2024 Updates On Solana Network, SOL Price Potential, and The Markethive Community Wins

With Bitcoin's record-breaking surge, the crypto community is abuzz with anticipation for the next altcoin to make a significant leap. And all signs are pointing to SOL. Solana has shown remarkable resilience recently and is on the cusp of achieving significant milestones that could trigger a substantial price surge. This growth potential is an exciting prospect for cryptocurrency enthusiasts and investors.

SOL, a native cryptocurrency of the Solana blockchain, holds immense potential. It covers costs on the Solana network through burning and can be deposited as a stake to operate a blockchain node. SOL tokens are not just for trading and peer-to-peer transactions but also as rewards for staking SOL. Since its introduction to the market in March 2020, it has gained significant popularity, being recognized as one of the top ten cryptocurrencies on CoinMarketCap. With a market capitalization of $61.9 billion and 618,596 SOL tokens in circulation, SOL is poised for a promising future.

As valued members of the Markethive community, we've been at the forefront of Solana's journey, given that our own Hivecoin operates on the Solana blockchain. This previous article from 2022 provides an overview of Solana, highlighting its blockchain's suitability for supporting Markethive's decentralized ecosystem. In this update, I will discuss Solana's recent developments, explore SOL's potential growth, and identify the key factors that could drive its value higher, emphasizing Solana’s crucial role in the Markethive community in this exciting journey.

Solana Has Been Making Waves

Solana, a layer-1 protocol in the blockchain arena, stands out with its exceptional transaction velocity and affordability. It can handle an impressive 50,000 to 65,000 transactions per second, far surpassing Ethereum's current processing power of around 30 transactions per second. This cutting-edge platform deploys smart contracts and decentralized applications, leveraging a proof-of-stake consensus mechanism that ensures ease of access and timestamped transactions to optimize performance.

This article highlights Solana's eight core features, including its groundbreaking Sealevel technology. This innovative feature allows concurrent execution of multiple smart contract runtimes on a single chain, thereby significantly boosting the network's ability to handle multiple transactions simultaneously.

Since its establishment in 2017, Solana has experienced significant growth and development, forging connections with major technology corporations like Google, Visa, and Amazon. These alliances are crucial benchmarks for blockchain initiatives, as they validate the project's credibility, demonstrating real-world adoption, practical use cases, and technological progress.

Solana has forged alliances with a diverse range of notable entities, including Chainlink, a decentralized data provider on Ethereum, and two leading stablecoin issuers: Tether, which has integrated its USDT token into Solana's network, and Circle, whose USDC stablecoin is a critical player in the decentralized finance (DeFi) sector.

Moreover, Solana has partnered with Asics, a renowned sportswear brand, and Membrane Finance, a Finnish fintech company that has introduced the first Euro-backed stablecoin on the Solana platform. Notably, Solana's collaboration with e-commerce giant Shopify has opened the door for customers to make purchases using USDC, further expanding the utility of the Solana ecosystem.

In May 2023, Solana unveiled the Saga, a cutting-edge Android smartphone boasting robust blockchain capabilities. This innovative device is now accessible to consumers in various countries, including the UK, EU member states, Canada, the US, New Zealand, Switzerland, and Australia.

Concurrently, Solana revealed its collaboration with ChatGPT, a cutting-edge technology born out of Solana Labs. According to Anatoly Yakovenko, the founder and CEO, "AI will make Solana more usable and understandable." The open-source ChatGPT plugin seamlessly merged with Solana's ecosystem, initially facilitating various operations, including NFT acquisitions, token transfers, finding NFT collections, reviewing transactions, and interpreting public account data.

The frenzy surrounding meme coins on Solana kicked off in December 2023 with the debut of the BONK token. The subsequent distribution of BONK to owners of Solana's Saga smartphone led to the device selling out, and it appears to have had a ripple effect, causing Solana's future phone releases to sell out as well. Amidst the chaos of meme coin excitement, Solana made two significant announcements that flew under the radar.

One notable development was Circle's decision to launch its euro-pegged stablecoin natively on the Solana blockchain. It's worth mentioning that Solana was previously designated as the preferred blockchain for Circle's USDC, although it's unclear if this is still the case. Combined with the recent approval from New York regulators for Paxos to issue its assets on Solana, institutional investors increasingly view Solana as a viable alternative to Ethereum.

