What Has The World Health Organization Been Up To Lately?

WHO Knows Best??

There is so much happening in our GOD-given world, and many are distractions to keep us occupied for many reasons. One reason could be that proposals and treaties were being discussed and perhaps even approved by the globalist few without our knowledge or consent.

Last week, from May 22 to May 28, 2022, the WHO (World Health Organization) held its 75th annual assembly in Geneva. In this assembly, one of the things on the agenda is a proposal for amendments to the international health regulations. Titled –

Image source: Geneva.usmission.gov

You can also find the Proposal for Amendments document on the World Health Organization’s website under A75/18.pdf. All excerpts in this article are from this document. Strengthening WHO preparedness for and response to health emergencies. Proposal for amendments to the International Health Regulations (2005)

The results of this proposal will directly impact our lives, especially with what we’ve been through over the past two years. The United States proposed the amendment in January of 2022, and in this article, we’ll briefly interpret the sections in the amendment.

The regulations are not new, but the amendment reinforces some key elements. Some are crucial in what many people think and interpret as a very aggressive chunk into our civil rights and dangerous to our democracies.

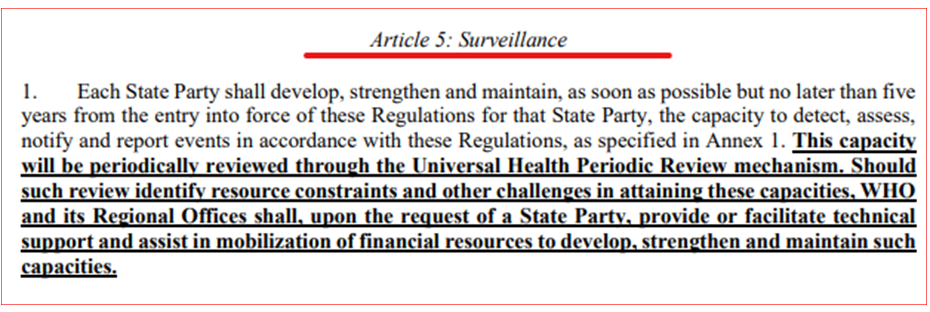

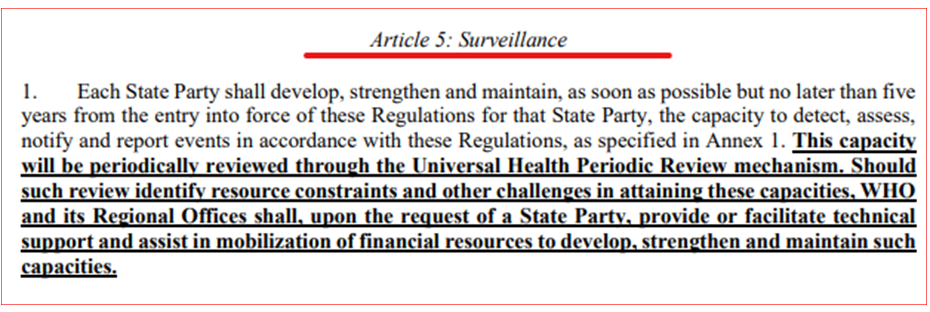

Article 5 refers to surveillance and is a requirement for each country to develop its ability to identify, evaluate, inform, and report events according to the regulations within five years.

In layman's terms, besides monitoring medical information, they're asking countries to develop a system that monitors and reports data from airports, border crossings, and water and food infrastructure directly to the WHO surveillance team.

This system should be able to surveil containers, suitcases, and equipment and isolate potential suspects in spreading disease. They also say that countries that cannot create this infrastructure for surveillance will be able to get assistance in funding.

