Gold Price News: Gold Rallies as Geopolitics Back in Focus

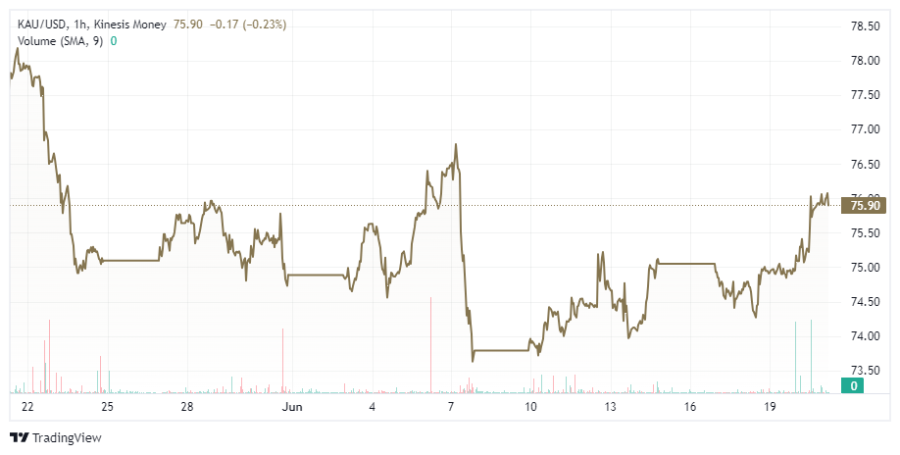

Gold enjoyed a strong, but somewhat volatile session yesterday, briefly spiking to the two-week (pre-Fed) high of $2,364/toz before profit-taking set in. Still, gold has moved decisively through the 50-day simple moving average at $2,343/toz. If held, next resistance level is at the 7 June high at $2,387/toz. Today’s early trading sees gold at $2,359/toz.

While this latest rally has been framed as an indication of markets’ increasing confidence of US rate cuts later this year, rate markets tell another story. Gold has risen as both US 2-Year and 10-Year Treasury yields have edged up and US Fed Fund Futures pricing in a slightly lower probability of cuts in 2024. While this back up in rates markets has been small, it is certainly not gold supportive. The answer lies elsewhere.

A far more plausible explanation is that markets are now pricing in higher levels of geopolitical risk and gold’s rise has notably been accompanied by an uptick in the safe-haven US dollar.

Investors’ anxiety over French parliamentary elections on 30 June and 7 July have been heightened by the European Commission recommended placing France into an Excessive (budget) Deficit Procedure on Wednesday. This has exacerbated concerns in the French bond market, sending credit spreads against German Bunds to a 7-year high.

Meanwhile, Russia’s President Putin has just signed a mutual defence pact with a nuclear-armed North Korea. It is difficult to argue that geopolitical risk hasn’t risen – with gold a likely beneficiary.

The market calendar for today includes Euro Area, UK and US flash PMI data for June, with a focus on the Prices Paid and New Orders sub-components as lead indicators of inflation and growth respectively.

Mike is a market strategist and media commentator with 30 years of experience analysing precious metals markets. He developed his expertise working as an investment banker in emerging markets such as South Africa, Russia and Chile. His focus on precious metals was extended through subsequent work within private wealth management and his own research consultancy. During this time, he covered the gold, silver, platinum and palladium markets.

Mike Ingram

Tim Moseley