Source: X

Could a Solana Spot ETF Be the Next Big Thing?

Following the debut of Bitcoin spot ETFs in January, there has been mounting anticipation about the potential for a similar investment product dedicated to Solana. This buzz seems to have originated from statements made by Franklin Templeton, a prominent asset management firm, which emphasized Solana's notable advantages on the social media platform X.

Despite expectations, Bloomberg's ETF analyst James Seyffart casts doubt on the imminent arrival of a Solana ETF, citing the US Securities and Exchange Commission's (SEC) ongoing scrutiny. The SEC's classification of SOL as a security in its recent lawsuits against major exchanges Binance and Coinbase may be a significant hurdle.

Nevertheless, Solana may still have a chance to secure its own ETF in the future. This prospect appears to hinge on whether SOL is listed on the prestigious Chicago Mercantile Exchange (CME), following in the footsteps of Bitcoin and Ethereum. Industry insiders believe that SOL and other prominent cryptocurrencies like ADA and DOT will eventually be listed on the CME, particularly since the exchange began providing pricing data for these assets in 2022.

Beyond the excitement surrounding ETF speculation, Solana garnered attention in January by introducing Token Extensions, a new development designed to facilitate widespread adoption among institutional investors. Essentially, these extensions represent fresh token standards on the Solana platform, boasting integrated compliance and privacy safeguards to meet the specific needs of institutional users.

Obstacles Facing Solana

Despite the positive developments, Solana's progress was hindered by a significant setback in early February when the network suffered unexpected downtime. This marked the first such incident in nearly 12 months. However, it's important to note that Solana's team swiftly addressed the issue, demonstrating their commitment to maintaining the network's stability. A thorough investigation subsequently identified the outage's root cause as a known bug previously flagged by developers, reassuring us of Solana's ability to overcome challenges and continue its upward trajectory.

Institutional investors prioritize consistency and stability above all else, so Solana's downtime may have affected their trust in the project. Nevertheless, this setback did not prevent Abu Dhabi from collaborating with Solana to develop blockchain solutions. Moreover, it did not deter Sam Bankman-Fried, the embattled founder of FTX, from promoting SOL to his prison authorities.

In addition, Binance revealed in March 2024 that it had put a temporary hold on withdrawals due to overwhelming network activity on the Solana blockchain. Around the same time, Coinbase users may recall similar notifications. Clearly, the Solana network became overwhelmed due to the surging popularity of memecoins, which reached a fever pitch and generated hundreds of millions of dollars in presale revenue on the platform.

Several people drew parallels between these pre-sales and the excitement surrounding Ethereum's initial coin offering (ICO) during the bullish market 2017. Yet, the underlying technical causes of the problems caused by this congestion may be obscure. A deeper understanding reveals that the congestion problems primarily stemmed from the Maximum Extractable Value (MEV) mechanism provided by Solana clients, particularly Jito, which ceased its mempool functionality in March 2024.

To clarify for those who may not know, MEV gives validators the ability to reorder transactions in a way that boosts their earnings. As a result, some transactions may not be processed successfully, leading to exchange problems.

Furthermore, transactions are temporarily stored in mempools before being included in the blockchain. While Solana's fundamental structure does not include a mempool, Jito's block engine, which aims to maximize extractable value (MEV), does have one. As a result, numerous expensive front-running attacks have been carried out on cryptocurrency traders, including sandwich attacks.

In the end, the Jito Labs team sees negative MEV, including sandwich attacks, as a hindrance to the Solana ecosystem, which is why they have decided to suspend it. Nonetheless, they are committed to providing an additional revenue stream for validators and stakers while striving to make Solana the top choice for all users in terms of performance.

On a positive note, Jito's bundle and block processing systems remain functional, and the rewards for maximizing extractor value (MEV) have not experienced a significant decline. Moreover, the attractive economic benefits will likely motivate teams to develop similar mempool solutions inspired by Jito's model.

It's worth noting that Franklin Templeton remains optimistic about Solana's prospects, as evidenced by a recent research report shared with its clients, which argues that memecoins can successfully drive user growth. This suggests that the recent surge in memecoin popularity may be intentionally orchestrated to achieve this goal. The results support this theory, with Solana reportedly surpassing Ethereum in terms of decentralized exchange trading volume.