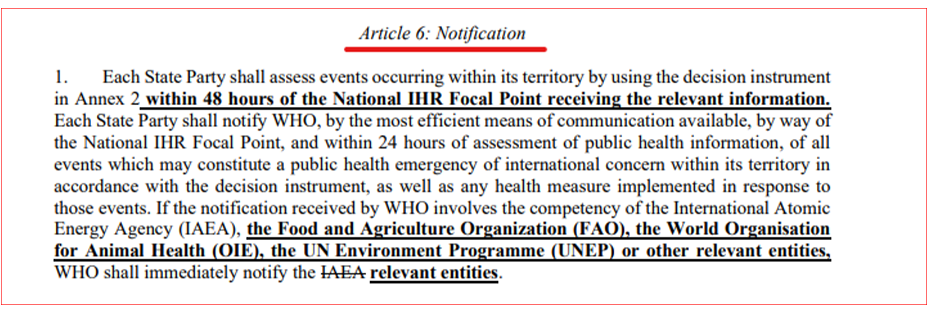

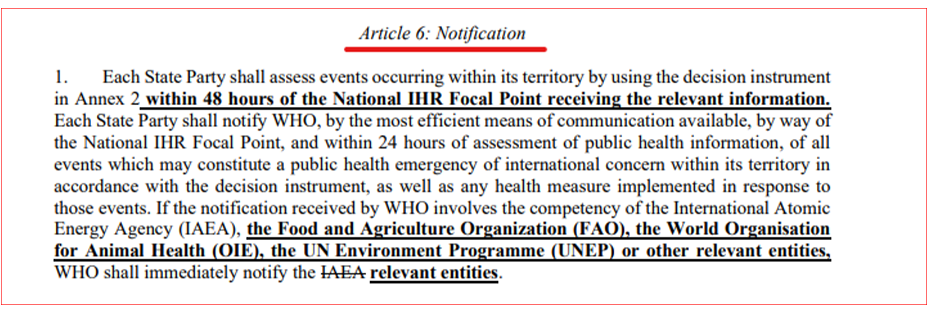

Article 6: Notification. This section discusses the requirements for countries to notify the world about an event and its source, requiring all information to be routed through the WHO. It also lists organizations that must report to the WHO and requests genetic sequence data reports.

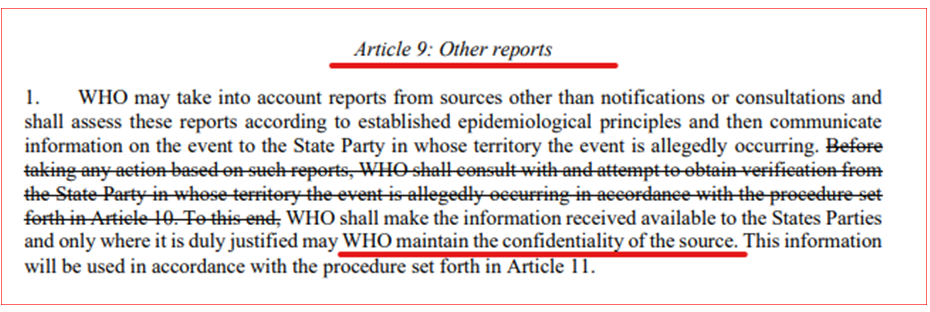

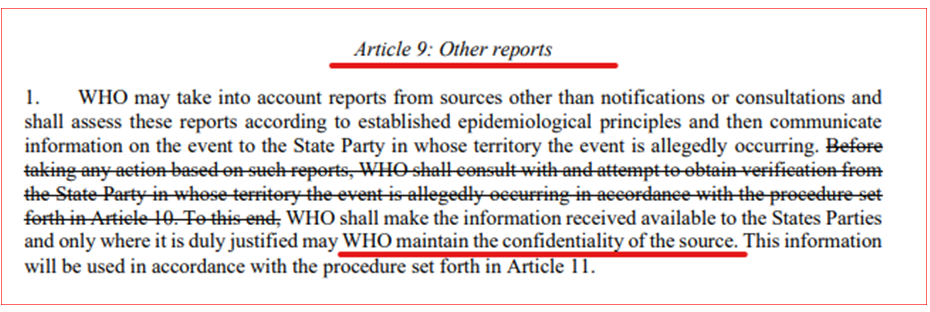

Article 9: Other Reports. This section is one of the important ones, and I'll come back to it later when explaining the system they're implementing here. This section says that the WHO will no longer depend on the country itself to verify the occurrence of an event in its territory, and it can rely on other sources from other places.

It’s basically saying that it can declare an event even if the country itself denies it or contradicts the information if the WHO claims to have other sources of information. It also retains the right to maintain the confidentiality of the source so that it can declare an event in any member country without the country's consent and without revealing the source of information.

