Extreme dollar strength limits the price gains in gold today

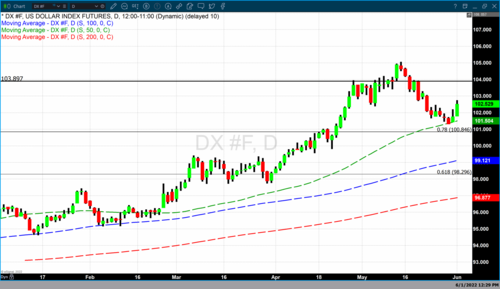

A substantial move in the dollar nullified market participants from bidding the precious yellow metal substantially higher in trading today. As of 6:30 PM EDT gold futures basis, the most active August 2022 contract is fixed at $1849.70. The gains in gold today were largely muted by extreme dollar strength. The dollar gained 0.80%, or 81 points taking the dollar index to 102.58.

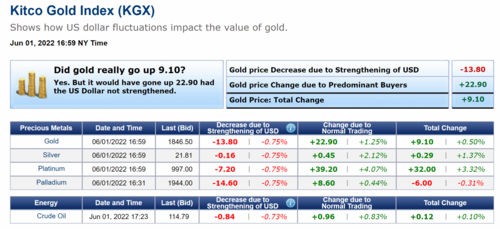

The significance of dollar strength can be best illustrated by viewing spot gold pricing through the eyes of the Kitco gold index, which separates the effect of dollar strength or weakness and market participants actively buying or selling gold. In the case of today, spot gold is currently fixed at $1846.70. This screen-print below is of the Kitco Gold Index taken at approximately 5 PM EDT. It has the current spot price of gold fixed at $1846.50, normal trading took gold pricing higher by $22.90 and dollar strength took away $13.80 of those gains resulting in today’s $9.10 price increase.

Both dollar strength and gains in gold pricing today were the byproducts of the market sentiment shifting its focus from inflation rather than raising rates today. It was this market sentiment that resulted in bidding the U.S. dollar higher and also being supportive of gold pricing. Typically, gold and the dollar move in an inverse direction rather than in tandem, as witnessed today.

According to Reuters, “Gold prices rose from a two-week low on Wednesday as investors looked toward the safe-haven metal amid worries over an increase in inflation primarily due to rising fuel prices, although a stronger dollar and higher U.S. yields kept gains in check.”

In a Reuters article penned by Seher Dareen, the author cited oil prices strengthening today after European Union leaders agreed to a partial and phased ban on Russian oil as a major force that will keep inflation at current levels. This article quoted Edward Moya, senior analyst with OANDA as saying, “Investors now are desperate for more safe havens than just treasuries and that is why you are seeing gold outperforming.” Adding that “Inflation cannot really drop if these energy costs are that elevated. So I think the risk of much more aggressive tightening globally could really fuel the gold trade,”

This is precisely why the Federal Reserve’s plan to raise interest rates considerably over the next few FOMC meetings will not impact inflationary pressures brought about by the consistently high cost of energy. Without energy costs subsiding the Federal Reserve will have a difficult task at best at having a real impact on lowering inflationary pressures.

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

Tim Moseley