Source: X

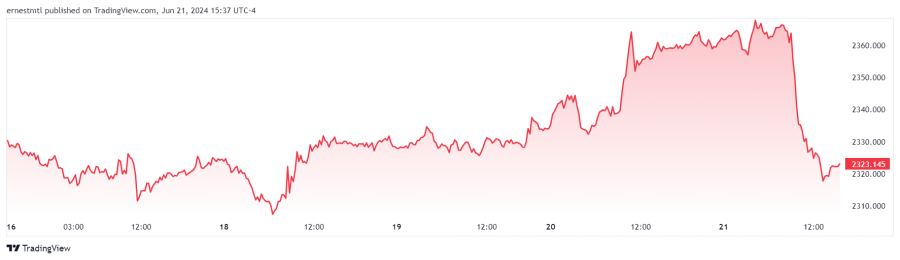

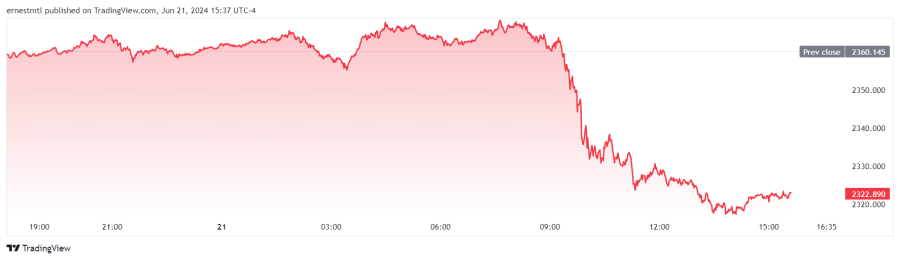

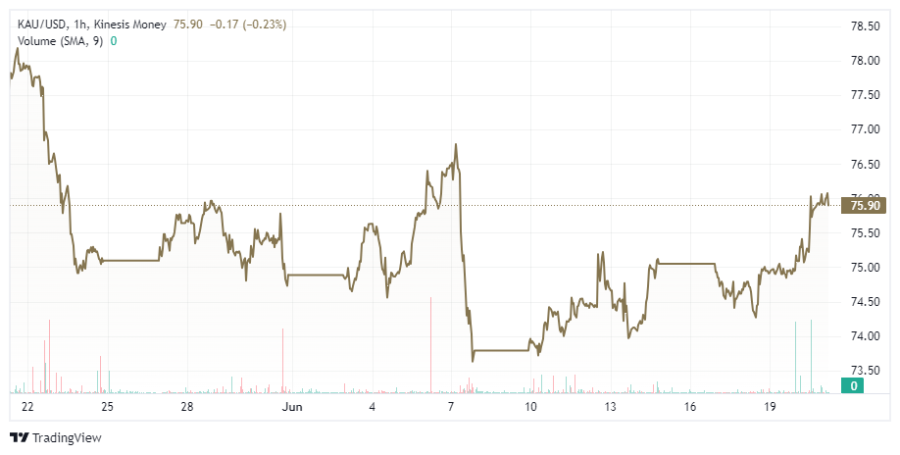

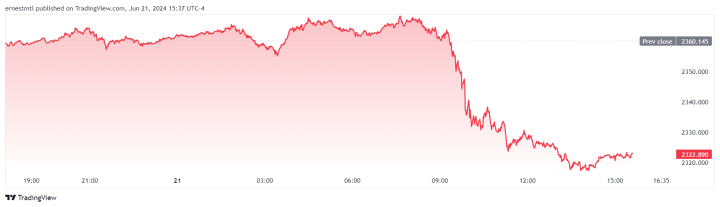

SOL’s Price Movement

Solana's price movement has been influenced by its recent updates, announcements, and progress, leading to significant SOL value growth. Analysis of on-chain data indicates that this surge in price may be attributed to the popularity of memecoins, with an increase in user activity and transactions on the Solana network. This trend is further supported by the growing adoption of the Phantom wallet browser extension, which has now surpassed 3 million downloads.