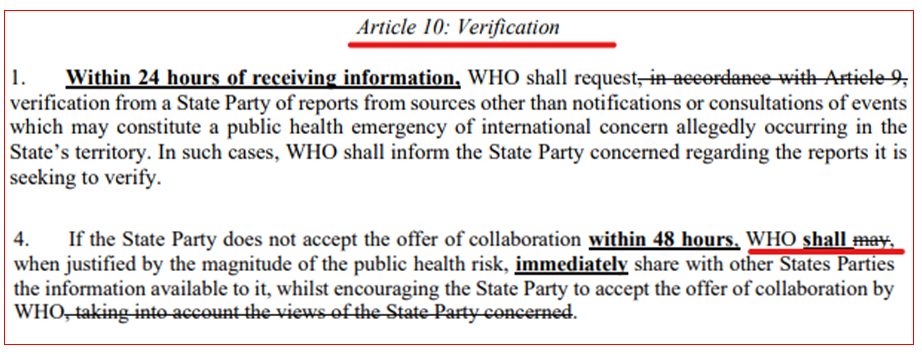

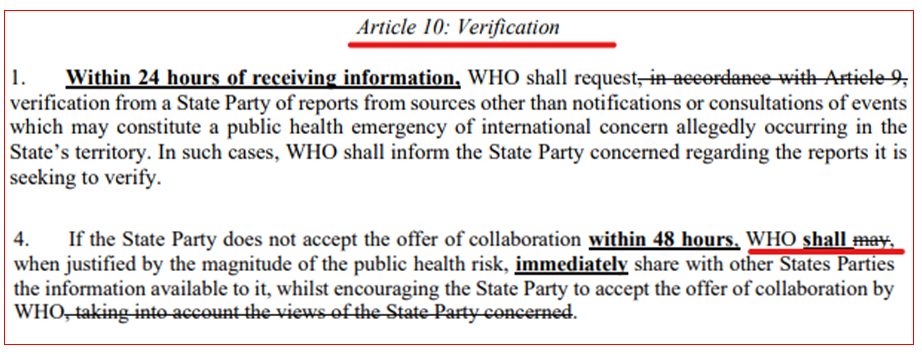

Article 10: Verification. This section is also curious about the language's meaning, where they move the language, and the tone to one of a threat, a motif that keeps reoccurring throughout this amendment. This is about the response time of the country once an event or even a suspicion of one is declared either by the country itself or by the WHO.

The country is requested to give an initial reply or acknowledgment within 24 hours and to provide initial information. The WHO will issue recommendations that may include an offer to mobilize international assistance. This means the people from the WHO may descend on the country and act. What is their status legally? What is their Authority? It’s unclear.

After 48 hours from the initial offer to collaborate with the WHO, if the country fails to respond or collaborate, the WHO shall (and that's a new term) immediately share with other member states the information available to it while encouraging the affected state to accept the offer of collaboration with the WHO.

This is where they're crossing into the threat area, and the language being used is typical of organized crime. It seems like a message with a “cooperate, or else” tone.

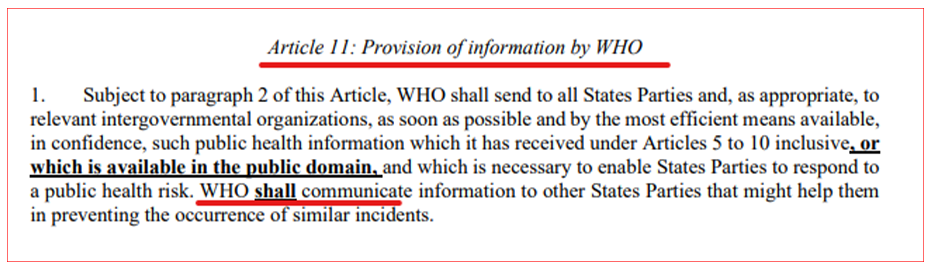

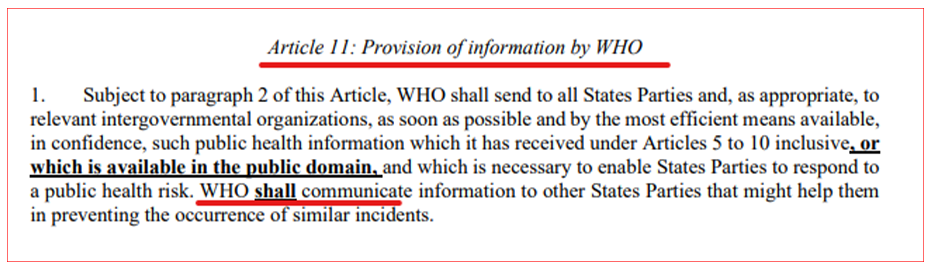

Article 11: Provision of information by the WHO. This section is a direct continuation of the previous article, keeping the right to share information about the country suspected of having an event with other countries and parties. Any information can now be shared without consent, including medical cargo flights, passengers, the flow of commodities, etc.

