formed by merging various smart contracts. These dApps cover a wide range of functions, such as payments, trading, lending, borrowing, and even gambling. Utilizing dApps does not necessitate sharing personal information; all that is required is an internet connection. The most significant advantage of dApps is the absence of intermediaries extracting fees or compromising your data. Transactions within dApps occur directly between individuals, ensuring a level of privacy for your activities. (However, there is one exception to this, which will be elaborated on later.)

Many decentralized applications (dApps) with a significant user base operate on various smart contract-based cryptocurrency platforms, primarily Ethereum and Binance Smart Chain. Also, Solana is very active in this niche. These cryptocurrencies derive value from their utility in facilitating transactions and executing smart contracts rather than solely as a store of value.

Transaction fees on these networks are paid in the native cryptocurrency of the respective platform, such as ETH for Ethereum, BNB for Binance Smart Chain, and SOL for Solana. To maintain a sufficient supply of cryptocurrency for transaction fees, most smart contract cryptocurrencies do not have a maximum supply. Instead, they implement annual inflation schedules that can range into double digits under certain conditions.

If there are sufficient dApp users purchasing the coin to cover the necessary fees, the act of ‘printing coins’ is typically not an issue. This leads me to the main benefit of smart contract cryptocurrencies: their worth is connected to the scale and acceptance of the dApp and token ecosystems established on their blockchains. Despite Ethereum and the Binance smart chain having only a few million users, ETH and BNB had market capitalizations in the hundreds of billions. And SOL is not far behind them.

The adoption of smart contract cryptocurrencies could significantly increase market caps for associated coins, reaching trillions of dollars by the end of the decade. However, the main drawback of smart contract cryptos is the uncertainty of which one will emerge as the winner. The competition in this category is fierce, with new projects entering the market regularly. Unless you have the means to invest in all of them, it is crucial to conduct thorough research before making any decisions.

Image source: Researchgate

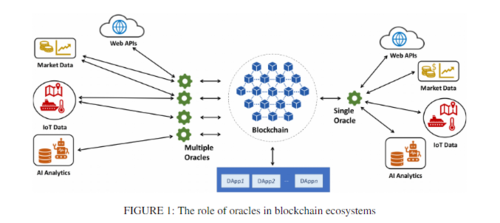

Oracle Cryptos

Oracle cryptocurrencies facilitate the integration of real-world data into smart contract blockchains, enabling decentralized applications to access and utilize external information. In centralized systems, applications rely on APIs provided by external entities to obtain data such as weather or pricing information. Similarly, smart contracts require access to real-world data to execute practical tasks. This is where Oracle cryptocurrencies come in, providing a decentralized means of sourcing and verifying data for blockchain-based applications.

Oracle cryptocurrencies differ from data feeds like APIs by offering decentralized data feeds. Typically, multiple individuals or institutions will tell an oracle crypto the price of a particular item, and the oracle calculates an average of their responses. Similar to smart contract cryptocurrency coins, oracle crypto tokens are required to pay for the fees to cover the costs of obtaining this data.

Despite Chainlink currently holding the top position and being widely used as an Oracle cryptocurrency, around twelve other Oracle cryptos exist, including Band Protocol and API3. The main benefit of Oracle cryptos lies in the increasing number of smart contract cryptocurrency dApps and users. The demand for their tokens is also expected to rise. However, a significant drawback of these oracle cryptos is that most have allocated substantial portions of their pre-mined token supplies to their teams and private investors.

Consequently, if the prices of these cryptocurrencies increase, it creates a strong motivation for teams and private investors to sell, preventing the price from reaching higher levels. Additionally, many smart contract cryptocurrencies rely on multiple oracles to provide data for their decentralized applications, and specific cryptocurrencies, such as Cardano, have chosen to develop their own decentralized data oracles. As a result, this decreases the demand for any individual Oracle cryptocurrency.

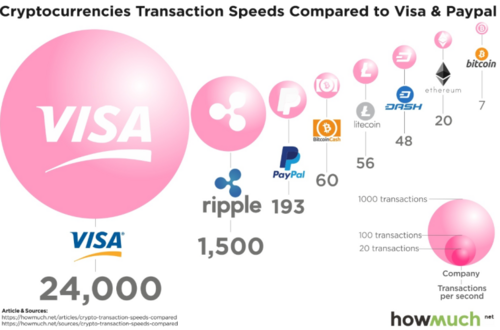

Image source: Howmuch.net

Payment Cryptos

Payment cryptocurrencies, which belong to the third classification of virtual currencies, aim to substitute the existing payment systems currently in use. In some instances, these payment cryptos utilize smart contract technology. If you have ever made an international money transfer, you know its exorbitant costs and sluggishness. For business owners, the substantial fees charged by payment processors such as Visa, Mastercard, and PayPal per transaction are for business owners well known.