Let's take a step back to appreciate the rapid progress: just six months ago, Phantom had 2 million downloads—this stark contrast highlights Solana's astounding growth rate, which is accelerating at an incredible pace. A closer look at on-chain data reveals a remarkable surge in Solana accounts, with growth rates reminiscent of the crypto market's peak in 2021.

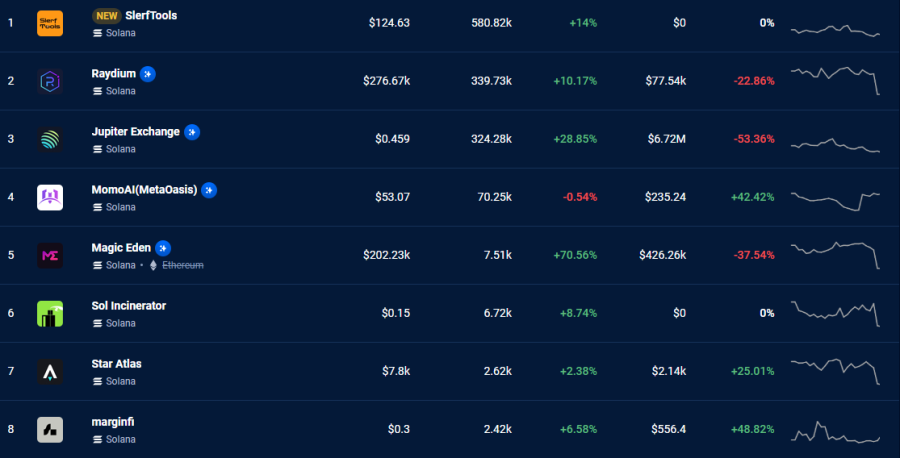

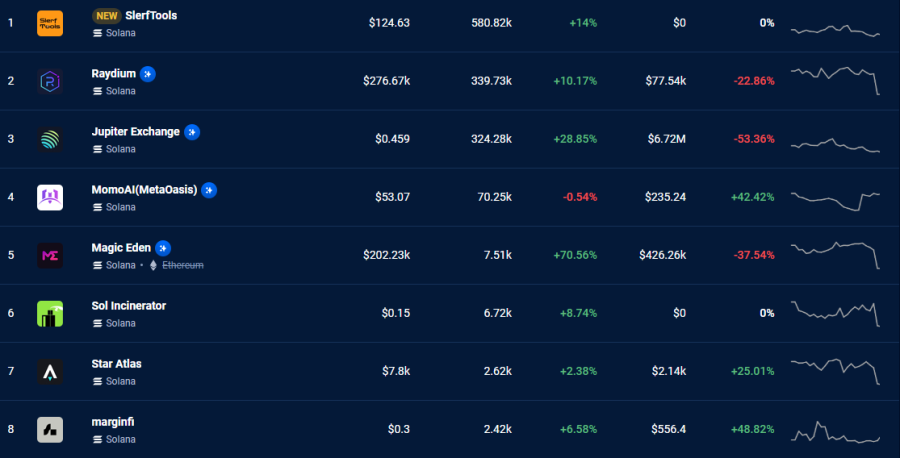

According to DappRadar's statistics, the Raydium DEX on Solana has attracted nearly 1.3 million unique wallets, while the Magic Eden NFT Marketplace has gained 300,000 new wallets. This indicates a resurgence in Solana's NFT environment. Current data shows that Solana NFT transactions have reached a significant milestone of $5 billion in trading volume.

Source: DappRadar

The importance of this lies in the fact that SOL is a necessary prerequisite for purchasing memecoins and NFTs on the Solana platform. As a result, any individual seeking to invest in or speculate on these digital assets must initially acquire SOL, thereby generating a surge in demand. This increased demand has been the primary force driving up the value of SOL over the past few months.

However, that only addresses the demand side of the situation. When considering the supply side of the equation, historical information indicates that the SOL supply has risen by around 20 million in the past six months. Therefore, using an estimated price of $150 per SOL could lead to potential selling pressure amounting to as high as $3 billion.

Despite significant selling pressure, SOL's price came remarkably close to reaching a record high, implying that the demand was exceptionally strong, possibly exceeding $3 billion. Alternatively, the selling pressure may have been overstated. Nevertheless, observing the substantial funds invested in memecoins is quite revealing.