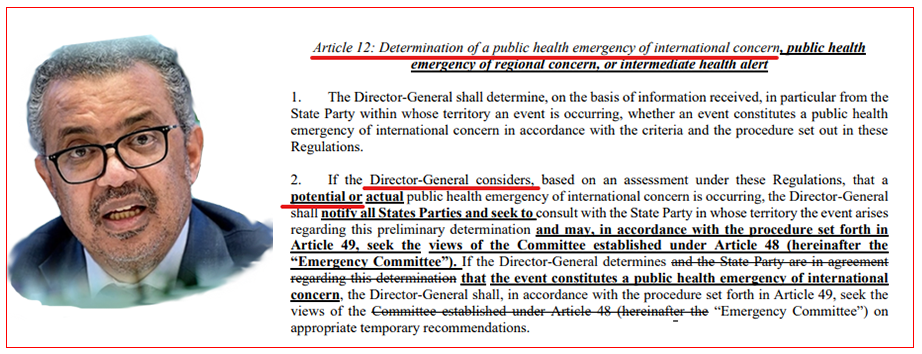

Article 12: The Determination of the public health emergency of international concern. It also adds public health, emergency of regional concern, or intermediate health alert to the title.

This title is a long one and probably the most significant red flag in this entire Amendment. It is about who can declare an emergency event or suspicion of one, and it is just one person. That one person, in this case, is the Director-General of the WHO, Tedros Adhanom Ghebreyesus.

He can determine that a potential or an actual public health emergency of international concern is occurring. Take note of the word, potential used – it’s vague language. So the fate of an entire country is in his hands; just one person can shut down an entire country with a nod of his head. Of course, it says, he will consult with the emergency committee and relevant State parties, but that is just to keep the appearance of a democratic process. When in fact, he has all the power to do that by himself.

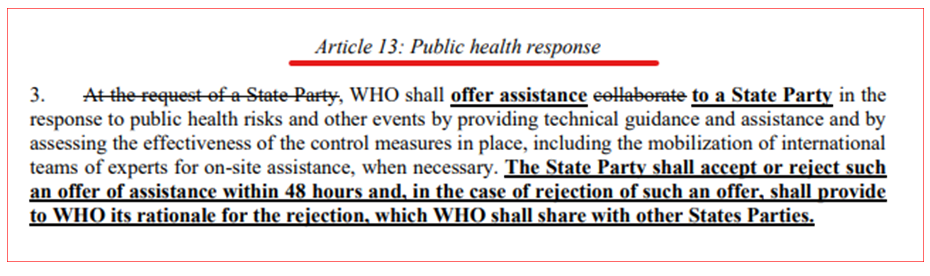

Article 13: Public health response. Again, the WHO is offering assistance to any state party in the case of an event, giving only a short time of 48 hours to respond. In case of a rejection, the information will be passed on to other state parties. The WHO can immediately send the team, and in the event of a denial, the state party must provide its rationale for the denial or rejection.

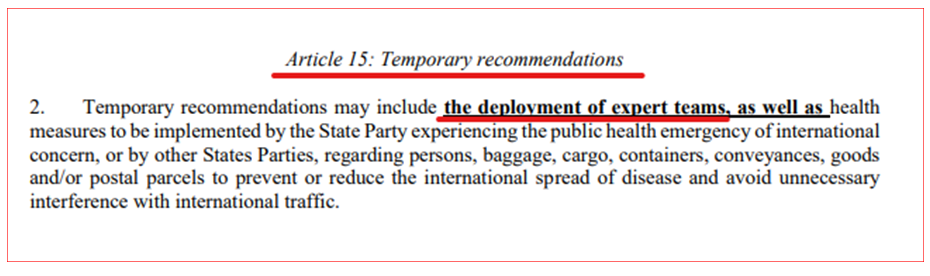

Article 15: Temporary recommendations. This is more about the deployment of expert teams by the WHO. These teams will have access to basically everything; every site, border crossing, harbors, and data.