Those who have experienced payment problems are also familiar with the numerous hurdles one must overcome when resolving issues with their bank. Additionally, many of us pay monthly fees simply to maintain a bank account or credit card. Irrespective of the circumstances, whenever money is involved, an intermediary takes a portion, causing delays and introducing complexities to processes that would otherwise be straightforward.

Payment cryptocurrencies enable swift transaction settlements and significantly reduce costs compared to using an antiquated payment network that takes several days to finalize transactions. Furthermore, similar to other cryptocurrencies, you can securely store payment-oriented coins or tokens in your personal wallet, eliminating the need to depend on a bank for fund storage. This also removes concerns regarding unauthorized access to your bank account or restrictions on incoming and outgoing payments.

Cryptocurrencies optimized for payments like Bitcoin Cash, Dash, Telcoin, and Solana have gained popularity due to their sophisticated smart contracts and dApp ecosystems centered around payment systems. These cryptocurrencies boast the highest potential for widespread adoption, targeting the largest and most profitable market globally.

Dash has already achieved significant usage in Argentina for everyday payments, while Telcoin has made strides in offering affordable remittance services. Solana has been of particular interest in the payments niche as it's becoming clear that its technical capabilities are suitable for these applications. Recently, Visa joined the Solana ecosystem designed to offer high-speed performance, expanding its stablecoin settlement capabilities with the USDC stablecoin and furthering its core business with things like cross-border payments and using crypto for one of its core use cases.

The principal drawback of cryptocurrencies, except for stablecoins, designed for payment purposes, is that it is highly improbable that they will supersede traditional currencies in the near future. This is primarily because the value of these cryptocurrencies is often unstable. Additionally, governments have demonstrated a willingness to intervene and restrict their use for payment purposes.

Image source: Investing.com

Privacy Cryptos

Privacy cryptos, also known as privacy coins, constitute the fourth classification of cryptocurrencies. These types of cryptos aim to safeguard users' privacy during transactions and while utilizing decentralized applications (dApps). It is a common misconception that cryptocurrency transactions are inherently private. However, as mentioned earlier, most cryptocurrency blockchains are publicly accessible, enabling anyone to observe transactions as they occur in real-time. Although an individual's identity is not initially linked to their cryptocurrency wallet address, it is still feasible for others to determine which addresses belong to them.

This holds particularly true if you utilized a platform or trading service that demanded your personal details for buying cryptocurrency. Your identity can readily be associated with your digital wallets in transactions. It is plausible that you are perfectly fine with this and believe that all transactions should be completely open and confirmable by anyone. However, companies and affluent individuals hold a contrasting viewpoint. The very last thing they desire is for others to see the extent of wealth stored in their cryptocurrency wallets.

Furthermore, as an individual utilizing cryptocurrency dApps, it is highly likely that you desire a high level of privacy for your data. Privacy cryptocurrencies aim to tackle these concerns and come in various forms and options. For instance, Secret Network enables the development of dApps that prioritize privacy.

Specific cryptocurrencies, like Monaro and Zcash, prioritize confidential transactions and employ top-notch privacy mechanisms that are supposedly impervious to government surveillance. Another privacy-focused cryptocurrency, Haven Protocol, takes it a step further by enabling the generation of virtual fiat currencies, cryptocurrencies, and precious metals, thereby creating a virtually untraceable offshore bank account.

Privacy cryptocurrencies have a significant edge due to their robust design and durable structure. Most have had a fair and transparent launch without any pre-mining or favoritism towards private investors. Using Monero's XMR coin as an illustration, it shares similar store of value properties with BTC and can be transacted as quickly and as cheaply as most payment cryptocurrencies.

Monero also employs a unique mining algorithm known as RandomX, which prevents specialized computers from mining XMR. This feature enhances Monero's decentralization by allowing anyone to participate in mining XMR.

One of the main drawbacks of privacy cryptocurrencies is that regulators often single them out due to their association with illegal activities, or at least that is the primary reason given. Consequently, privacy coins are frequently removed from cryptocurrency exchanges, making them difficult to obtain and hindering their potential for price appreciation.

Decentralized exchanges like THORChain provide a means to trade privacy-focused cryptocurrencies, such as Monero and Haven, without relying on a centralized platform. Notably, some privacy-centric cryptocurrencies have been developed with regulatory compliance in mind, allowing users to demonstrate their wallet balance and transaction history to regulatory authorities upon request, thanks to sophisticated cryptographic techniques.

Image source: Binance Square

Exchange Tokens

Cryptocurrencies, known as exchange tokens, fall into the fifth category. These tokens are owned and controlled by the cryptocurrency exchanges they are associated with. Exchange tokens can be seen as a mix of a membership subscription and company shares. Similar to a subscription, they offer various benefits, such as discounts on trading fees and exclusive access to early coin and token sales. However, like company stock, the value of exchange tokens is influenced by the popularity of the exchange they are connected to.