As mentioned in this article, the rise in popularity of memecoins is thought to be caused by the absence of new retail investors entering the market. This situation may have encouraged large-scale investors, known as "whales," to target the existing retail investors familiar with decentralized exchanges (DEXs), leading to the hype surrounding memecoins. Despite the underlying reasons, Solana (SOL) displays a strongly optimistic outlook across various time frames.

Source: Messari

Solana’s Actual Road Map For 2024

Solana developed a de facto roadmap for 2024, established by the Solana Foundation in January. This plan includes four key milestones. The first milestone was the introduction of Token Extensions, completed in January. The second milestone involves the rollout of new validator clients, such as Fire Dancer, which is already operational on the testnet. Without delving into complex technical details, validator clients effectively enable validators to engage with the blockchain, enhancing network performance.

The introduction of the Fire Dancer client is expected to substantially boost Solana's speed, although the exact improvement remains uncertain. Anatoly Yakovenko, the founder of Solana, mentioned in a December 2023 discussion that the Fire Dancer client is anticipated to be launched by the upcoming Breakpoint Conference in September 2024.

Interesting tidbit: With the successful integration of Fire Dancer, Solana will finally shed its beta label. This milestone, combined with the anticipated boost in performance, is expected to have a profoundly positive impact on SOL's value. Many experts believe this could be the spark that propels SOL to surpass the $300 mark in the upcoming weeks.

The next significant benchmark on Solana's defacto roadmap is unspecified institutional support. This milestone marks a crucial step forward, indicating that businesses now have unrestricted access to a comprehensive suite of tools necessary for building on the Solana platform. Furthermore, given Solana's ambition to emulate a decentralized version of the NASDAQ exchange, the integration of tokenized, real-world assets is likely on the horizon.

The following key objective is establishing a “mature building ecosystem,” where Solana’s developers are encouraged to leverage the full range of tools to create innovative products and services on the platform. The authors identify six critical focus areas: developing gaming finance applications, (GameFi) decentralized autonomous organizations, (DAOs) permission products, infrastructure solutions, payment systems, and interoperability features.

The Solana Foundation recently announced a new milestone in a blog post involving an upcoming upgrade to address Solana's congestion problems. This upgrade began in mid-April and may include potential MEV functionality.

The Governance Forum of Solana has indicated that it plans to develop a new governance framework. An article published in August 2023 mentions that the introduction of this governance structure is expected in the first quarter of 2024. However, it remains to be seen whether it has been finalized at this point.

Closing Thoughts on Solana

Anatoly Yakovenko, the mastermind behind Solana, noted in an interview the importance of considering the potential shift in efficiency between decentralized and centralized exchanges. As decentralized exchanges become more effective, centralized cryptocurrency exchanges will likely transition to utilizing the decentralized blockchain for enhanced efficiency. Solana is determined to be at the forefront of this shift and has a strong possibility of emerging as the go-to blockchain solution.

Solana boasts 29.7 million active accounts and 340 million minted NFTs. With fast block times at 400ms and a low median TX fee of $0.00064, the network is known for its energy efficiency and zero net carbon impact. Despite notable obstacles, the Solana ecosystem has shown impressive resilience and sustained expansion. It has emerged as a leading candidate for managing millions of users on decentralized trading platforms.

Solana is an impressive venture supported by influential figures who believe in the network. The team is both reliable and innovative. Despite being in beta, Solana has demonstrated its capabilities beyond just a polished interface, processing billions of transactions. Additionally, the company started modestly without relying on massive amounts of venture capital, focusing on achieving tangible outcomes. These aspects collectively indicate a focus on delivering results.

Markethive Thrives On The Solana Blockchain

Solana is a perfect fit for the Markethive ecosystem, empowering the Markethive to further its mission of creating a fully decentralized platform for social media, marketing, and broadcasting where users can freely express themselves without fear of censorship. This all-encompassing ecosystem provides a comprehensive suite of tools for social media, marketing, broadcasting, publishing, eCommerce, and business facilitation. Ultimately, this collaboration aims to create an environment where individuals from diverse backgrounds can flourish in a cottage industry economy.