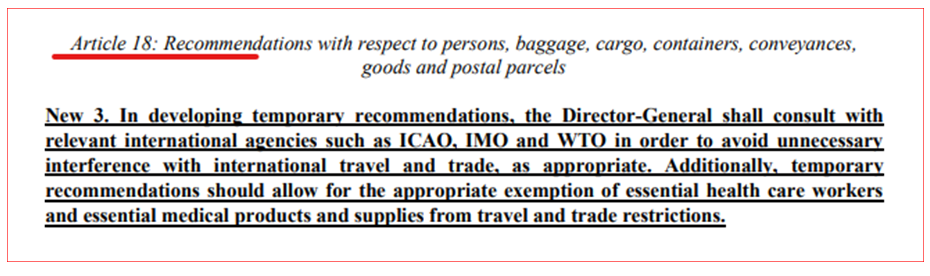

Article18 is about traveling and travel restrictions. It underlines the free passage to health personnel and equipment, exempting themselves from any restrictions and giving themselves a free pass to go everywhere with no interference.

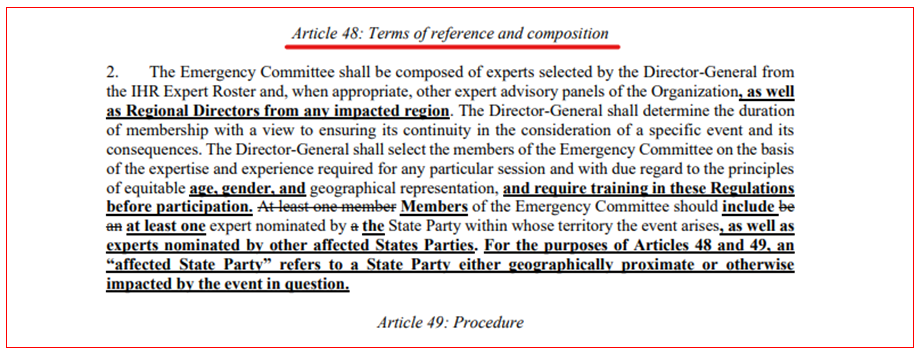

Articles 48 and 49 are about the one-man show named Tedros Adhanom Ghebreyesus. He will pick the committee members, the duration of their service, pretty much everything. The committee, according to this, is nothing more than a rubber stamp and only gives the appearance of due process when in reality, he decides everything.

Here we have a new chapter – Chapter 4: The Compliance Committee. Each member state that signs this amendment must establish a compliance committee, which would monitor the level of compliance in the state and report to the WHO.

It has the right to give the WHO any information regarding the level of compliance, which could include information about vaccinations or any data that measures how much and to what extent the country's people are following the rules and orders of the WHO.

It states the compliance committee shall strive to make its recommendations based on

consensus. This section looks, sounds, and feels like a page from George Orwell’s book, 1984! This is the world they are preparing for us.

Article 59: Entry into force; period for rejection or reservations. Last but not least, Article 59 says that any state party has only six months for rejection or reservation. Usually, this period is set for two years, but not in this case.

In Summary

So to reiterate all of the above, countries that are members of the WHO are being asked to vote, to hand over their sovereignty to an unelected entity consisting mainly of one person, maybe two, who can decide to declare that there is a health emergency or even a suspicion of one in their territory.

The WHO can then threaten to share all information with other countries if they do not get full cooperation and compliance. For example, if that country's authorities do not agree with the WHO assessment or recommendations, they can send teams to the most sensitive places in your country. They can monitor food and water distribution, inspect the equipment and shipments and perform any test they see fit.

They can shut down airports and harbors, stop the country's economy, and hold its fate and citizens in their hands. All they need to do is to declare an event. Every aspect of your life will be in the hands of a small group of people that was not elected in any democratic process.

This type of power that is so concentrated and centralized with such a small group of people is unprecedented and extremely dangerous to what we thought was a free world, particularly in western civilization.

The technique they use is sophisticated. Firstly, the language keeps it as vague and opaque as possible. What is an event? What is a suspicion of an event? What are the criteria?

Every aspect of this amendment says one thing, one person will decide. Based on “the WHO knows best,” he will determine the definition of an event. That way, nobody can blame him or the WHO for not following an exact rule and also keeping all the definitions to themselves.