The reason for this is that nearly all exchanges buy back and burn a portion of their circulating exchange tokens using a fraction of the trading fees they collect. Buying back raises the price, while the burn reduces the overall supply, resulting in a cryptocurrency token that appreciates in worth as time passes. Additionally, certain exchanges like Binance have developed smart contract cryptocurrency networks that necessitate using their exchange tokens, creating an additional source of demand for these tokens.

The main benefit of exchange tokens is their strong potential for price appreciation. On the other hand, exchange tokens have a slower growth rate than other cryptocurrencies, nor are they guaranteed. As the influence of cryptocurrency exchanges continues to grow, regulators are gradually beginning to resist. It has been observed that a single unfavorable announcement regarding an exchange can result in a significant decline in its token value.

Meme Coins

Another type of cryptocurrency is meme coins. These digital currencies often lack a clear purpose or practical application, and their main appeal is based on hype and the promise of financial gain. In reality, if someone tried to sell you on the idea of becoming a millionaire by investing a few hundred dollars, you'd likely recognize it as a dubious proposition.

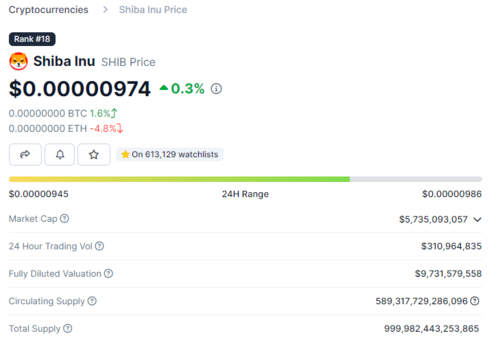

Interestingly, this apparent impossibility inexplicably becomes achievable when the identical concept is expressed for cryptocurrency. This could be attributed to the fact that novice cryptocurrency investors may not comprehend the connection between a meme coin's market capitalization, supply, and value in dollars. For instance, a single Shiba Inu token is priced at approximately 1/1000th of a cent. Without considering the market capitalization, one might think that if they invest a mere few hundred dollars into Shiba and its value rises to one dollar, they would become multi-millionaires.

Screenshot: Coingecko

The primary challenge with Shiba Inu's valuation is that its market capitalization is already in the billions, owing to its considerable circulating supply of 590 trillion and maximum supply of over 999 trillion, even after factoring in perpetual burns. Consequently, for Shiba Inu's price to reach $1, it would require an investment of over four times the total amount of money in existence, which seems unrealistic.

A large number of the meme coins that have emerged in recent months share a common characteristic: they have enormous supplies, which makes it unlikely that they will reach a value of one dollar in the near future. If you are considering the possibility that these coins have deflationary properties or unique economic mechanisms that will drive up their price, take a moment to reflect on the true purpose and potential outcome of these meme coins.

A common viewpoint is that none of these meme coins genuinely intend to provide useful functions for their community. The main objective behind most meme coins is to benefit their creators financially. While some individuals may choose to take a chance on them, the risk often outweighs the potential benefits.

Having said that, due to its unique origins and features, Dogecoin stands out among other meme coins. It was created as a lighthearted joke, and its survival during the last bear market can be attributed to its ability to be 'merged mined' with Litecoin at no extra cost.

Meme coins may provide an opportunity for rapid profit, but their volatility means the potential for loss is equally high. The unpredictability of pump and dump schemes makes it challenging to turn a profit, as the likelihood of being left with losses when the dust settles is significant. Meme coins are notoriously susceptible to manipulation and are the most manipulated cryptocurrencies on the market, with their prices often being artificially inflated and then suddenly collapsing. It makes the price manipulation of Bitcoin seem insignificant in comparison.

Image: Markethive

In Closing

Grasping the various forms of cryptocurrency and their potential applications is crucial. Projects that have pioneered a specific field, offering genuine utility to the broader community, have a distinct edge. By continuously adapting and staying up-to-date with technology, being a first mover enables a project to gain a significant portion of the market and avoid the negative consequences of oversaturation.

In terms of being a pioneer, Markethive belongs to the category of first movers, offering a wide range of practical applications. This raises the question of where Hivecoin (HVC) fits in among other cryptocurrencies. All of this and more will be disclosed in the upcoming article.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Tim Moseley

.png)

According to some analysts, next week will be an important test for the gold market as a hawkish Fed could put downward pressure on a market that is already sensitive following Monday's blow-off top.

According to some analysts, next week will be an important test for the gold market as a hawkish Fed could put downward pressure on a market that is already sensitive following Monday's blow-off top.

Central bank gold purchases remained strong through October – World Gold Council

Central bank gold purchases remained strong through October – World Gold Council

Is Argentina's new anti-central bank stance triggering a new trend? – Cory Klippsten

Is Argentina's new anti-central bank stance triggering a new trend? – Cory Klippsten