A key long-term goal is to launch the Markethive blockchain and decentralized exchange (DEX). This comprehensive project, designed to operate independently at every level, will resist the oppressive forces affecting societies worldwide. Multiple components of Markethive's ecosystem are being developed in tandem, preparing the way for the millions seeking a safe haven and reclaiming their independence. We have established our sovereign merchant account and successfully activated the Markethive wallet.

To conduct transactions through your Markethive wallet, you will need Solana's native coin (SOL) for the transaction fees, as Markethive’s Hivecoin (HVC) is a Solana token. Sending HVC involves paying gas fees. If Hivecoin were based on the Ethereum network, sending 10 HVC would cost $4.16. However, because Hivecoin is built on the Solana Network, the cost of sending 10 HVC is just $0.00003, which is a minuscule amount by comparison.

SOL can be purchased from a wallet like Solflare, Trust, or Exodus and then sent to your Markethive Solana sub-wallet. Watch this video for a step-by-step guide on setting up and utilizing the Exodus wallet to purchase SOL. To begin building your SOL reserves, leverage Solana's numerous faucets, which offer free SOL in exchange for participation. As detailed in this article, you can also take advantage of airdrops through Trojan On Solana.

Markethive originated from modest roots without the backing of influential investors. Instead, it was created by the people and for the people, forming a collaborative environment that empowers entrepreneurs. The true beneficiaries of this system are its grassroots community, who will collectively reap the rewards and share in the prosperity and abundance that permeates every level of humanity.

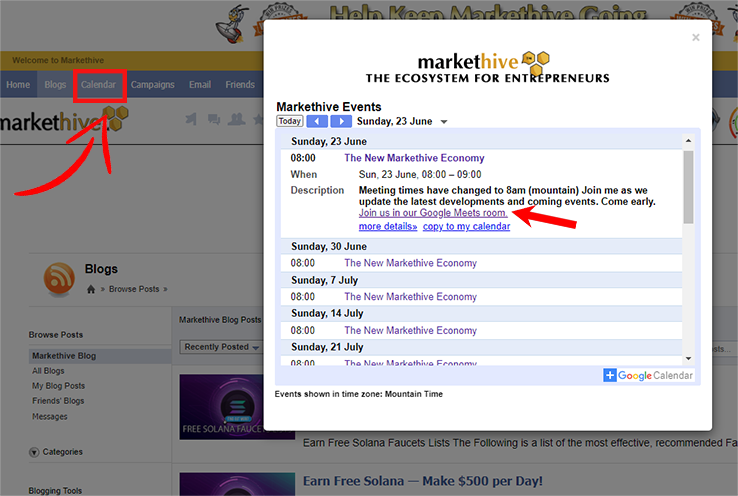

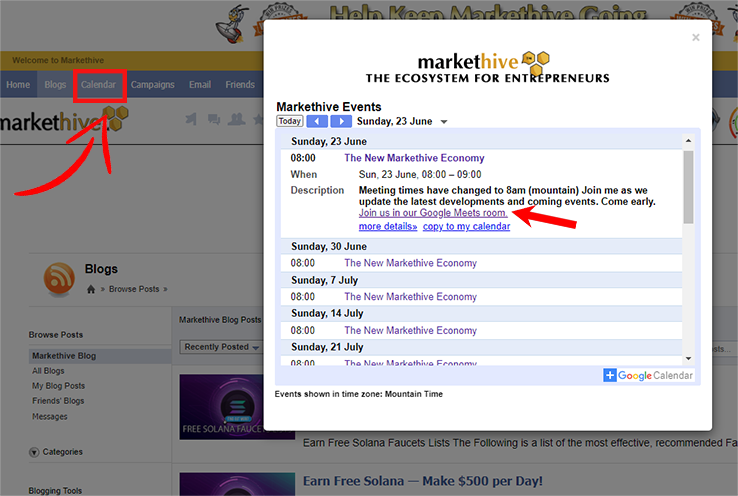

Keep updated on the advancements of Markethive as we implement our innovative new system—a secure Divine fortress impervious to malevolent forces. Join us for the weekly meetings held every Sunday at 8 a.m. Mountain Time. You can access the meeting via the invitation link in the Markethive calendar.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.png)