In 2009, the WHO redefined the term pandemic to suit their needs making it easier to declare it. But the true genius in what and how they're doing it is in a false notion that countries have a choice. Even when they are taking your freedom, they have to maintain a false sense of democracy, as these NGOs know they have no true powers over a country that prides itself as free and democratic.

Nobody elected them, and of course, they cannot just declare that they are, in fact, in power, and establish a dictatorship like in China, because the collective minds of citizens in the western world are that of freedom, or so they've been told. If they declare anything that contradicts that, people will rise and resist.

So they need to act more subtly. First, by using fear, anxiety, and constant state of emergency and panic. People living in fear for their lives will be consumed by that and enter into a compliance state. Using the ultimate fear, the fear of death is the perfect leverage. As long as people are in a state of fear, those in power can demand and get anything they want.

We have seen it in the covid years from the numbers of death attributed to the virus, which was later found to be massively exaggerated. Through to nothing less than crimes and lies surrounding the vaccine that turns out not to be nearly as effective as they claimed, not safe, and not relevant for most people.

As far as the country itself is concerned, they just need to threaten the government. Threaten to take it all away, to close everything. Like a mobster that enters your business, that in a polite voice tells you that you “better play nice or else.” It is extortion, and it’s s clear as day.

This whole Amendment, everything that preceded it, and everything that will follow all come down to one thing. Like the Godfather stated, “I’m gonna make him an offer he can’t refuse.” They are making us an offer we can't refuse. Why?

Let’s Pretend…

Let's go into the state of mind of a prime minister or a country's president, and let's just assume that they are honest and not corrupt. Let's assume you lead the country that is probably already in debt to the World Bank. You are dependent on commerce, and business with other countries, and your whole infrastructure, economy, and security depend on your connection with other countries.

Then one day, according to the WHO, there is an event in your country, some kind of an outbreak. And let's say that no such thing is happening according to your knowledge and investigation. The WHO, which is basically one man, the Director-General, backed by Bill Gates and all the people and entities behind them, tells you that you have 48 hours to decide if you will follow their recommendations—also notifying you that they're sending teams to your country.

Let's say you try to resist. You disagree, and you do not follow the advice. According to WHO’s document, they can now share this information with other countries. What does it mean? They can warn them that you are a threat and dangerous and that no traffic of either people or commodities should occur in and from your country.

In effect, you are isolating your country from the rest of the world and bringing everything to a halt. Would you take that risk if you were the leader of that country? Of course not. You’d never get elected again! (Remember, you’re honest and not corrupt. One of the very few, if any.)

When South Africa signaled Pfizer that they wanted to stop buying vaccines, there was a declaration about a virus mutation called Omicron, which they immediately announced came from, you guessed it, South Africa. The mentality of what they're creating is a herd mentality that no individual, country, or person can leave; the perfect mechanism.

This is the same mechanism they used with the vaccinations, only in that case, instead of a country, it was the individual. The authorities did not physically coerce people into getting the shots; instead, they were threatened they’d lose their jobs, livelihood, and freedom to travel and attend school. There were fired or dismissed.

They had their name smeared by the media, calling them anti-vaxxers, and were blamed for everything. That's why so many agreed to get the shots, not for health reasons but for fear of losing everything.

Ironically, their fear of losing their freedoms caused them to lose their freedoms on a much bigger scale. And that is precisely what this WHO amendment is all about; the same mechanism and covid-19 is just phase one.

So why is it happening? It's just another brick in the wall of what has occurred over the last couple of years and started long ago. A small, rich, and influential group of people, who actually own most, if not almost, all the commerce in the world, are using these bodies, like the UN and the WEF led by Klaus Schwab, who wants to shape the future. In his own words, “to globalize the world,” he is also not elected by anyone.

And by the WHO is being used to create this control over countries and people and maintains a state of medical emergency as an excuse to take more freedoms and civil rights away and give governments and corporations more power.

The World Economic Forum (WEF) and their almost insane vision of the world of top-down control. Transhumanism, loss of privacy, total control over the exchange of money, digital passport, social ranking systems, collapsing the middle class, relying on a fixed income provided by them that will be only be given with the demand to agree to any terms they dish out. These are different branches of the same tree, and behind it, all is a group of very wealthy and powerful people who have a plan.

The current world population of 7.3 billion people who seek freedoms and rights is something that scares them deeply. (And expected to reach 8.5 billion by 2030) They cannot afford anything but complete control over our lives, and the use of technology is one of the ways to implement that. As we've seen throughout the past two years, they used covid as an opportunity, as an excuse to escalate their plans.

The sheer amount of lies, corruption, and nothing less than crimes against humanity, as far as false information, the vaccines, the way they ignore all vaccine injuries and death. Labeling people who are not playing ball and resisting their agenda as ‘anti-vaxxers’ or “corona deniers” looks like a playbook from every dictator’s manual.

Bill Gates’ foundation and his Gavi initiative are one of their tools and the biggest donor to the WHO. His foundation is behind every action being taken by the WHO. Gates made billions from investing in covid tests, and he has holdings in what are deemed very unhealthy corporations, such as McDonald's and Coca-Cola.

Here’s a snippet of the TED Talk Bill Gates presented in 2010 on the topic of climate issues, CO2, vaccines, and how they plan to slow population growth. He also talks relentlessly about the next plague or disease, which always miraculously shows up immediately after his predictions. He is currently creating a “GERM team.” More control, more fear, and more power.

Additionally, The world population of 500 million is blatantly displayed and first on the list etched into the monument of the Georgia Guidestones. It seems that it may be all part of the elites’ Agenda 21/30.

Final Results Of The Assembly (for now)

The United States Biden Administration put forward the information about the proposal above. Although some amendments were approved, some smaller nations took the time to read the proposal and saw it was questionable, so the WHO could not pass the amendments the United States submitted at this stage.

We can consider it a battle won, but not the war. An international health regulations working group was organized, encouraging all nations to submit their amendments by September 20th, to be considered in November, and to be presented before January 2023 for consideration next May at the Assembly.

Investigative journalist James Roguski took a deep dive into the conference analyzing the complete live stream over the five days and reporting the results. The video below explains further, and full coverage is on his website LeaveTheWHO.com.

What Can We Do?

So what can we do? Well, these people get the power from us, pure and simple. As long as we keep playing their game, which is based on “divide and conquer,” they will keep doing whatever they want. But we need to remember without our money, our consumption of what they want us to consume, without our silence, and without our obedience, they have nothing.

New world order is necessary, not the one they're planning, but a world that puts the people first. This 1% of wealthy and powerful people will stop at nothing. They own the media (MSM), entertainment industry, most social media platforms, and information and search engine platforms.

They are censoring anything that contradicts their wishes and agendas, and that is how they think they control the message and are hell-bent on creating the reality they want. This 1% may own significant corporations and the online media giants that have the monopoly for the time being, but they don’t own Markethive.

Markethive is the only social media, marketing, and broadcasting platform underpinned by Blockchain technology that is sovereign, built by the people, and for the people. It stands for freedom and liberty with a non-partisan approach, so you’ll never be surveilled or canceled for expressing yourself, thoughts and beliefs.

It’s the perfect way to get your message out to countless other platforms with the technology to help you “fly under the radar,” so to speak. By sharing any information and raising the issues like the one being told here to the surface, we can counteract their power in attempting to create a sick and dependent society and dystopian reality.

The only way to defeat their plot is by creating a united world of people who are aware of what's being done and ensuring that people en masse are aware of these crimes and this shadow dictatorship that each day with each play is increasingly coming out of the shadows.

A united world and the flow of information are their biggest threat. Don't underestimate these so-called overlords or think they care about humanity. But be aware of your personal power and as a collective. Remember, fear is their weapon, and ours is love and unity, and our strength is in numbers and solidarity. You're not alone.

References:

Avi Barak

James Roguski

Sarah Westall

Also published @ BeforeIt’sNews.com: https://beforeitsnews.com/agenda-21/2022/06/what-has-the-world-health-organization-been-up-to-lately-who-knows-best-3698.html

Tim Moseley

Emerging market central banks represent new demand for gold as they de-dollarize – Société Générale

Emerging market central banks represent new demand for gold as they de-dollarize – Société Générale.gif)

.gif)

Is global 'slavery' coming? Gold guards against 'total control' – Bob Moriarty

Is global 'slavery' coming? Gold guards against 'total control' – Bob Moriarty

.gif)

Tennessee removes sales tax on gold and silver, only eight states to go

Tennessee removes sales tax on gold and silver, only eight states to go.png)

.png)

.png)